Resources

About Us

North America X-ray Detectors Market by Product Type (FPD, CSI, GADOX, CR, CCD), FOV (Large, Medium, Small), Portability (Portable, Fix), System (New, Retrofit), and Application [Medical (Mammogram, Spine), Dental, Industrial, Veterinary] - Forecast to 2032

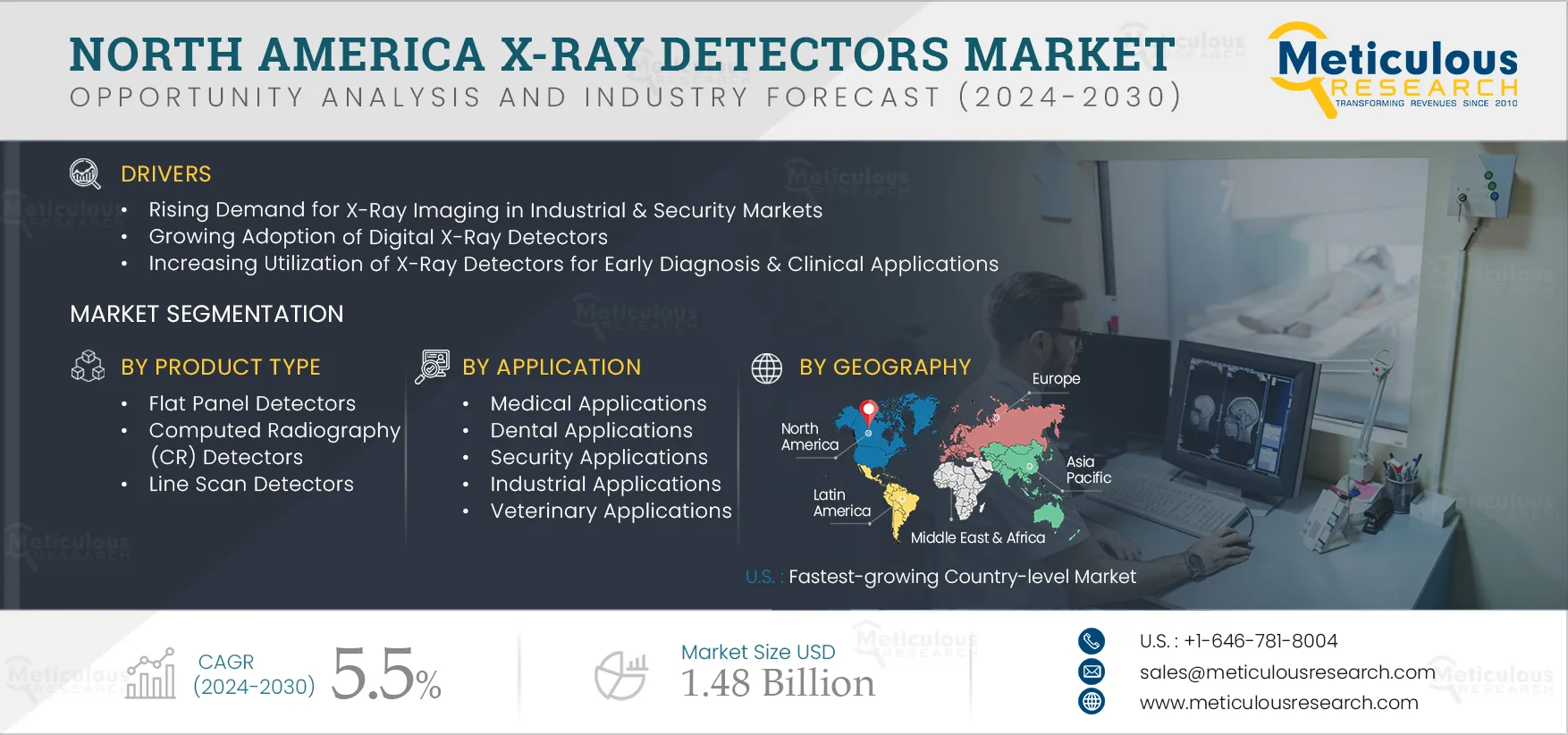

Report ID: MRHC - 104914 Pages: 150 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe North America X-ray Detectors Market is projected to reach $1.48 billion by 2032, at a CAGR of 5.5% from 2025 to 2032. X-ray detectors are devices designed to capture and measure the X-ray radiation that passes through an object. These detectors play a crucial role in various applications, including medical imaging, security screening, non-destructive testing, and scientific research.

The growth of this market is driven by the growing geriatric population coupled with the rising prevalence of chronic diseases & respiratory infections, the rising demand for X-ray imaging in industrial & security markets, and the growing adoption of digital X-ray detectors. Furthermore, ongoing innovations in X-ray imaging systems are expected to offer significant market growth opportunities. However, the health hazards caused by radiation restrain the market’s growth.

Click here to: Get Free Request Sample Copy of this report

X-ray imaging is used for non-destructive testing (NDT) and manufacturing inspection in the food & beverage, automotive, aerospace, oil & gas, and nuclear industries. X-ray imaging is used during manufacturing for non-destructive testing of critical automotive components. This process helps detect defects, cracks, and other flaws in materials without damaging the parts, ensuring the quality and safety of the final products. Moreover, with the rise of electric vehicles (EVs), X-ray imaging is increasingly used to inspect battery packs for internal defects or abnormalities, ensuring the safety and efficiency of the battery systems.

X-ray imaging is also used in security applications such as cargo & passenger screening for port, passenger, and border protection. The X-ray detectors market is attributed to the rising number of airports, growth in air travel, rising cargo volumes, heightened concerns over security due to increasing incidents of terror attacks, and the growing need for non-destructive testing (NDT) across diverse industries. In 2021, international traveler numbers were 27% of 2019 levels. This number is projected to reach 92% in 2025 and 101% by 2025 (source: International Air Transport Association). Thus, the growing volume of passengers has highlighted the need for security measures at airports, driving the demand for X-ray screening systems and detectors used in these systems.

Growing Adoption of Digital X-ray Detectors Drives the Demand for North America X-ray Detectors Market

Digitalization has played a prominent role in transforming X-ray & medical equipment in recent years. Film-based and Computed Radiography (CR) plates are being replaced by fully digital X-ray detectors that require a lower radiation dose and provide high-quality images quickly. In addition, digital technology enables video capabilities, which has given rise to new applications, such as fluoroscopy, cone beam computed tomography (CBCT), and tomosynthesis. These advances drive the adoption of digital detectors, especially flat panel detectors.

Digital X-ray detectors are lightweight, compact, offer high image quality & throughput, enable screening at much lower radiation doses and improve overall workflow at healthcare facilities. These digital flat panel detectors are equipped with data processing engines and carry their calibration files, which allows for the correction of images on panels. This on-panel image correction capability increases image transmission speed and reliability.

X-ray imaging technology has transitioned from film/CR plate-based imaging to digital radiography (DR) imaging. Furthermore, reimbursement cuts imposed by Medicare on the use of analog systems have further compelled healthcare facilities in the U.S. to switch from film/CR to DR. The reimbursement cuts to traditional imaging methods are driving the uptake of digital X-ray detectors.

In 2025, the Flat Panel Detectors (FPD) Segment is Expected to Dominate the North America X-ray Detectors Market

Among the product types included in the report, in 2025, the Flat Panel Detectors (FPD) segment is expected to account for the largest share of the North America X-ray detectors market. Flat panel detectors (FPD) are solid-state detectors that produce digital electronic signals. FPDs are used in digital radiography (DR) to convert X-rays into light (indirect conversion) or charge (direct conversion), which is interpreted using a thin film transistor (TFT) array. The growing adoption of digital technology, rising demand for retrofit FPDs, and favorable regulatory reforms contribute to the large market share of this segment.

In 2025, the Medical Applications Segment is Expected to Dominate the North America X-ray Detectors Market

Among the applications included in the report, in 2025, the medical applications segment is expected to account for the largest share of the North America X-ray detectors market. X-rays are used to look for signs of lung pneumonia, injuries, bone fractures, and some types of tumors. According to International Osteoporosis Foundation (IOF), in 2010, globally, 158 million individuals were at high fracture risk, which is projected to double by 2040.

In addition, dental X-rays are used to diagnose cavities and other dental issues. Despite the availability of various innovative imaging modalities, such as MRI and ultrasound, X-ray imaging remains the first choice of testing in most cases due to its easy availability, low cost, and satisfactory performance. This factor contributes to the increased demand for X-ray detectors for medical applications.

U.S.: Fastest-growing Country-level Market

Based on geography, the U.S. is slated to record the highest growth rate during the forecast period. The increasing demand for advanced technologies, the rising aging population, the increasing incidence of chronic diseases, and the increasing adoption of healthcare services mainly drive the growth of this market. According to the U.S. Census Bureau, in 2021, the number of adults aged 65 and older reached over 54 million in the U.S., which is 16.5% of the country's total population. This number is expected to reach an estimated 85.7% by 2050, which is roughly 20% of the U.S. population. This demographic shift will necessitate enhanced disease diagnosis approaches to mitigate unnecessary surgeries and associated costs. These factors are expected to increase the demand for X-ray detectors.

Key Players

The key players profiled in this market study are Varex Imaging Corporation (U.S.), Trixell (France), Canon Inc. (Japan), Agfa-Gevaert N.V. (Belgium), Teledyne Technologies Incorporated (U.S.), Carestream Health, Inc. (U.S.), Konica Minolta, Inc. (Japan), Rayence (U.S.), Vieworks Co., Ltd (Republic of Korea), Hamamatsu Photonics K.K. (Japan), Analogic Corporation (U.S.), and FUJIFILM Holdings Corporation (Japan).

Scope of the Report:

North America X-ray Detectors Market Assessment, by Product Type

North America X-ray Detectors Market Assessment, by Application

North America X-ray Detectors Market Assessment, by Geography

Key questions answered in the report:

The North America X-ray detectors market study covers the market sizes & forecasts for types of X-ray detectors used in hospitals, industries, and laboratories. The report includes the value analysis of various segments of the North America X-ray detectors at the country level.

The North America X-ray detectors market is projected to reach $1.48 billion by 2032, at a CAGR of 5.5% during the forecast period.

Based on product type, the flat panel detectors segment is expected to register the highest CAGR during the forecast period. Flat panel detectors play a crucial role in digital radiography (DR) by converting X-rays into light (indirect conversion) or charge (direct conversion). The resulting signals are then interpreted using a thin-film transistor (TFT) array. As a result, FPDs are widely utilized in medical imaging applications, including CT, X-rays, and mammography, as well as in several extraoral imaging devices.

Based on application, the security applications segment is expected to grow with the highest CAGR. X-rays play a crucial part in the identification of concealed weapons. X-rays are essential for identifying concealed weapons, making them crucial for enhancing security, especially due to the increasing global incidence of terror attacks. These factors drive the demand for X-ray detectors for screening luggage and people, particularly at airports.

The growth of this market is driven by the growing geriatric population coupled with the rising prevalence of chronic diseases & respiratory infections, the rising demand for X-ray imaging in industrial & security markets, and the growing adoption of digital X-ray detectors. Furthermore, ongoing innovations in X-ray imaging systems are expected to offer significant market growth opportunities.

The key players operating in the North America X-ray detectors market are Varex Imaging Corporation (U.S.), Trixell (France), Canon Inc. (Japan), Agfa-Gevaert N.V. (Belgium), Teledyne Technologies Incorporated (U.S.), Carestream Health, Inc. (U.S.), Konica Minolta, Inc. (Japan), Rayence (U.S.), Vieworks Co., Ltd (Republic of Korea), Hamamatsu Photonics K.K. (Japan), Analogic Corporation (U.S.), and FUJIFILM Holdings Corporation (Japan).

The U.S. is projected to offer significant growth opportunities for vendors operating in this market due to the growing partnerships between vendors and healthcare organizations, coupled with the increasing launches of advanced X-ray detectors into the market.

Published Date: Jan-2025

Published Date: Jul-2024

Published Date: May-2024

Published Date: Oct-2023

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates