Resources

About Us

Dental Imaging Market Size, Share, Forecast, & Trends Analysis by Product (Extraoral [CBCT, Cephalometric, Panoramic], Intraoral [Scanners, X-ray, Sensor, Camera], Software) Application (Implant, Prosthetic, Surgery) Portability – Global Forecast to 2032

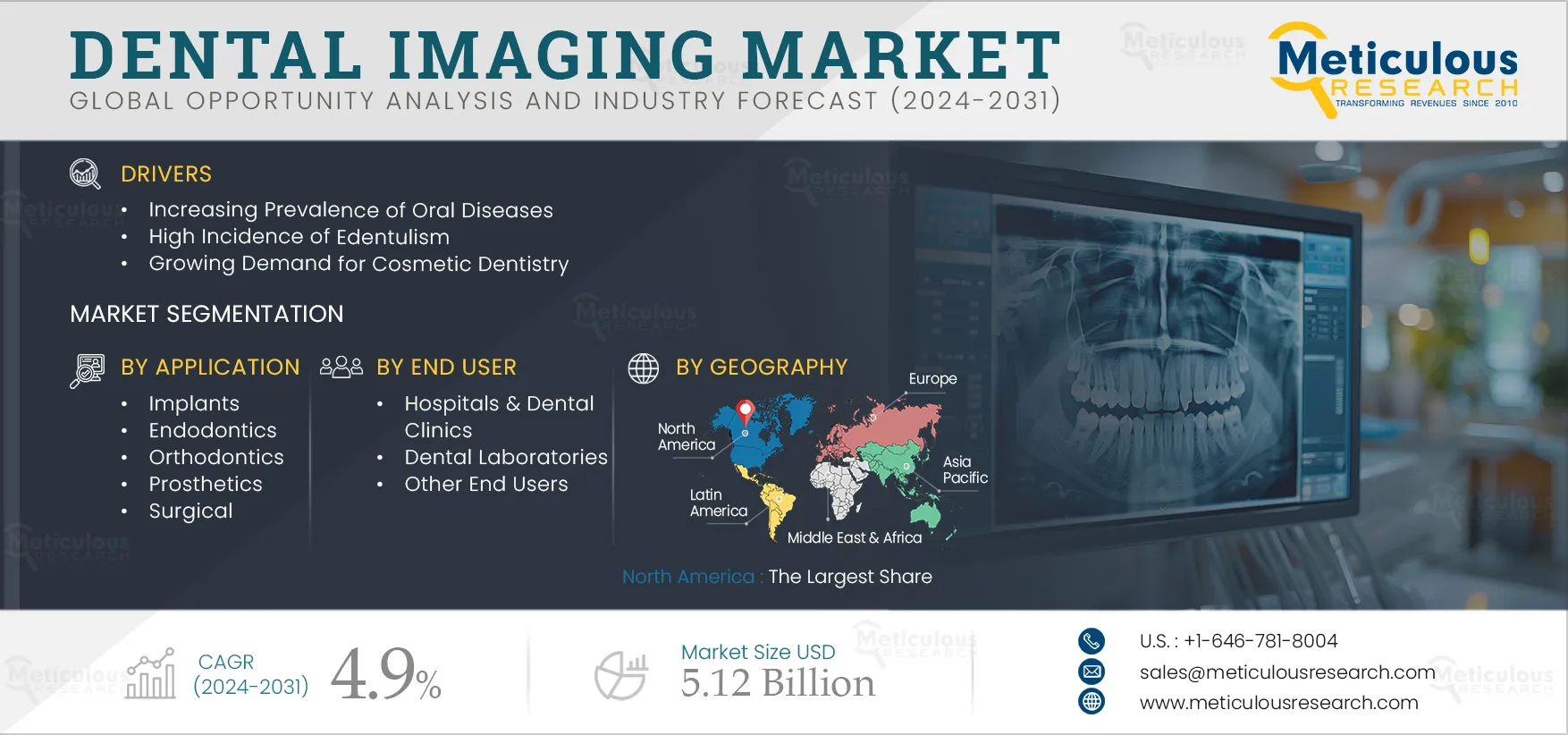

Report ID: MRHC - 1041197 Pages: 270 May-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the dental imaging market is driven by the increasing prevalence of oral diseases, high incidence of edentulism, growing demand for cosmetic dentistry, and rising geriatric population. Moreover, the rise in CAD/CAM dentistry and growth in dental tourism are expected to generate growth opportunities for the players operating in the dental imaging market.

Complete edentulism refers to the absence of teeth in the oral cavity. Despite advancements in preventive dentistry, edentulism remains a significant global health issue. For instance, more than 36 million Americans are fully edentulous, while over 120 million are partially edentulous (Source: American College of Prosthodontists). Having adequate dentition is crucial for maintaining overall well-being and quality of life. Edentulism poses a substantial public health challenge for older adults and impacts primary care. It is a profound and irreversible condition, often considered the ultimate indicator of oral health burden.

Dental imaging plays a vital role in managing edentulism by detecting conditions that may necessitate treatment before constructing dentures. Panoramic radiography is commonly utilized to examine edentulous jaws for various conditions, including retained teeth, root fragments, radiolucent lesions, foreign bodies, and impacted teeth.

The demand for cosmetic dentistry is on the rise, particularly among individuals aged 24–40 and 57–75. Those in the younger age bracket seek to enhance dental aesthetics, reflecting evolving preferences and needs in the industry. Patients now have a spectrum of choices, ranging from basic hygiene to more pronounced image enhancements, reshaping the dynamics of the field. Present-day individuals exhibit a greater willingness to invest in self-improvement, driving this trend. Factors such as affluent baby boomers, ambitious young professionals prioritizing appearance for career advancement, and notable industry advancements contribute to the surge in aesthetic dentistry.

Consequently, the increasing demand for cosmetic dental procedures fuels the adoption of dental imaging systems. These systems provide dental professionals with comprehensive information on patients' dental health and structure, thereby fostering market growth.

Click here to: Get Free Sample Pages of this Report

The integration of augmented reality (AR) and artificial intelligence (AI) into dental imaging technology holds significant promise for its advancement. AR has the potential to provide dentists and patients with an immersive, interactive view of dental structures and treatment plans, enhancing understanding and engagement. Similarly, AI-driven analysis of dental scans could enable swift assessments, anticipate treatment results, and recommend tailored treatment strategies by drawing on vast datasets of dental cases. This fusion within dental imaging technology is anticipated to greatly enhance the precision and personalization of dental care.

Digital dentistry is revolutionizing the dental imaging market by leveraging advanced technologies. From the superior imaging capabilities of cone beam computed tomography (CBCT) to the efficiency of intraoral scanners, digital tools are enhancing diagnostics and treatment planning. The precision afforded by CAD/CAM systems ensures the accurate fabrication of dental restorations, resulting in better fitting and longer-lasting outcomes. Integration with treatment planning software allows dentists to visualize procedures beforehand, enhancing both outcomes and patient satisfaction. Moreover, digital tools facilitate patient engagement by offering visual representations of dental issues and treatment options. As technology continues to advance, digital dentistry will remain a pivotal trend in propelling innovation and growth within the dental imaging market.

Dental tourism is rising in countries such as India, South Korea, and Brazil. This rise in dental tourism can be attributed to the dental procedures offered at a lower cost, the availability of skilled dental professionals, and the growing adoption of advanced dental technologies by dentists in the countries. For instance, a single tooth implant in South Korea costs around USD 1,160 compared to USD 4,800 in the U.S. and Canada. In addition, the rising adoption of aesthetic & cosmetic dentistry leads to the growth in dental tourism. Dental tourism offers several dental procedures ranging from restorative procedures to cosmetic and beautification. Most dental procedures require imaging, such as dental X-rays, CBCT, and intraoral scans, to assess the dental structure before any dental procedure.

Based on product type, the market is segmented into extraoral imaging systems, intraoral imaging systems, and software. In 2025, the extraoral imaging systems segment is expected to account for the largest share of 44.5% of the dental imaging market. The large market share of this segment is attributed to the high prevalence of dental disorders, high costs of extraoral scanners, growing adoption of dental implants, and jawbone reconstruction procedures.

Dental imaging, including bitewing X-ray, occlusal X-ray, periapical X-ray, dental images, and CBCT, provides detailed information on a patient’s oral anatomy. These images provide information on jawbone structure, bone density, and the condition of surrounding teeth and gums. This information is vital for the success and longevity of dental implants.

However, the intraoral imaging systems segment is projected to witness the highest growth rate of 6.0% during the forecast period. The growth of this segment is driven by the rising adoption of intraoral scanners, technological advancements in 3D intraoral scanners leading to their growing adoption, and rising preference for intraoral scanners due to their portability and patient convenience.

Based on application, the dental imaging market is segmented into implants, endodontics, orthodontics, prosthetics, surgical, and other applications. In 2025, the implants segment is expected to account for the largest share of 42.9% of the dental imaging market. The large share of the segment is attributed to the high prevalence of dental disorders, high adoption of dental implants, rising geriatric population with dental issues, and rising incidence of edentulism.

However, the orthodontics segment is also expected to grow at the highest CAGR of 6.3% during the forecast period. This growth can be attributed to the growing adoption of clear aligners; the rising adoption of dental scanners for orthodontic treatments; the high prevalence of orthodontic disorders such as overbite, crossbite, & teeth overlap; and demand for dental esthetics and cosmetic dentistry.

Based on portability, the dental imaging market is segmented into stationary, wall-mounted, and portable. In 2025, the stationary segment is expected to account for the largest share of the market. The large of this segment is attributed to the rising prevalence of dental disorders, the high incidence of dental clefts driving demand for dental surgery, and the importance of CBCT imaging for dental procedures.

However, the portable segment is slated to register the highest CAGR during the forecast period. The growth of this segment is attributed to the rising adoption of portable dental imaging systems due to technological advancements, increasing patient-centric care, and the growing availability of portable dental scanners. For instance, in 2024, Freqty Technology (China), launched PANDA Smart is the smallest and lightest intra-oral scanner.

Based on end user, the dental imaging market is segmented into hospitals & dental clinics, dental laboratories, and other end users. In 2025, the hospitals & dental clinics segment is expected to account for the largest share of the market. The large segmental share can be attributed to high patient visits due to more services provided by the hospitals compared to clinics, the high purchasing power of hospitals compared to clinics, and hospitals are generally the first choice of patients.

Similarly, the hospitals & dental clinics segment is expected to grow at the fastest CAGR during the forecast period. This growth can be attributed to the trend of consolidations of dental clinics, the adoption of new technologies by dental clinics, which enable them to perform procedures with less time, and the rising adoption of CAD/CADM by dental clinics & hospitals.

In 2025, North America is expected to account for the largest share of 32.7% of the dental imaging market. Among the U.S. and Canada, in 2025, the U.S. is expected to account for the larger share of the dental imaging market in North America. The large market share is attributed to the high prevalence of dental caries, high awareness regarding oral health, high adoption of dental insurance, willingness to spend more on implant and cosmetic dentistry, and industry-academia collaborations yielding advancements in dental fillings.

However, the region of Asia-Pacific is slated to register the highest CAGR of 6.2% during the forecast period. The growth of this region is attributed to the favorable government initiatives for oral health access and awareness, increasing disposable incomes, high prevalence of dental caries and other dental disorders, growing cases of edentulism associated with the rise in geriatric population, and high consumption of tobacco and processed sugars.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. The key players operating in the dental imaging market are Midmark Corporation (U.S.), 3Shape A/S (Denmark), Amann Girrbach AG (Austria), Carestream Dental LLC (U.S.), Condor Technologies NV (Belgium), Envista Holdings Corporation (U.S.), Kulzer GmbH (Germany), Institut Straumann AG (Switzerland), densys Ltd. (Israel), Align Technology, Inc. (U.S.), Medit Corp. (Republic of Korea), DENTSPLY SIRONA Inc. (U.S.), Planmeca Oy (Finland), AGE Solutions S.r.l. (Italy), Shining 3D Tech Co., Ltd. (China), J. MORITA CORP. (Japan), and ACTEON Group (U.K.).

|

Particular |

Details |

|

Page No |

270 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

4.9% |

|

Market Size (Value) |

$5.12 billion by 2032 |

|

Segments Covered |

By Product Type

By Application

By Portability

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Spain, Italy, Switzerland, Sweden, Poland, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of APAC), Latin America (Brazil, Mexico, Rest of Latin America), and Middle East & Africa (South Africa, Saudi Arabia, Rest of Middle East & Africa) |

|

Key Companies |

Midmark Corporation (U.S.), 3Shape A/S (Denmark), Amann Girrbach AG (Austria), Carestream Dental LLC (U.S.), Condor Technologies NV (Belgium), Envista Holdings Corporation (U.S.), Kulzer GmbH (Germany), Institut Straumann AG (Switzerland), densys Ltd. (Israel), Align Technology, Inc. (U.S.), Medit Corp. (Republic of Korea), DENTSPLY SIRONA Inc. (U.S.), Planmeca Oy (Finland), AGE Solutions S.r.l. (Italy), Shining 3D Tech Co., Ltd. (China), J. MORITA CORP. (Japan), and ACTEON Group (U.K.). |

The dental imaging market covers the market sizes & forecasts of dental imaging by product type, application, portability, and end user. The dental imaging market studied in this report involves the value analysis of various segments and sub-segments of the dental imaging market at regional and country levels.

The dental imaging market is projected to reach $5.12 billion by 2032, at a CAGR of 4.9% during the forecast period.

In 2025, the extraoral imaging systems segment is expected to account for the largest share of the dental imaging market.

The growth of the dental imaging market is driven by the increasing prevalence of oral diseases, high incidence of edentulism, growing demand for cosmetic dentistry, and rising geriatric population. Moreover, the rise in CAD/CAM dentistry and growth in dental tourism are expected to generate growth opportunities for the players operating in the dental imaging market.

The key players operating in the dental imaging market are Midmark Corporation (U.S.), 3Shape A/S (Denmark), Amann Girrbach AG (Austria), Carestream Dental LLC (U.S.), Condor Technologies NV (Belgium), Envista Holdings Corporation (U.S.), Kulzer GmbH (Germany), Institut Straumann AG (Switzerland), densys Ltd. (Israel), Align Technology, Inc. (U.S.), Medit Corp. (Republic of Korea), DENTSPLY SIRONA Inc. (U.S.), Planmeca Oy (Finland), AGE Solutions S.r.l. (Italy), Shining 3D Tech Co., Ltd. (China), J. MORITA CORP. (Japan), and ACTEON Group (U.K.).

The countries India and China are projected to offer significant growth opportunities for the vendors in this market due to increasing access to dental care, rising awareness regarding oral health, favorable government initiatives, and rising disposable incomes.

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: May-2024

Published Date: Apr-2023

Published Date: Mar-2019

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates