Resources

About Us

Medical Laser Market Size, Share, Forecast, & Trends Analysis by Type (Device Type (Solid-state Lasers, Gas Lasers, Dye Lasers, Diode Lasers), Fiber Type (Disposable Laser Fibers, Reusable Laser Fibers)), Application (Device, Fiber), and Geography - Global Forecast to 2031

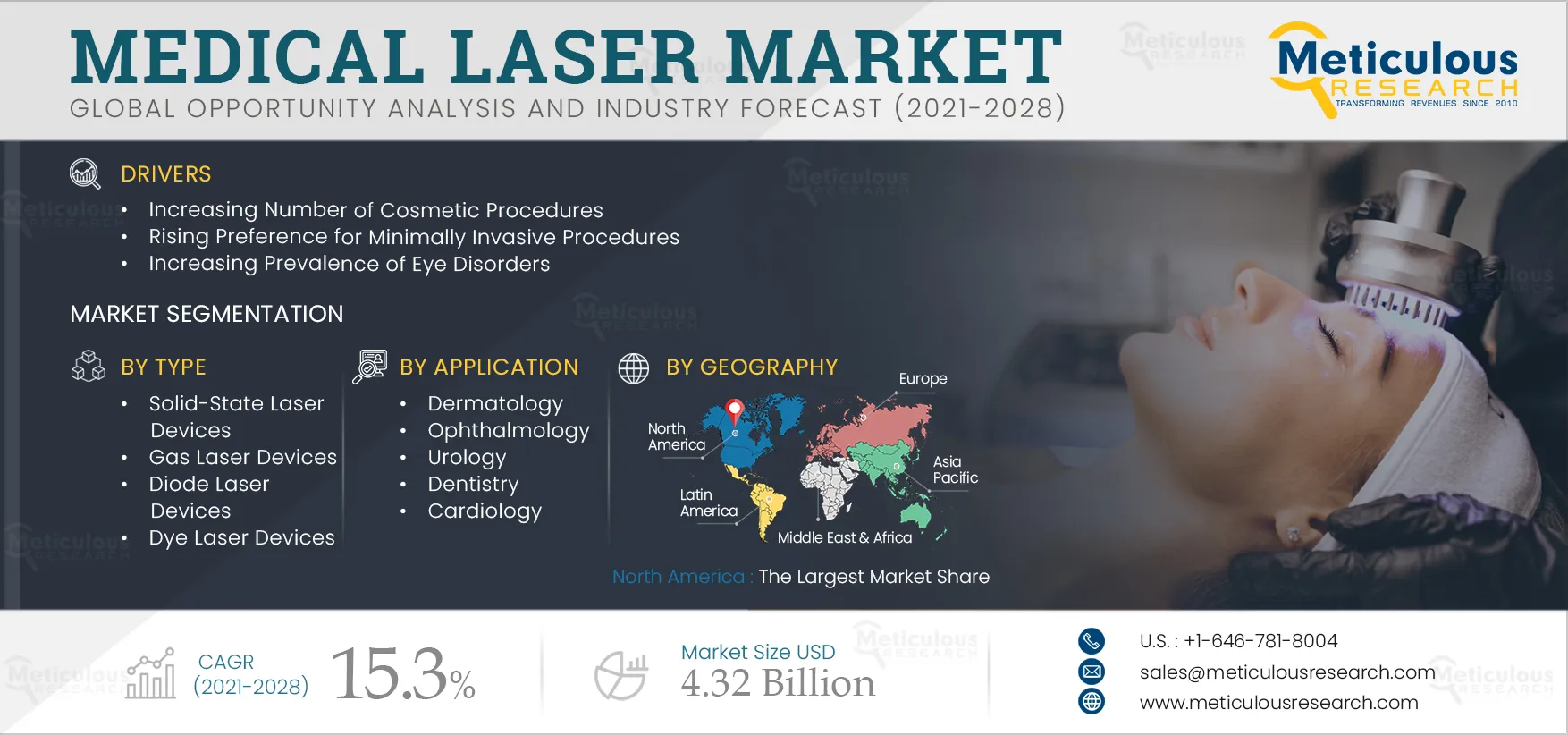

Report ID: MRSE - 104503 Pages: 250 Jun-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 48 Hours Download Free Sample ReportThe Medical Laser Market is expected to reach $17.3 billion by 2031, at a CAGR of 17.6% from 2024 to 2031. The growth of this market is attributed to the increasing number of cosmetic procedures, rising preference for minimally invasive procedures, and increasing prevalence of eye disorders. Moreover, the growth of medical tourism is expected to offer growth opportunities for the players operating in this market.

There has been an increase in the demand for laser cosmetic procedures, such as body contouring, skin tightening, hair removal, dermabrasion, acne, wrinkles, and skin rejuvenation procedures. Aesthetic laser devices are preferred over other devices due to various advantages, including ease of use, minimal invasiveness, and less time consumption.

Researchers are also working on applying artificial intelligence (AI) in medical lasers for cosmetic surgeries. AI technology can be used in medical lasers as it has several benefits. It eliminates human error, reduces potential risks and side effects, provides high precision, and simplifies treatments for doctors.

Growing awareness among people about aesthetics, growing adoption of surgeries, and growing affordability of advanced treatments such as acne and scar removal, among others, is expected to increase the demand for medical lasers. Various factors, such as increasing advancements in technologies in aesthetic procedures, increased focus on body appearance, high disposable income, rising problems of obesity, and rising number of private clinics and surgeons providing treatments, are increasing the demand for medical lasers in the cosmetics industry.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

Minimally invasive surgery is a procedure that is performed through tiny incisions instead of a large opening. This surgery has several benefits, such as smaller incisions, less pain, minimal to no scars, less blood loss, and a lower complication rate. As the demand for treatments such as microdermabrasion, laser hair removal, and several other treatments is increasing, the need for minimally invasive procedures is also growing. Factors such as the increasing number of surgeries and rising diagnoses of various disorders, such as appendicitis, cancer, and cardiovascular diseases, drive the demand for these procedures. MIS surgeries are widely adopted among the geriatric population due to the relatively shorter recovery time and less pain. Minimally invasive surgery has become a standard surgical technique in many routine operations that include:

Such factors are expected to stimulate the demand for minimally invasive procedures, further supporting market growth.

In medical tourism, a person travels outside the country of residence to receive affordable advanced medical care. The top countries known for medical tourism are Thailand, Singapore, India, South Korea, Bulgaria, and Panama. Several developed regions, such as the U.S. and Europe, are known for their expensive medical treatments due to various reasons, such as high drug prices, high salaries of doctors, and high costs of hospital administration.

In Latin America, Brazil has the best healthcare delivery system. The rising number of private hospitals, improvements in medical infrastructure, and inexpensive treatments boost the growth of medical tourism in Thailand. Cosmetic surgery centers are also appearing in medical tourism destinations. They offer elective procedures, paid for out of pocket and nonurgent at a fraction of American prices, making them especially well-suited for medical travel.

The low cost of medical procedures in developing countries is one of the major factors for the growth of medical tourism. Governments of various developing countries are taking various initiatives for the promotion of medical tourism in their country. Also, increasing awareness in patients about the safety and effectiveness of medical procedures in foreign countries is boosting the growth of medical tourism, further offering growth opportunities for the medical laser market.

Based on device type, the medical laser devices market is segmented into solid-state laser devices, gas laser devices, diode laser devices, and dye laser devices. In 2024, the solid-state laser devices segment is expected to account for the largest share of above 45% of the medical laser devices market. The large market share of this segment is attributed to the increasing use of solid-state lasers in medical applications, such as treatment processes for scar removal, melisma treatment, and skin resurfacing, which has encouraged various healthcare facilities to adopt these lasers for performing treatments. Various advantages associated with solid-state lasers, such as high efficiency compared to gas lasers, simple construct than to other lasers, and economical nature of solid-state lasers, are driving the growth of this segment.

However, the diode lasers segment is projected to register the highest CAGR during the forecast period. The segment's growth is attributed to the preference for these lasers in various surgical procedures, such as hair removal, soft tissue cutting, aesthetic procedures, dental surgeries, coagulation, and thermal cancer therapy. Diode lasers deliver wavelengths ranging from 810 to 1064 nm. They are compact and portable solid-state units.

Based on fiber type, the medical laser fibers market is segmented into disposable laser fibers and reusable laser fibers. In 2024, the disposable laser fibers segment is expected to account for the larger share of above 75% of the medical laser fibers market. The large market share of this segment is attributed to the increasing use of laser fiber in diagnostic procedures, rising demand for non-invasive surgical procedures, the effective cost of disposable laser fibers, and the increasing number of urologic and plastic surgery procedures. Moreover, this segment is also projected to register the highest CAGR during the forecast period.

Based on device application, the medical laser devices market is segmented into dermatology, ophthalmology, urology, dentistry, cardiology, gynecology, and other device applications. In 2024, the dermatology segment is expected to account for the largest share of above 31% of the medical laser devices market. The large market share of this segment is attributed to the increasing number of cosmetic surgeries simultaneously increasing the use of medical lasers in these treatments and increasing integration of AI technology for dermatology applications. These lasers are used for various treatments, such as vascular lesions, pigmented lesions and tattoos, hair removal, facial wrinkles, scars, sun-damaged skin, and skin cancers.

However, the urology segment is projected to register the highest CAGR during the forecast period. The segment's growth is attributed to the rising number of kidney diseases, increasing urinary tract infections, the growing elderly population, and rising chronic kidney disorders. Different types of lasers are used in urology, such as KTP:YAG (potassium titanyl phosphate), LBO:YAG (lithium borate), diode lasers, holmium (Ho):YAG, and thulium (Tm):YAG lasers, among others.

Based on fiber application, the medical laser fibers market is segmented into general surgeries, urology, dermatology, gynecology, cardiology, dentistry, and other fiber applications. In 2024, the general surgeries segment is expected to account for the larger share of above 27% of the medical laser fibers market. The large market share of this segment is attributed to the growing prevalence of colon cancer, appendicitis procedures, pancreatic cancer, and small and large intestine cancers. Medical laser fibers perform highly efficient surgeries and reduce the risk of cross-contamination between surgeries, increasing the demand for medical laser fibers.

However, the cardiology segment is projected to register the highest CAGR during the forecast period. Cardiovascular surgeons use various types of laser fibers, such as Nd:YAG, holmium, and CO2, to treat patients suffering from heart disease, heart attack, stroke, or blood clots and individuals at high risk for developing these problems. The better outcomes and high efficiency of medical laser fibers have accelerated the demand for laser fibers in this segment.

In 2024, North America is expected to account for the largest share of above 45% of the medical laser market. The market growth in North America is driven by the presence of major vendors in the region, technological advancements in medical devices, government investments to promote innovation in the healthcare segment and the exponential growth of aesthetic/cosmetic procedures. The aging population in the U.S. is creating the need for major surgeries related to geriatric populations, such as ophthalmic surgeries, including cataracts, glaucoma, cardiovascular surgeries, and urological surgeries, driving the demand for medical lasers in this region.

However, Asia-Pacific is projected to record the highest CAGR of above 24% during the forecast period. The growth of medical tourism in most Asian countries, rising disposable income, growing awareness and adoption of minimally invasive aesthetic procedures, government support to provide better medical infrastructure, and the arrival of several medical device manufacturers in the region support the market growth in the region. In countries such as China and Japan, government bodies are introducing policies to support the standardization of the aesthetic medicine industry.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the medical laser market are Lumenis Ltd. (Israel), Fotona d.o.o. (Slovenia), BIOLASE, Inc. (U.S.), IRIDEX Corporation (U.S.), Cutera, Inc. (U.S.), Alna-Medicalsystem AG & Co. KG (Germany), Bausch & Lomb Incorporated (U.S.), Boston Scientific Corporation (U.S.), Alcon, Inc. (Switzerland), Stryker Corporation (U.S.), Alma Lasers (Israel), biolitec AG (Germany), Bluecore, Inc. (South Korea), Cynosure LLC (U.S.), PhotoMedex (U.S.) and Spectranetics (U.S.) MED-Fibers, INC.(U.S.), Clarion Medical Technologies (Canada), Olympus Corporation (Japan).

In February 2024, BIOLASE, Inc. (U.S.) launched Waterlase iPlus Premier Edition, an all-tissue laser system for dental care applications.

In February 2024, Meridian Medical AG (Switzerland) launched three new ophthalmic lasers, namely, Microruptor (MR) Q lasers: MR Q, MR Q SLT, and MR Q supine in the U.S.

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

17.6% |

|

Market Size (Value) |

USD 17.3 Billion by 2031 |

|

Segments Covered |

By Type

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Rest of Asia-Pacific), Latin America (Mexico, Brazil, Rest of Latin America), and the Middle East & Africa (UAE, Israel, Rest of Middle East & Africa) |

|

Key Companies |

Lumenis Ltd. (Israel), Fotona d.o.o. (Slovenia), BIOLASE, Inc. (U.S.), IRIDEX Corporation (U.S.), Cutera, Inc. (U.S.), Alna-Medicalsystem AG & Co. KG (Germany), Bausch & Lomb Incorporated (U.S.), Boston Scientific Corporation (U.S.), Alcon, Inc. (Switzerland), Stryker Corporation (U.S.), Alma Lasers (Israel), biolitec AG (Germany), Bluecore, Inc. (South Korea), Cynosure LLC (U.S.), PhotoMedex (U.S.) and Spectranetics (U.S.) MED-Fibers, INC.(U.S.), Clarion Medical Technologies (Canada), Olympus Corporation (Japan) |

The medical laser market study focuses on market assessment and opportunity analysis through the sales of medical lasers across different regions and countries across different market segments. This study is also focused on competitive analysis for medical lasers based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The medical laser market is projected to reach $17.3 billion by 2031, at a CAGR of 17.6% during the forecast period.

In 2024, the solid-state laser devices segment is expected to account for the largest share of above 45% of the medical laser devices market.

Based on fiber application, the cardiology segment is projected to register the highest CAGR during the forecast period.

The growth of this market is attributed to the increasing number of cosmetic procedures, rising preference for minimally invasive procedures, and increasing prevalence of eye disorders. Moreover, the growth of medical tourism is expected to offer growth opportunities for the players operating in this market.

The key players operating in the medical laser market are Lumenis Ltd. (Israel), Fotona d.o.o. (Slovenia), BIOLASE, Inc. (U.S.), IRIDEX Corporation (U.S.), Cutera, Inc. (U.S.), Alna-Medicalsystem AG & Co. KG (Germany), Bausch & Lomb Incorporated (U.S.), Boston Scientific Corporation (U.S.), Alcon, Inc. (Switzerland), Stryker Corporation (U.S.), Alma Lasers (Israel), biolitec AG (Germany), Bluecore, Inc. (South Korea), Cynosure LLC (U.S.), PhotoMedex (U.S.) and Spectranetics (U.S.) MED-Fibers, INC.(U.S.), Clarion Medical Technologies (Canada), Olympus Corporation (Japan).

Asia-Pacific is projected to register the highest CAGR of above 24% during the forecast period.

Published Date: Jun-2024

Published Date: Oct-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates