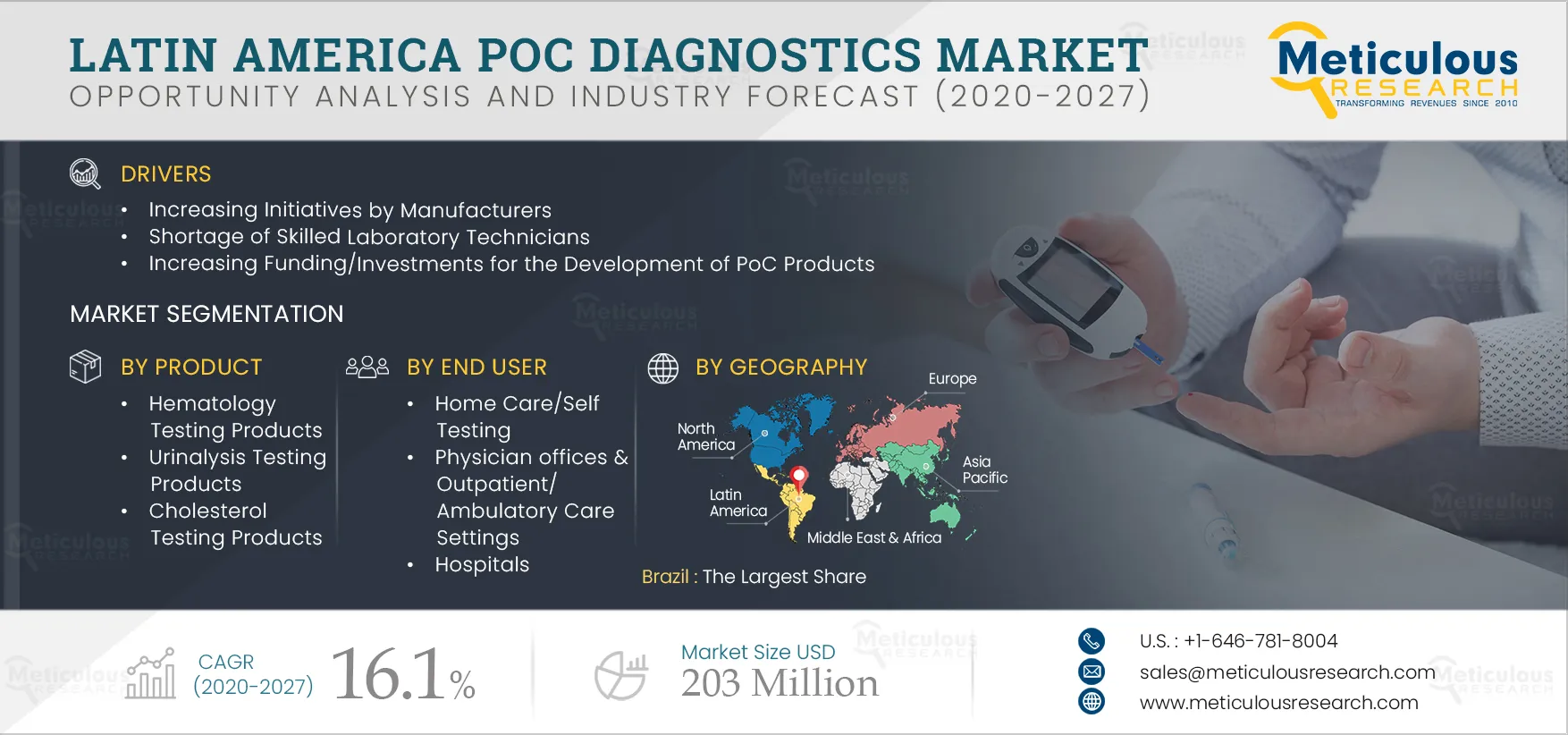

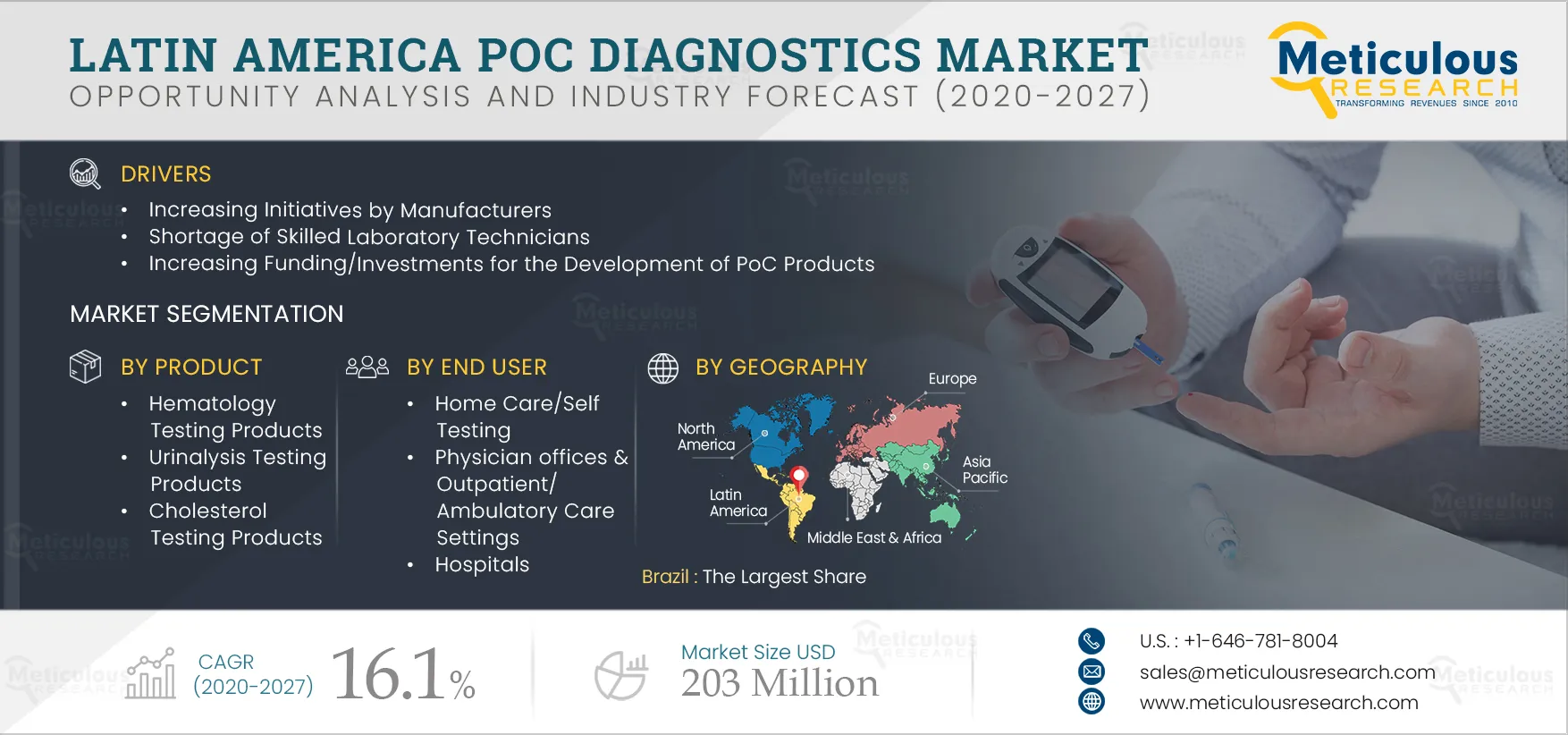

The Latin American Point-of-Care (POC) Diagnostics Market is expected to grow at a CAGR of 16.1% from 2020 to 2027 to reach at $203 million by 2027. The Latin America region has noted significant epidemiological burden of infectious diseases like severe acute respiratory syndrome (SARS), Middle East respiratory syndrome (MERS), Ebola, chikungunya, avian flu, swine flu, Zika, and COVID-19 in the recent years. The increased prevalence of these diseases have led to a greater demand for PoC diagnostics technologies in the region. Furthermore, the growing geriatric population, increasing initiatives by manufacturers to widen their portfolio and enhance availability of advanced products in the Latin American region, shortage of skilled laboratory technicians, and increasing funding/investments for the development of PoC products are expected to propel the growth of the PoC diagnostics market in the region.

COVID-19 Impact on the Latin America PoC Diagnostics Market

Increase in prevalence of various chronic and infectious diseases such as cardiac diseases, hepatitis, cancer, gastrointestinal, respiratory, and sexually transmitted diseases (STDs) play a vital role in the growth of the point of care diagnostics market. However, the recent outbreak of the coronavirus disease (COVID-19) has led to the rapid expansion of PoC diagnostics market in the region. In March 2020, Vale S.A., a Brazilian multinational corporation, purchased 5 million new coronavirus (COVID-19) rapid test kits to help the Brazilian government combat the spread of the illness in the country. Also, Hi Technologies, a Brazilian healthtech startup which specializes in laboratory exam equipment, is producing batches of rapid tests to diagnose COVID-19.

Amidst the ongoing pandemic, the overall adoption for point-of-care diagnostic test kits in the Latin American region has increased significantly, on the advice of WHO.

Click here to: Get Free Sample Pages of this Report

Growing prevalence of chronic and infectious diseases in the region

Currently, chronic infectious diseases caused by bacterial and viral pathogens are on the rise in Latin American countries due to various factors including changes in climatic conditions, increased human population growth and density in both urban and rural areas, increased human migration and mobility, and poor public health resources. The pathogenic agents that cause emerging and re-emerging diseases in Latin America include, bacterial pathogens (Salmonella enteritidis; Salmonella typhimurium, Salmonella typhi, Brucellaabortus and Klebsiella pneumonia) and viral pathogens (HPV; HIV; EBV; Zika and Chikungunya). According to the Joint United Nations Programme on HIV/AIDS (UNAIDS), as in 2017, there were approximately 1.8 million people living with HIV in the Latin America region. According to Brazil’s Health Ministry, a total of 4,680 flu cases were found in Brazil in the first seven months of 2018. Also, according to the Global Cancer Institute, the prevalence of cancer in LATAM has increased in past decades and is further expected to rise by 35% by 2030. This is mainly attributed to the demographic and epidemiological transition in the region, changes in lifestyle and dietary patterns, and surge in risk factors. Further, the recent outbreak of coronavirus (COVID -19) is affecting large population in the region, which has led to sudden growth in demand for related POC diagnostic tests in the region.

Rising initiatives by key players in the region

Owing to the rapid increase in the geriatric population, chronic diseases are becoming a major health problem in Latin America. As a result, the demand for diagnostic products and services is increasing in the region. For instance, in 2019, Alere Inc. (U.S.) launched its ID NOW point of care molecular platform in Brazil with tests for the rapid detection of respiratory diseases, such as influenza, bronchiolitis, and pharyngotonsillitis.

Apart from such developments from point-of-care diagnostics tests providers, conferences and workshops to create awareness among local medical device manufacturers and healthcare community are also supporting the growth of the PoC testing market in Latin America.

Key findings of the Latin America PoC diagnostics market study:

Infectious diseases testing kits are expected to register the fastest growth during the forecast period

During 2018-2019, influenza caused 848 deaths in Mexico. Similarly, Brazil reported nearly 1,000 deaths from influenza in the first five months of 2016. These numbers are increasing every year. Rapid testing for influenza A and B allows for accurate and timely treatment, as patients only have a 48-hour window to receive critical antiviral therapy. Thus, the growing prevalence of infectious diseases and need for rapid testing and treatment provide robust revenue growth opportunities for players offering PoC tests in Latin America.

Based on mode, Over-The-Counter (OTC) testing kits segment to hold the largest share in 2020

The greater adoption of OTC over prescription kits is mainly due to the expansion of test portfolio from the POC technology providers, greater benefits offered by POC tests for patients and clinicians, enhanced quality of POC tests, and growing use of novel technologies such as nanotechnology and microfluidics in point of care testing products which enables the miniaturization of devices.

Home care/self-testing to hold the largest share of the PoC diagnostics market in 2020

Growing inclination towards at-home healthcare, increasing focus on continuous and remote patient monitoring, and increasing need for rapid tests among home care users support the high demand for point-of-care diagnostics products in home care/self-testing end user segment in the Latin America region.

Brazil to dominate the Latin America point of care diagnostics market in 2020

Brazil is estimated to command the largest share of the Latin America PoC diagnostics market in 2020. This market is expected to continue its dominance during the forecast period as well, driven by the rising prevalence of infectious diseases, diabetes, cancer and cardiac disorders; and increased healthcare spending in Brazil with its developing economy. Government initiatives to control the incidence levels of chronic and endemic diseases is also expected to support the growth of the point-of-care diagnostics market in Brazil during the forecast period.

Key Players

The report includes competitive landscape based on extensive assessment of the product portfolio, geographic presence, and key strategic developments adopted by leading market players in the industry over the past 4 years. The key players profiled in the Latin America PoC diagnostics market are Alere Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Danaher Corporation (U.S.), Thermo Fisher Scientific (U.S.), Becton, Dickinson and Company (U.S.), Quidel Corporation (U.S.), biomérieux S.A. (France), Chembio Diagnostics (U.S.), Johnson & Johnson (U.S.), Siemens Healthineers GmbH (Germany), and PTS Diagnostics (U.S.).

Scope of the Report:

Latin America PoC Diagnostics Market, by Product

- Blood Glucose Monitoring Testing Products

- Cardiac Metabolism Monitoring Testing Products

- Infectious Disease Testing Products

- Coagulation Monitoring Products

- Pregnancy and Fertility Testing Products

- Fecal Occult Testing Products

- Hematology Testing Products

- Tumor/Cancer Markers Testing Products

- Drugs of Abuse Testing Products

- Urinalysis Testing Products

- Cholesterol Testing Products

- Other PoC Testing Products

Latin America PoC Diagnostics Market, by Platform

- Lateral Flow Assays (Immunochromatography Tests/Lateral Flow Immunoassays)

- Dipsticks

- Microfluidics

- Molecular Diagnostics

Latin America PoC Diagnostics Market, by Mode

- Prescription-Based Testing Products

- Over-the-Counter (OTC) Testing Products

Latin America PoC Diagnostics Market, by End User

- Home Care/Self Testing

- Physician offices & Outpatient/Ambulatory Care Settings

- Hospitals

- Research Laboratories

Latin America PoC Diagnostics Market, by Geography

- Brazil

- Mexico

- Argentina

- Chile

- Colombia

- Peru

- Rest of LATAM

Areas of Focused Research Services in Latin America:

- Market Access

- In-depth Regulatory Analysis

- Assessment of Top Technology Trends

- End User Perception Analysis

- Partner Identification

- Due Diligence

- Distribution Channel Assessment

- Supply Chain Analysis

- Procurement Practices Analysis

- Key Customer Assessment

- Others

Key questions answered in the report: