Resources

About Us

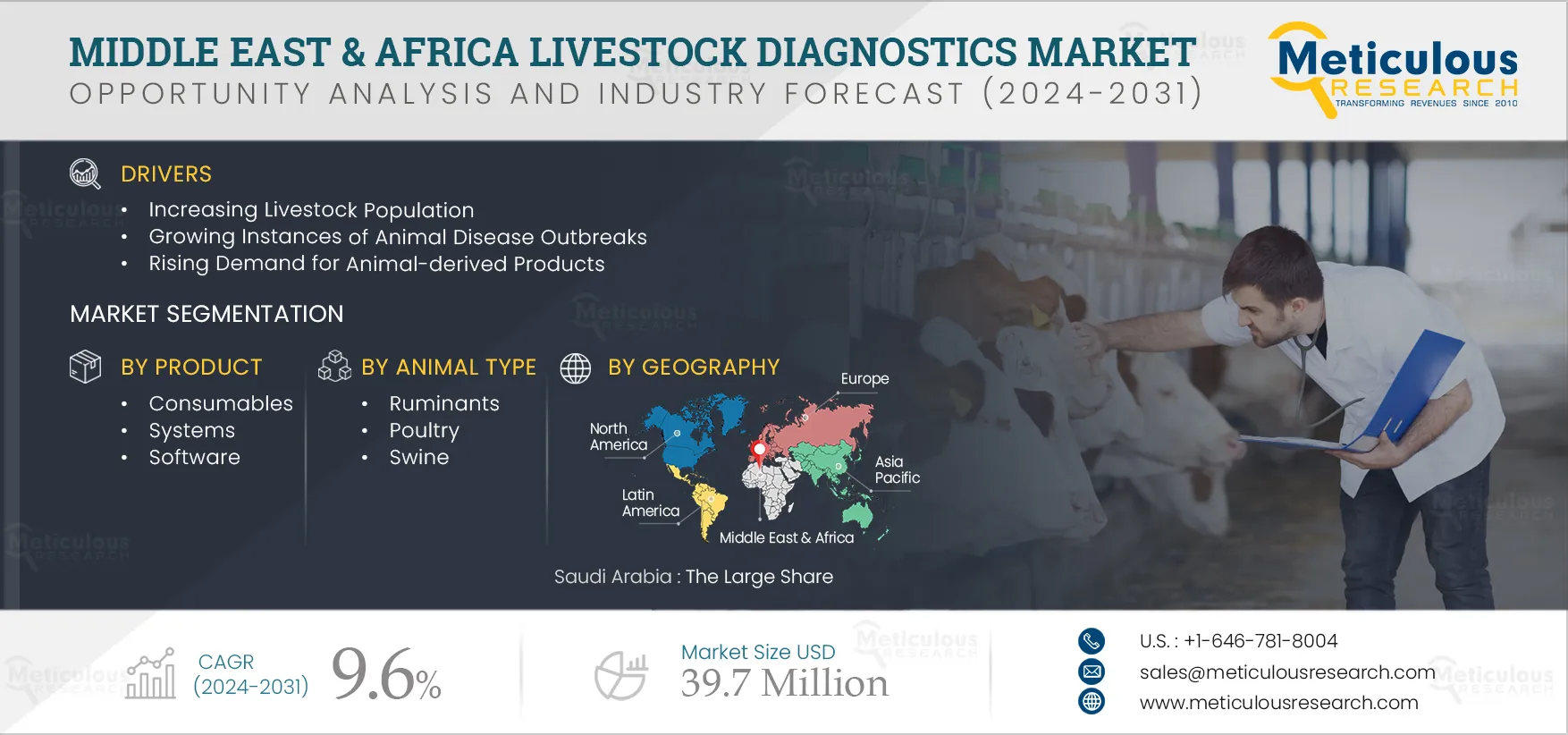

Middle East & Africa Livestock Diagnostics Market by Product (Consumables {ASF, FMD, Influenza}, Systems), Technology (Immunodiagnostics {ELISA, LFA}, PCR), Animal Type (Ruminants {Bovines}, Poultry), End User (POC, Veterinary Hospitals) - Forecast to 2032

Report ID: MRHC - 1041098 Pages: 190 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportPopulation growth has boosted the demand for animal-derived food products in the Middle East & Africa region, leading to an increase in livestock production and consumption. Diagnostics are crucial to keep this growing livestock population healthy as they enable early disease diagnosis and prevent the spread of diseases among animals. Technologies such as immunodiagnostics and molecular diagnostics are used to diagnose diseases such as bovine viral diarrhea, influenza, African swine fever, foot & mouth disease, and bluetongue.

The growth of the Middle East & Africa livestock diagnostics market is driven by the increasing livestock population, growing instances of animal disease outbreaks, the rising demand for animal-derived food products, and the increasing risk of zoonotic diseases. Additionally, rising government focus on increasing self-sufficiency and reducing food imports from other countries and the growing awareness regarding animal health and food quality in the region are expected to create growth opportunities for the stakeholders in this market. However, the underdeveloped animal diagnostics infrastructure in low-income countries of the region is a major challenge impacting the growth of this market.

Click here to: Get Free Sample Pages of this Report

The demand for animal-derived food products, namely meat, milk, and eggs, has increased in the Middle East & Africa (MEA) region. The increasing consumption of animal-derived foods in MEA is attributed to decreasing agricultural productivity due to shrinking resources and the reduced availability of cultivable land. Foods derived from animals are a major source of protein, and a protein-rich diet is essential to leading a healthy life.

The consumption of animal proteins is stable (around 44 to 55 g/capita/day) in developed countries, while the consumption is increasing in developing regions. According to the Food and Agriculture Organization (FAO), by 2050, small ruminant meat and beef production in Nigeria will increase by 159% and 233%, respectively, compared to 2012. Also, according to FAO, the volume of milk and beef consumed in Uganda will increase by nearly 3,300 thousand tons and 750 thousand tons, respectively, in the next 38 years, with aggregate consumption estimated at over 4,600 thousand tons for milk and 930 thousand tons for beef in 2050. Farmers are expected to increase livestock production to meet the increasing demand for animal-derived foods. The increased livestock population will necessitate the adoption of diagnostic testing for animals. Diagnostic testing helps in the early detection and treatment of diseases, ensuring the safety and quality of animal-derived food products. This factor is expected to boost the growth of the MEA livestock diagnostics market in the coming years.

Over the last century, there has been an alarming increase in the number, frequency, and diversity of zoonotic disease outbreaks. Caused by the spillover of pathogens from animal hosts to humans, these events may have more than tripled in the last decade, with the number of new zoonotic diseases infecting people quadrupling over the same period globally.

Several zoonotic disease outbreaks have been reported in the MEA region. As Africa has one of the world’s fastest-growing populations, the region is witnessing increasing urbanization and encroachment on wildlife habitats, with an increased risk of zoonotic infection for humans and farm animals. According to the World Health Organization (WHO), between 2012 and 2022, there was a 63% increase in the number of zoonotic outbreaks in Africa compared to 2001-2011. Moreover, 2087 monkeypox cases were reported in Africa between 1 January to 8 July 2022. Diagnostic testing is important in order to prevent the spread of such infections. These factors are increasing the demand for livestock diagnostics in the region, driving the growth of this market.

On account of their recurrent use, the demand for consumables is increasing with the rising volume of livestock diagnostic testing, growing awareness regarding the importance of regular animal health check-ups, and the increasing livestock population. Moreover, the emergence of various POC tests and assays is expected to create significant opportunities for the players operating in the Middle East & Africa livestock diagnostics market.

Immunodiagnostics is a preferred technology in diagnostics and quality-control programs due to the speed, convenience, and accuracy of research tools in detecting and quantifying targets. Further, the continuous development of new biomarkers and their cost benefits and the growing adoption of automated platforms for ELISA contribute to the segment’s large market share.

The segment's large share is attributed to the high prevalence of diseases in ruminants, the large population base of ruminants in the region, and the constant health monitoring required for ruminants to ensure high productivity. Moreover, the growing bovine population in the region is further expected to drive the growth of this segment during the forecast period. According to the Food and Agriculture Organization of the United Nations, in 2022, the population of cattle in Saudi Arabia reached 655.6 thousand from 477.2 thousand in 2018.

The segment's large share is attributed to the higher adoption of livestock diagnostic products among reference laboratories, easy access to clinics and small to mid-sized hospitals that outsource their tests to laboratories, and farm owners’ preference for utilizing health screening and disease diagnostic services offered by reference laboratories, particularly for complex tests.

In 2025, Saudi Arabia is expected to dominate the Middle East & Africa livestock diagnostics market. Saudi Arabia’s large share is attributed to the high demand and consumption of animal-derived food, the high production of animal-derived products, and the growing livestock population in the country.

The report offers a competitive landscape based on an extensive assessment of the product portfolios, geographic presence, and key strategic developments of leading market players in the last three to four years. The key players profiled in the Middle East & Africa livestock diagnostics market study are IDEXX Laboratories, Inc. (U.S.), Zoetis Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), bioMérieux S.A. (France), Neogen Corporation (U.S.), IDvet (France), FUJIFILM Middle East FZE (UAE), VMRD, Inc. (U.S.), and GD Animal Health (Netherlands).

|

Particulars |

Details |

|

Number of Pages |

~190 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

9.6% |

|

Estimated Market Size (Value) |

$39.7 Million by 2032 |

|

Segments Covered |

By Product

By Animal Type

By Technology

By End User

|

|

Countries/Regions Covered |

Middle East & Africa (Saudi Arabia, UAE, Israel, Iran, Egypt, South Africa, Qatar, Kuwait, Bahrain, Kenya, Nigeria, Rest of the Middle East & Africa) |

|

Key Companies |

IDEXX Laboratories, Inc. (U.S.), Zoetis Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), bioMérieux S.A. (France), Neogen Corporation (U.S.), IDvet (France), FUJIFILM Middle East FZE (UAE), VMRD, Inc. (U.S.), and GD Animal Health (Netherlands) |

The Middle East & Africa livestock diagnostics market report covers market sizes & forecasts for consumables, systems, and software used for livestock diagnostics. The Middle East & Africa livestock diagnostics market study includes the value analysis of various segments and subsegments of the Middle East & Africa livestock diagnostics market at the regional and country levels.

The Middle East & Africa livestock diagnostics market is projected to reach $39.7 million by 2032, at a CAGR of 9.6% from 2025 to 2032.

The consumables segment is estimated to account for the largest share of the Middle East & Africa livestock diagnostics market in 2025. Moreover, this segment is expected to record the highest CAGR during the forecast period.

Based on animal type, the ruminants segment is projected to gain more traction in the Middle East & Africa livestock diagnostics market.

The growth of the Middle East & Africa livestock diagnostics market is mainly driven by the region’s increasing livestock population, growing instances of animal disease outbreaks, the rising demand for animal-derived food products, and the growing risk of zoonotic diseases. Additionally, the growing government focus on increasing self-sufficiency and reducing food imports from other countries and the rising awareness regarding animal health and food quality are expected to generate growth opportunities for the stakeholders in this market.

The key players operating in the Middle East & Africa livestock diagnostics market are IDEXX Laboratories, Inc. (U.S.), Zoetis Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), bioMérieux S.A. (France), Neogen Corporation (U.S.), IDvet (France), FUJIFILM Holdings Corporation (UAE), VMRD, Inc. (U.S.), and GD Animal Health (Netherlands).

The UAE and Saudi Arabia are expected to offer significant growth opportunities for the vendors in this market due to the growing demand and consumption of animal-derived food products, the countries’ growing livestock populations, and government initiatives to increase self-sufficiency and reduce food imports from other countries.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates