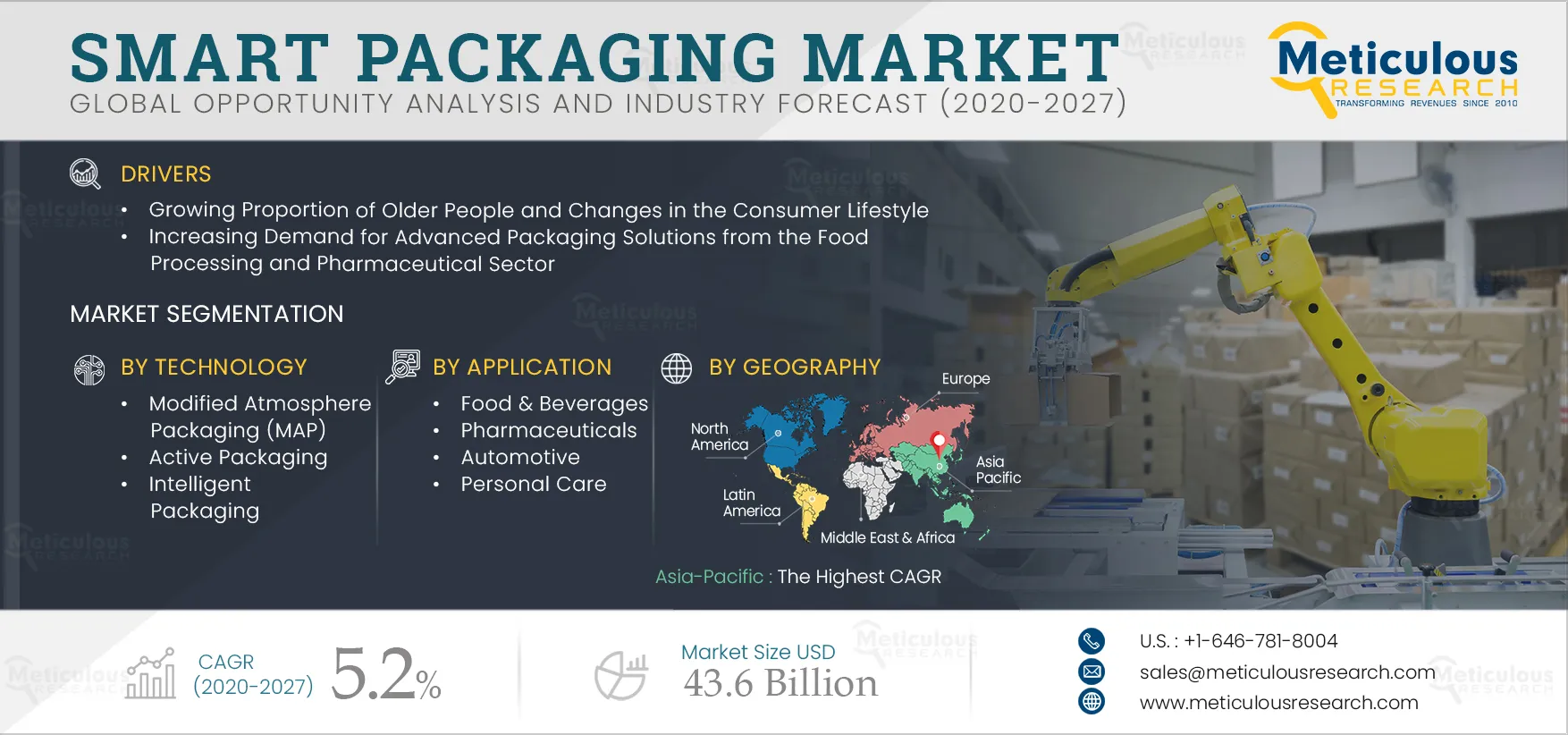

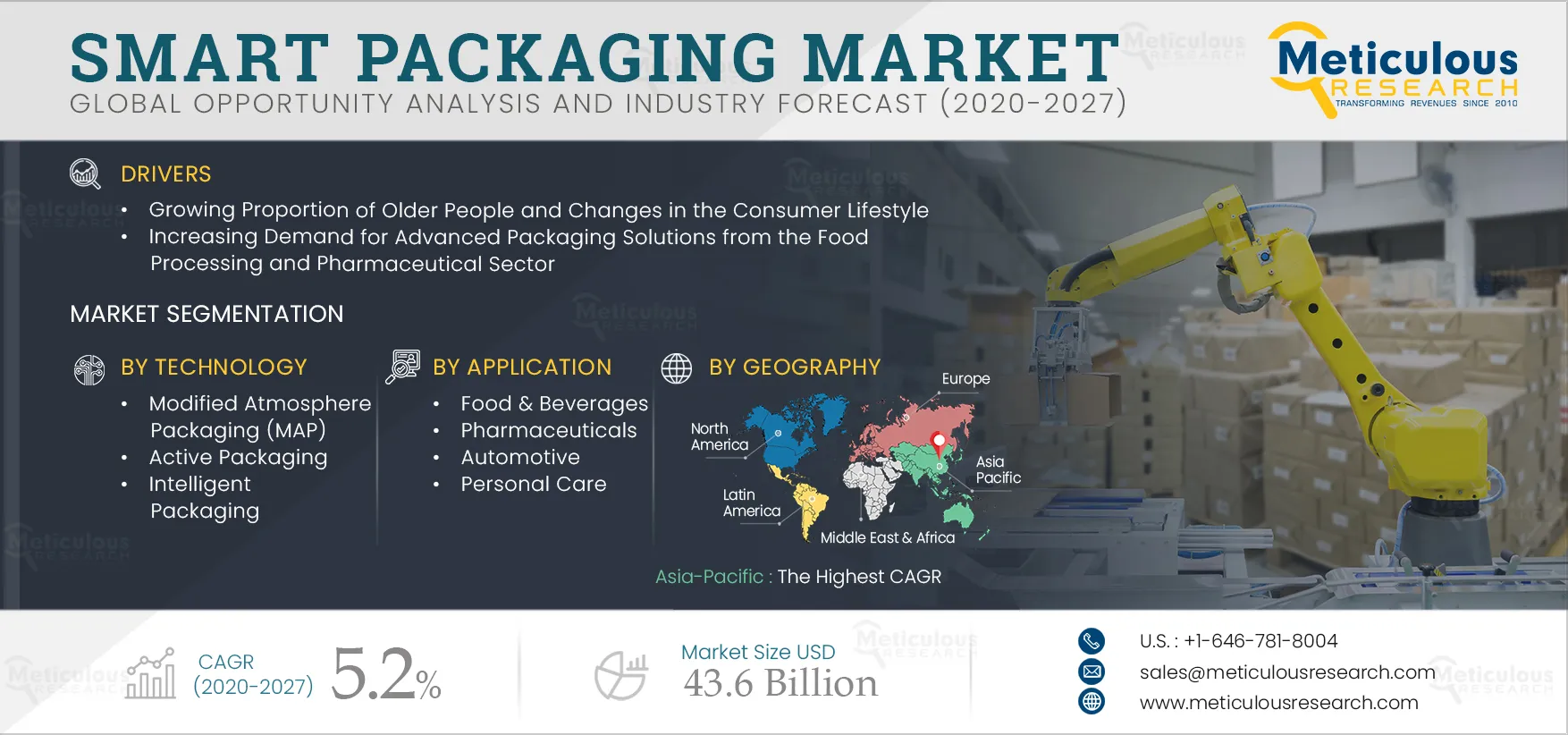

The Smart Packaging Market is expected to reach $43.6 billion by 2027, at a CAGR of 5.2% during the forecast period of 2020 to 2027. The increasing demand for advanced packaging solutions from the food processing & pharmaceutical sector, growing consumer concern for food wastage reduction, and rising demand for smart & functional packaging are the major factors driving the growth of this market. Moreover, the growing E-commerce market and rising industrialization coupled with strong demand for superior logistics and supply chain management are likely to create lucrative opportunities for players operating in this market.

Impact of COVID-19 on Smart Packaging Market

The global impact of COVID-19 will significantly affect the smart packaging market in 2020. This is mainly due to strict lockdowns in some regions and several problems, such as truck shortages, reduced deliveries, and employees contracting COVID-19. In addition, truncated air freight capacity, port congestion, roadblocks, and logistic disruptions in Southeast Asia are expected to escalate as stricter measures are implemented by governments.

Impact of Covid-19 on the F&B Smart Packaging Market

The outbreak COVID-19 has had a significant impact not only on public health worldwide but also on all stages of the supply chain and value chain of various industries. The F&B sector is currently experiencing impacts due to the outbreak. As the effect of COVID-19 is felt around the world, F&B companies are facing significantly reduced consumption and supply chain disruption challenges. While due to lockdowns, at-home consumption has been showing a spike over the last 4-6 months. The impact of COVID-19 on the F&B industry is expected to limit the growth of smart packaging in the F&B industry. E-commerce is expected to continue expanding share over traditional retail channels.

Click here to: Get Free Request Sample Pages of this report

Impact of COVID-19 on the Pharmaceutical Smart Packaging Market

The initial impact of COVID-19 on the pharma supply chain revolved around material and information delays. When, with immediacy and urgency, many governments sent countries and regions into lockdown, there was little time for employees and companies to prepare for a remote working scenario. This has severely affected the pharma supply chain and restricted the demand for smart packaging. Shopping for medicines online was still at a nascent stage in emerging countries before the outbreak of COVID-19, but given the current circumstances and the need for social distancing, there has been an exponential rise in this practice.

Moreover, when a vaccine for COVID-19 is found, it will have to be transported worldwide at the same time in all climatic zones. And, this will be possible only with the help of effective packaging solutions, amongst other factors. This is also one of the major factors that will boost the demand for smart packaging in the market.

Impact of COVID-19 on the Automotive Smart Packaging Market

The impact of COVID-19 on the globally integrated automotive sector has been swift and significant. The initial concerns over the disruption in Chinese part exports quickly pivoted to large scale manufacturing interruptions across Europe and the U.S. Further, automobile and component manufacturing plants are being shuttered around the world, consumer footfalls in showrooms have fallen sharply, vehicle sales are dropping are adding to the intense pressure on an increasingly distressed global supply base. Thus, the highly impacted automotive industry somehow affects the demand for smart packaging in the market.

Impact of COVID-19 on the Personal Care Smart Packaging Market

COVID-19 can affect the global economy in three main ways—directly affecting production & demand, creating supply chain & market disruption, and financial impact on firms & financial markets. With months of consumer lockdowns, international travel bans, and retail business shuttered, purchase & usage behavior has changed dramatically across the beauty & personal care spaces & sales have fallen across many beauty segments. Thus, the decreasing personal care industry hinders the growth of smart packaging in the market.

Key Findings in the Smart Packaging Market Study:

In 2020, the modified atmosphere packaging (MAP) segment dominated the global smart packaging market.

Based on packaging technology, the global smart packaging market is segmented into modified atmosphere packaging (MAP), active packaging, and intelligent packaging. In 2020, the modified atmosphere packaging segment commanded the largest share of the smart packaging market. The increasing demand for fresh & high-quality packaged food products is one of the major factors expected to drive this segment. Furthermore, on-the-go lifestyle, shift towards easy-to-handle & convenient packaging, and emerging economies are stimulating the demand for modified atmosphere packaging.

In 2020, the food and beverages segment accounted for the largest share of the smart packaging market.

Based on application, the global smart packaging market is segmented into food & beverages, pharmaceuticals, automotive, personal care, and other applications. In 2020, the food and beverages segment commanded the largest share of the smart packaging market. The large share of this segment can be attributed to the rising use of active products in the F&B industry, coupled with growing emphasis to preserve the quality and safety of packaged products from manufacturing to the time the food is consumed.

The Asia-Pacific region to grow at the highest CAGR during the forecast period.

On the basis of region, the smart packaging market is segmented into North America, Europe, APAC, Latin America, and the Middle East & Africa. During the forecast period, the Asia-Pacific market is expected to grow at the highest CAGR. The changing lifestyle, increasing demand for packaging solutions with longer sustainability, and growing demand for fresh & quality food are the factors driving the growth of this regional segment.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments adopted by the leading market participants in the smart packaging market over the last four years. The key players operating in the global smart packaging market are 3M (U.S.), Avery Dennison Corporation (U.S.), American Thermal Instruments (U.S.), Temptime Corporation (U.S.), Smartrac N.V. (Netherlands), BASF SE (Germany), Thin Film Electronics ASA (U.S.), Stora Enso (Finland), International Paper (U.S.), Amcor plc (Switzerland), Emerson Electric Co. (U.S.), R.R. Donnelly & Sons (RRD) Company (U.S.), Sealed Air Corporation (U.S.), and Smartglyph Ltd. (U.K.).

Scope of the report:

Smart Packaging Market, by Packaging Technology

Smart Packaging Market, by Application

- Food & Beverages

- Pharmaceuticals

- Automotive

- Personal Care

- Others

Smart Packaging Market,by Geography

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- Australia

- South Korea

- Vietnam

- Rest of The Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Peru

- Rest of Latin America

- Middle East and Africa

Key questions answered in the report: