Resources

About Us

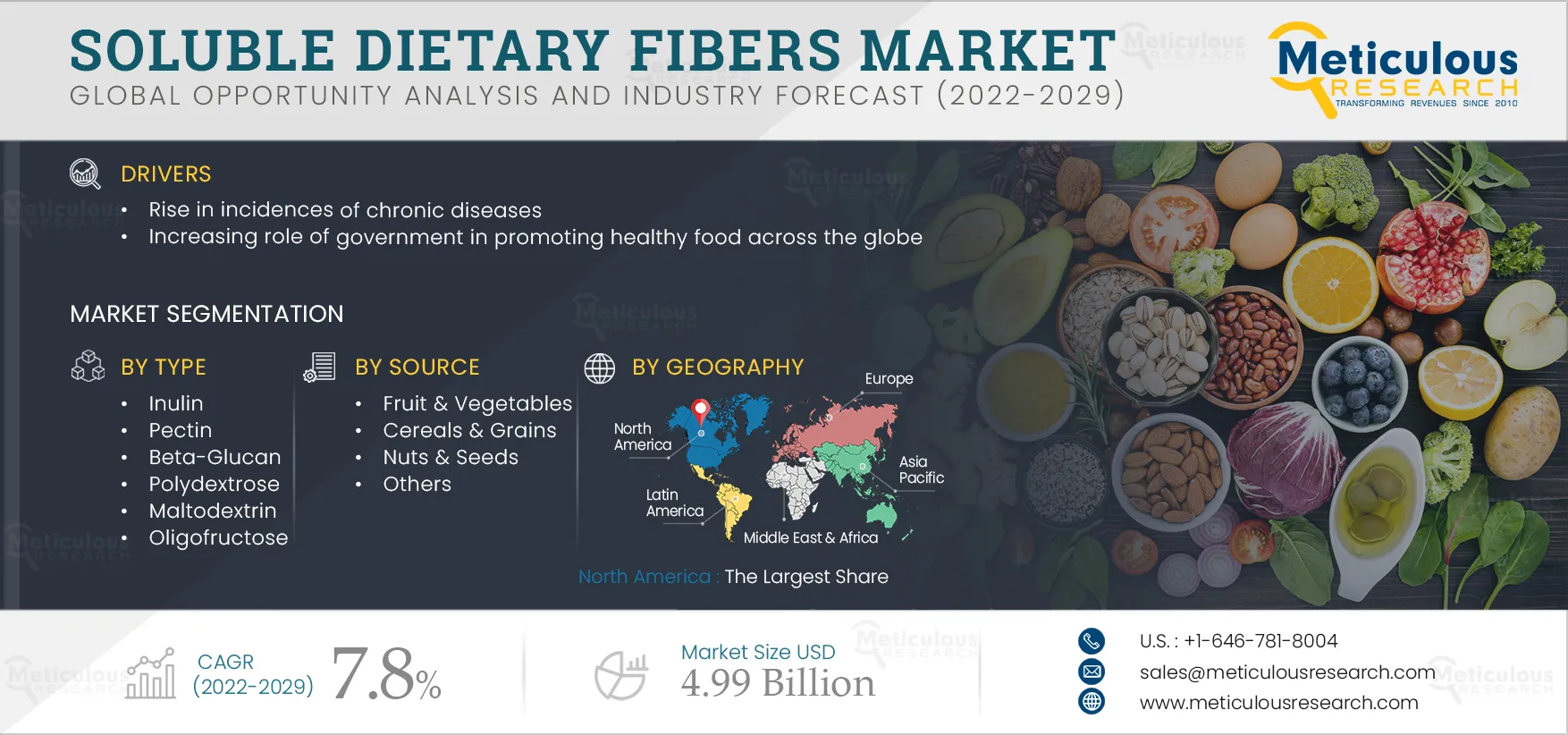

Soluble Dietary Fibers Market by Source (Fruit & Vegetables, Cereals & Grains), Type (Inulin, Pectin, Beta-Glucan, Maltodextrin, Oligofructose), Application (pharmaceuticals, animal feed), and Geography - Global Forecast to 2029

Report ID: MRFB - 104105 Pages: 240 Jun-2022 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe Soluble Dietary Fibers Market is projected to reach $4.99 billion by 2029, at a CAGR of 7.8% during the forecast period 2022–2029. The growing health consciousness among consumers, rising awareness about the health benefits of soluble dietary fibers, the rise in incidences of chronic diseases, increasing demand from pharma, food, and feed manufacturers to incorporate soluble dietary fibers into their products, and increasing role of government to promote healthy food across the globe drive the growth of this market.

Moreover, emerging applications of soluble dietary fibers and emerging markets such as Southeast Asia, Latin America, and the Middle East & Africa are expected to create lucrative opportunities for players operating in this market. However, the lengthy and costly regulatory approval process and high cost of manufacturing technology are expected to hinder the growth of this market to some extent.

The COVID-19 pandemic significantly impacted both public health and the different stages of the supply chain of several industries, including the soluble dietary fibers market.

Implementing measures to combat the spread of the virus has aggravated the situation and affected the growth of several industrial sectors. Nation-wide lockdowns in some regions have impacted the transportation of raw materials from suppliers. The temporary closures of manufacturing bases due to indefinite lockdowns and temporary quarantines impacted the growth of the soluble dietary fibers market during the pandemic. Furthermore, the pandemic has significantly impacted the food and beverage industry, further affecting this market's growth.

However, as much as the pandemic has affected the supply, it also changed the consumer's shift toward nutritional food products. The COVID-19 pandemic has triggered consumers to examine their health. This has amplified consumers’ search for healthy products and functional foods that might help them improve their health. For instance, the pandemic has created growth opportunities for the soluble dietary fiber market with the growing inclination toward organic, natural, and clean label products, along with a strong focus on gut health and sugar replacements. Soluble dietary fibers are widely used in various products, including dietary supplements, animal feed, and pharmaceuticals. Products containing soluble dietary fibers are also used to improve muscle mass and immunity, leading to high demand for soluble dietary fiber products in the market.

Furthermore, a Gut Microbes article suggests that the high fiber diet could help control the inflammatory response associated with the COVID-19, subsequently driving the demand for soluble dietary fibers in the market.

Click here to: Get Free Sample Pages of this Report

Growing Health Consciousness among Consumers and Awareness about the Health Benefits of Soluble Dietary Fibers Boost its Demand in the market

Consumers seek to ensure healthy lives for as long as possible—particularly as average life spans continue to rise. Rapid industrialization, urbanization, economic development, and globalization have resulted in consumers' changing diets and lifestyles, impacting the health and nutritional status of populations in developing countries. Increasing health consciousness is associated with increased incidences of diseases. According to WHO (World Health Organization), in 2020, among 55.4 million deaths worldwide, more than half (55%) were due to the top 10 causes, with Ischemic heart disease and stroke being the world’s biggest killers, accounting for 15 million deaths. Unhealthy diets and physical inactivity are thus among the leading causes of the major non-communicable diseases, including cardiovascular disease, type 2 diabetes, and certain types of cancer, substantially contributing to disease, death, and disability. The most health-centric group of consumers is the more than 20 age group. The individuals of this generation are willing to spend more money on healthier products for health-conscious eating.

Further, with the increasing world population and welfare, the demand for food ingredients like soluble dietary fiber as a food-nutritional component is rising sharply. Furthermore, people's spending has increased on healthier food to better their lifestyle and fitness. Consumers have become more aware of soluble dietary fiber benefits in supporting an active lifestyle. A soluble dietary fiber-rich diet is efficient in the treatment of various diseases. People with diabetes can benefit from soluble fiber-rich diets, as it slows the emptying of the stomach and prevents instant spikes in blood glucose levels. Soluble fiber also relieves inflammatory bowel conditions, diarrhea, and constipation and helps people control caloric intake by increasing the release of satiety hormones and slowing digestion. In addition to the satiety effects of soluble fibers, resistant maltodextrin, inulin, and oligofructose can help reduce food's overall caloric content without adversely affecting taste and texture. Furthermore, high dietary fiber diets promote intestinal regularity and reduce cardiovascular disease risk.

Many regulatory agencies recommend supportive guidelines for soluble dietary fiber consumption. According to the U.S. FDA (Food & Drug Administration), the daily average value for fiber is 25 g per day, based on a 2,000-calorie diet. Dietary Reference Intake (DRI) is 21 to 38 grams daily for adults, depending on age, life stage, and sex. The American Heart Association (AHA) recommends a total dietary fiber intake of 25 g/day to 30 g/day from foods (not supplements) to ensure nutrient adequacy and maximize the cholesterol-lowering impact of a fat-modified diet. With the increasing number of consumers becoming health conscious and aware of the health benefits of including active ingredients such as soluble dietary fibers in their diet, the demand for dietary fiber-rich products is increasing from food and other industries, driving the growth of soluble dietary fibers across the globe.

Fruit & Vegetables Segment to Grow with the Fastest CAGR During the Forecast Period

Based on source, the soluble dietary fibers market is segmented into fruit & vegetables, cereals & grains, nuts & seeds, and others. The fruit & vegetables segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment is attributed to the factors such as increasing chronic diseases; use of fibers extracted from fruit & vegetables in the treatment of digestive health, cardiovascular health, healthy blood glucose levels, satiety, and weight management; and high content of soluble dietary fiber such as inulin, pectin, and beta-glucan in fruit & vegetables as compared to other crops. Furthermore, the growing consumption of healthy and functional food products is projected to drive the market over the next few years.

Inulin Segment to Dominate the Soluble Dietary Fibers Market in 2022

Based on type, the soluble dietary fibers market is segmented into inulin, pectin, beta-glucan, polydextrose, maltodextrin, oligofructose, arabinoxylan-oligosaccharides, and others. In 2022, the inulin segment is estimated to account for the largest share of the soluble dietary fibers market. The large share of this segment is mainly attributed to the wide range of applications in functional food & beverages, pharmaceutical, animal feed, and cosmetics industries and multiple health benefits over other soluble fibers. Further, many food manufacturers add inulin to processed products to boost the nutritional content and replace fat and sugar.

Animal Feed Segment to Grow with the Fastest CAGR During the Forecast Period

Based on application, the soluble dietary fibers market is segmented into functional foods & beverages, pharmaceuticals, animal feed, and others. The animal feed segment is expected to grow at the highest CAGR during the forecast period. The rapid growth of this segment is attributed to factors such as its efficiency in reducing side effects & minimize cost and increasing preference for oral dosages rather than injected routes. Furthermore, increased awareness of the beneficial effects of soluble dietary fibers on animal health, advances in canine and feline nutrition, and the growing animal feed industry are expected to boost the demand for soluble dietary fibers in the market.

North America to Dominate the Soluble Dietary Fibers Market in 2022

Based on geography, the soluble dietary fibers market is segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2022, the North American region is expected to command the largest soluble dietary fibers market share. The large share of the North American soluble dietary fibers market is attributed to the increasing chronic diseases, growing functional food consumption, demand for healthy & nutritional products, consumer expectations for innovation and healthy food products, and health & wellness trend.

Key Players

The key players operating in the global soluble dietary fibers market are Tate & Lyle plc (U.K.), DuPont de Nemours, Inc. (U.S.), Nexira (France), Roquette Frères (France), Cosucra Groupe Warcoing SA (Belgium), FutureCeuticals, Inc. (U.S.), Sensus B.V. (A Part of the Royal Cosun Group) (Netherlands), BENEO GmbH (A part of the Südzucker Group) (Germany), The Archer-Daniels-Midland Company (U.S.), Ingredion Incorporated (U.S.), Herbafood Ingredients GmbH (Germany), Cargill, Inc. (U.S.), Lonza Group AG (Switzerland), Kerry Group plc (Ireland), Tereos S.A. (France), and Frutarom Industries Ltd. (Israel), among others.

Scope of the Report:

Soluble Dietary Fibers Market, by Source

Soluble Dietary Fibers Market, by Type

Soluble Dietary Fibers Market, by Application

Soluble Dietary Fibers Market, by Geography

Key Questions Answered in the Report-

Soluble dietary fiber is the edible parts of plants or analogous carbohydrates resistant to digestion and absorption in the human small intestine with complete or partial fermentation in the large intestine. This soluble dietary fibers market study provides valuable insights across key segments, such as market by source, type, application, and geography.

The soluble dietary fibers market is projected to reach $4.99 billion by 2029, at a CAGR of 7.8% during the forecast period.

Based on source, the beta-glucan segment is projected to register the fastest growth rate during the forecast period.

o Growing health consciousness among consumers and awareness about the health benefits of soluble dietary fibers

o A rise in incidences of chronic diseases

o Increasing demand from pharma, food, and feed manufacturers to incorporate soluble dietary fibers into their products

o Lengthy and costly regulatory approval process

o High cost of manufacturing technology

The key players operating in the global soluble dietary fibers market are Tate & Lyle plc (U.K.), DuPont de Nemours, Inc. (U.S.), Nexira (France), Roquette Frères (France), Cosucra Groupe Warcoing SA (Belgium), FutureCeuticals, Inc. (U.S.), Sensus B.V. (A Part of the Royal Cosun Group) (Netherlands), BENEO GmbH (A part of the Südzucker Group) (Germany), The Archer-Daniels-Midland Company (U.S.), Ingredion Incorporated (U.S.), Herbafood Ingredients GmbH (Germany), Cargill, Inc. (U.S.), Lonza Group AG (Switzerland), Kerry Group plc (Ireland), Tereos S.A. (France), and Frutarom Industries Ltd. (Israel), among others.

Asia-Pacific is expected to grow with the fastest CAGR during the forecast period. The fast growth of this market is attributed to the factors such as increasing awareness about a healthy diet; the booming food & beverage industry in the countries such as China, India, Japan, and Indonesia; and rising health awareness among people coupled with the increasing number of fitness clubs in Asia-Pacific countries.

Published Date: Oct-2024

Published Date: May-2025

Published Date: Jun-2023

Published Date: Nov-2024

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates