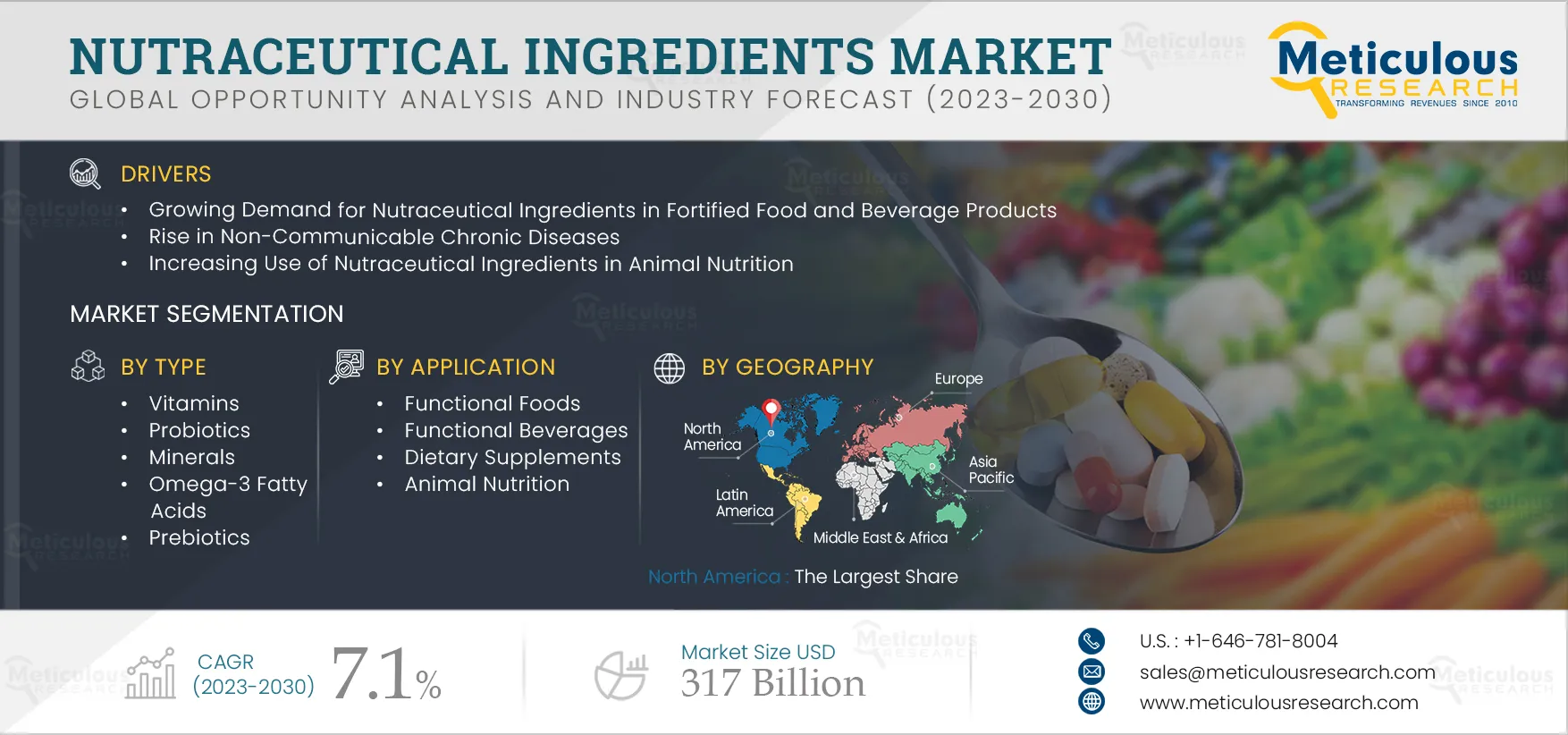

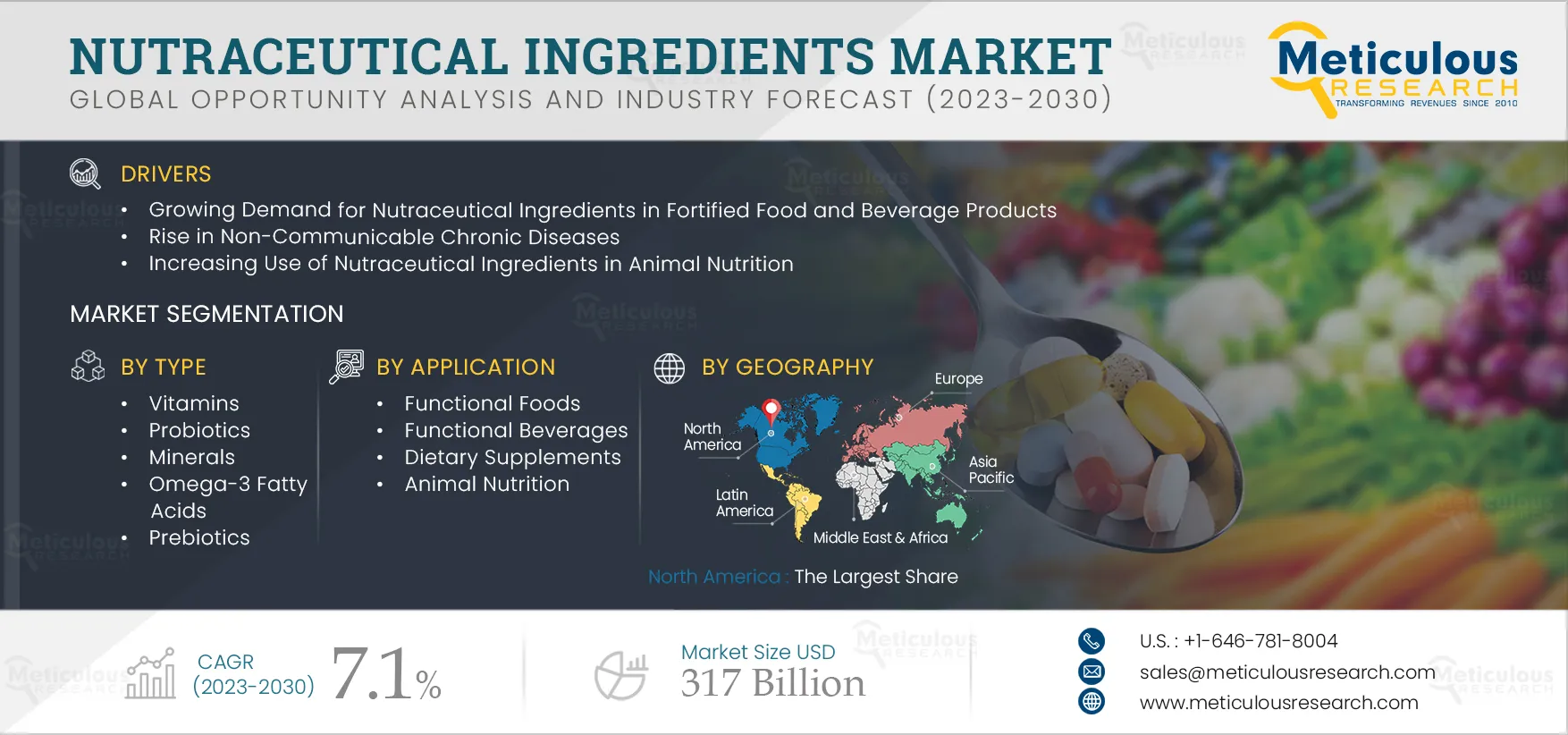

The Nutraceutical Ingredients Market is slated to register a CAGR of 7.1% from 2023–2030 to reach $317 Billion by 2030. The popularity of nutraceutical ingredients is rising due to changing lifestyles and the growing veganism trend, innovations in nutraceutical products, growing venture investments in nutraceutical companies, increasing incidence of chronic and infectious diseases and growing use of nutraceutical ingredients in food & beverage products which positively impacts the demand for nutraceutical ingredients.

The Nutraceutical Ingredients Market is driven by growing demand for these ingredients in fortified food and food and beverage products, a rise in non-communicable chronic diseases, and the increasing use of nutraceutical ingredients in animal nutrition. However, the high cost of nutraceutical products and consumers' misbeliefs is expected to restrain the growth of this market to some extent.

Growing Demand for these Ingredients in Fortified Food and Beverage Products

Consumers are becoming increasingly concerned about their health and paying more attention to their lifestyles and dietary habits. The global demand for healthy & nutrition-rich diets is rising with the growing world population. According to the Food and Agriculture Organization (FAO), in 2050, the global demand for food, particularly nutrient-rich, will be twice as compared to 2013.

In recent years, consumer awareness regarding health, nutrition-rich diets, calorie reduction, and food safety has grown globally, which is expected to transform the food & beverage sector and boost the growth of the fortified food market.

Furthermore, the incidence of anemia caused due to iron deficiency has increased significantly and is expected to increase in the coming years. The increasing cases of anemia may result in millions of women facing poor health and quality of life and impaired development and learning in children. Anemia is an indicator of both poor nutrition and poor health. According to World Health Organization (WHO), in 2019, 29.9% of women suffered from anemia worldwide, and about 60.2% of children were affected by anemia in 2019.

Moreover, nearly 462 million adults are underweight. In 2020, 149 million children under 5 were estimated to be short for age, 45 million were estimated too thin for height, and 38.9 million were overweight or obese. Around 45% of deaths among children under 5 years of age are due to undernutrition [Source: World Health Organization (WHO]). Thus, the increasing cases of deficiency of nutrients and increased consumer interest in nutrition and health are expected to boost the demand for healthy & nutrition-rich diets, subsequently driving the demand for nutraceutical ingredients used in food and beverage products.

Moreover, consumers are increasingly spending on value-added food categories to maintain healthier lifestyles, boosting the sales of fortified foods and nutritional food and beverage products. Increasing awareness among people regarding strengthening their immunity to prevent risks of infections has compelled them to maintain healthy lifestyles and adopt proper dietary habits. These factors are expected to drive the growth of this market across the globe.

Click here to: Get a Free Sample Copy of this report

Key Findings in the Nutraceutical Ingredients Market Study :

In 2023, the Probiotics Segment is Slated to Register the Highest CAGR During the Forecast Period

Based on product type, the global nutraceutical ingredients market is segmented into vitamins, proteins and amino acids, probiotics, minerals, omega-3 fatty acids, fibers & specialty carbohydrates, prebiotics, phytochemical & plant extracts, and others. In 2023, the probiotics segment is slated to register the highest CAGR during the forecast period. The fastest growth of this segment is attributed to the changing lifestyle and eating habits, increasing awareness about the health benefits of probiotics beyond digestive health, and growing use of probiotics in animal feed for animal nutrition. In addition, increasing health issues such as digestive disorders and diarrhea and the growing aging population also drive the demand for probiotics.

In 2023, the Naturally Sourced Segment to Account for the Larger Share

Based on Source, the global nutraceutical ingredients market is segmented into natural and synthetic. In 2023, the natural segment is expected to account for the larger share of the global nutraceutical ingredients market. The large market share of this segment is attributed to the increased consumer confidence in organic foods as well as their concern about possible health risks and side effects associated with artificial food and synthetic chemicals.

The Liquid Form Segment is Slated to Register the Highest CAGR During the Forecast Period

Based on form, the global nutraceutical ingredients market is segmented into dry form and liquid form. The liquid segment is slated to register the highest CAGR during the forecast period. The rapid growth of this segment is attributed to the greater ease of creating new products, ease of consumption, and low cost for processing.

The Infant and Maternal Nutrition Segment is Slated to Register the Highest CAGR During the Forecast Period

Based on application, the global nutraceutical ingredients market is segmented into functional foods, functional beverages, dietary supplements, animal nutrition, and other applications. The functional beverages segment is slated to register the highest CAGR during the forecast period. The rapid growth of this segment is attributed to the growing demand for functional beverages in emerging economies, increasing demand for sports drinks, and a rise in health expenditure.

In 2023, the Food and Beverage Manufacturers Segment to Dominate the Nutraceutical Ingredients Market

Based on end user, the nutraceutical ingredients market is segmented into food and beverage manufacturers, health supplement manufacturers, pharmaceutical manufacturers, animal feed manufacturers, and other end users. In 2023, the food and beverage manufacturers segment is expected to account for the largest share of the nutraceutical ingredients market. The large market share of this segment is attributed to the factors such as the increasing demand for proteins from food & beverage products, the increasing vegan population, continued innovations in food with nutritious value, and growing health awareness among consumers.

North America: The Dominating Regional Market

The nutraceutical ingredients market is segmented into five major regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, North America is expected to account for the largest share of the nutraceutical ingredients market. The large market share of this region is attributed to the presence of high nutraceutical product manufacturers, the growing vegan population, consumer awareness of nutraceutical products, and high investments in the research & development of food processing equipment.

However, Asia-Pacific is slated to register the highest CAGR during the forecast period. The growth of this regional market is attributed to technological advancements in the food industry, the wide availability of raw materials with huge production capabilities, increasing demand for dietary supplements, rising awareness regarding the health benefits of nutritional products, increasing disposable incomes, rapid urbanization, and rising health wellness trends in nutraceutical sector.

Key Players

The report offers a competitive landscape based on an extensive assessment of the product portfolio offerings, geographic presences, and key strategic developments adopted by leading market players in this market in the last 2020-2023. Some of the key players operating in the global nutraceutical ingredients market are Associated British Foods plc (U.K.), Arla Foods (Denmark), Koninklijke DSM N.V. (Netherlands), Ingredion Incorporated (U.S.), Tate & Lyle plc (U.K.), Ajinomoto Co. Inc. (Japan), Chr. Hansen Holding A/S (Denmark), Glanbia plc. (Ireland), Cargill, Incorporated (U.S.), BASF SE (Germany), and Kerry Group plc (Ireland).

Scope of the Report:

Nutraceutical Ingredients Market Assessment, by Type

- Vitamins

- Proteins and Amino Acids

- Probiotics

- Minerals

- Omega-3 Fatty Acids

- Fibers & Specialty Carbohydrates

- Prebiotics

- Phytochemical & Plant Extracts

- Other Products

Nutraceutical Ingredients Market Assessment, by Source

- Naturally-sourced

- Synthetic

Nutraceutical Ingredients Market Assessment, by Form

Nutraceutical Ingredients Market Assessment, by Application

- Functional Foods

- Functional Beverages

- Dietary Supplements

- Animal Nutrition

- Other Applications

Nutraceutical Ingredients Market Assessment, by End User

- Food and Beverage Manufacturers

- Health Supplement Manufacturers

- Pharmaceutical Manufacturers

- Animal Feed Manufacturers

- Other End Users

Nutraceutical Ingredients Assessment, by Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Latin America

- Middle East & Africa

Key Questions Answered in the Report: