Resources

About Us

Precision Bearings Market Size, Share, & Forecast by Bearing Type (Ball, Roller, Air), Material, Precision Class (ABEC), and Application (Spindles, Robotics) – Global Forecast (2026-2036)

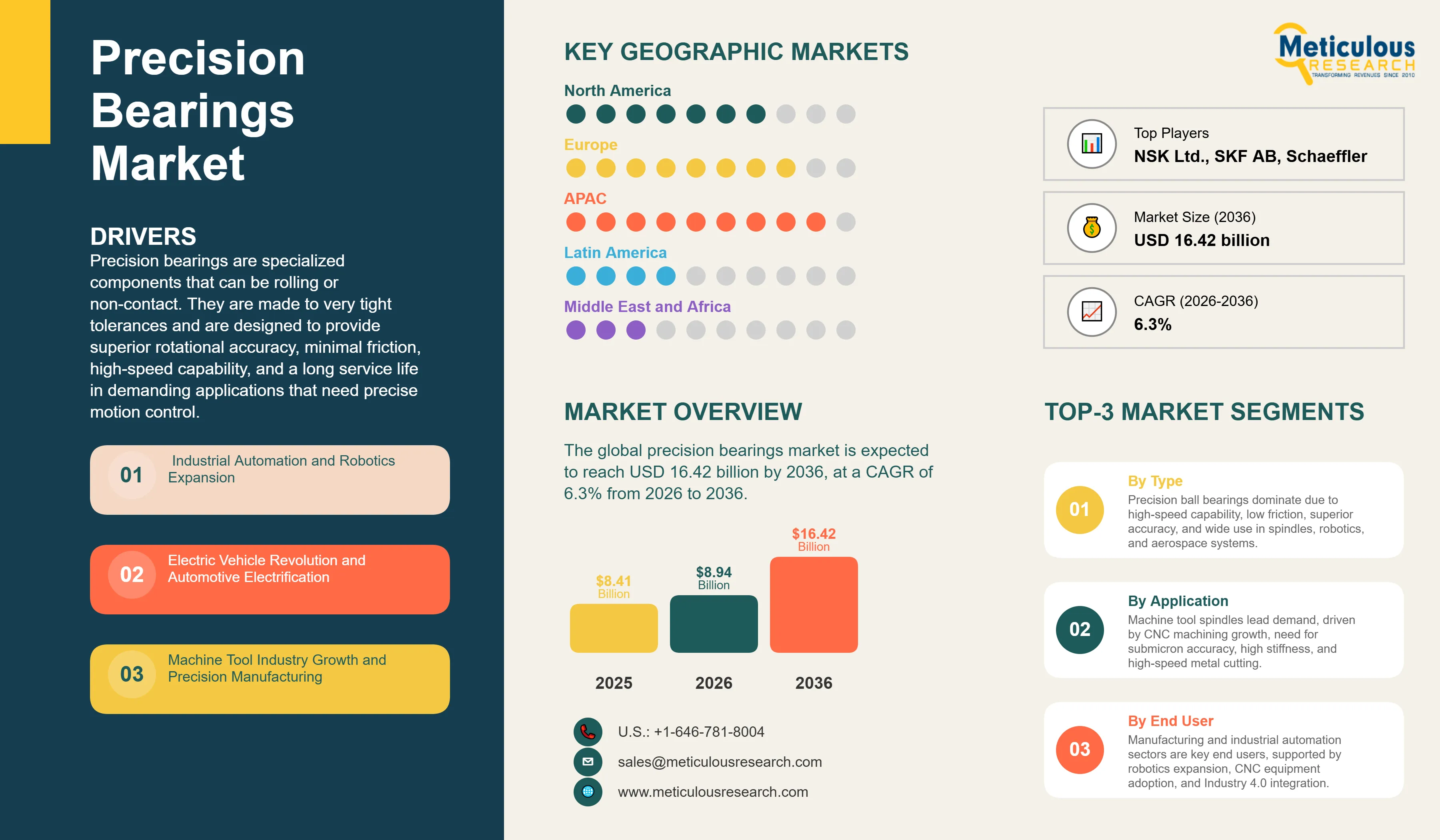

Report ID: MROTH - 1041679 Pages: 273 Jan-2026 Formats*: PDF Category: Others Delivery: 24 to 72 Hours Download Free Sample ReportThe global precision bearings market is expected to reach USD 16.42 billion by 2036 from USD 8.94 billion in 2026, at a CAGR of 6.3% from 2026 to 2036.

Precision bearings are specialized components that can be rolling or non-contact. They are made to very tight tolerances and are designed to provide superior rotational accuracy, minimal friction, high-speed capability, and a long service life in demanding applications that need precise motion control. These bearing systems have complex design features, including ultra-precise raceway geometry with tolerances measured in micrometers. They are made from high-grade bearing steel or ceramics that have high hardness and fatigue resistance. Their internal geometry is optimized to reduce friction and heat generation. They include lubrication systems that ensure consistent performance and precision-ground or super-finished contact surfaces with surface roughness values below 0.02 micrometers.

These bearings are made using strict manufacturing processes like precision grinding, honing, and lapping. Stringent quality control and classification systems, such as ABEC (Annular Bearing Engineers' Committee) and ISO precision grades, also play a key role. Precision bearings are essential for critical applications. These include machine tool spindles that need submicron runout accuracy, industrial robots that require precise joint positioning and smooth movement, aerospace systems that need lightweight and reliable components, medical devices like surgical instruments and imaging equipment, semiconductor manufacturing equipment that must operate ultra-clean and vibration-free, and high-performance automotive applications such as electric vehicle motors and transmission systems.

Click here to: Get Free Sample Pages of this Report

Precision bearings are essential mechanical parts that enable advanced machinery and precision equipment to perform exceptionally across various industries. These specialized bearing systems provide the foundation for accurate rotation. They support and guide rotating elements with tolerances measured in micrometers while reducing friction, heat generation, and vibration that can affect precision. The main challenge in designing precision machinery is achieving and maintaining accurate rotational motion under different loads, speeds, and environmental conditions. This makes precision bearings vital for applications ranging from submicron-accuracy machine tool spindles and nanometer-precision semiconductor manufacturing equipment to reliable aerospace systems and smoothly operating industrial robots.

Several key trends are changing the precision bearings market. These include the development of hybrid and full ceramic bearing technologies that offer better high-speed and high-temperature performance. There's also a rise in industrial automation and robotics that require smooth, precise motion control. The growth of semiconductor manufacturing creates demand for equipment that operates without vibration and remains ultra-clean. The shift toward electric vehicle powertrains opens up new applications in motors and transmissions. Finally, the integration of smart sensor technologies helps with monitoring conditions and predictive maintenance. The combination of manufacturing precision needs, faster automation, the development of advanced materials, and the rise of Industry 4.0 has moved precision bearings from being standard mechanical parts to key enablers of competitive advantage in precision manufacturing and advanced technology applications.

The precision bearings market is shifting towards higher performance specifications, better materials, and intelligent bearing systems that come with monitoring features. Modern precision bearings are breaking traditional performance limits through innovations such as ultra-high precision grades (ABEC 9 and ISO Class 2) that achieve submicron runout for ultra-precision applications. Advanced bearing steel metallurgy improves fatigue life and temperature resistance. Hybrid bearing designs combine steel rings with ceramic rolling elements for optimal performance. Specialized coatings like diamond-like carbon (DLC) reduce friction and wear. Improved internal geometry reduces heat generation and extends speed limits. The introduction of smart technologies—such as embedded sensors for monitoring temperature, vibration, and load, along with wireless communication for real-time condition monitoring—helps transform bearings from simple mechanical parts into intelligent components that increase overall equipment effectiveness and prevent unexpected failures.

Ceramic bearing technology is advancing quickly and gaining traction in the market due to its superior performance in demanding applications. Silicon nitride (Si3N4) ceramic rolling elements provide several advantages over traditional steel. They are 60% lighter, which reduces centrifugal forces at high speeds. They have higher hardness (Vickers hardness ~1600 compared to ~800 for bearing steel), which enhances wear resistance. A lower thermal expansion coefficient helps maintain clearance despite temperature changes. They are electrically insulated, which prevents damaging electric discharge machining (EDM) in motor applications. The corrosion resistance of ceramic bearings allows them to function in harsh environments. These features make ceramic bearings especially valuable in electric vehicle motors, which require high-speed operation and electrical insulation, as well as in machine tool spindles that need maximum speed capability, aerospace components that require lightweight, reliable parts, and semiconductor manufacturing equipment that must operate cleanly without particle contamination. The growth in this segment results from falling ceramic material costs that make hybrid bearings (ceramic balls with steel rings) competitive in price, a booming electric vehicle market that drives demand for motor bearings, and proven performance benefits in high-value applications that justify higher costs.

Machine tool spindle applications continue to inspire innovation in precision bearings and represent the largest application segment. Modern CNC machining centers, grinding machines, and ultra-precision manufacturing equipment need spindle bearings that provide submicron runout accuracy, high-speed capability exceeding 30,000 RPM for small-diameter spindles, high stiffness to handle cutting forces, thermal stability to maintain accuracy despite temperature shifts, and long service life to reduce costly downtime. Angular contact ball bearings are the most common choice for machine tool spindle applications due to their balance of radial and axial load capacity, high-speed capability, and precision performance. Typical configurations often involve matched bearing sets positioned in tandem, back-to-back, or face-to-face arrangements. This segment benefits from ongoing advancements in machine tools toward higher speeds and precision, increasing CNC machine tool production, especially in Asia. It also serves industries such as aerospace and automotive, which demand precision machining capabilities, along with medical device manufacturing that needs ultra-precision components.

|

Parameter |

Details |

|

Market Size Value in 2026 |

USD 8.94 Billion |

|

Revenue Forecast in 2036 |

USD 16.42 Billion |

|

Growth Rate |

CAGR of 6.3% from 2026 to 2036 |

|

Base Year for Estimation |

2025 |

|

Historical Data |

2021–2025 |

|

Forecast Period |

2026–2036 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2026 to 2036 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Bearing Type, Precision Class, Material, Application, Industry Vertical, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, Germany, U.K., France, Italy, Spain, Sweden, Japan, China, South Korea, Taiwan, India, Singapore, Brazil, Mexico, Saudi Arabia, UAE |

|

Key Companies Profiled |

NSK Ltd., SKF AB, Schaeffler Technologies AG & Co. KG, NTN Corporation, JTEKT Corporation, Timken Company, Minebea Mitsumi Inc., THK Co. Ltd., C&U Group, ZWZ Bearing Co. Ltd., LYC Bearing Corporation, GMN Paul Müller Industrie GmbH & Co. KG, Barden Precision Bearings (Schaeffler), RBC Bearings Incorporated, Kaydon Corporation (SKF), SNR Bearings (NTN), FAG (Schaeffler), IKO International Inc., Nachi-Fujikoshi Corp., Koyo Bearings (JTEKT) |

The combination of precision bearings and industrial robotics is creating specific bearing needs and significant market opportunities. Industrial robots need bearings that offer smooth and precise motion control for accurate positioning. They also require minimal backlash and friction for responsive servo control, a long service life of over 20,000 hours under continuous operation, compact and lightweight designs for better robot dynamics, and low noise operation for cooperative tasks with humans. Robot joints generally use precision angular contact ball bearings or crossed roller bearings, depending on what the application needs. In cases where harmonic drives and RV reducers are involved, specialized bearing configurations are necessary.

The rapid rise in industrial robot installations, which exceed 550,000 units annually worldwide and are expected to reach over 700,000 by 2027, is driving a strong demand for precision bearings. Each articulated robot typically needs 10 to 20 precision bearings across its joints and reducers. This market benefits from the growth of collaborative robots, as their applications spread from the automotive sector into electronics, food processing, and logistics. Continuous improvements in robot performance also create a need for high-precision bearings.

Air bearing technology serves a specialized but expanding market focused on ultra-precision applications that require motion free from friction and vibrations. Air bearings use pressurized air films instead of rolling elements to support loads. This design eliminates mechanical contact and achieves nearly zero friction, meaning no wear or maintenance is needed. They also provide infinite resolution for positioning, ultra-smooth motion without stick-slip, and produce no particles, making them suitable for clean-room environments. These features are crucial for applications such as semiconductor wafer inspection and metrology equipment that demands nanometer-level positioning, ultra-precision coordinate measuring machines (CMM), and laser beam delivery systems that need vibration-free mirror positioning. The growth in this sector is fueled by advancements in semiconductor manufacturing that strive for smaller process nodes, the expansion of precision manufacturing applications, and research in nanotechnology and advanced materials that require ultra-precise measurement and manipulation.

Driver: Industrial Automation and Robotics Expansion

The global growth of industrial automation and robotics is mainly driving the demand for precision bearings in manufacturing. In 2022, industrial robot installations reached 553,000 units, according to the International Federation of Robotics. Projections suggest continued growth, surpassing 700,000 annual installations by 2027. Each industrial robot requires several precision bearings for joint movement, reducer integration, and end-effector mechanisms. Typical six-axis robots use 10 to 20 precision bearings, including angular contact ball bearings in harmonic drive and RV reducers, crossed roller bearings in wrist and tool mounting, and specialized bearings in linear axes and grippers. The active stock of robots exceeds 3.9 million worldwide, creating ongoing demand for bearing replacement and maintenance. Collaborative robots, or cobots, are the fastest-growing segment, with over 50,000 installations each year and expected to reach more than 150,000 units by 2030. Cobots focus on smooth, precise movement for safety and quality, requiring high-quality precision bearings with low friction, minimal vibration, and reliable performance. The automation trend includes not just robotics, but also CNC machine tools, automated assembly equipment, packaging machines, semiconductor manufacturing tools, and medical device production systems—all of which need precision bearings for accurate motion control. Factors like labor shortages in developed countries, rising labor costs, the need for consistent quality beyond human capabilities, and dangerous or hard-to-handle tasks fuel the demand for automation equipment and precision bearings.

Opportunity: Semiconductor Manufacturing Equipment Expansion

The growth in semiconductor manufacturing capacity worldwide presents important opportunities for ultra-precision bearing suppliers in this demanding sector. Semiconductor fabrication equipment, including lithography systems, wafer inspection tools, chemical vapor deposition systems, and wafer handling robotics, requires bearings that provide nanometer-level positioning accuracy, ultra-clean operation to avoid particle contamination, vibration-free motion for imaging and measurement, and exceptional reliability for high-uptime manufacturing. The global semiconductor industry is experiencing unprecedented expansion, driven by demand for AI chips, automotive semiconductors, 5G infrastructure, and government support for domestic production. The United States CHIPS Act allocates $52 billion for semiconductor manufacturing and research, leading to significant investments in fabrication facilities by Intel, TSMC, Samsung, and others. Similar efforts in Europe, Japan, South Korea, and China are driving investments over $200 billion globally through 2030. Each advanced semiconductor fabrication facility represents a $10 to $20 billion investment in equipment, with precision bearings being critical components. The shift to smaller process nodes (5nm, 3nm, 2nm) requires increasingly precise lithography and metrology tools, where bearing performance directly impacts manufacturing yield and costs. Precision bearing suppliers with ultra-clean manufacturing, experience in semiconductor applications, and the ability to meet strict particle generation and outgassing requirements can command premium prices in this high-value sector.

By Bearing Type:

In 2026, the precision ball bearing segment will have the largest share of the overall precision bearings market. Ball bearings are preferred for precision applications because they have several advantages. They have better high-speed capabilities and lower friction than roller bearings. They can also handle both radial and axial loads, especially in angular contact settings. They achieve excellent precision, reaching ABEC 9 and ISO Class 2 tolerances. They operate smoothly with minimal vibration and have an established manufacturing base that allows for competitive pricing. Angular contact ball bearings are the largest sub-segment. They are crucial for machine tool spindles, robot joints, and precision machinery. They support combined radial and axial loads, provide high stiffness when preloaded in matched sets, operate at speeds over 30,000 RPM in small sizes, and offer exceptional runout accuracy. Deep groove ball bearings primarily support radial loads with moderate axial capability, while thrust ball bearings mainly manage axial loads in applications like machine tool spindle thrust bearings and automotive transmissions. The segment benefits from ongoing material and manufacturing improvements. Vacuum-degassed bearing steel enhances fatigue life. Precision grinding and super-finishing achieve surface roughness below 0.01 micrometers. Optimized internal geometry reduces friction and heat generation. Improved cage materials and designs boost high-speed performance. Hybrid ball bearings that combine steel rings with silicon nitride ceramic balls are the fastest-growing sub-segment. They provide 30-50% higher speed capability, reduced weight and centrifugal forces, electrical insulation, and a longer service life, justifying higher prices for electric vehicle motors, high-speed spindles, and aerospace applications.

By Precision Class (ABEC/ISO):

The ABEC 7 (ISO Class 4) segment is expected to be the largest in the overall market in 2026. ABEC 7 strikes a balance between precision performance and cost for most industrial applications. It provides tolerances suitable for general machine tool spindles operating up to 15,000 RPM, industrial robots requiring smooth, precise motion, precision machinery, and general aerospace applications. ABEC 7 bearings typically achieve inner ring raceway runout under 5 micrometers, outer ring raceway runout under 7 micrometers, and ball diameter variation under 0.13 micrometers. These specifications are enough for most precision manufacturing applications and remain cost-effective through established manufacturing processes. This segment dominates production across industrial applications where ultra-precision (ABEC 9) is not needed and standard precision (ABEC 5) is insufficient. Market positioning reflects the segment's sweet spot, which caters to the largest part of precision bearing demand, including mid-range CNC machine tools, general industrial robots, precision gearboxes, and automotive applications.

By Material:

The bearing steel segment is expected to retain significant market share throughout the forecast period. High-carbon chromium bearing steel (AISI 52100 / DIN 100Cr6) remains the leading bearing material due to proven performance. It has excellent hardness after heat treatment (Rockwell C 60-65), superior fatigue resistance under cyclic loading, established manufacturing processes that facilitate cost-effective production, and reliable performance across various applications. Innovations in bearing steel metallurgy continue, including vacuum degassing that reduces non-metallic inclusions causing fatigue failures, optimized heat treatment processes for uniform hardness and optimal residual stress profiles, the use of specialized alloys like nitrogen-bearing steels that improve corrosion resistance, and surface treatments such as nitriding and coating that enhance wear resistance and fatigue life. The segment benefits from its established presence in existing applications, cost advantages over ceramic alternatives for moderate performance needs, continuous improvements that enhance capabilities, and a comprehensive manufacturing infrastructure that supports global supply. Bearing steel remains dominant in areas where traditional performance suffices, cost is a consideration, and extreme operating conditions—such as high speed, high temperature, or electrical environments—are not encountered.

The ceramic bearing segment is growing rapidly due to its superior performance in demanding applications. Silicon nitride (Si3N4) ceramic rolling elements provide significant advantages, including a 60% weight reduction compared to steel, which decreases centrifugal forces at high speeds. They also have superior hardness (Vickers 1600 versus 800), improved wear resistance, lower thermal expansion that maintains bearing clearances across temperature changes, and electrical insulation that prevents damage in motor applications. They are chemically inert, allowing operation in corrosive environments, and offer extended service life in tough conditions. Hybrid bearings that combine ceramic balls with steel rings make up the largest portion of the ceramic segment, offering a good balance between performance and cost while being compatible with existing bearing designs. Full ceramic bearings, which have ceramic rings and balls, are used in specialized applications needing complete electrical insulation, extreme chemical resistance, or non-magnetic operation compatible with MRI. The growth of this segment is driven by the rise in electric vehicles that need electrically insulating bearings for motors operating at high voltages, high-speed machine tool spindles that benefit from reduced centrifugal forces, semiconductor manufacturing equipment that requires ultra-clean operation, aerospace applications that take advantage of weight reductions, and declining ceramic material costs that enhance competitiveness. Hybrid bearings are nearing cost parity with premium steel bearings for many applications, which should further increase their adoption.

By Application:

The machine tool spindles segment accounts for the largest share of the market in 2026. Machine tool applications represent the historical core of precision bearing demand, with CNC machining centers, grinding machines, lathes, and milling machines requiring bearings that provide submicron runout accuracy for surface finish quality, high-speed capability matching spindle speeds from 5,000 to 40,000+ RPM, high stiffness resisting deflection under cutting forces, thermal stability maintaining accuracy as spindle temperature rises, and long service life minimizing costly production interruptions. Angular contact ball bearings dominate spindle applications in various arrangements including tandem (back-to-back) configurations providing high axial and radial stiffness, face-to-face arrangements for maximum moment stiffness, and tandem (in-series) configurations for extreme axial loads. The segment benefits from continuous machine tool advancement toward higher speeds, precision, and productivity, growing global machine tool production particularly in Asia exceeding $80 billion annually, aerospace and automotive precision machining requirements, medical device manufacturing, and mold and die making requiring ultra-precision surface finishes. High-speed machining trends drive demand for premium ABEC 7 and ABEC 9 bearings with ceramic ball upgrades, while ultra-precision grinding applications require ABEC 9 bearings achieving nanometer-level spindle error motion.

The electric vehicle motors and drivetrains segment represents the fastest-growing application area. EV motors operating at 10,000-20,000+ RPM require bearings providing electrical insulation preventing EDM damage from motor voltages, high-speed capability with reduced friction and heat generation, lightweight design for optimal power-to-weight ratio, and extended service life matching vehicle warranty requirements of 150,000+ miles. Hybrid ceramic bearings with silicon nitride balls dominate EV motor applications due to electrical insulation and high-speed performance. E-axle transmissions require additional precision bearings for gear support and differential functions. The segment's explosive growth is driven by global EV sales exceeding 14 million units in 2023 and projected to surpass 40 million by 2030, transition to 800V electrical architectures increasing EDM risk, and EV efficiency focus demanding ultra-low-friction bearings minimizing parasitic losses.

In 2026, the Asia-Pacific region commands the largest share of the global precision bearings market. This leadership position is primarily attributed to the region's dominance in manufacturing sectors requiring precision bearings with China, Japan, and South Korea representing world leaders in machine tool production, industrial robot manufacturing and deployment, semiconductor fabrication capacity, and automotive production including rapidly expanding EV manufacturing. Major bearing manufacturers headquartered in the region include NSK, NTN, JTEKT (Koyo), Nachi-Fujikoshi, and Minebea Mitsumi in Japan, plus rapidly developing Chinese manufacturers including C&U Group, ZWZ, and LYC expanding capabilities in precision grades. China drives substantial market growth through world's largest machine tool production exceeding 50% global output, industrial robot installation base surpassing 1.2 million operational units, semiconductor manufacturing expansion with new fabs under construction, and electric vehicle production leadership with over 9 million units in 2023. Japan maintains technological leadership in ultra-precision bearing design and manufacturing, serving high-value applications including semiconductor equipment, ultra-precision machine tools, and aerospace. South Korea contributes through semiconductor manufacturing concentration (Samsung, SK Hynix), automotive production, and display panel manufacturing requiring precision automation equipment.

The European region is expected to grow at a significant CAGR during the forecast period due to advanced manufacturing sector emphasizing quality and precision, strong automotive industry transitioning to electric vehicles, aerospace industry including Airbus and defense manufacturers, medical device manufacturing cluster, and machine tool industry particularly in Germany, Italy, and Switzerland. Germany dominates the regional market through its precision engineering tradition and world-leading machine tool industry (DMG Mori, Trumpf, Chiron), premium automotive manufacturers requiring precision components (BMW, Mercedes-Benz, Volkswagen, Porsche), aerospace and defense sectors, and headquarters of major bearing companies including Schaeffler (FAG, INA brands) and SKF European operations. The region emphasizes ultra-precision applications, advanced materials including ceramic bearings, Industry 4.0 integration with smart bearing technologies, and stringent quality requirements creating demand for premium precision grades. European machine tool builders' focus on high-value, high-precision equipment creates sustained demand for ABEC 7-9 bearings and hybrid ceramic solutions.

North America represents a significant market driven by aerospace and defense industry representing world's largest with substantial bearing demand for aircraft, helicopters, missiles, and military systems, advanced manufacturing reshoring initiatives bringing production back to United States particularly in aerospace, medical devices, and semiconductors, medical device industry cluster with precision bearing requirements for surgical instruments, imaging equipment, and diagnostic devices, automotive sector including traditional manufacturers and EV startups, and semiconductor fab expansion with Intel, TSMC, Samsung, and others investing over $100 billion in U.S. facilities. The United States market emphasizes high-value, high-performance applications including aerospace where reliability and certification justify premium pricing, medical devices with stringent regulatory requirements, semiconductor equipment serving advanced fabs, and defense applications requiring exceptional reliability. The region benefits from strong intellectual property protection encouraging innovation, quality-conscious customers accepting premium pricing for superior performance, and established relationships between bearing suppliers and major aerospace and medical device manufacturers.

Key Players:

The major players in the precision bearings market include NSK Ltd. (Japan), SKF AB (Sweden), Schaeffler Technologies AG & Co. KG (Germany), NTN Corporation (Japan), JTEKT Corporation (Japan), Timken Company (U.S.), Minebea Mitsumi Inc. (Japan), THK Co. Ltd. (Japan), C&U Group (China), ZWZ Bearing Co. Ltd. (China), LYC Bearing Corporation (China), GMN Paul Müller Industrie GmbH & Co. KG (Germany), Barden Precision Bearings (Schaeffler) (U.S./Germany), RBC Bearings Incorporated (U.S.), Kaydon Corporation (SKF) (U.S.), SNR Bearings (NTN) (France), FAG (Schaeffler) (Germany), IKO International Inc. (Japan), Nachi-Fujikoshi Corp. (Japan), and Koyo Bearings (JTEKT) (Japan), among others.

The precision bearings market is expected to grow from USD 8.94 billion in 2026 to USD 16.42 billion by 2036.

The precision bearings market is expected to grow at a CAGR of 6.3% from 2026 to 2036.

The major players in the precision bearings market include NSK Ltd., SKF AB, Schaeffler Technologies AG & Co. KG, NTN Corporation, JTEKT Corporation, Timken Company, Minebea Mitsumi Inc., THK Co. Ltd., C&U Group, ZWZ Bearing Co. Ltd., LYC Bearing Corporation, GMN Paul Müller Industrie GmbH & Co. KG, Barden Precision Bearings (Schaeffler), RBC Bearings Incorporated, Kaydon Corporation (SKF), SNR Bearings (NTN), FAG (Schaeffler), IKO International Inc., Nachi-Fujikoshi Corp., and Koyo Bearings (JTEKT), among others.

The main factors driving the precision bearings market include explosive growth of industrial automation and robotics with over 550,000 annual robot installations requiring multiple precision bearings per unit, electric vehicle revolution creating substantial demand for high-speed motor bearings with electrical insulation properties, machine tool industry growth and increasing precision manufacturing requirements, semiconductor manufacturing equipment expansion with ultra-precision positioning needs, aerospace and defense applications requiring high-reliability lightweight bearings, advancement of ceramic and hybrid bearing technologies offering superior high-speed and high-temperature performance, and integration of smart sensor technologies enabling condition monitoring and predictive maintenance.

Asia-Pacific region will lead the global precision bearings market in 2026 due to massive machine tool production, industrial robot deployment, and semiconductor manufacturing concentration, and is expected to maintain the largest market share during the forecast period 2026 to 2036.

Published Date: Apr-2025

Published Date: Mar-2025

Published Date: Feb-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates