Resources

About Us

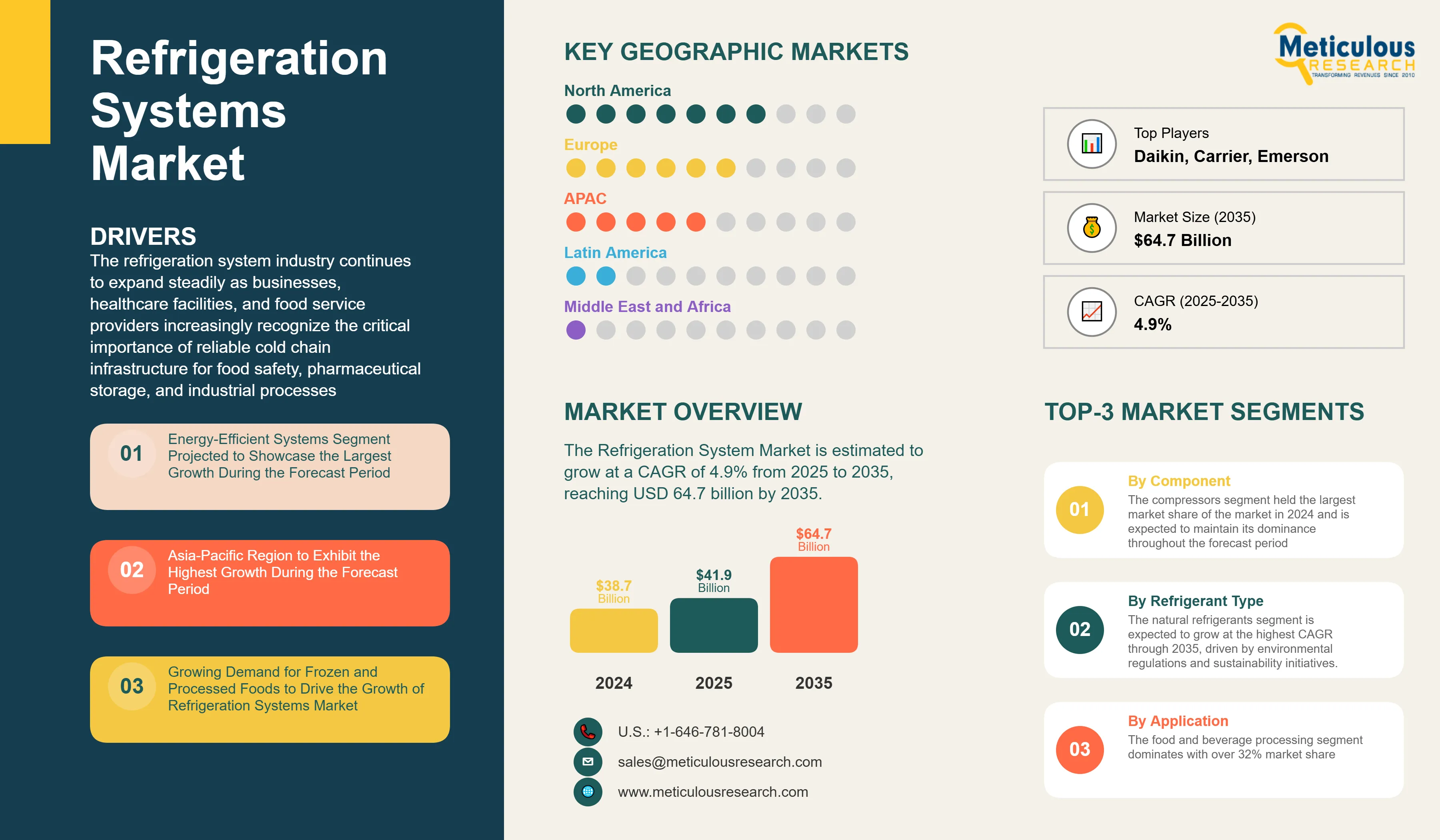

Refrigeration Systems Market Size, Share, Trends & Forecast by Component (Compressor, Condenser, Evaporator), Refrigerant Type (HFC, HFO, Ammonia, CO₂), Application – Global Outlook 2025–2035

Report ID: MRSE - 1041526 Pages: 265 Jul-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe refrigeration system industry continues to expand steadily as businesses, healthcare facilities, and food service providers increasingly recognize the critical importance of reliable cold chain infrastructure for food safety, pharmaceutical storage, and industrial processes. With global food production expected to increase by 60% by 2050 to feed a growing population, the demand for advanced refrigeration systems across commercial, industrial, and residential sectors is driving consistent market growth.

The integration of energy-efficient technologies and natural refrigerants is transforming the industry landscape, with manufacturers investing heavily in sustainable cooling solutions. For instance, according to the International Energy Agency, space cooling systems such as air conditioners and fans account for nearly 10% of global electricity consumption, while refrigeration systems contribute a smaller yet significant share. This creates substantial opportunities for deploying energy-efficient technologies. In parallel, government regulations mandating the phase-out of high Global Warming Potential (GWP) refrigerants are driving the adoption of natural alternatives—such as ammonia, CO₂, and hydrocarbons—across industrial and commercial applications.

The industry is experiencing significant technological transformation through IoT-enabled smart controls, predictive maintenance systems, and AI-driven optimization platforms. Leading refrigeration system manufacturers are investing in digitalization to improve system efficiency, reduce operational costs, and enhance remote monitoring capabilities. These technological advances are enabling operators to achieve 20-30% energy savings while maintaining optimal temperature control and food safety standards. For instance, in 2024, major refrigeration and HVAC companies like Carrier Global and Johnson Controls have introduced AI-based predictive analytics platforms—such as Carrier’s Abound™ Predictive Insights and Johnson Controls’ diagnostic services—to forecast equipment health issues, enhance uptime, and streamline maintenance via proactive alerts.

Energy-Efficient Systems Segment Projected to Showcase the Largest Growth During the Forecast Period

Energy-efficient refrigeration systems are projected to show significant growth during the forecast period, representing approximately 30-40% share of the total refrigeration system market. These systems include variable speed compressors, heat recovery units, advanced controls, and natural refrigerant technologies. The growing emphasis on sustainability and operating cost reduction is driving unprecedented demand for high-efficiency refrigeration solutions across all application segments.

The growth in energy-efficient refrigeration systems is driven by rising energy costs, tighter environmental regulations, and corporate sustainability goals. Commercial facilities using ENERGY STAR-certified refrigeration systems often achieve 20–40% reductions in electricity consumption compared to conventional units.

Major refrigeration manufacturers such as Daikin Industries, Emerson Electric, and Danfoss have significantly expanded their energy-efficient product portfolios. These companies collectively increased their R&D investments in sustainable refrigeration technologies in 2024. The integration of smart sensors, variable frequency drives, and advanced heat exchanger designs is enabling system manufacturers to achieve ENERGY STAR and other high-efficiency certifications while meeting strict environmental compliance requirements.

Asia-Pacific Region to Exhibit the Highest Growth During the Forecast Period

The Asia-Pacific region is estimated to show remarkable growth during the forecast period, driven by rapid industrialization, urbanization, and expanding cold chain infrastructure. Countries like China, India, and Southeast Asian nations are experiencing unprecedented demand for refrigeration systems as food retail modernization, pharmaceutical manufacturing, and data center construction accelerate across the region.

China leads the region with the world's largest refrigeration equipment manufacturing base and growing domestic demand for commercial and industrial cooling systems. The country's refrigeration system market is projected to grow at a highest CAGR through 2035, driven by government initiatives supporting cold chain development and food safety regulations. India follows closely with significant investments in agricultural cold storage and pharmaceutical manufacturing facilities requiring specialized refrigeration systems.

The region’s growth is also supported by major international refrigeration companies establishing local manufacturing and service operations across Asia-Pacific. Carrier and Johnson Controls, among others, continue to expand regional production and maintenance facilities to meet rising demand. Significant foreign direct investment is flowing into broader cold‑chain and refrigeration infrastructure in 2024—though specific figures dedicated solely to refrigeration are not publicly detailed. These investments are driving local capacity expansion and strengthening export capabilities.

Refrigeration System Market Analysis

The refrigeration system industry faces challenges from refrigerant regulations, skilled technician shortages, and supply chain disruptions affecting key components like compressors and electronic controls. The phase-out of HFC refrigerants under the Kigali Amendment creates compliance complexity and requires significant investment in new equipment and technician training. Energy cost volatility and raw material price fluctuations continue to impact manufacturer margins and end-user operating expenses.

Despite these constraints, the market offers substantial growth opportunities through sustainability-focused regulations, cold chain expansion in emerging markets, and technological innovation in smart refrigeration systems. The adoption of natural refrigerants and IoT-enabled monitoring systems is helping operators achieve regulatory compliance while improving operational efficiency and reducing environmental impact. Government support for energy efficiency programs and cold chain infrastructure development provides sustainable growth pathways for innovative refrigeration technologies.

Based on component, the refrigeration system market is segmented into compressors, condensers, evaporators, expansion devices, controls and automation, heat exchangers, vessels and receivers, pumps and circulation equipment, valves and fittings, and auxiliary equipment. The compressors segment held the largest market share of the market in 2024 and is expected to maintain its dominance throughout the forecast period.

Based on refrigerant type, the market is segmented into hydrofluorocarbons (HFCs), hydrofluoroolefins (HFOs), natural refrigerants, and hydrochlorofluorocarbons (HCFCs). The natural refrigerants segment is expected to grow at the highest CAGR through 2035, driven by environmental regulations and sustainability initiatives.

Based on application, the market serves food and beverage processing, cold storage and warehousing, food retail and supermarkets, pharmaceuticals and healthcare, chemical and petrochemical processing, data centers and IT infrastructure, marine and fishing industry, transportation and logistics, and other specialized applications. The food and beverage processing segment dominates with over 32% market share, reflecting the critical importance of temperature-controlled environments in food production and safety.

Regional Market Analysis

North America leads the refrigeration system market with advanced regulatory frameworks supporting energy efficiency and natural refrigerant adoption. The region's mature cold chain infrastructure and strong food safety regulations drive continuous technology upgrades and system replacements, creating steady demand for advanced refrigeration solutions.

Europe continues to expand its sustainable refrigeration infrastructure with aggressive HFC phase-out schedules and carbon neutrality commitments. The region's strict environmental regulations and energy efficiency standards create opportunities for manufacturers specializing in natural refrigerant systems and ultra-high efficiency technologies.

Asia-Pacific demonstrates the strongest growth potential driven by rapid economic development, urbanization, and cold chain infrastructure expansion. The region's large manufacturing base and growing middle-class population create significant demand for commercial and industrial refrigeration systems across multiple application segments.

Latin America focuses on agricultural cold storage development and food processing facility modernization. The region's emphasis on food export capabilities and pharmaceutical manufacturing expansion creates opportunities for specialized refrigeration systems serving temperature-sensitive products.

Middle East & Africa shows growing demand for refrigeration systems driven by food security initiatives, pharmaceutical manufacturing, and data center development. The region's harsh climate conditions and expanding retail infrastructure create unique opportunities for energy-efficient and reliable refrigeration solutions.

Refrigeration System Market Share

Major players like Daikin Industries, Carrier Global Corporation, Johnson Controls International, Emerson Electric, and Dover Corporation compete strongly in the refrigeration system industry. These companies focus on strategic acquisitions, technology innovation, and sustainable product development to strengthen their market positions and expand global reach. As demand grows for energy-efficient and environmentally-friendly refrigeration solutions, companies invest heavily in R&D, manufacturing capacity expansion, and service network development.

Leading manufacturers are forming strategic partnerships with technology companies, engineering firms, and end-users to develop integrated cooling solutions that address specific industry requirements. These collaborations enable better system optimization, improved energy efficiency, and enhanced reliability under diverse operating conditions. The market is also witnessing increased consolidation as major players acquire specialized manufacturers and regional competitors to expand their product portfolios and market coverage.

Refrigeration System Market Companies

Major players operating in the refrigeration system industry include:

Refrigeration System Industry News

In 2024: Daikin Industries announced significant global investments exceeding US $2 billion in research, development, and manufacturing capacity, with a strong focus on advancing low-GWP and natural refrigerant technologies. These efforts are part of the company’s broader initiative to accelerate the transition to climate-friendly cooling solutions and support its goal of achieving carbon neutrality by 2050.

October 2024: The U.S. Environmental Protection Agency finalized new regulations accelerating the HFC phase-down schedule, requiring 85% reduction in HFC production and consumption by 2036. The policy change is expected to drive significant demand for natural refrigerant systems across commercial and industrial applications.

October 2024: Carrier Global Corporation finalized the sale of its European and global commercial refrigeration business—including brands like Profroid, Celsior, and Green & Cool—to Haier Smart Home for approximately US $775 million in enterprise value (about US $679 million in cash proceeds). This strategic divestment allowed Carrier to sharpen its focus on HVAC and climate-control solutions, while bolstering Haier’s position in the industrial and CO₂-based refrigeration markets..

August 2024: Johnson Controls introduced its next-generation IoT-enabled platform within the OpenBlue ecosystem, designed to optimize energy use and enhance predictive maintenance across HVAC and refrigeration systems. Leveraging AI and advanced analytics, the platform enables remote monitoring, fault detection, and system-level efficiency improvements. In commercial applications, OpenBlue has demonstrated energy savings of up to 30% and a reduction in chiller-related unplanned downtime by as much as 50%, helping facilities improve reliability and reduce operating costs.

Refrigeration System Industry Segmentation

The refrigeration system market includes compressors, condensers, evaporators, expansion devices, controls and automation systems, heat exchangers, and auxiliary equipment used in commercial, industrial, and residential cooling applications. The report covers complete refrigeration systems and individual components designed for temperature-controlled environments.

The refrigeration system market is segmented by component, refrigerant type, application, and geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa). By component, the market includes compressors, condensers, evaporators, expansion devices, controls and automation, heat exchangers, vessels and receivers, pumps and circulation equipment, valves and fittings, and auxiliary equipment. By refrigerant type, the market covers hydrofluorocarbons (HFCs), hydrofluoroolefins (HFOs), natural refrigerants, and hydrochlorofluorocarbons (HCFCs). The report provides comprehensive market analysis and forecasts for each segment.

|

Particulars |

Details |

|

Number of Pages |

265 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.4% |

|

Market Size (Value)in 2025 |

USD 40.1 Billion |

|

Market Size (Value) in 2035 |

USD 64.7 Billion |

|

Segments Covered |

By Product Offering

By Refrigerant Type

By Application

|

|

Countries Covered |

North America (U.S., Canada) |

|

Key Companies |

Daikin Industries, Ltd., Carrier Global Corporation, Johnson Controls International plc, Emerson Electric Co., Dover Corporation, Lennox International Inc., GEA Group AG, Bitzer SE (Bitzer Kühlmaschinenbau GmbH), Danfoss A/S, Baltimore Aircoil Company Inc., EVAPCO, Inc., Hussmann Corporation, AB Electrolux, Haier Inc., LU-VE S.p.A., Ali Group S.r.l., Hillphoenix (Dover Corporation), AHT Cooling Systems GmbH, EPTA Group, Industrial Frigo Srl.. |

The Refrigeration System Market size is expected to reach USD 38.7 billion in 2024 and grow at a CAGR of 4.9% to reach USD 64.7 billion by 2035.

In 2024, the Refrigeration System Market size is expected to reach USD 38.7 billion.

Daikin Industries Ltd., Carrier Global Corporation, Johnson Controls International plc, Emerson Electric Co., and Dover Corporation are the major companies operating in the Refrigeration System Market.

The Asia-Pacific region is estimated to grow at the highest CAGR over the forecast period (2025-2035).

In 2024, compressors account for the largest market share in the Refrigeration System Market.

What years does this Refrigeration System Market report cover, and what was the market size in 2024?

In 2024, the Refrigeration System Market size was estimated at USD 38.7 billion. The report covers historical market size data and forecasts through 2035.

Published Date: Jan-2025

Published Date: Jun-2023

Published Date: Nov-2019

Published Date: Aug-2024

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates