Resources

About Us

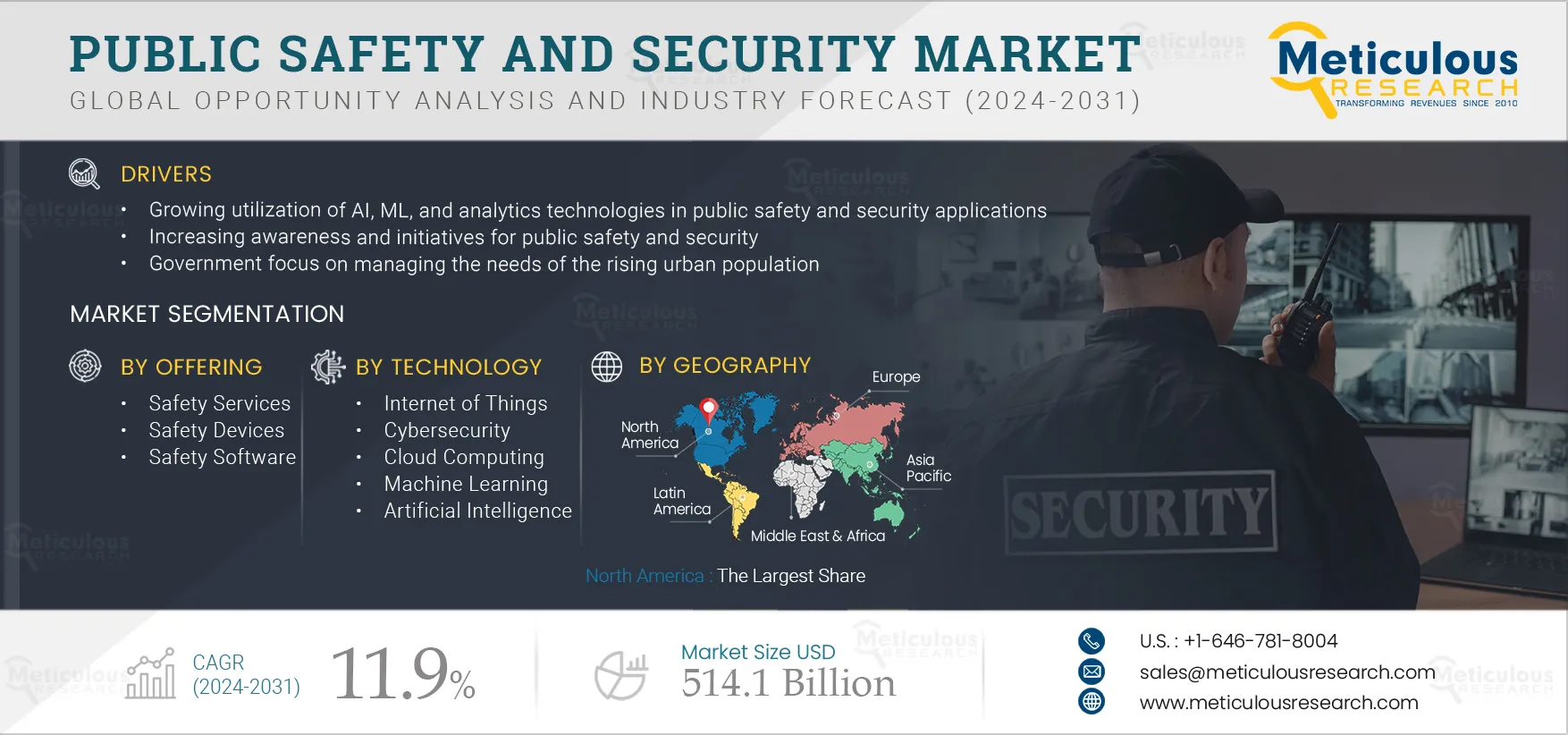

Public Safety and Security Market Size, Share, Forecast, & Trends Analysis by Offering (Safety Devices, Safety Software, Safety Services), Technology (IoT, AI, Cloud Computing, ML), Application (Data Gathering, Mapping, and 3D Imaging), End Use, and Geography - Global Forecast to 2031

Report ID: MRSE - 104978 Pages: 362 Jan-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 2 to 4 Hours Download Free Sample ReportThe Public Safety and Security Market is expected to reach $514.1 billion by 2031, at a CAGR of 11.9% from 2024 to 2031. The growth of the public safety and security market is driven by the growing utilization of AI, ML, and analytics technologies in public safety and security applications, increasing awareness and initiatives for public safety and security, and government focus on managing the needs of the rising urban population. However, the significant initial investments required to implement public safety and security solutions restrain the growth of this market. The integration of cloud computing and big data analytics in public safety and security solutions and the rising incidence of terrorism and security breaches are expected to generate market growth opportunities. However, the complexities in implementing advanced public safety and security systems and the rising cases of data theft are major challenges for market stakeholders.

The rising occurrence of terrorist activities and security breaches has increased the demand for public safety and security solutions. Leading public safety and security solutions providers are leveraging this demand as an opportunity to develop innovative offerings to increase revenues and capture larger market shares. Governments worldwide are undertaking various initiatives, such as implementing advanced surveillance systems, including CCTV cameras and facial recognition technology, to monitor and identify potential threats in public spaces. For instance, in August 2021, the U.S. Federal Government announced plans to expand the use of facial recognition technology to pursue criminals and identify threats. The federal government had also experienced issues, such as improper surveillance and false arrests; hence, the government announced increasing the implementation of facial recognition systems by the end of 2023.

Furthermore, there is a high focus on improving access control systems to enhance security in sensitive spaces such as airports, government buildings, and critical infrastructure. For instance, according to an article posted on the NFCW website in November 2022, Airports in the U.S. were likely to begin testing biometric access control cards using built-in fingerprint sensors to verify the identities of employees and other authorized cardholders at points of entry to secure areas. Moreover, terrorist attacks and security breaches are driving the demand for safety devices. For instance, biometric authentication systems, such as fingerprint and iris scanners, are being adopted to enhance access control and prevent unauthorized entry. Furthermore, there is an increased emphasis on deploying advanced threat detection technologies, such as explosive detection systems and X-ray scanners, to enhance security screening at airports and other high-risk locations. Therefore, the rising occurrence of terrorist activities and security breaches is generating growth opportunities for the players operating in the public safety and security market.

Click here to: Get Free Sample Pages of this Report

The integration of smart technologies such as artificial intelligence (AI), machine learning (ML), and analytics is revolutionizing the public safety industry. These technologies enable proactive threat detection and efficient incident response. In recent years, AI has been increasingly used to detect security breaches. For instance, according to a 2021 survey by Delinea Inc. (U.S.), a security software company, 61% of enterprises failed to detect security breach attempts without AI systems globally, with 49% of global enterprises increasing their AI cybersecurity budgets by an average of 29% after 2020.

Furthermore, to analyze the potential opportunities for integrating AI in public safety, understand how AI is being used to support security operations and quantify its impact on cybersecurity performance, the IBM Institute for Business Value (IBV) partnered with the American Productivity and Quality Center (APQC) to survey 1,000 executives with overall responsibility for their organization’s IT and operational technology (OT) cybersecurity systems. The respondents described their initiatives to use AI technology to support security operations and manage protection, prevention, detection, and response processes. Approximately 64% of respondents agreed to have implemented AI for its security capabilities, and 26% were evaluating implementation. Machine learning lacks popularity compared to artificial intelligence; however, the technology’s feasibility in health safety and security is being researched. Over the last decade, ML technology has developed tremendously and applied in biometric recognition, medical diagnosis, detection of credit card fraud, and speech and handwriting recognition, among other public safety and security applications.

Government efforts to safeguard public spaces and the rapid growth in the global urban population support the growth of the public safety and security market. Increasing urbanization is driving the demand for effective public safety solutions. Governments worldwide are initiating large-scale projects to develop safe cities and implement robust safety infrastructures. Such projects are boosting the adoption of advanced safety devices and driving the public safety and security market. For instance, in May 2023, approximately 1,401 cameras were installed in Ludhiana, Punjab (India), under the Safe City project launched in 2016. These cameras have been installed across the city to reduce crime and provide people with a safer environment. Additionally, population growth and rapid urbanization are driving the need for initiatives to develop urban infrastructure. Currently, over 50% of the global population lives in urban areas, and by 2045, the world’s urban population is expected to reach 6 billion. Rapid urbanization has created new challenges for governments, such as meeting the ever-increasing need for critical and safety infrastructure, transport systems, and emergency response services. For instance, in August 2023, the Maharashtra Public Health Department announced plans to launch a toll-free helpline number (115) for doorstep medical emergencies throughout the Indian state of Maharashtra. Such initiatives are boosting the adoption of public safety and security products, driving the growth of this market.

The integration of cloud computing technology and big data analytics has greatly improved public safety and security. Using cloud computing, organizations can store and access vast amounts of data securely, allowing for real-time analysis and improved decision-making. The technology enables law enforcement agencies to monitor and respond to threats effectively.

Big data analytics is vital in enhancing public safety and security. The technology can help government agencies analyze large volumes of data from various sources, such as surveillance cameras, biometric systems, and sensor networks. By leveraging advanced analytics techniques, law enforcement agencies can identify patterns, detect anomalies, and predict potential incidents, leading to proactive prevention and faster response times. For instance, in March 2022, the Los Angeles Police Department (LAPD) set up a Real-Time Analysis Critical Response (RACR) System in collaboration with an IT firm, a private technology company that began developing social network software to track terrorists and has now entered big data policing. Using big data, the LAPD generates crime heat maps daily by utilizing tons of historical data and real-time indicators to predict possible crimes. Real-time facial-recognition software links existing video surveillance cameras and massive biometric databases to automatically identify people with open warrants. Thus, big data is invaluable in tackling anti-social elements and maintaining law and order.

Furthermore, governments around the world are investing in the development of smart cities, which rely on cloud computing and big data analytics to enhance public safety. Additionally, partnerships between technology companies and law enforcement agencies are driving the development of innovative solutions that leverage these technologies. Such initiatives will potentially create lucrative opportunities for market growth.

Complexities in implementing advanced public safety and security systems are impacting their adoption, hampering the growth of this market. Organizations are also reluctant to adopt advanced safety technologies due to cost and privacy concerns. However, the lack of new safety systems powered by advanced technologies, such as deep learning, sensors, and low-latency edge computing, can leave public spaces vulnerable to evolving risks, as traditional security measures may not be sufficient to ensure safety and security. This reluctance to adopt advanced public safety and security solutions is a major challenge for the players operating in this market; however, raising awareness about the benefits and effectiveness of new safety technologies can help market players overcome this challenge in the coming years.

Based on offering the global public safety and security market is segmented into safety devices, safety software, and safety services. In 2024, the safety services segment is expected to account for the largest share of 48.9% of the public safety and security market. The large market share of this segment is attributed to the increasing demand for specialized safety services to address specific safety and security challenges. Safety services such as critical infrastructure security, emergency medical, firefighting, and disaster management services are critical in ensuring the safety and well-being of citizens and critical assets. Moreover, the safety services segment is also projected to register the highest CAGR 12.3% during the forecast period.

Based on technology, the global public safety and security market is segmented into the internet of things, artificial intelligence, cloud computing, machine learning, cybersecurity, and other technologies. In 2024, the internet of things segment is estimated to reach revenue of USD 72.9 billion of the total public safety and security market. The large share of the segment is attributed to the rising demand for real-time data insights and improved situational awareness. Moreover, the Internet of Things segment is projected to register the highest CAGR during the forecast period.

Based on application, the global public safety and security market is segmented into data gathering, mapping and 3D imaging, threat detection, security and incident management, monitoring, fire and explosion examination, network security, and other applications. In 2024, security and incident management segment is expected to account for the largest share of 18.5% of the global public safety and security market. The large market share of this segment is attributed to the need to respond effectively to emergencies, the increasing adoption of smart city technologies, and the integration of IoT devices. Moreover, the segment is also expected to grow with the highest growth rate over the forecast period.

Based on end use, the global public safety and security market is segmented into warehouses & depots, workplaces, shopping malls & retail stores, schools & universities, hospitals & healthcare, residential, transportation, and other end uses. In 2024, the transportation segment is expected to account for the largest share of the global public safety and security market. The segment is expected to reach USD 31.8 billion by 2024. The large share of this segment is attributed to the growing concern of terrorist threats and passenger safety. Advances in contactless ticketing and facial recognition for identity verification are driving the adoption of modern transportation security solutions. Furthermore, the implementation of AI-based video analytics for crowd monitoring contributes to the growth of this segment.

The hospitals and healthcare segment is expected to register the highest CAGR during the forecast period. The growth of this segment is driven by the need to ensure the safety of patients, medical staff, and sensitive medical data within healthcare facilities. Safety devices used in hospitals and healthcare facilities include access control systems, surveillance cameras, and panic alarms. Additionally, safety services such as emergency response planning and patient tracking are widely used for maintaining a safe healthcare environment. The implementation of safety solutions in hospitals and healthcare facilities is rising due to increasing incidents of violence and security breaches. Advances in telemedicine platforms and remote patient monitoring are driving the adoption of digital healthcare security solutions. Furthermore, the rising integration of security systems with electronic health records contributes to the growth of this segment.

Based on geography, the public safety and security market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, North America is expected to account for the largest share of 40.1% of the global public safety and security market. North America public safety and security market is estimated to be worth USD 95.4 billion in 2024. The large share of this region is attributed to the rising adoption of digital technology and data due to the growing need for improving decision-making, promoting digital inclusivity and equity, creating a collaborative ecosystem, prioritizing citizen safety and health, establishing trust and transparency, and developing resilience and adaptability to manage change effectively.

Europe is slated to register the highest CAGR of the global public safety and security market during the forecast period. The public safety and security market in Europe is experiencing significant growth due to the rising concern over terrorism, cyber threats, and crime. European governments and organizations are increasingly investing in advanced security solutions to combat these challenges and ensure public safety.

The report offers a competitive analysis based on an extensive assessment of the leading players' product portfolios and geographic presence and the key growth strategies adopted by them over the past 3–4 years. Some of the key players operating in the public safety and security market are Hexagon AB (Sweden), Fujitsu Ltd. (Japan), Robert Bosch GmbH (Germany), Atos SE (France), Cisco Systems, Inc. (U.S.) Saab AB (Sweden), Airbus SE (Netherlands), Siemens AG (Germany), Intel Corporation (U.S.), Fotokite AG (Switzerland), CityShob (Israel), 3xLOGIC (U.S.), L3Harris Technologies, Inc. (U.S.), OnSolve (U.S.) and Haystax (U.S.).

|

Particulars |

Details |

|

Number of Pages |

362 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR |

11.9% |

|

Market Size (Value) |

USD 514.1 Billion by 2031 |

|

Segments Covered |

By Offering

By Technology

By Application

By End Use

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Taiwan, and Rest of Asia-Pacific), Latin America, and Middle East & Africa. |

|

Key Companies |

Hexagon AB (Sweden), Fujitsu Ltd. (Japan), Robert Bosch GmbH (Germany), Atos SE (France), Cisco Systems, Inc. (U.S.) Saab AB (Sweden), Airbus SE (Netherlands), Siemens AG (Germany), Intel Corporation (U.S.), Fotokite AG (Switzerland), CityShob (Israel), 3xLOGIC (U.S.), L3Harris Technologies, Inc. (U.S.), OnSolve (U.S.) and Haystax (U.S.). |

This study focuses on market assessment and opportunity analysis by analyzing the revenue of global public safety and security across various regions and countries. This study also offers a competitive analysis of the global public safety and security market based on an extensive assessment of the leading players' product portfolios, geographic presence, and key growth strategies.

The global public safety and security market is expected to reach $514.1 billion by 2031 from an estimated $234.2 billion in 2024, at a CAGR of 11.9% during the forecast period (2024–2031).

Based on offering, in 2024, the safety services segment is estimated to account for the largest share of the public safety and security market.

Based on technology, in 2024, the Internet of Things segment is estimated to account for the largest share of the public safety and security market.

Based on end user, in 2024, the transportation segment is estimated to account for the largest share and highest CAGR of the public safety and security market.

The growth of this market is attributed to factors such as growing use of AI, ML, and analytics, increasing awareness and training initiatives for public safety and security, and government focus on managing the needs of the rising urban population. Besides, integration of cloud computing and big data analytics and rising incidence of terrorism and security breaches is expected to create market growth opportunities.

The key players operating in the public safety and security market are Hexagon AB (Sweden), Fujitsu Ltd. (Japan), Robert Bosch GmbH (Germany), Atos SE (France), Cisco Systems, Inc. (U.S.) Saab AB (Sweden), Airbus SE (Netherlands), Siemens AG (Germany), Intel Corporation (U.S.), Fotokite AG (Switzerland), CityShob (Israel), 3xLOGIC (U.S.), L3Harris Technologies, Inc. (U.S.), OnSolve (U.S.) and Haystax (U.S.).

North America is projected to register the highest growth rate over the coming years and offer significant growth opportunities for vendors operating in this market.

Published Date: Jan-2023

Published Date: Mar-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates