Resources

About Us

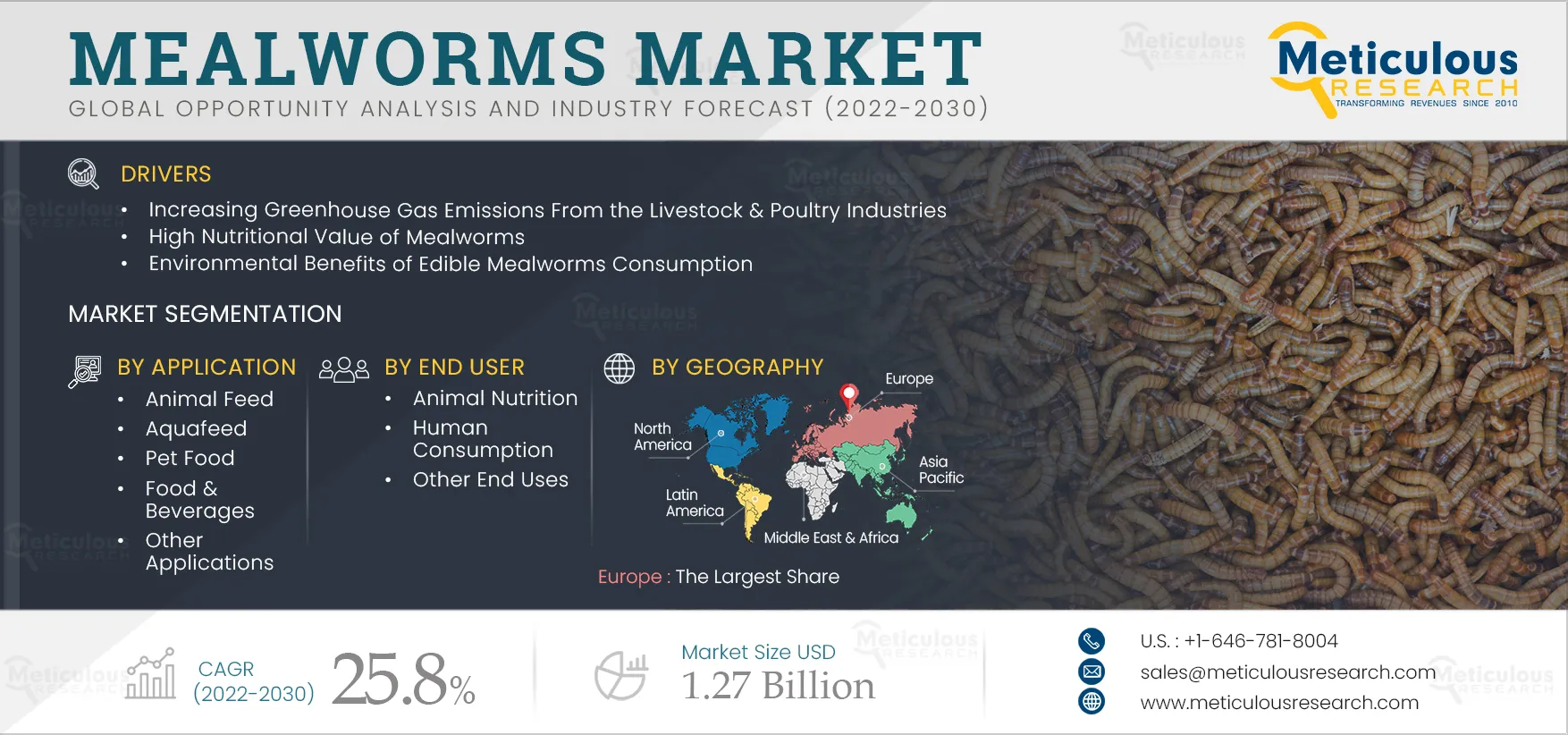

Mealworms Market by Product Type (Whole Mealworm, Mealworm Powder, Mealworm Meal), Application (Animal Feed, Aquafeed, Pet Food, Food & Beverages), End Use (Animal Nutrition, Human Consumption) - Global Forecast to 2030

Report ID: MRFB - 104578 Pages: 159 May-2022 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThe Mealworms Market is expected to reach $1.27 billion by 2030, at a CAGR of 25.8% during the forecast period 2022–2030. In terms of volume, the mealworms market is expected to grow at a CAGR of 28.6% from 2022–2030 to reach 367,491.7 tons by 2030. The growth of this market is driven by factors such as the increasing greenhouse gas emissions from the livestock and poultry industries, the high nutritional value of mealworms, environmental benefits of edible mealworms consumption, and the lower risk of zoonotic diseases with insect consumption compared to the consumption of animal-derived products. However, the risk of allergic reactions due to the consumption of mealworms is expected to restrain the growth of this market to a notable extent.

The outbreak of the COVID-19 pandemic became a severe public health emergency globally, as it spread to more than 215 countries. Many countries declared emergencies and announced complete nationwide, statewide, or citywide lockdowns, halting all travel, transport, manufacturing, educational institutions, and non-essential trade to curb the spread of this disease. These restrictions significantly impacted numerous industries, reducing manufacturing and distribution globally.

The COVID-19 pandemic significantly impacted the food sector, negatively affecting meat producers worldwide. The meat products sector faced several challenges, such as the risk of continuing production, distribution, transportation; lack of workforce; supply chain disruptions, and delays in development activities. These factors impacted the meat products sector, driving the demand for alternative proteins, such as insect protein products (mealworm proteins).

In May 2020, Wuhan's municipal government banned breeding, hunting, and consuming wild animals for five years to prevent zoonotic diseases. This is expected to trigger restrictions on the consumption of certain animals and related products in some cities in East Asian countries, increasing the shortage of meat products and accelerating the demand for alternative substitutes, such as edible insects and plant-based products.

Moreover, increasing health & wellness trends and rising health awareness, such as the risk of viral infections, cardiovascular diseases, liver diseases, bone disorders, and the increased risk of certain types of cancers associated with the long-term use of animal proteins, have created the traction for sustainable protein sources such as mealworms. To capture this traction in the edible insect industry, many vendors are focusing on enhancing their production capacities, processes, and end products.

In May 2020, Beta Hatch, a U.S.-based insect rearing technology company, received $3 million in a Series A1 funding round from Cavallo Ventures, Wilbur-Ellis' venture capital arm; and early-stage venture firm–Innova Memphis. The round also included Klein Private Equity Investment and Brighton Jones Investment Partners investments. Moreover, in December 2020, the company raised $9.3 million to build a mealworm facility in North America.

Thus, the rising preference for alternative proteins over animal proteins due to the COVID-19 outbreak has significantly driven the growth of the mealworms market.

Click here to: Get Free Sample Pages of this Report

High Nutritional Value of Mealworms Fuels the Growth of the Mealworms Market

Mealworms contain high-quality protein, vitamins, and amino acids. The health benefits of mealworms equate to that of meat or fish. They contain monounsaturated fats and omega-3 fatty acids, which are essential parts of a healthy and balanced diet. Many developing nations still face significant problems of hunger and malnutrition, and the lack of sufficient intake of food energy is, in many cases, due to the absence of available sources of fat. For instance, in 2020, nearly 811 million people were undernourished worldwide (Source: World Health Organization). Also, globally, nearly 149.2 million children under the age of five suffered from stunting, a sign of chronic undernutrition; 45.4 million children suffered from wasting due to acute undernutrition, and 38.9 million children were overweight (Source: World Health Organization).

Various edible insect species are rich in good fats and are easily converted into energy. Also, insects are a rich source of protein and vitamins, and they contain a high level of calcium, iron, and zinc. In countries that struggle with malnutrition, such species could prove to be an invaluable part of their diets.

Nowadays, the yellow mealworm (Tenebrio Molitor), an edible insect, is gaining attention as a source of protein worldwide. Per 100g of weight, the mealworm provides nearly 23.7g of protein, which is highest than any other insects, such as crickets (20.5g), waxworms (14.1g), soldier fly larvae (17.5g), silkworms (9.3g), cockroach nymphs (19g), and house flies (19.7g). Moreover, apart from protein, mealworms are a good source of fat, calcium, iron, zinc, potassium, niacin, magnesium, and B12.

Furthermore, some people cannot stomach soy, milk, or egg-derived protein due to related allergic reactions. In some people, milk sugar causes severe allergic reactions, such as bloating and diarrhea. Thus, insects can be good alternatives, as they comprise amino acids and high protein, due to which manufacturers can add mealworm protein to several food products.

In developing countries, the growing population deteriorates the problem of food security. Besides, changing sociodemographics will place increased pressure on the world's resources to provide different food types. Furthermore, the rising demand for animal-based protein is expected to negatively impact the environment, resulting in increased greenhouse gas emissions. Insects such as mealworms could be a solution for this due to their high nutritional content.

Whole Mealworm Segment to Dominate the Mealworms Market in 2022

Based on product type, the mealworms market is segmented into whole mealworm, mealworm meal, mealworm powder, and others. In 2022, the whole mealworm segment is expected to account for the largest share of the mealworms market. The large share of this segment is attributed to the growing preference for whole mealworms by food & feed manufacturers for further processing due to their easy availability and cost-effectiveness.

Animal Feed Segment to Dominate the Mealworms Market in 2022

Based on application, the mealworms market is segmented into animal feed, aquafeed, pet food, food & beverages, and other applications. In 2022, the animal feed segment is estimated to account for the largest share of the mealworms market. The growth of this segment is driven by the wide availability of mealworm products for use in animal feed, growing usage of mealworm-based products by feed manufacturers, and the high nutritional value of mealworms in animal nutrition. Mealworms are rich in amino acids, minerals, fats, vitamins, and energy. They have the potential to be a valuable feed source for poultry, aquaculture, and pets.

Animal Nutrition Segment to Dominate the Mealworms Market in 2022

Based on end use, the mealworms market is segmented into animal nutrition, human consumption, and other end uses. In 2022, the animal nutrition segment is estimated to account for the largest share of the mealworms market. The growth of this segment is driven by factors such as the increasing animal population, rapidly growing pet expenditure, increasing customer willingness to provide high-quality food to their pets, lower price of insect-based feed compared to other types of animal feed, and the growing demand for insect protein in the pet food industry.

In 2022, Europe to Account for the Largest Share of the Mealworms Market

Based on geography, the mealworms market is segmented into five major geographies: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2022, Europe is expected to account for the largest share of the mealworms market. The large market share of this region is attributed to factors such as the presence of key mealworm manufacturers, increasing demand for alternative protein sources, high demand for protein-rich food & feed, the increasing number of government approvals for mealworms to be used in human, animal, and pet food applications; and the presence of supportive policies for insect farming.

However, North America is slated to register the highest CAGR during the forecast period of 2022 to 2030. The rapid growth of this market is driven by the growing demand for environment-friendly protein-rich food. In addition, the growing awareness of insects-as-food, decreasing food neophobia, and the altering attitudes of consumers towards insects as food products are expected to create significant opportunities for the growth of the mealworms market.

Key Players

Some of the key players operating in the mealworms market are Protix B.V. (Netherlands), Ÿnsect SAS (France), BETA HATCH (U.S.), Armstrong Crickets Georgia (U.S.), TEBRIO (Formerly MealFood Europe SL) (Spain), Tebrito AB (Sweden), Entec Nutrition (U.K.), Invertapro AS (Norway), Keil Co., Ltd (South Korea), EntoBreed Farming BV (Netherlands), and Goterra (Australia).

Scope of the Report:

Mealworms Market, by Product Type

Mealworms Market, by Application

Mealworms Market, by End Use

Mealworms Market, by Geography

Key Questions Answered in the Report-

Published Date: May-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates