Resources

About Us

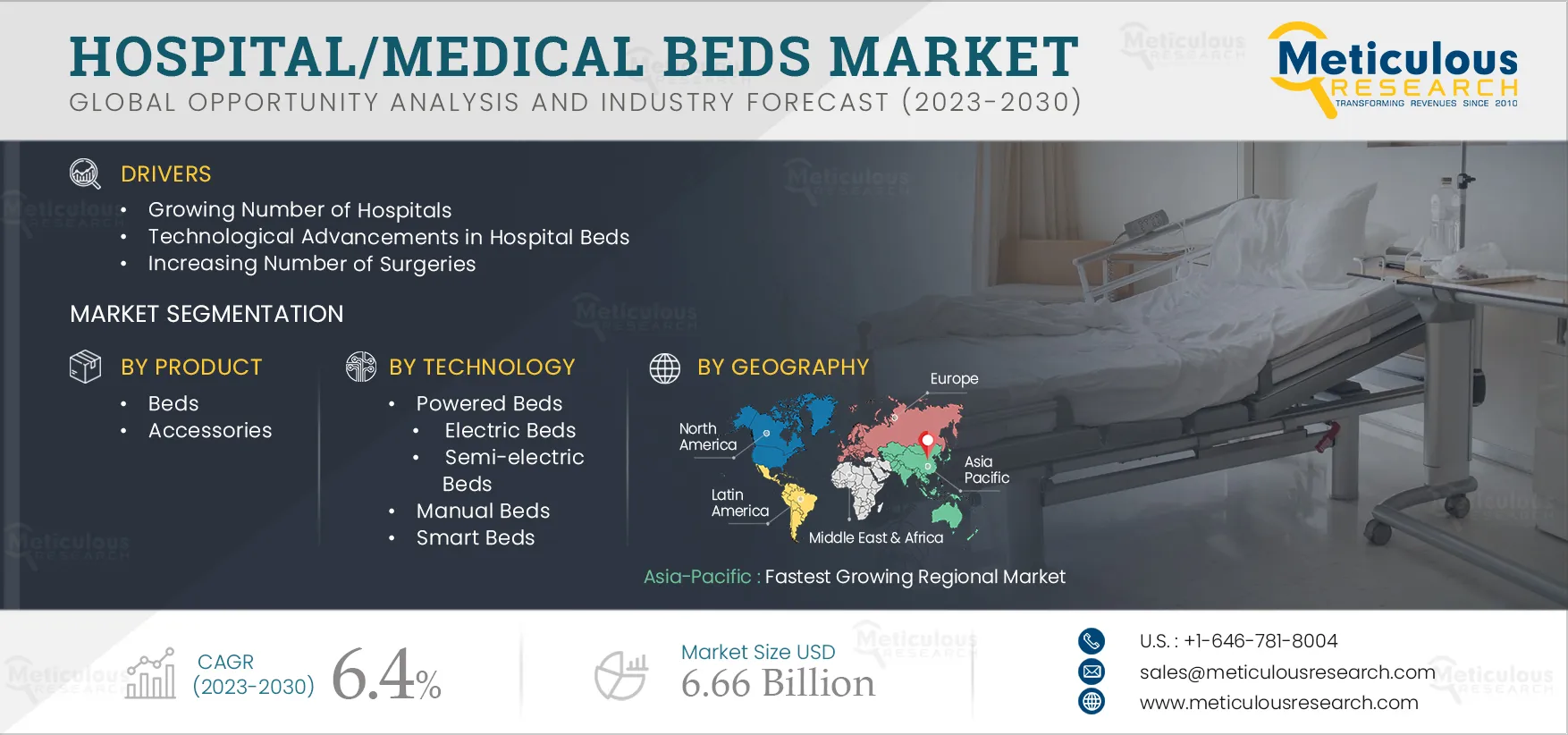

Hospital Beds Market by Product (Bed, Accessories), Technology (Manual, Powered), Type of Care (Rehabilitative, Curative, Long Term), Healthcare Facility (Pediatric, Maternal, Bariatric, Critical, Homecare, Med Surg) - Global Forecast to 2030

Report ID: MRHC - 104393 Pages: 209 Feb-2024 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe Hospital Beds Market is projected to reach $6.66 billion by 2030, at a CAGR of 6.4% from 2023 to 2030. Hospital beds are appropriate for patients who have trouble getting into or out of the beds due to some medical conditions. These beds also come in adjustable sizes, making it easier for caregivers to handle the patient. These beds adapt to patients’ heights and other conditions and offer advantages like frequent repositioning to reduce stiffness and joint pains after lying on the bed for longer durations and prevent the formation of bedsores, mainly on the buttocks and heels. The adjustable foot and height sections allow positions that may cause pain when using pillows or wedges. Side rails of Hospital beds prevent falling from bed.

The increasing elderly population, coupled with the growing prevalence of chronic diseases, the growing number of hospitals, and the launch of technologically advanced beds are the factors driving the growth of this market. Whereas launches of smart and robotic beds, growing demand for beds in home care settings, developing economies, and growing medical tourism are creating new opportunities for the market. However, the requirement for medical equipment technicians for servicing hospital beds and the lack of technical knowledge among healthcare workers about technologically advanced medical beds are challenges obstructing the market growth.

The aging population is growing in most countries. The increase in the aging population is attributed to an increase in life expectancy and improvement in healthcare quality, leading to greater survival rates. As per the report published by WHO, it is expected that by 2030, one in six people globally will be more than 60 years old. By 2050, globally, the population aged 60 and above is likely to increase to nearly 2.1 billion.

Furthermore, the number of individuals aged 80 or older is expected to reach 426 million between 2020 and 2050. According to the United Nations and World Population Prospects, in 2022, the geriatric population was more in Eastern and Southeastern Asia, followed by Europe and North America. In the coming decades, the older population is expected to grow at the fastest rate in Northern Africa and Western Asia, with a growth rate of 3% per year.

The growing aging population is leading to an increase in the prevalence of chronic diseases. Most of the deaths associated with chronic diseases are attributed to cancer, cardiovascular diseases, obesity, and diabetes, which are prevalent among the aging population, and their growing prevalence is likely to increase the number of hospital admissions. For instance, as per the WHO report in February 2022, nearly 10 million cancer deaths in 2020 occurred due to cancer, which is approximately 1 in 6 deaths. Apart from cancer, in 2020, an estimated 244.1 million people globally lived with ischemic heart disease (Source: American Heart Association). Thus, the increasing elderly population and rising prevalence of chronic diseases will lead to a growth in the demand for medical beds.

Click here to: Get a Free Sample Copy of this report

Owing to high healthcare costs in developed countries, patients are increasingly looking for more affordable options for their healthcare. The aging population in developed countries and increasing life expectancy are the two major factors that have significantly strained national healthcare systems, thus limiting healthcare access. Therefore, patients are opting for cross-border healthcare options. Additionally, international accreditations for improving the global healthcare services standards and hospital websites dedicated to medical tourism provide patients with a choice of services worldwide.

According to World Health Organization 2022 report, medical tourism accounted for $104.68 billion in 2019 and is expected to reach $273 billion by 2027. Additionally, in recent years, medical tourism in Southeast Asian and Latin American countries has been expanding as healthcare hotspots due to JCI accreditation and cooperation with US-based health providers. This is mainly driven by expanding private hospital chains and increasing investment in infrastructure, equipment, staff, and services. Additionally, 2 million patients visit India annually from approximately 78 countries for IVF, medical, and wellness treatments. Therefore, the increasing movement of patients from developed economies to low-cost medical tourism locations is likely to provide high growth opportunities for players operating in the med beds market in these regions.

Based on product, in 2023, the beds segment is expected to generate the largest share of the market

The demand for beds is rising due to various advantages offered by these med beds, which include adjustable side rails, easy mobility, and availability of a high variety of shapes and sizes. High hospitalization rates, longer patient waiting times, supportive initiatives by government organizations for improving healthcare infrastructure, and high demand for advanced healthcare facilities are the factors supporting the large market share of this segment.

Powered beds offer various benefits like proper blood circulation, reduced pressure on body parts, increased sleep quality, and increased blood flow. These beds also reduce back pain, improve patients’ digestion, and relieve and prevent arthritis. Also, powered beds reduce caregivers' chances of injury, reduce long-term care burnout, and provide more medical support.

Based on type of care, in 2023, the curative care segment is expected to account for the largest share of the market

The demand for curative care is high as hospital admissions for treating various conditions or injuries have increased. For instance, as per the research conducted by the British Cardiovascular Society, the number of times patients admitted to Blackpool Victoria Hospital (U.K.) with heart failure increased from 341 episodes from August 2019 to January 2020 to 415 episodes during August 2020 to January 2021, registering an increase of 22%.

Based on healthcare facility, in 2023, the critical care unit segment is expected to account for the largest share of the market

Asia-Pacific: Fastest growing regional market

The growth of this market is attributed to factors like the rising geriatric population, rising prevalence of chronic diseases, growing healthcare spending, increasing investments in the healthcare infrastructure, and the growing number of hospitals. Moreover, the sudden outbreak of infectious diseases has created huge pressure on developing countries' healthcare systems, fueling the demand for advanced healthcare systems.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments that led market participants to adopt over the past three years. The key players profiled in the global medical beds market are Stryker Corporation (U.S.), Hill-Rom Holding, Inc. (Part of Baxter International Inc.) (U.S.), Invacare Corporation (U.S.), Getinge AB (Sweden), Paramount Bed Holdings Co., Ltd. (Japan), Medline Industries, LP (U.S.), Stiegelmeyer GmbH & Co. KG (Germany), LINET Group SE (Czech Republic), Joerns Healthcare LLC. (U.S.), Drive DeVilbiss Healthcare (U.S.), Savaria Corporation (Canada), Midmark Corporation (U.S.), Amico Corporation (U.S.), Famed Zywiec Sp. z o.o. (Poland), and Malvestio Spa (A Subsidiary of Malvestio Group) (Italy).

Scope of the Report:

Hospital Beds Market, by Product

Hospital Beds Market, by Technology

Powered Beds

Hospital Beds Market, by Type of Care

Hospital Beds Market, by Healthcare Facility

Hospital Beds Market, by Geography

Key questions answered in the report:

This study offers a detailed assessment of the hospital beds market, including the market size & forecast for various segmentation like product, technology, type of care, and healthcare facility. The medical beds market studied in this report also involves the value analysis of various segments of hospital beds at regional and country levels.

The global hospital beds market is projected to reach $ 6.66 billion by 2030, at a CAGR of 6.4% during the forecast period.

Based on product, the beds segment accounted for the largest share of the market.

Based on technology, the powered beds segment is projected to register the highest CAGR over the forecast period. Powered hospital beds partially or completely use motors to raise the head and foot sections of the bed. These beds provide folding positions that can be changed according to the treatment requirements and patient comfort. Powered beds are used for patients who have undergone multiple surgeries, needing physical support, and continuous monitoring. Thus, various advantages of these beds are the factors for supporting their growing adoption.

Based on type of care, the long-term care segment is projected to register the highest CAGR over the forecast period.

Based on healthcare facility, the home care settings segment is projected to record the fastest growth rate over the forecast period.

The increasing elderly population, coupled with the growing prevalence of chronic diseases, the growing number of hospitals, and the launch of technologically advanced beds are driving the market growth. New smart and robotic beds, growing demand for beds in home care settings, developing economies, and growing medical tourism are creating new opportunities for the market.

The key players profiled in the global hospital beds market are Stryker Corporation (U.S.), Hill-Rom Holding, Inc. (Part of Baxter International Inc.) (U.S.), Invacare Corporation (U.S.), Getinge AB (Sweden), Paramount Bed Holdings Co., Ltd. (Japan), Medline Industries, LP (U.S.), Stiegelmeyer GmbH & Co. KG (Germany), LINET Group SE (Czech Republic), Joerns Healthcare LLC. (U.S.), Drive DeVilbiss Healthcare (U.S.), Savaria Corporation (Canada), Midmark Corporation (U.S.), Amico Corporation (U.S.), Famed Zywiec Sp. z o.o. (Poland), and Malvestio Spa (A Subsidiary of Malvestio Group) (Italy).

Emerging economies like China and India are projected to offer significant growth opportunities to the market players due to the growing medical tourism and aging population in these countries.

Published Date: Jul-2024

Published Date: Nov-2023

Published Date: Sep-2023

Published Date: Mar-2016

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates