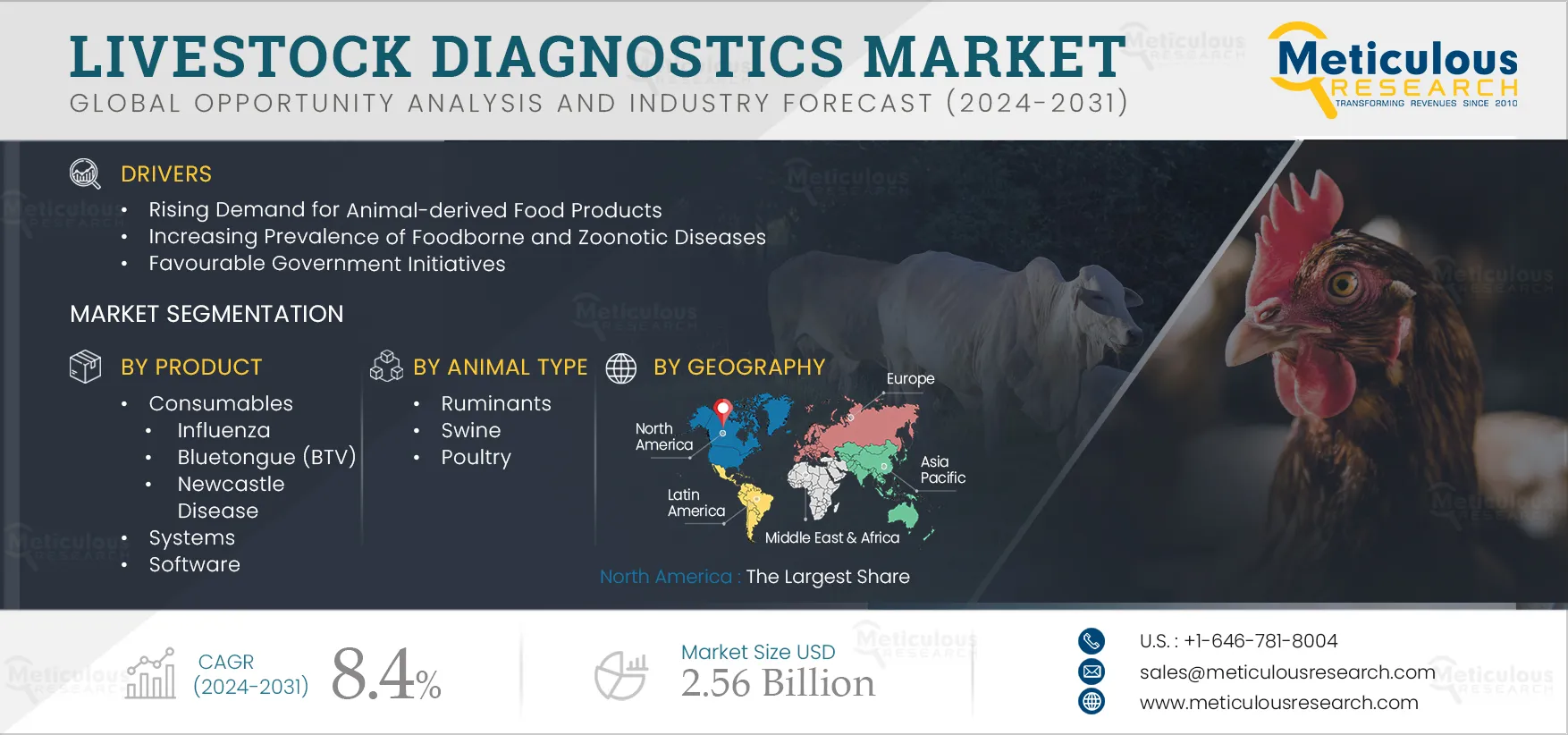

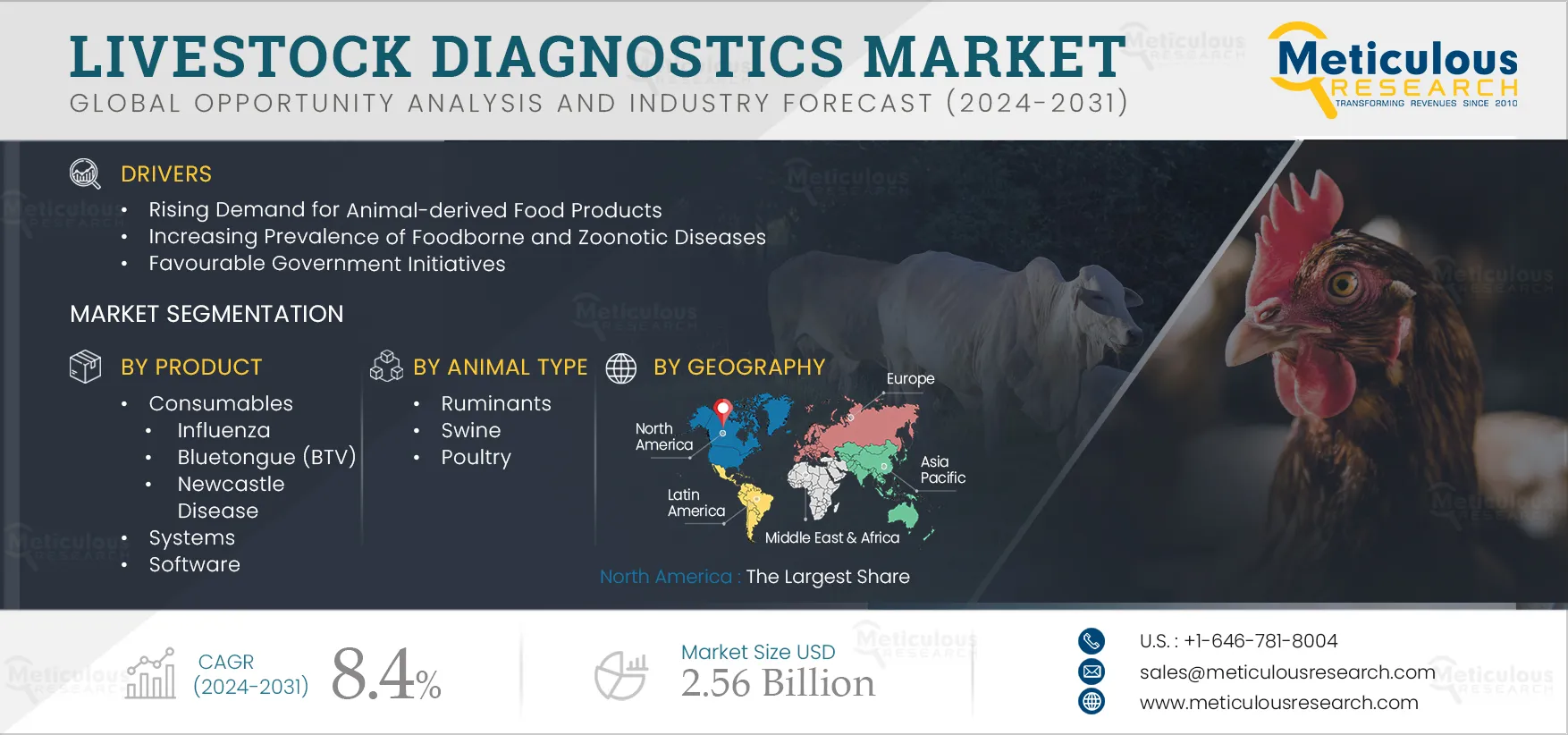

Livestock Diagnostics Market Size & Forecast

The Livestock Diagnostics Market is expected to reach $2.56 billion by 2031, at a CAGR of 8.4% from 2024 to 2031.The growth of the livestock diagnostics market can be attributed to several factors, including the rising demand for animal-derived food products, the increasing prevalence of foodborne and zoonotic diseases, favorable government initiatives, and advancements in veterinary diagnostic methods. Moreover, development in emerging markets is expected to offer growth opportunities for the players operating in this market.

Livestock Diagnostics Market Growth Drivers

Rising Demand for Animal-derived Food Products

The demand for animal-derived food products, particularly meat, milk, and eggs, has increased. This demand is growing naturally due to the decrease in agricultural productivity due to the shrinking resources and reduced availability of cultivable land. Food derived from animals is a major source of protein, and a protein-rich diet is essential to leading a healthy life.

Consumption of animal proteins is stable (around 44 to 55g/capita/day) in developed countries, while consumption is increasing in developing regions. For instance, according to the OECD-FAO Agricultural Outlook 2021–2030, meat consumption is expected to grow by 18% in the Asia-Pacific region by the year 2030. Farmers are expected to increase livestock populations to meet the increasing demand for animal-derived foods. Increased livestock population will encourage the adoption of diagnostic testing for livestock. Diagnostic testing helps detect diseases early and starts a proper treatment to ensure the safety and quality of animal-derived food products by preventing the spread of diseases. This would drive the growth of the market.

Click here to: Get Free Sample Pages of this Report

Increasing Prevalence of Foodborne and Zoonotic Diseases

Animals can sometimes appear healthy even when carrying germs that can make people sick, depending on the zoonotic disease. As animals also provide us with food for consumption, foodborne zoonotic diseases are caused by consuming food or water contaminated by pathogenic microorganisms. Many of these microorganisms are commonly found in the intestines of healthy food-producing animals, which are then transferred to humans.

According to the World Health Organization (WHO), an estimated 600 million, or almost 1 in 10 people worldwide, fall ill every year from consuming contaminated food. Children under five years of age are at high risk of carrying foodborne diseases, with 1,25,000 children dying from foodborne diseases every year globally. Diarrheal diseases are the most common illnesses resulting from the consumption of contaminated food, causing 550 million people to fall ill and 2,30,000 deaths every year. According to the Centers for Disease Control (CDC), in 2020, nearly 18,462 foodborne disease infections were seen in the U.S., which included 4,788 hospitalizations and 118 deaths.

To prevent these foodborne diseases, livestock diagnostic technologies are expected to play a crucial role by helping identify the early cause of disease and thereby providing proper treatment. Diagnostic technologies also help in the timely monitoring of farm animals for diseases.

Livestock Diagnostics Market Trends

Advancements in Veterinary Diagnostic Methods

Some of the current technologies used to diagnose and test animals, namely enzyme-linked immunosorbent assay (ELISA) and radiolabeled DNA probe methods, have turnaround times anywhere between days to weeks for sample submission and diagnosis. This diagnostic gap and subsequent disease under-reporting can allow emerging and transboundary animal pathogens to spread, with potentially serious and far-reaching consequences.

Traditional diagnostics techniques were based on detecting antibodies to the pathogen by using techniques such as enzyme-linked immunosorbent assay (ELISA), agar gel immune diffusion, and complement fixation. These techniques depend on the interaction of serum polyclonal antibodies against the agent of interest, followed by a detection system. However, recent methods such as cloning genes, overexpression vectors, and peptide synthesis have produced specific proteins serving as target antigens or positive controls in the newly developed immunoassays. Also, commercial assays for detecting cell-mediated responses have become available, including gamma interferon assays in cattle to detect tuberculosis.

Moreover, antigen detection has also been incorporated into portable immuno-chromatographic strip tests, known as antigen lateral flow devices (Ag–LFDs), which work by binding both viral antigen and antibody-coated detector particles to bands of capturing monoclonal antibodies on a membrane. Also, new powerful diagnostic tools have been developed with the advancement in molecular biology, such as bio-sensors, wearables, and nanotechnology test platforms.

Use of Artificial Intelligence (AI) in Livestock Diagnostics

Artificial intelligence has been highly beneficial in all healthcare categories, including livestock farming and diagnosis. AI can potentially improve efficiency in livestock farming by helping track and identify livestock and also predict the most optimal feeding and breeding strategies. In addition, AI can be used in animal pathology for diagnostic, research, and preclinical purposes. Some of the features that can be used for veterinary diagnostics include image analysis, pattern recognition, diagnostic assistance, and predictive modeling, among others.

Various companies are adopting AI to improve the efficiency of disease diagnosis. For instance, in September 2020, Zoetis, Inc. (U.S.) launched the Vetscan Imagyst, a diagnostic platform that uses a combination of image recognition technology and cloud-based AI to deliver accurate testing results. This product expanded in March 2023 with the inclusion of AI dermatology and AI equine FEC analysis.

Livestock Diagnostics Market Opportunity

Developments in Emerging Markets

Developed nations like the U.S. and some European countries are the major contributors to the livestock diagnostics market. These markets are relatively better penetrated, and thus, players in this market are increasingly shifting their focus on underpenetrated emerging economies. Emerging countries in the Asia-Pacific region offer high growth opportunities for livestock and companion diagnostic manufacturers, owing to the rising prevalence of foodborne and zoonotic diseases, increasing livestock and pet populations, increasing demand for livestock-derived food products, and favorable government campaigns being conducted in these regions.

According to a report by FAO, the per capita chicken consumption in India is set to grow from 3.2 Kg in 2020 to 9.1 Kg by 2030 on account of individuals' rapidly changing consumer behavior. Poultry & other meat’s share in household food consumption is expected to grow from 12% in 2020 to 24% by 2030. Thus, to meet this ever-increasing demand for livestock-derived food, the adoption of better reproductive strategies and improving the health of livestock animals by using newer livestock diagnostics technologies becomes obligatory. This, in turn, is expected to expand the livestock diagnostics market.

Livestock Diagnostics Market Analysis: Key Findings

By Product: In 2024, the Consumables Segment to Dominate the Livestock Diagnostics Market

Based on products, the market is segmented into consumables, systems, and software. In 2024, the consumables segment is expected to account for the largest share of 66.6% of the livestock diagnostics market. The large share of the segment is attributed to factors such as the growing demand for consumables with rising livestock diagnostic tests volume and the commercial availability of a diverse range of reagents and consumables for various diseases. Apart from this, the growing prevalence of foodborne and zoonotic diseases is further expected to expand the portfolio of these consumables for early diagnosis.

By Technology: In 2024, the Immunodiagnostics Segment to Dominate the Livestock Diagnostics Market

Based on technologies, the market is segmented into immunodiagnostics, molecular diagnostics, and other technologies. In 2024, the immunodiagnostics segment is expected to account for the largest share of 53.9% of the livestock diagnostics market. Immunodiagnostic technologies utilize antigen-antibody reactions for the detection of causative agents. ELISA is the most widely used immunoassay technique for diagnosing livestock diseases. The large share of the segment is attributed to factors such as higher preference for immunodiagnostic tests by veterinary practitioners owing to its high accuracy standards, increasing usage of miniaturized devices, rising trend of automation in immunoassay instruments, and the emergence of advanced diagnostic immunoassay formats.

By Animal Type: In 2024, the Ruminants’ Segment to Dominate the Livestock Diagnostics Market

Based on animal types, the market is segmented into ruminants, swine, poultry, and other livestock animals. In 2024, the ruminants segment is expected to account for the largest share of 47.3% of the livestock diagnostics market. The large share of the segment is attributed to factors such as the rising cattle population, growing demand for livestock products, growing access to various diagnostic tests, rising government initiatives, and the development of advanced techniques. For instance, in 2021, USDA’s Animal and Plant Health Inspection Service (APHIS) and its National Animal Disease Preparedness and Response Program (NADPRP) worked jointly with National Animal Health Laboratory Network (NAHLN) to award USD 4.3 million funds to support high-value projects engaged in the development and evaluation of point-of-care diagnostic tests to enhance the nation’s ability to quickly detect high-consequence foreign animal diseases and accelerate response and containment efforts.

However, the swine segment is slated to register the highest CAGR during the forecast period. Pigs develop diseases through congenital malformations or reproductive diseases during the breeding process. Porcine reproductive and respiratory syndrome (PRRS) represents the greatest disease challenge for the pig industry. The fast growth of the segment is attributed to factors such as increasing demand for pork, rising incidence of swine infections, and development of schemes & campaigns for the prevention of zoonotic diseases.

By End User: The Reference Laboratories Segment to Dominate the Livestock Diagnostics Market

Based on end users, the market is segmented into reference laboratories, veterinary hospitals & clinics, and POC testing. In 2024, the reference laboratories segment is expected to account for the largest share of the market. Reference laboratories are independent and well-equipped diagnostic facilities that handle many samples and a wide variety of tests. Veterinary hospitals and clinics mostly rely on external reference laboratories to handle complex or rarely-utilized tests. The large share of the segment is attributed to factors such as higher adoption of livestock diagnostic products by reference laboratories, growing research activities in these labs leading to advancements in the existing procedures used for animal health diagnosis, and growing preference for clinics, small to mid-sized hospitals, and farm owners towards utilizing health screening and diseases diagnostic services offered by reference laboratories for complex tests.

However, the point-of-care/in-house testing segment is slated to register the highest CAGR of 9.4% during the forecast period. PoC/in-house testing services are the services that are provided at home or places outside of laboratories or hospitals. These tests are known to provide better clinical and financial outcomes. The high growth of the segment is attributed to factors such as the rising availability of PoC tests for a wider test menu (disease areas), increasing demand for a quick turnaround in diagnostic tests for immediate care, reduction in time-dependent changes, and shifting trend towards an increased preference for PoC testing by farm owners & visiting veterinarians for regular animal health screening & disease diagnosis.

Geographical Analysis

By Geography: The North America Segment to Dominate the Livestock Diagnostics Market

In 2024, North America is expected to account for the largest share of 44.1% of the livestock diagnostics market, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The largest share of the segment is primarily due to increased public awareness via animal health R&D companies, a large consumer base, higher government funding for animal health research, and the acceptance of novel approaches that provide robust results quickly. Some of the major players operating in the North American livestock diagnostics market are Zoetis lnc. (U.S.), IDEXX Laboratories, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), AFFINITECH CO., LTD. (U.S.), Neogen Corporation (U.S.), and Aquila Diagnostic Systems Inc. (Canada), among others.

However, Asia-Pacific is slated to register the highest CAGR of 10.2% during the forecast period. This is attributed to factors such as the large population of livestock animals, rising incidence of various zoonotic diseases, rising awareness about animal health, and increasing income levels. Livestock serves as a major financial resource for the agriculture-based economy of Asia-Pacific. The countries in this region majorly focus on the production, consumption, and export of food-derived products. In order to ensure superior animal health and high-quality products, animal diagnostic helps by providing early disease diagnosis and stopping the disease from spreading amongst animals, therefore driving the growth of the market in the region.

Livestock Diagnostics Market: Key Companies

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the livestock diagnostics market are IDEXX Laboratories, Inc. (U.S.), Zoetis Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), bioMérieux S.A. (France), INDICAL BIOSCIENCE GmbH (Germany), Agrolabo SpA (Italy), Neogen Corporation (U.S.), IDvet (France), GD Animal Health (Netherlands), BioChek B.V. (Netherlands), and VMRD, Inc. (U.S.).

Livestock Diagnostics Industry Overview: Latest Developments from Key Industry Players

- In December 2023, Anitoa Systems (U.S.) launched an all-in-one swine flu test solution for livestock. This test includes a qPCR instrument, lyophilized swine flu test qPCR reagent, and a one-time-use sample collection tube with pre-filled lysis buffer solution.

- In August 2023, Zoetis, Inc. (U.S.) launched the Vetscan Mastigram+ test in several European markets. This rapid mastitis diagnostic test can detect gram-positive mastitis in approximately 8 hours.

- In November 2023, BioChek B.V. (Netherlands) and VolitionRx Limited (U.S.) launched the Nu.Q Vet Cancer Screening Test across the U.S., which is a non-invasive diagnostic tool for cancer screening and monitoring in canines.

Livestock Diagnostics Market Research Summary

|

Particulars

|

Details

|

|

Number of Pages

|

245

|

|

Format

|

PDF

|

|

Forecast Period

|

2024–2031

|

|

Base Year

|

2023

|

|

CAGR (Value)

|

8.4%

|

|

Market Size (Value)

|

USD 2.56 Billion by 2031

|

|

Segments Covered

|

By Product

- Consumables

- Bovine Viral Diarrhea (BVD)

- Influenza

- Avian Influenza

- Swine Influenza

- Other Influenza

(Note: Other influenza include equine influenza, goat & sheep influenza, among others)

- Foot and Mouth Disease (FMD)

- Bluetongue (BTV)

- Bovine Tuberculosis (TB)

- Bovine Herpes Virus (BHV)

- Porcine Reproductive and Respiratory Syndrome (PRRS)

- Newcastle Disease

- Avian Mycoplasma

- Other Diseases

(Note: Other diseases include infectious bronchitis virus, pneumonia, Mycoplasmosis, bovine spongiform encephalopathy, anemia, Johne’s Disease, and Equine Piroplasmosis)

- Systems

- Software

By Technology

- Immunodiagnostics

- Enzyme-Linked Immunosorbent Assay (ELISA) Tests

- Other Immunodiagnostic Tests

- Molecular Diagnostics

- Polymerase Chain Reaction (PCR) Tests

- Other Molecular Diagnostic Tests

- Other Technologies

(Note: Other technologies include microbiology, hematology, urinalysis, clinical biochemistry, histopathology tests, and rapid immune migration tests)

By Animal Type

- Ruminants

- Bovine Animals

- Other Ruminants

(Note: Other ruminants include sheep, goats, deer, elk, giraffes, and camels)

- Swine

- Poultry

- Other Animals

(Note: Other animals include equine and fish)

By End User

- Reference Laboratories

- Diagnostic Hospitals & Clinics

- Point-of-care (POC) Testing

|

|

Countries Covered

|

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Switzerland, Netherlands, Denmark, Belgium, Rest of Europe), Asia-Pacific (China, Japan, India, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), and Middle East & Africa

|

|

Key Companies

|

IDEXX Laboratories, Inc. (U.S.), Zoetis Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), bioMérieux S.A. (France), INDICAL BIOSCIENCE GmbH (Germany), Agrolabo SpA (Italy), Neogen Corporation (U.S.), IDvet (France), GD Animal Health (Netherlands), BioChek B.V. (Netherlands), and VMRD, Inc. (U.S.)

|

Key questions answered in the livestock diagnostics market report: