Resources

About Us

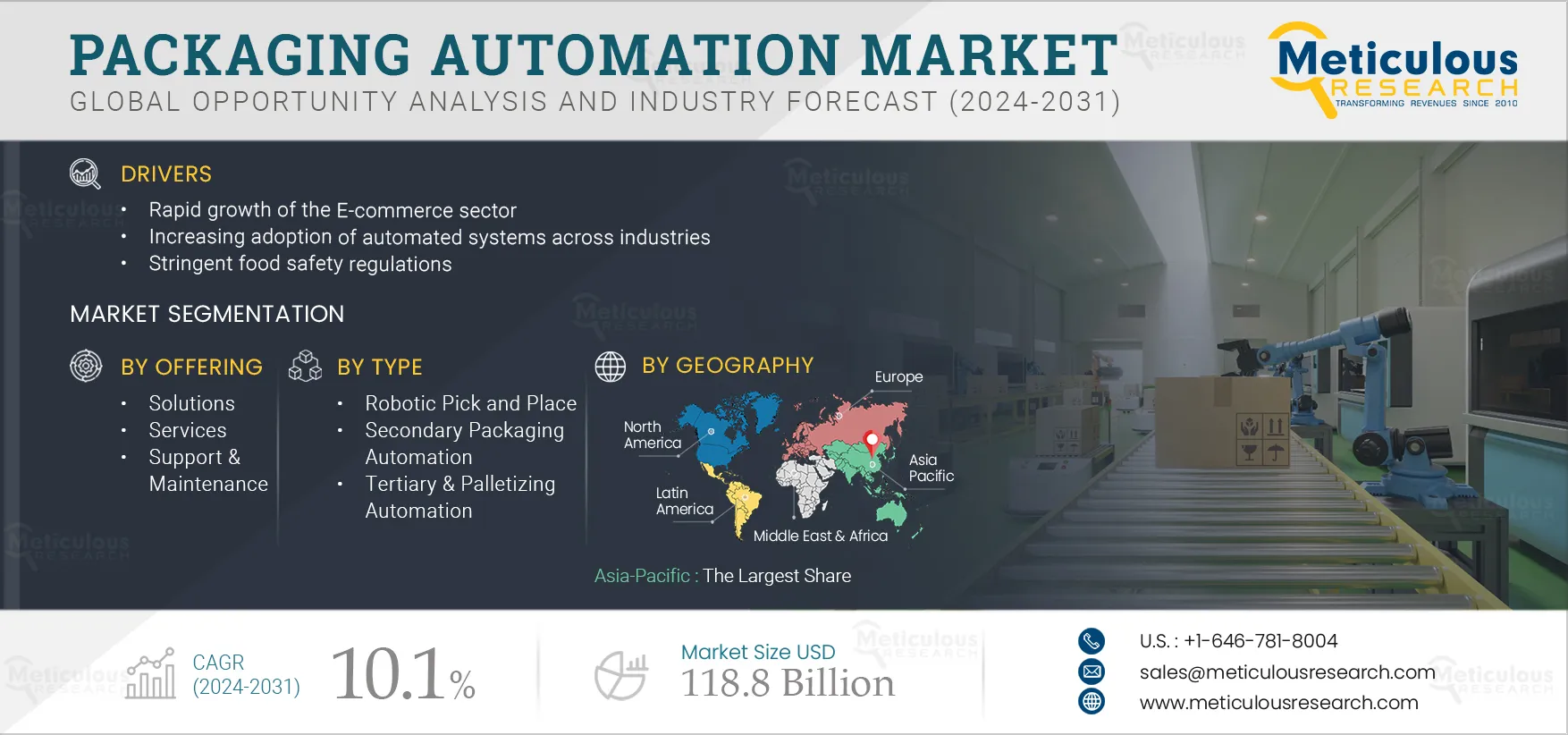

Packaging Automation Market Size, Share, Forecast, & Trends Analysis by Offering (Solution, Services), Type, End-use Industry (Healthcare & Pharmaceuticals, E-Commerce & Logistics, Food & Beverage, Chemical & Refinery, Aerospace & Defense), and Geography - Global Forecast to 2031

Report ID: MRICT - 104638 Pages: 306 Jan-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe Packaging Automation Market is expected to reach $118.8 billion by 2031, at a CAGR of 10.1% from 2024 to 2031. The growth of the packaging automation market is mainly attributed to the rapid growth of the E-commerce sector, the increasing adoption of automated systems across industries, and stringent food safety regulations. However, the high initial costs of installing automated systems restrain the market’s growth.

The high demand for packaging automation in the logistics industry and the increasing demand for sustainable and eco-friendly packaging are expected to create market growth opportunities. However, the shortage of skilled operators is a major challenge for the players in this market. Integration of advanced technologies and smart packaging are major trends in the packaging automation market.

Businesses are under pressure to deliver products more efficiently, safely, and sustainably. As a result, several industries, including manufacturing, logistics, healthcare, and food processing, are adopting automated packaging solutions to streamline operations, improve efficiency, and enhance overall productivity. Packaging automation helps address labor shortages, reduces waste, and enhances customer experience.

In the manufacturing industry, packaging automation optimizes the assembly line process, ensuring that products are packaged consistently and minimizing the risk of errors. In the logistics industry, packaging automation helps enhance sorting and shipping processes, enabling faster and more accurate deliveries. In the healthcare industry, packaging automation helps maintain the quality and safety of medical supplies. Furthermore, E-commerce & logistics companies use packaging automation to sort, package, and ship goods swiftly and accurately. In the food processing industry, packaging automation helps ensure compliance with hygiene standards, reduces contamination risks, and extends product shelf life.

Major players in the packaging automation market are focusing on launching new solutions to help businesses reduce labor costs, improve product quality, and enable faster time-to-market. For instance, in January 2023, Numina Group (U.S.) launched PaktTM, a fully productized packaging and shipping automation solution that enables businesses to lower labor costs by 70%.

Click here to: Get Free Sample Pages of this Report

The convenience of online shopping has increased the demand for customized packaging solutions across the e-commerce industry. Packaging automation offers numerous advantages for e-commerce companies, including enhancing operational efficiency by automating repetitive and time-consuming packaging tasks, allowing businesses to process orders faster and meet the ever-increasing consumer demand for quicker deliveries. It helps optimize packaging materials, reduces labor costs, and minimizes errors, ensuring that products are packaged consistently and securely. Moreover, automation allows for customization in packaging, which is crucial for branding and offering unique customer experiences. Hence, packaging automation is essential for the rapidly growing e-commerce market, with technological innovations further driving efficiency, sustainability, and cost-effectiveness. Major players in the packaging automation market are focused on offering solutions that can automate the packaging of small products, streamline operations, minimize the need for manual labor, and lower labor costs. For instance, in July 2022, Ranpak Holdings Corp. (U.S.) launched the Flap’it!TM solution, which automates the packing of various small products for e-commerce and industrial supply chains.

The logistics industry is facing challenges such as ensuring efficient order fulfillment, minimizing errors in packaging and shipping, optimizing warehouse spaces, and meeting the ever-increasing demand for e-commerce and global shipping. Logistics companies are leveraging packaging automation solutions to streamline operations and overcome such challenges. Packaging automation solutions streamline sorting, packaging, and shipping processes, improve efficiency by reducing manual handling, and ensure accurate order fulfillment. Packaging automation solutions commonly used by logistics companies include automated sorting and packaging systems that efficiently group products for shipping and automated labeling and tracking solutions that enhance product traceability throughout the supply chain. Key players operating in the packaging automation market are focused on strategies such as expansions and product development to meet the evolving needs of logistics companies and gain a competitive advantage in the market. For instance, in June 2023, ABB Ltd (Switzerland) expanded its robotics packaging and logistics headquarters in North Atlanta. The new facility will serve as ABB‘s dedicated center for robotic automation solutions for the logistics and packaging industries. Also, in August 2022, Unboxrobotics Labs Private Limited (India) launched a first-of-its-kind vertical robotics sortation solution to help e-commerce retailers scale up their logistics to handle high parcel volumes and automate the sorting of returned goods. Such developments are expected to generate market growth opportunities during the forecast period.

The demand for sustainable and eco-friendly packaging is increasing due to consumers’ rising environmental awareness and the growing need to mitigate the ecological impact of packaging materials. As consumers become more environmentally conscious, the demand for eco-friendly packaging solutions is expected to increase exponentially. Sustainable and eco-friendly packaging offers several benefits, including reductions in the packaging industry’s carbon footprint and minimization of waste. Governments worldwide are focused on reducing the utilization of single-use plastics and offering incentives to promote the use of eco-friendly packaging materials. Packaging automation helps companies meet compliance requirements, enable sustainable packaging, enhance operational efficiency, and reduce costs over time. Packaging automation solutions provide enterprises with precise control over materials, minimize waste, and enable efficient packaging processes that accommodate sustainable materials and designs with consistency and quality. These benefits of packaging automation solutions, coupled with the rising need for sustainable and eco-conscious packaging practices, are expected to generate growth opportunities for market players in the coming years.

Smart packaging refers to packaging materials and containers equipped with innovative technologies, including RFID (Radio Frequency Identification), NFC (Near Field Communication), QR codes, and augmented reality (AR). These technologies make packaging more interactive, informative, and adaptable. Smart packaging provides additional functionalities beyond traditional packaging. The incorporation of smart features in packaging, such as QR codes, allows product tracking and provides customers with interactive packaging experiences. QR codes can be scanned using a smartphone, providing quick access to digital content, such as instructional videos or product details. RFID technology allows real-time tracking and identification of products throughout the supply chain. NFC technology enables contactless communication with a simple tap, offering consumers access to product information, promotions, or even payment options. AR technology enables immersive experiences by providing a virtual layer of information to the physical packaging. All these technologies enable end-to-end product traceability, reduce the risk of counterfeiting, and allow consumers to access real-time information about products, including their origin, freshness, instructions for use, and interactive content through their smartphones or other smart devices.

Smart packaging helps businesses enhance supply chain efficiency and improve customer experience by providing data on product movement, usage instructions, storage conditions, interactive content, and shelf life. Several players operating in the market are leveraging advanced technologies, including IoT, to make packaging smarter, more interactive, and more secure. For instance, in March 2023, Tapwow (U.S.) partnered with Identiv, Inc. (U.S.) to deliver IoT solutions for smart packaging. The solutions offer customer engagement, authentication, product diversion, and traceability. Thus, the smart packaging trend is expected to gain momentum in the coming years due to the benefits offered.

Based on offering, the packaging automation market is segmented into solutions and services. Furthermore, the solutions segment is subsegmented into case sealers & erectors, sleevers & cartoners, palletizers & depalletizers, strappers, markers & labelers, automated mailer systems, case packers, and other solutions. In 2024, the solutions segment is expected to account for the larger share of the global packaging automation market. This segment is projected to reach USD 51.2 billion in 2024. The segment’s large market share is mainly attributed to the need for increased manufacturing speed, and the increasing demand for products and workers’ safety.

However, the services segment is projected to record the highest CAGR during the forecast period. The segment’s rapid growth is driven by increasing deployment of automation in various industries such as e-commerce, healthcare & pharmaceuticals, food & beverage, automotive, and Chemical & Refineries and the growing demand for packaging automation to speed up production, optimize warehouse space, and reduce reliance on labor to provide more value-added services to their customers.

Based on type, the packaging automation market is segmented into robotic pick & place, secondary packaging, and tertiary & palletizing. In 2024, the secondary packaging segment is expected to account for the largest share of 41.5% of the global packaging automation market. The segment’s large market share is mainly attributed to rising demand for secondary packaging logistics across various industries such as manufacturing, food & beverage, automotive, Chemical & Refineries, aerospace & defense, e-commerce & logistics, healthcare & pharmaceuticals, and the growing demand for automation in manufacturing companies to increase production rates.

Moreover, the secondary packaging segment is also projected to record the highest CAGR of 11.2% during the forecast period. The segment’s rapid growth is driven by the rising need to safely transport products during shipment and the growing demand for supplementary protection in the e-commerce and pharmaceutical sectors.

Based on end use industry, the packaging automation market is segmented into healthcare & pharmaceuticals, E-commerce & logistics, food & beverage, automotive, chemical & refineries, aerospace & defense, and other end-use industries. Furthermore, the healthcare & pharmaceuticals segment is subsegmented into healthcare & pharmaceuticals manufacturing companies and contract manufacturing organizations. The E-commerce & logistics segment is subsegmented into E-commerce, contract packaging, and logistics companies. In 2024, the food & beverage segment is expected to account for the largest share of 44.1% of the global packaging automation market. The segment’s large share is mainly attributed to shifting consumer tastes, intensifying competition in the packaged food market, and a surge in demand for packaged food.

However, the E-commerce & logistics segment is projected to record the highest CAGR of 14.4% during the forecast period. The segment’s rapid growth is driven by growing online sales channels, increasing online shopping among customers, increasing adoption of automation in e-commerce & logistics for on-time delivery, and rising consumer demand for convenience shopping.

Based on geography, the global packaging automation market is segmented into North America, Europe, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of 38.3% of the global packaging automation market. Asia-Pacific packaging automation market is estimated to be worth USD 23.2 billion in 2024. The large share of Asia-Pacific market is attributed to the surging usage of sustainable packaging in the food & beverage sector, increasing government initiatives promoting automation and Industry 4.0 technologies to enhance manufacturing capabilities, growing demand for eco-friendly packaging solutions, and the rapid expansion of the E-commerce sector in countries like China and India. The region is also projected to grow at the highest CAGR of 11.0% over the forecast period.

The report offers a competitive analysis based on an extensive assessment of the leading players' product portfolios and geographic presence and the key growth strategies adopted by them over the past 3–4 years. Some of the key players operating in the packaging automation market are ABB, Ltd. (Switzerland), Robert Bosch GmbH (Germany), Siemens AG (Germany), Fanuc Corporation (Japan), and Mitsubishi Electric Corporation (Japan), Swisslog Holding AG (Switzerland), Rockwell Automation, Inc. (U.S.), Schneider Electric SE (France), WestRock Company (U.S.), SATO Holdings Corporation (Japan), Krones AG (Germany), Automated Packaging Systems, Inc. (U.S.), Emerson Electric Co. (U.S.), Crawford Packaging (Canada), Fuji Machinery (Japan), Brenton LLC (U.S.), BEUMER Group GmbH & Co. KG (Germany), Barry-Wehmiller Group, Inc. (U.S.), KHS GmbH (Italy), MULTIVAC Sepp Haggenmüller SE & Co. KG (Germany), Omori Machinery Co., Ltd. (Japan), and Syntegon Technology GmbH (Germany).

|

Particulars |

Details |

|

Number of Pages |

306 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR |

10.1% |

|

Market Size (Value) |

USD 118.8 Billion by 2031 |

|

Segments Covered |

By Offering

By Type

By End-use Industry

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Taiwan, and Rest of Asia-Pacific), Latin America, and Middle East & Africa. |

|

Key Companies |

ABB, Ltd. (Switzerland), Robert Bosch GmbH (Germany), Siemens AG (Germany), Fanuc Corporation (Japan), and Mitsubishi Electric Corporation (Japan), Swisslog Holding AG (Switzerland), Rockwell Automation, Inc. (U.S.), Schneider Electric SE (France), WestRock Company (U.S.), SATO Holdings Corporation (Japan), Krones AG (Germany), Automated Packaging Systems, Inc. (U.S.), Emerson Electric Co. (U.S.), Crawford Packaging (Canada), Fuji Machinery (Japan), Brenton LLC (U.S.), BEUMER Group GmbH & Co. KG (Germany), Barry-Wehmiller Group, Inc. (U.S.), KHS GmbH (Italy), MULTIVAC Sepp Haggenmüller SE & Co. KG (Germany), Omori Machinery Co., Ltd. (Japan), and Syntegon Technology GmbH (Germany) |

This study focuses on market assessment and opportunity analysis by analyzing the revenue of global packaging automation across various regions and countries. This study also offers a competitive analysis of the global packaging automation market based on an extensive assessment of the leading players' product portfolios, geographic presence, and key growth strategies.

The global packaging automation market is expected to reach $118.8 billion by 2031 from an estimated $60.4 billion in 2024, at a CAGR of 10.1% during the forecast period (2024–2031).

Based on offering, in 2024, the solution segment is estimated to account for the largest share of the packaging automation market.

Based on automation, in 2024, the secondary packaging automation segment is estimated to account for the largest share of the packaging automation market.

Based on end use industry, in 2024, the food & beverage segment is estimated to account for the largest share and highest CAGR of the packaging automation market.

The growth of this market is attributed to factors such as rapid growth of the e-commerce, increasing adoption of automated system across industries and stringent food safety regulations in various countries. Additionally, high demand for packaging automation in logistics industry and growing demand for sustainable and eco-friendly packaging is expected to create market growth opportunities.

The key players operating in the packaging automation market are ABB, Ltd. (Switzerland), Robert Bosch GmbH (Germany), Siemens AG (Germany), Fanuc Corporation (Japan), and Mitsubishi Electric Corporation (Japan), Swisslog Holding AG (Switzerland), Rockwell Automation, Inc. (U.S.), Schneider Electric SE (France), WestRock Company (U.S.), SATO Holdings Corporation (Japan), Krones AG (Germany), Automated Packaging Systems, Inc. (U.S.), Emerson Electric Co. (U.S.), Crawford Packaging (Canada), Fuji Machinery (Japan), Brenton LLC (U.S.), BEUMER Group GmbH & Co. KG (Germany), Barry-Wehmiller Group, Inc. (U.S.), KHS GmbH (Italy), MULTIVAC Sepp Haggenmüller SE & Co. KG (Germany), Omori Machinery Co., Ltd. (Japan), and Syntegon Technology GmbH (Germany).

Asia-Pacific is projected to register the highest growth rate over the coming years and offer significant growth opportunities for vendors operating in this market.

Published Date: May-2025

Published Date: May-2024

Published Date: Apr-2023

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates