This report is executed in collaboration with the European Algae Biomass Association (EABA). Combining Meticulous Research®’ market intelligence services with EABA’s broad expertise in the development of research, technology and industrial capacities in the field of algae, the two organizations have leveraged their research capabilities to come up with the most reliable and accurate market assessments in this field.

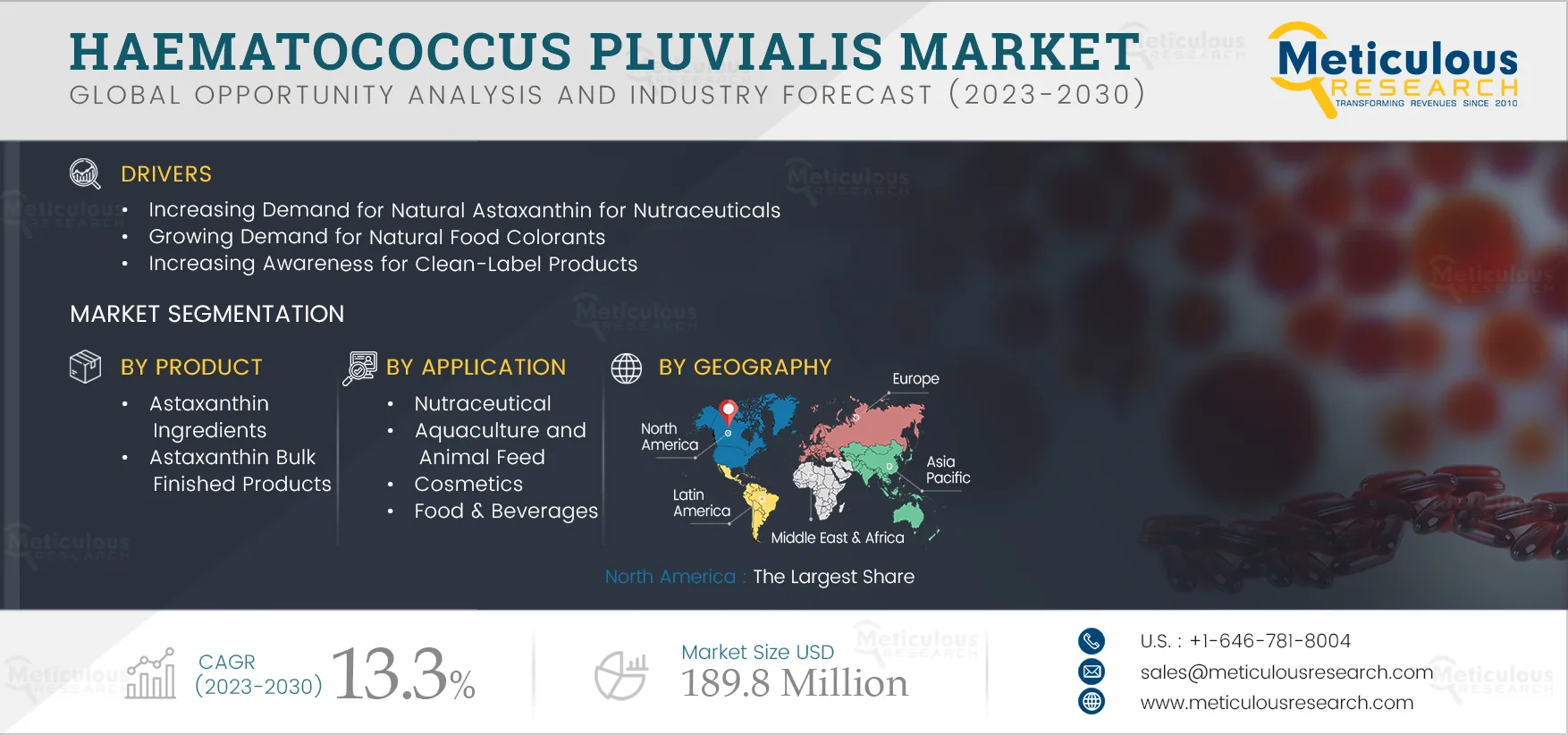

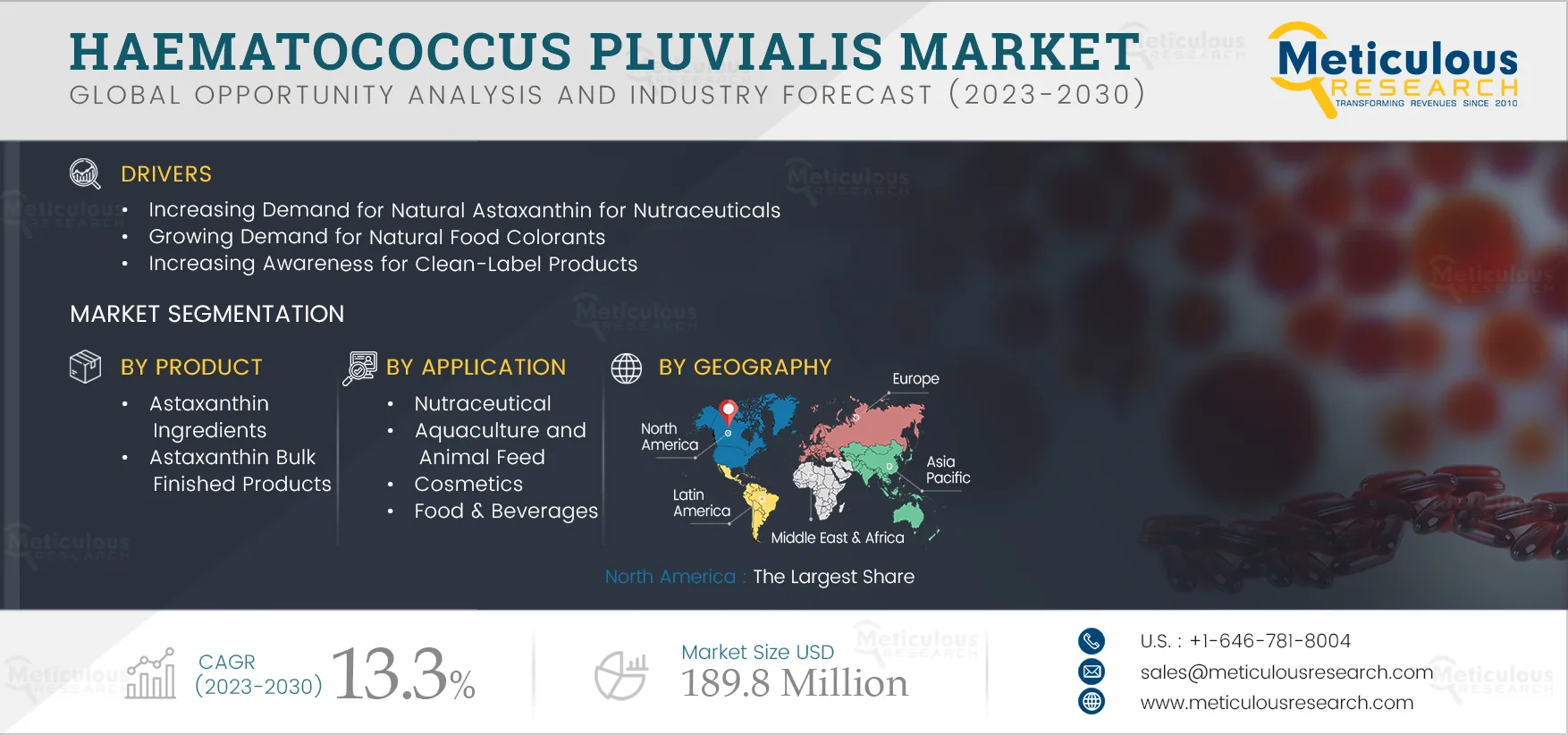

The Haematococcus Pluvialis Market is projected to reach $189.8 million by 2030, at a CAGR of 13.3% during the forecast period of 2023 to 2030, while in terms of volume, this market is projected to reach 1,369.9 tons by 2030, at a CAGR of 14.8% from 2023 to 2030. The growth of this market is driven by increasing demand for natural astaxanthin for nutraceuticals, growing demand for natural food colorants, and increasing awareness about clean-label products. However, the high production cost is expected to restrain the growth of this market.

The growing demand for natural astaxanthin and the use of natural astaxanthin in poultry and aquaculture are expected to create market growth opportunities. However, the complex production process of haematococcus pluvialis is a major challenge for the players operating in this market.

Increasing Demand for Natural Astaxanthin for Nutraceuticals

Microalgae haematococcus pluvialis is a promising source of astaxanthin. It is a colored and antioxidant carotenoid that accumulates during the red growth phase. Algae-based astaxanthin is widely used for pharmaceutical applications due to its increased antioxidant activity and ability to treat diseases. Emerging research has validated the vibrant red carotenoid’s ability to quench free radicals and reduce oxidative stress, correlating cardiovascular health benefits, sports nutrition and recovery, and skin and joint health.

According to the Association for Packaging and Processing Technologies, the global nutraceuticals market is expected to grow from about USD 209.0 billion in 2017 to USD 373.0 billion in 2025. This growth is mainly attributed to the increasing popularity of natural nutraceuticals. Thus, the demand for natural astaxanthin is rising in the nutraceuticals industry.

Natural algae astaxanthin is almost exclusively used in human food and dietary supplements. Oxidative stress is a causative or at least ancillary factor in the pathogenesis of major neurodegenerative diseases, such as Alzheimer's, Huntington's, Parkinson's, and amyotrophic lateral sclerosis-ALS. Diets high in antioxidants offer the potential to lower the associated risks. Natural astaxanthin can cross the blood-brain barrier in mammals and can extend its antioxidant benefits beyond that barrier. Therefore, astaxanthin can help to alleviate the effects of Alzheimer's disease and other neurological diseases.

In late 1990, natural astaxanthin was launched in the human nutrition market after the FDA reviewed safety parameters and was validated for human consumption. Since 2011, natural astaxanthin, which is 20 to 50 times stronger than synthetically derived astaxanthin, was allowed by the FDA at 12 mg/day. Astaxanthin is used as a nutritional supplement, antioxidant and anticancer agent, prevents diabetes, cardiovascular diseases, and neurodegenerative disorders, and stimulates immunization. Astaxanthin is a potential therapeutic agent against atherosclerotic cardiovascular disease. Its supplementation can be beneficial for people with an enhanced risk of heart attacks. Its carried out by VLDL, LDL, and HDL (high-density lipoprotein) in human blood and protects LDL-cholesterol against oxidation. Moreover, it also can constrain the growth of fibrosarcoma, breast and prostate cancer cells and embryonic fibroblasts, cell death, cell proliferation, and mammary tumors. Astaxanthin has a role in reducing blood plasma levels and increasing basal arterial blood flow.

Thus, due to its potential effects on various diseases, including cancers, hypertension, diabetes, cardiovascular, gastrointestinal, liver, neurodegenerative, and skin diseases, there is a growing demand for natural astaxanthin antioxidant supplements derived from haematococcus for the nutraceutical industry.

Click here to: Get a Free Sample Copy of this report

Key Findings in the Haematococcus Pluvialis Market Study:

In 2023, the Astaxanthin Ingredients Segment is Expected to Dominate the Haematococcus Pluvialis Market

Based on product, the haematococcus pluvialis market is mainly segmented into astaxanthin ingredients and astaxanthin bulk finished products. In 2023, the astaxanthin ingredients segment is expected to account for the largest share of the global haematococcus pluvialis market. The large market share of this segment is mainly attributed to the growing end-use applications of astaxanthin ingredients, rising awareness about preventive healthcare & nutraceuticals, rising demand for natural antioxidants, growing cosmetic & personal care markets, and government initiatives to support the aquaculture industry.

In 2023, the Nutraceuticals Segment is Expected to Dominate the Haematococcus Pluvialis Market

Based on application, the haematococcus pluvialis market is segmented into nutraceuticals, aquaculture and animal feed, cosmetics, food and beverages, and pharmaceuticals. In 2023, the nutraceuticals segment is expected to account for the largest share of the global haematococcus pluvialis market. The large market share of this segment is mainly attributed to the growth of this segment are the growing end-use applications of astaxanthin ingredients, rising awareness about preventive healthcare & nutraceuticals, rising demand for natural antioxidants, growing cosmetic & personal care markets, and government initiatives to support the aquaculture industry.

However, the food & beverages segment is projected to register the highest CAGR during the forecast period of 2023–2030. The growth of this segment is attributed to the rising health awareness & food consciousness, growing demand for organic foods, rising use of natural food colors over synthetic, and increasing consumption of antioxidants in food & supplements.

North America Dominates the Overall Haematococcus Pluvialis Market, While Asia-Pacific Leads in Growth

Based on geography, the global haematococcus pluvialis market is majorly segmented into five regions, North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, North America is expected to account for the largest share of the global haematococcus pluvialis market, followed by Asia-Pacific and Europe. The large share of this market is primarily attributed to the increasing demand for natural food supplements and growing awareness about the adverse effects of chemical products among consumers. In addition, several awareness programs by various organizations are estimated to upsurge the regional market share. For instance, the Natural Algae Astaxanthin Association (NAXA) is focused on increasing awareness about astaxanthin usage. Further, haematococcus pluvialis algae have been approved for use as a dietary supplement ingredient in the U.S., and Canada is one of the major factors contributing to the growth of haematococcus pluvialis in North America.

However, Asia-Pacific is expected to witness significant growth during the forecast period, mainly due to increasing health consciousness and growing adoption of haematococcus pluvialis-derived products in the growing nutraceutical, personal care products, and F&B industries. Furthermore, the high investments in algae production offer significant opportunities for various stakeholders in the Asia-Pacific region.

Key Players

The report offers a competitive analysis based on an extensive assessment of the product portfolio offerings, geographic presences, and key strategic developments adopted by leading market players in this market in the last three to four years. The key players profiled in the haematococcus pluvialis market research report are E.I.D. - Parry (India) Limited (A Subsidiary of M/S. Ambadi Investments Limited) (India), Cyanotech Corporation (U.S.), YUNNAN GREEN A BIOLOGICAL PROJECT CO., LTD. (Yunnan Spirin Biotechnology Co. Ltd) (China), Sun Chlorella Corporation (Japan), Roquette Klötze GmbH & Co. KG (Germany), Tianjin Norland Biotech Co., Ltd (China), Aliga Microalgae (Denmark), DAESANG Corporation (Korea), Plankton Australia Pty Limited (Australia), Shaanxi Rebecca Bio-Tech Co., Ltd (China), BlueBioTech Group (Germany), Algatechnologies Ltd. (A Part of Solabia Group) (Israel), AstaReal Group (Japan), Yunnan Alphy Biotech Co.,Ltd (China), Beijing Gingko Group (BGG) (U.S.), FENCHEM (China), PIVEG, Inc. (U.S.), Algamo s.r.o. (Czech Republic), Algalíf Iceland ehf. (Part of Sana Pharma Industries) (Iceland), Atacama Bio Natural Products S.A. (Chile), BDI BioLife Science GmbH (Austria), AstaMAZ NZ LTD (New Zealand), FjordAlg AS (Norway), Sea & Sun Organic GmbH (Subsidiary of Sea & Sun Technology GmbH) (Germany), MC Biotech Sdn. Bhd. (Brunei Darussalam), Pond Technologies Inc. (Canada), Algicel, Biotecnologia e Investigação, Lda (Portugal), Algae to Omega, LLC (U.S.), Shaivaa Algaetech LLP (India), and Astaxa GmbH (Germany).

Scope of the Report:

Haematococcus Pluvialis Market, by Product

- Astaxanthin Ingredients

- Astaxanthin Oleoresin

- Beadlets

- Whole Biomass Powder

- Water Dispersible Powder

- Astaxanthin Bulk Finished Products

- Capsules/Softgels

- Tablets

Haematococcus Pluvialis Market, by Application

- Nutraceutical

- Aquaculture and Animal Feed

- Cosmetics

- Food & Beverages

- Pharmaceuticals

Haematococcus Pluvialis Market, by Geography

- North America

- Europe

- Germany

- U.K.

- Italy

- France

- Sweden

- Spain

- Russia

- Netherlands

- Denmark

- Poland

- Rest of Europe (RoE)

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Vietnam

- Rest of Asia-Pacific (RoAPAC)

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America (RoLATAM)

- Middle East and Africa

- Israel

- Egypt

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Questions Answered in the Report :