1. Introduction

1.1. Market Ecosystem

1.2. Currency and Limitations

1.2.1. Currency

1.2.2. Limitations

1.3. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.1.1. Secondary Research

2.1.2. Primary Research

2.1.3. Market Size Estimation

3. Executive Summary

4. Market Insights

4.1. Introduction

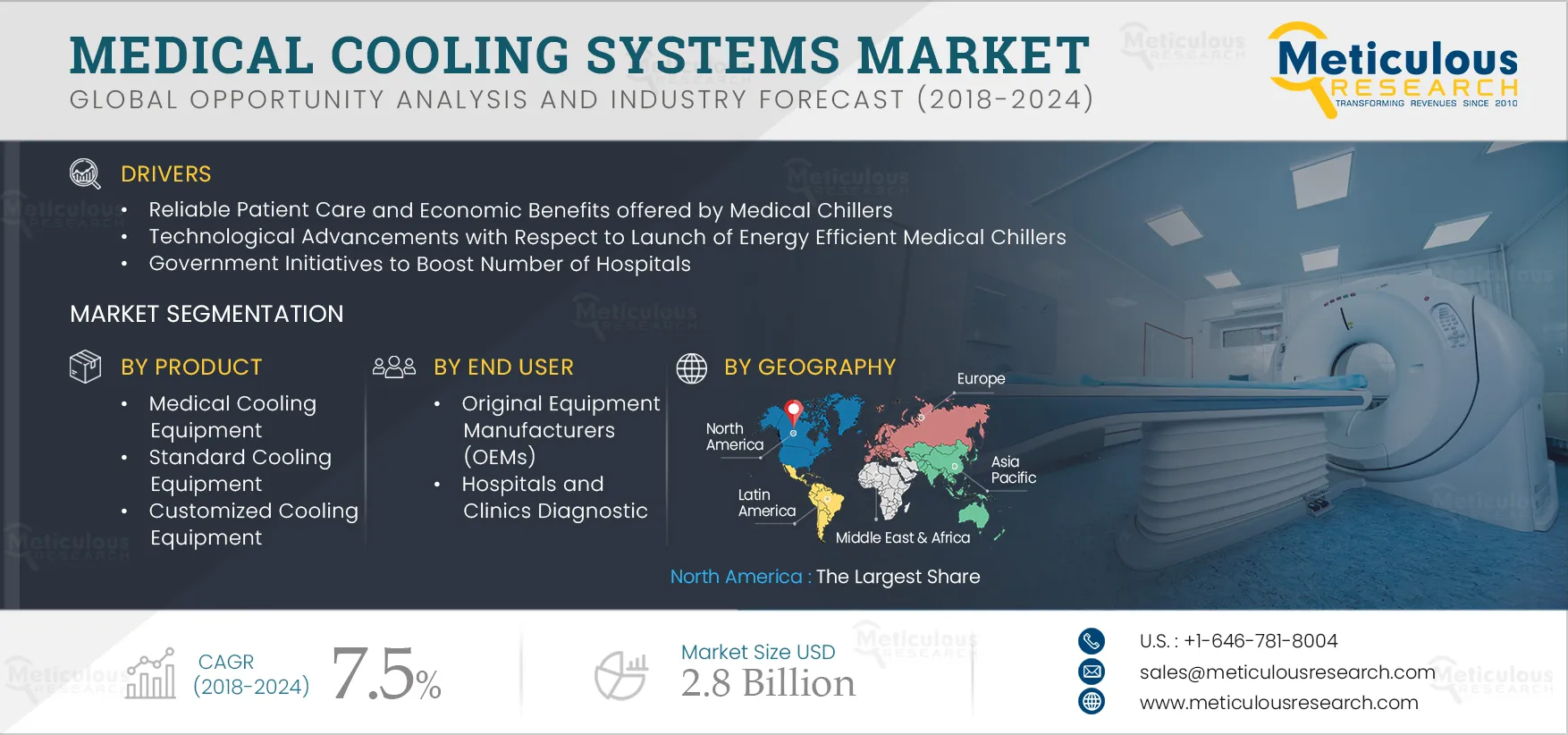

4.2. Drivers

4.2.1. Reliable Patient Care and Economic Benefits offered by Medical Chillers

4.2.2. Technological Advancements with Respect to Launch of Energy Efficient Medical Chillers

4.2.3. Government Initiatives to Boost Number of Hospitals

4.2.4. Increasing Elderly Population Coupled with Growing Prevalence of Chronic Diseases

4.3. Restraint

4.3.1. High Cost of Medical Imaging Systems

4.4. Opportunity

4.4.1. Opportunities from Asian Countries

5. Global Medical Cooling Systems Market, by Product Type

5.1. Introduction

5.2. Medical Cooling Equipment

5.2.1. Standard Equipment

5.2.2. Customized Cooling Equipment

5.3. Medical Cooling Systems Accessories

6. Global Medical Cooling Systems Market, by Type

6.1. Introduction

6.2. Water-Cooled Systems/Chillers

6.3. Air-Cooled Systems/Chillers

7. Global Medical Cooling Systems Market, by Model

7.1. Introduction

7.2. Packaged Systems

7.3. Modular Systems

7.4. Split Systems

8. Global Medical Cooling Systems Market, by Compressor Type

8.1. Introduction

8.2. Scroll Compressors

8.3. Screw Compressors

8.4. Centrifugal Compressors

8.5. Reciprocating Compressors

9. Global Medical Cooling Systems Market, by Application

9.1. Introduction

9.2. Imaging Applications

9.2.1. Magnetic Resonance Imaging (MRI)

9.2.2. Computed tomography (CT) Scan

9.2.3. Linear Accelerators

9.2.4. Positron-Emission tomography (PET) Scan

9.2.5. Other Imaging Applications

9.3. Cold Storage and Testing

9.4. Dehumidification

9.5. Laser Application

10. Global Medical Cooling Systems Market, by End User

10.1. Introduction

10.2. Original Equipment Manufacturers (OEMs)

10.3. Hospitals and Clinics

10.4. Diagnostic Imaging Centers

11. Global Medical Cooling Systems Market, by Geography

11.1. Introduction

11.2. North America

11.2.1. U.S.

11.2.2. Canada

11.3. Europe

11.3.1. Germany

11.3.2. France

11.3.3. U.K.

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

11.4. Asia-Pacific

11.4.1. Japan

11.4.2. China

11.4.3. India

11.4.4. Rest of Asia-Pacific

11.5. Rest of the World

11.5.1. Latin America

11.5.2. Middle East & Africa

12. Company Profiles ( Business Overview, Financial Overview, Product Portfolio, Strategic Development)

12.1. Glen Dimplex Group

12.2. Cold Shot Chillers

12.3. Parker Hannifin Corporation

12.4. Legacy Chiller Systems, Inc.

12.5. Johnson thermal Systems Inc.

12.6. American Chiller Service, Inc.

12.7. Motivair Corporation

12.8. Filtrine Manufacturing Company

12.9. Carrier Corporation

12.10. Lytron Inc.

12.11. Drake Refrigeration, Inc.

12.12. Whaley Products, Inc.

12.13. General Air Products, Inc.

12.14. Ecochillers Inc.

12.15. KKT Chillers

13. Appendix

13.1. Questionnaire

List of Tables

Table 1 Global Medical Cooling Systems Market Drivers: Impact Analysis (2018-2024)

Table 2 Global Medical Cooling Systems Market Restraint: Impact Analysis (2018-2024)

Table 3 Cost of MRI Machines

Table 5 Global Medical Cooling Equipment Market Size, by Type, 2016-2024 ($Million)

Table 6 Global Medical Cooling Equipment Market Size, by Country, 2016-2024 ($Million)

Table 7 Key Vendors offering Standard Cooling Equipment

Table 8 Global Standard Cooling Equipment Market Size, by Country, 2016-2024 ($Million)

Table 9 Global Customized Cooling Equipment Market Size, by Country, 2016-2024 ($Million)

Table 10 Global Medical Cooling Systems Accessories Market Size, by Country, 2016-2024 ($Million)

Table 12 Benefits and Drawbacks of Water-Cooled Chillers

Table 13 Key Commercial Water-Cooled Chillers

Table 14 Global Water-Cooled Chillers Market Size, by Country, 2016-2024 ($Million)

Table 15 Key Commercial Air-Cooled Chillers

Table 16 Global Air-Cooled Chillers Market Size, by Country, 2016-2024 ($Million)

Table 18 Vendors offering Packaged Chiller Systems

Table 19 Global Packaged Systems Market Size, by Country, 2016-2024 ($Million)

Table 20 Global Modular Systems Market Size, by Country, 2016-2024 ($Million)

Table 21 Global Split Systems Market Size, by Country, 2016-2024 ($Million)

Table 23 Key Vendors offering Scroll Compressor-Based Medical Cooling Systems

Table 24 Global Scroll Compressors Market Size, by Country, 2016-2024 ($Million)

Table 25 Benefits and Drawbacks of Screw Compressors

Table 26 Global Screw Compressors Market Size, by Country, 2016-2024 ($Million)

Table 27 Global Centrifugal Compressors Market Size, by Country, 2016-2024 ($Thousand)

Table 28 Global Reciprocating Compressors Market Size, by Country, 2016-2024 ($Million)

Table 30 Global Medical Cooling Systems Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 31 Global Medical Cooling Systems Market Size for Imaging Applications, by Country, 2016-2024 ($Million)

Table 32 Medical Cooling Systems for MRI

Table 33 Global Medical Cooling Systems Market Size for MRI, by Country, 2016-2024 ($Million)

Table 34 Medical Cooling Systems for CT

Table 35 Global Medical Cooling Systems Market Size for Ct, by Country, 2016-2024 ($Million)

Table 36 Medical Cooling Systems for Linear Accelerators

Table 37 Global Medical Cooling Systems Market Size for Linear Accelerators, by Country, 2016-2024 ($Million)

Table 38 Medical Cooling Systems for PET Scan

Table 39 Global Medical Cooling Systems Market Size for Pet Scan, by Country, 2016-2024 ($Million)

Table 40 Global Medical Cooling Systems Market Size for Other Imaging Applications, by Country, 2016-2024 ($Million)

Table 41 Global Medical Cooling Systems Market Size for Cold Storage and Testing, by Country, 2016-2024 ($Million)

Table 42 Global Medical Cooling Systems Market Size for Dehumidification, by Country, 2016-2024 ($Thousand)

Table 43 Global Medical Cooling Systems Market Size for Laser Application, by Country, 2016-2024 ($Million)

Table 44 Global Medical Cooling System Market Size, by End User, 2016-2024 ($Million)

Table 45 Medical Cooling System Vendors and their Customers

Table 46 Global Medical Cooling System Market Size for OEMs, by Country, 2016-2024 ($Million)

Table 47 Global Medical Cooling System Market Size for Hospitals and Clinics, by Country, 2016-2024 ($Million)

Table 48 Global Medical Cooling System Market Size for Diagnostic Imaging Centers, by Country, 2016-2024 ($Million)

Table 49 Global Medical Cooling Systems Market Size, by Country, 2016-2024 ($Million)

Table 50 North America: Medical Cooling Systems Market Size, by Country, 2016-2024 ($Million)

Table 51 North America: Market Size, by Product, 2016-2024 ($Million)

Table 52 North America: Medical Cooling Equipment Market Size, by Type, 2016-2024 ($Million)

Table 53 North America: Market Size, by Type, 2016-2024 ($Million)

Table 54 North America: Market Size, by Model, 2016-2024 ($Million)

Table 55 North America: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 56 North America: Market Size, by Application, 2016-2024 ($Million)

Table 57 North America: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 58 North America: Market Size, by End User, 2016-2024 ($Million)

Table 59 U.S.: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 60 U.S.: Market Size, by Type, 2016-2024 ($Million)

Table 61 U.S.: Market Size, by Type, 2016-2024 ($Million)

Table 62 U.S.: Market Size, by Model, 2016-2024 ($Million)

Table 63 U.S.: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 64 U.S.: Market Size, by Application, 2016-2024 ($Million)

Table 65 U.S.: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 66 U.S.: Market Size, by End User, 2016-2024 ($Million)

Table 67 Canada: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 68 Canada: Market Size, by Type, 2016-2024 ($Million)

Table 69 Canada: Market Size, by Type, 2016-2024 ($Million)

Table 70 Canada: Market Size, by Model, 2016-2024 ($Million)

Table 71 Canada: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 72 Canada: Market Size, by Application, 2016-2024 ($Million)

Table 73 Canada: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 74 Canada: Market Size, by End User, 2016-2024 ($Million)

Table 75 Europe: Medical Cooling Systems Market Size, by Country, 2016-2024 ($Million)

Table 76 Europe: Market Size, by Product, 2016-2024 ($Million)

Table 77 Europe: Market Size, by Type, 2016-2024 ($Million)

Table 78 Europe: Market Size, by Type, 2016-2024 ($Million)

Table 79 Europe: Market Size, by Model, 2016-2024 ($Million)

Table 80 Europe: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 81 Europe: Market Size, by Application, 2016-2024 ($Million)

Table 82 Europe: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 83 Europe: Market Size, by End User, 2016-2024 ($Million)

Table 84 Germany: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 85 Germany: Market Size, by Type, 2016-2024 ($Million)

Table 86 Germany: Market Size, by Type, 2016-2024 ($Million)

Table 87 Germany: Market Size, by Model, 2016-2024 ($Million)

Table 88 Germany: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 89 Germany: Market Size, by Application, 2016-2024 ($Million)

Table 90 Germany: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 91 Germany: Market Size, by End User, 2016-2024 ($Million)

Table 92 France: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 93 France: Market Size, by Type, 2016-2024 ($Million)

Table 94 France: Market Size, by Type, 2016-2024 ($Million)

Table 95 France: Market Size, by Model, 2016-2024 ($Million)

Table 96 France: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 97 France: Market Size, by Application, 2016-2024 ($Million)

Table 98 France: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 99 France: Market Size, by End User, 2016-2024 ($Million)

Table 100 U.K.: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 101 U.K.: Market Size, by Type, 2016-2024 ($Million)

Table 102 U.K.: Market Size, by Type, 2016-2024 ($Million)

Table 103 U.K.: Market Size, by Model, 2016-2024 ($Million)

Table 104 U.K.: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 105 U.K.: Market Size, by Application, 2016-2024 ($Million)

Table 106 U.K.: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 107 U.K.: Market Size, by End User, 2016-2024 ($Million)

Table 108 Italy: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 109 Italy: Market Size, by Type, 2016-2024 ($Million)

Table 110 Italy: Market Size, by Type, 2016-2024 ($Million)

Table 111 Italy: Market Size, by Model, 2016-2024 ($Million)

Table 112 Italy: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 113 Italy: Market Size, by Application, 2016-2024 ($Million)

Table 114 Italy: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 115 Italy: Market Size, by End User, 2016-2024 ($Million)

Table 116 Spain: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 117 Spain: Market Size, by Type, 2016-2024 ($Million)

Table 118 Spain: Market Size, by Type, 2016-2024 ($Million)

Table 119 Spain: Market Size, by Model, 2016-2024 ($Million)

Table 120 Spain: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 121 Spain: Market Size, by Application, 2016-2024 ($Million)

Table 122 Spain: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 123 Spain: Market Size, by End User, 2016-2024 ($Million)

Table 124 RoE: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 125 RoE: Market Size, by Type, 2016-2024 ($Million)

Table 126 RoE: Market Size, by Type, 2016-2024 ($Million)

Table 127 RoE: Market Size, by Model, 2016-2024 ($Million)

Table 128 RoE: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 129 RoE: Market Size, by Application, 2016-2024 ($Million)

Table 130 RoE: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 131 RoE: Market Size, by End User, 2016-2024 ($Million)

Table 132 Asia-Pacific: Medical Cooling Systems Market Size, by Country, 2016-2024 ($Million)

Table 133 APAC: Market Size, by Product, 2016-2024 ($Million)

Table 134 APAC: Market Size, by Type, 2016-2024 ($Million)

Table 135 APAC: Market Size, by Type, 2016-2024 ($Million)

Table 136 APAC: Market Size, by Model, 2016-2024 ($Million)

Table 137 APAC: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 138 APAC: Market Size, by Application, 2016-2024 ($Million)

Table 139 APAC: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 140 APAC: Market Size, by End User, 2016-2024 ($Million)

Table 141 Japan: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 142 Japan: Market Size, by Type, 2016-2024 ($Million)

Table 143 Japan: Market Size, by Type, 2016-2024 ($Million)

Table 144 Japan: Market Size, by Model, 2016-2024 ($Million)

Table 145 Japan: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 146 Japan: Market Size, by Application, 2016-2024 ($Million)

Table 147 Japan: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 148 Japan: Market Size, by End User, 2016-2024 ($Million)

Table 149 China: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 150 China: Market Size, by Type, 2016-2024 ($Million)

Table 151 China: Market Size, by Type, 2016-2024 ($Million)

Table 152 China: Market Size, by Model, 2016-2024 ($Million)

Table 153 China: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 154 China: Market Size, by Application, 2016-2024 ($Million)

Table 155 China: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 156 China: Market Size, by End User, 2016-2024 ($Million)

Table 157 India: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 158 India: Market Size, by Type, 2016-2024 ($Million)

Table 159 India: Market Size, by Type, 2016-2024 ($Million)

Table 160 India: Market Size, by Model, 2016-2024 ($Million)

Table 161 India: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 162 India: Market Size, by Application, 2016-2024 ($Million)

Table 163 India: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 164 India: Market Size, by End User, 2016-2024 ($Million)

Table 165 RoAPAC: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 166 RoAPAC: Market Size, by Type, 2016-2024 ($Million)

Table 167 RoAPAC: Market Size, by Type, 2016-2024 ($Million)

Table 168 RoAPAC: Market Size, by Model, 2016-2024 ($Million)

Table 169 RoAPAC: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 170 RoAPAC: Market Size, by Application, 2016-2024 ($Million)

Table 171 RoAPAC: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 172 RoAPAC: Market Size, by End User, 2016-2024 ($Million)

Table 173 RoW: Medical Cooling Systems Market Size, by Country, 2016-2024 ($Million)

Table 174 RoW: Market Size, by Product, 2016-2024 ($Million)

Table 175 RoW: Market Size, by Type, 2016-2024 ($Million)

Table 176 RoW: Market Size, by Type, 2016-2024 ($Million)

Table 177 RoW: Market Size, by Model, 2016-2024 ($Million)

Table 178 RoW: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 179 RoW: Market Size, by Application, 2016-2024 ($Million)

Table 180 RoW: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 181 RoW: Market Size, by End User, 2016-2024 ($Million)

Table 182 Latin America: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 183 Latin America: Market Size, by Type, 2016-2024 ($Million)

Table 184 Latin America: Market Size, by Type, 2016-2024 ($Million)

Table 185 Latin America: Market Size, by Model, 2016-2024 ($Million)

Table 186 Latin America: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 187 Latin America: Market Size, by Application, 2016-2024 ($Million)

Table 188 Latin America: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 189 Latin America: Market Size, by End User, 2016-2024 ($Million)

Table 190 Middle East & Africa: Medical Cooling Systems Market Size, by Product, 2016-2024 ($Million)

Table 191 Middle East & Africa: Market Size, by Type, 2016-2024 ($Million)

Table 192 Middle East & Africa: Market Size, by Type, 2016-2024 ($Million)

Table 193 Middle East & Africa: Market Size, by Model, 2016-2024 ($Million)

Table 194 Middle East & Africa: Market Size, by Compressor Type, 2016-2024 ($Million)

Table 195 Middle East & Africa: Market Size, by Application, 2016-2024 ($Million)

Table 196 Middle East & Africa: Market Size for Imaging Applications, by Type, 2016-2024 ($Million)

Table 197 Middle East & Africa: Market Size, by End User, 2016-2024 ($Million)

List of Figures

Figure 1 Research Process

Figure 2 Key Executives Interviewed

Figure 3 Primary Research Techniques

Figure 4 Key Findings

Figure 5 Imaging Applications Segment Dominates the Global Medical Cooling Systems Market

Figure 6 Key Adopters of Medical Cooling Systems, 2017

Figure 7 Medical Cooling Systems Market Overview: 2017-2024

Figure 8 Global Medical Cooling Systems Market, by Geography, 2017

Figure 9 Market Dynamics

Figure 10 U.S.: Number of People Aged 65 and Over with Alzheimer Disease, 2010-2050 (In Million)

Figure 11 Global Medical Cooling Systems Market Size, by Product Type, 2018-2024 ($Million)

Figure 12 Global Medical Cooling Systems Market Size, by Type, 2018-2024 ($Million)

Figure 13 Global Medical Cooling Systems Market Size, by Model, 2018-2024 ($Million)

Figure 14 Global Medical Cooling Systems Market Size, by Compressor Type, 2018-2024 ($Million)

Figure 15 Global Medical Cooling Systems Market Size, by Application, 2018-2024 ($Million)

Figure 16 Global Number of DALYs for Neurological Disorders, 2005-2030

Figure 17 Global Mortality Due to Cardiovascular Diseases, 2013 Vs 2030 (In Million)

Figure 18 Number of New Cancer Cases Across the World (in Million)

Figure 19 Number of People Living with Dementia in the World (in Million)

Figure 20 Units of Blood Discarded in India

Figure 21 Global Number of Cataract Operations (in Millions), 1995-2020

Figure 22 Number of Plastic Surgeries in the U.S., 2016-2017

Figure 23 Global Medical Cooling System Market Size, by End User, 2018-2024 ($Million)

Figure 24 Global Medical Cooling Systems Market Size, by Geography, 2018-2024 ($Million)

Figure 25 North America: Medical Cooling Systems Market Size, by Country, 2018-2024 ($Million)

Figure 26 U.S.: Number of People with Chronic Diseases, 2005-2030 (Million)

Figure 27 U.S.: Number of Hospitals, 2014 Vs 2017

Figure 28 Canada: Number of MRI and CT Imaging Systems, 2007 Vs 2017

Figure 29 Percentage of Population Aged 65 and Above in G7 Countries, 2016

Figure 30 Breast Cancer Screening in Women Aged 50-69 Years, 2016

Figure 31 Europe: Medical Cooling Systems Market Size, by Country, 2018-2024 ($Million)

Figure 32 Germany: Population Aged 65 and Above, 2011-2017

Figure 33 Health Spending Per Capita in Germany (in Eur PPP), 2015

Figure 34 Healthcare Spending Per Capita: 2005-2015

Figure 35 U.K.: Average Emergency Hospital Admissions, 2011-2017

Figure 36 Population Aged 65 and Over (% of total Population), 2005 and 2016

Figure 37 Switzerland: Health Spending Per Capita (In $ PPP), 2017

Figure 38 Proportional Mortality Rate in Portugal, 2016

Figure 39 Asia-Pacific: Medical Cooling Systems Market Size, by Country, 2018-2024 ($Million)

Figure 40 Japan: Population Aged 65 or Above

Figure 41 Number of Cancer Cases in India, 2016

Figure 42 Proportion of Population Aged 60 or Above in Asia, 2015 Vs 2030

Figure 43 Row: Medical Cooling Systems Market Size, by Country, 2018-2024($Million)

Figure 44 Prevalence of Cancer in Mexico, 2013 Vs 2020

Figure 45 Parker Hannifin Corporation: Financial Overview (2016-2018)

Figure 46 United Technologies Corporation: Financial Overview (2015-2017)