Resources

About Us

Latin America NGS Market by Offering (Kits [Library Prep, QC, DNA Extraction], System) Type (Genome, Exome, Targeted) Application (Reproductive, Oncology, Infectious, Drug Discovery) Technology (SBS, Nanopore, Nanoball, SMRT Seq, DNB) – Forecast to 2032

Report ID: MRHC - 1041097 Pages: 170 Feb-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe speed, throughput, and accuracy of Next-Generation Sequencing (NGS) have revolutionized genetic analysis, enabling its use in various applications. NGS technology has found applications in genomic and clinical research, reproductive health, and environmental, agricultural, and forensic science. It has the potential to become the ultimate genotyping platform for human identification. The capabilities of NGS extend to forensic markers, including short tandem repeats (STR) and mitochondrial and Y-chromosome haplotypes. The decreasing cost of sequencing per base, along with the introduction of cost-effective benchtop laboratory sequencers, has driven the incorporation of discrete NGS data within the clinical arena for personalized medicine.

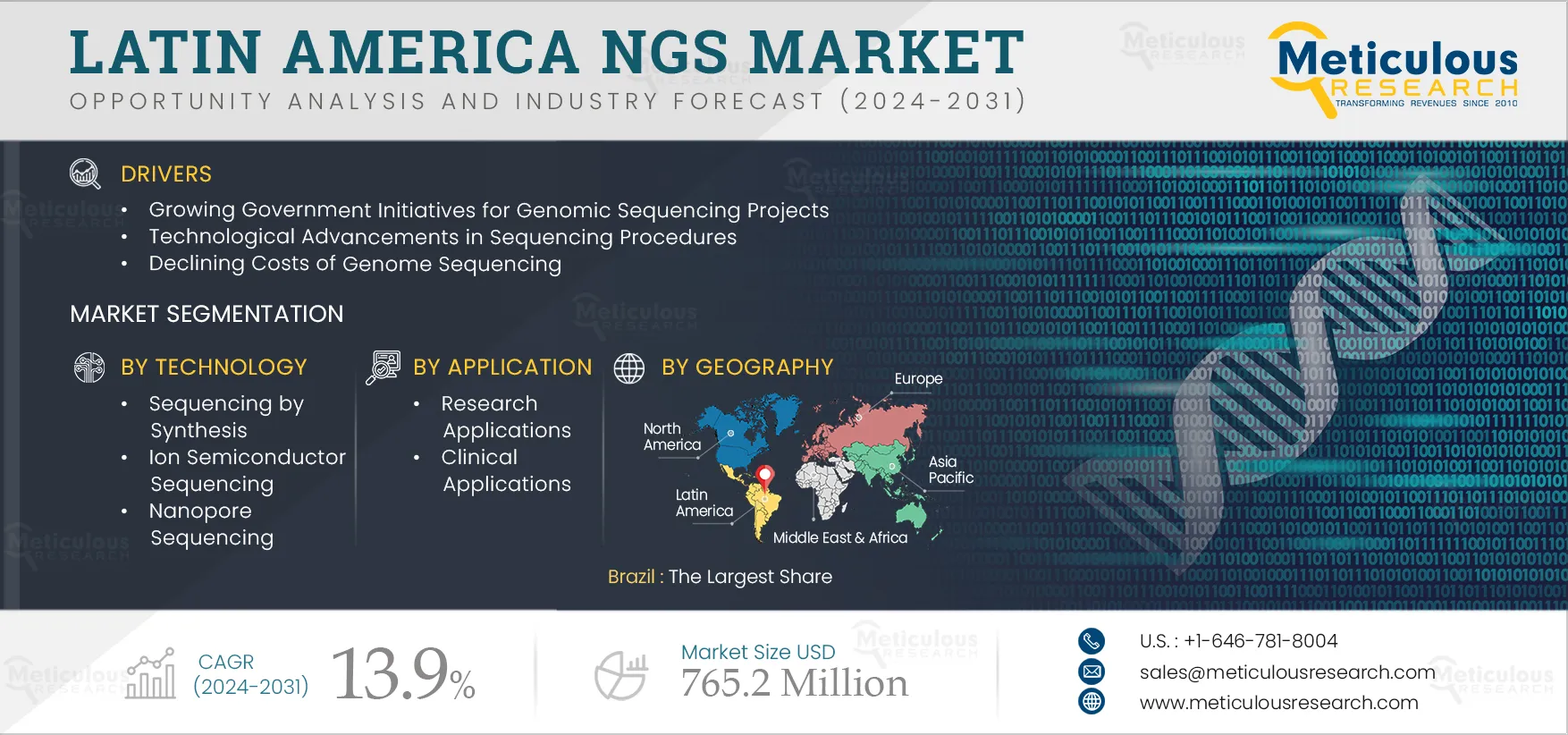

The growth of the Latin America NGS market can be attributed to various factors, including the increasing initiatives by governments and organizations for genomic sequencing projects, advancements in sequencing procedures, decreasing costs of genome sequencing, a rise in cancer prevalence, and the expanding application of NGS in cancer treatment and research. However, the high costs of NGS systems and consumables and the availability of alternative technologies restrain the market's growth.

The rising adoption of bioinformatics and genomic data management solutions, as well as collaborations and partnerships to support next-generation sequencing, are expected to create market growth opportunities. However, the lack of skilled professionals and ethical and legal issues related to NGS-based diagnosis pose a significant challenge to the market's growth.

Click here to: Get Free Sample Pages of this Report

With rapid advancements in NGS technology, various organizations & governments are actively undertaking initiatives for genomic sequencing projects. These initiatives aim to improve early disease diagnosis. Some of the initiatives are as follows:

In March 2024, MGI Tech Co., Ltd. (China) collaborated with Pensabio (Brazil) to assist a massive national genomic sequencing initiative using a sequencer. The objective of the project was to sequence the entire genomes of thousands of patients with hereditary cancers and rare diseases, search for genetic markers to monitor inherited diseases for early diagnosis, and stimulate technological advances and scientific development in the country by improving the growth of the Brazilian genomic industry.

Next Generation Sequencing (NGS) is a technology used to sequence the orientation of nucleotides in genetic material. This technology enables the sequencing of DNA or RNA more quickly and at a lower cost compared to Sanger sequencing. Continuous developments in NGS technology are revolutionizing the field of personalized medicine, genetic diseases, and clinical diagnostics by providing the capability to sequence multiple individuals with a variable genetic orientation simultaneously. Various organizations are focusing on partnerships, collaborations, and expansion to increase genetic testing and support next-generation sequencing. For instance:

Among the offerings, in 2025, the consumables segment is expected to account for the largest share of the Latin America NGS market. The recurring use of consumables, rising demand for NGS-based diagnostic tests, and increasing applications of NGS in oncology, reproductive health diagnosis, and drug discovery are increasing the demand for consumables, contributing to the large market share of this segment.

Among sequencing types, in 2025, the targeted genome sequencing segment is expected to account for the largest share of the Latin America NGS market. Targeted genome sequencing significantly reduces the cost per sample over whole genome shotgun sequencing by enabling sequencing of only the desired regions of a genome. Furthermore, the early success of targeted sequencing methods has created a rapidly growing demand for targeted sequencing in areas such as cancer, human genetic disease, and the validation of genome-wide association studies. These factors have increased the adoption of targeted genome sequencing, contributing to the large market share of this segment.

Among the technologies, in 2025, the sequencing by synthesis segment is expected to account for the largest share of the Latin America NGS market. The large share of this segment is primarily attributed to the high accuracy of this technology in DNA sequencing, its highest yield of error-free throughput, and the increasing incorporation of this technology in NGS products.

Among the applications, in 2025, the research applications segment is expected to account for the largest share of the Latin America NGS market. The large market share of this segment is attributed to the rising adoption of sequencing-based tests in laboratories, the growth in NGS-based research activities, and the increasing collaborations between market players in research programs for personalized medicine and genetic testing. For instance, in May 2024, BGI Genomics Co., Ltd. (China) collaborated with Universidad Mayor (Chile) to provide full NGS solutions comprising sequencing platforms and other equipment to support the university's precision oncology center. Similarly, BGI Genomics Co., Ltd. (China) signed an agreement with Biocódices SA (Argentina) to deliver advanced noninvasive prenatal genetic testing technologies, with the goal of reducing the cost of NIPT for Argentine consumers.

Among the end users, in 2025, the pharmaceutical & biotechnology companies segment is expected to account for the largest share of the Latin America NGS market. The large market share of this segment is attributed to factors such as the increasing adoption of advanced technologies for research purposes, increasing research for drug discovery with widening NGS applications, and the rising incidence of chronic diseases. For instance, according to GLOBOCAN, in 2020, 592,212 people were diagnosed with cancer in Brazil. This number is projected to reach 786,686 by 2032. Additionally, in 2020, 195,499 people were diagnosed with cancer in Mexico. This number is projected to reach 254,665 by 2032.

In 2025, Brazil is expected to account for the largest share of the Latin America NGS market. Brazil’s significant market share can be attributed to the rising healthcare expenditure, rising cancer cases,

growing adoption of NGS technology among healthcare professionals for the treatment of diseases, and an increasing number of sequencing projects such as the Brazilian Initiative on Precision Medicine (BIPMed), The ZiBRA project, and DNA do Brasil (DNABr).

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market players over the past three to four years. The key players profiled in the Latin America NGS market report are Thermo Fisher Scientific Inc. (U.S.), Illumina, Inc. (U.S.), Qiagen N.V. (Netherlands), F. Hoffmann-La Roche Ltd (Switzerland), PerkinElmer, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Danaher Corporation (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Oxford Nanopore Technologies Plc. (U.K.), and 10X Genomics, Inc. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

170 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

13.9% |

|

Estimated Market Size (Value) |

$765.2 million by 2032 |

|

Segments Covered |

By Offering

By Sequencing Type

By Technology

By Application

By End User

|

|

Countries Covered |

Latin America (Brazil, Mexico, Argentina, Chile, and Rest of Latin America) |

|

Key Companies |

Thermo Fisher Scientific Inc. (U.S.), Illumina, Inc. (U.S.), Qiagen N.V. (Netherlands), F. Hoffmann-La Roche Ltd (Switzerland), PerkinElmer, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Danaher Corporation (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Oxford Nanopore Technologies Plc. (U.K.), and 10X Genomics, Inc. (U.S.). |

This study offers a detailed assessment of the Latin America NGS market, including the market sizes and forecasts for various segmentations like offering, sequencing type, technology, application, and end user. This report also involves the value analysis of various segments and sub-segments of NGS at the country level.

The Latin America NGS market is projected to reach $765.2 million by 2032, at a CAGR of 13.9% during the forecast period.

Among the offerings, in 2025, the consumables segment is expected to account for the largest share of the Latin America NGS market. The large market share of this segment is attributed to the recurring use of consumables, rising demand for NGS-based diagnostic tests, and the increasing applications of NGS in oncology, reproductive health diagnosis, and drug discovery.

In 2025, the targeted genome sequencing segment is expected to account for the largest share of the Latin America NGS market. The large market share of this segment is attributed to its low sequencing costs compared to other sequencing technologies, increased sensitivity in variant calling, and advancements in targeted genome sequencing technologies.

The growth of the Latin America NGS market can be attributed to various factors, including the increasing initiatives by governments and organizations for genomic sequencing projects, advancements in sequencing procedures, decreasing costs of genome sequencing, a rise in cancer prevalence, and the expanding application of NGS in cancer treatment and research.

The rising adoption of bioinformatics and genomic data management solutions, as well as collaborations and partnerships to support next-generation sequencing, are expected to create market growth opportunities.

The key players profiled in the Latin America NGS market report are Thermo Fisher Scientific Inc. (U.S.), Illumina, Inc. (U.S.), Qiagen N.V. (Netherlands), F. Hoffmann-La Roche Ltd (Switzerland), PerkinElmer, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Danaher Corporation (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Oxford Nanopore Technologies Plc. (U.K.), and 10X Genomics, Inc. (U.S.).

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jul-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates