Resources

About Us

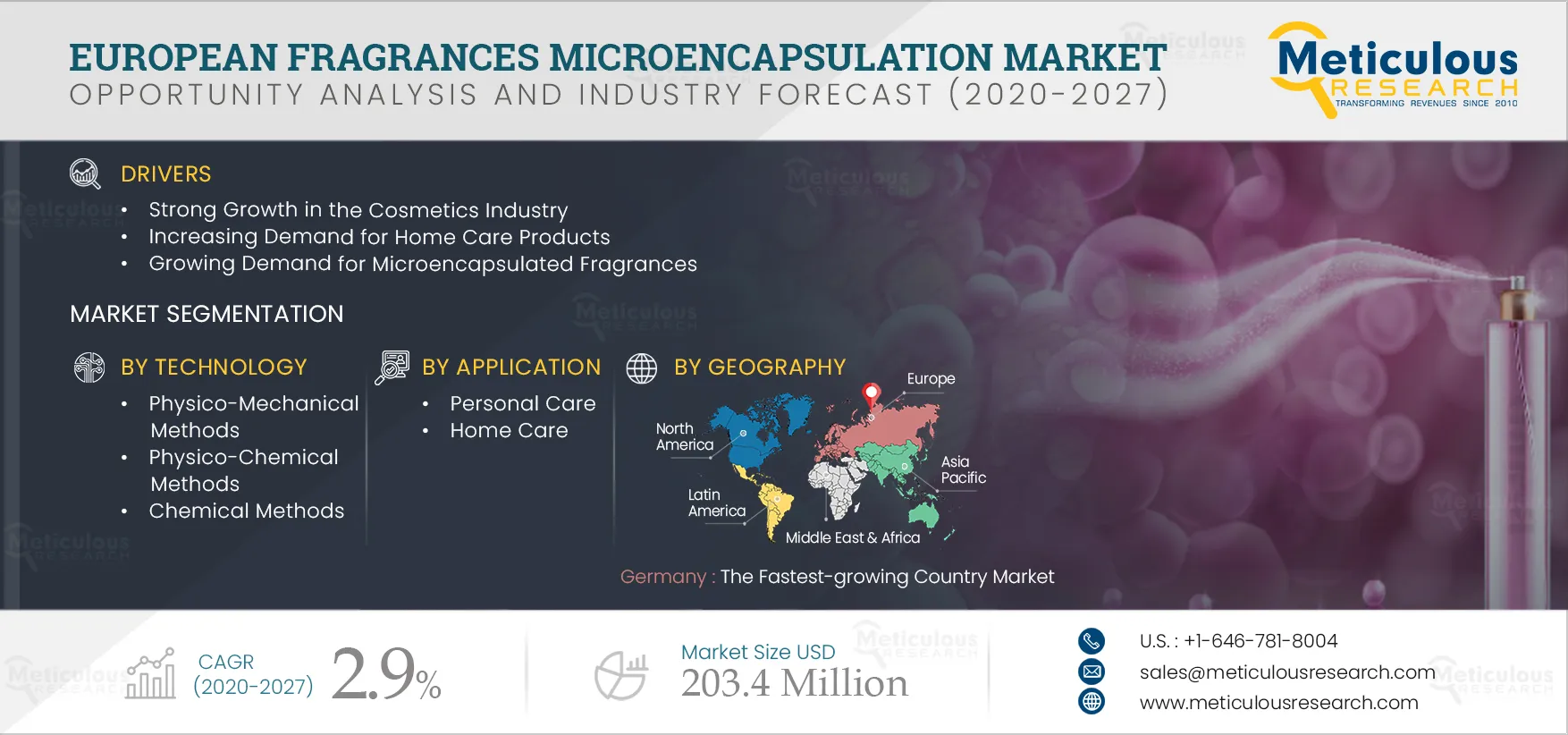

European Fragrances Microencapsulation Market for Home and Personal Care Products by Technology/Method [Physico-Mechanical (Spray Drying, Coextrusion); Physico-Chemical; Chemical] Application (Home care and Personal Care); and Geography -Forecast to 2027

Report ID: MRCHM - 104448 Pages: 137 Dec-2020 Formats*: PDF Category: Chemicals and Materials Delivery: 2 to 4 Hours Download Free Sample ReportThe European Fragrances Microencapsulation Market for Home and Personal Care Products is Expected to Grow at a CAGR of 2.9% From 2020 to 2027 to Reach $203.4 Million by 2027. The European fragrances microencapsulation market for home and personal care products is mainly driven by factors, such as strong growth in the cosmetic industry, increasing demand for home care products, growing demand for microencapsulated fragrances due to their wide applications across the home care and personal care industries, and rising R&D investment for improving process efficiency. However, the high production costs of some microencapsulation processes and stringent regulatory requirements are factors expected to restrain the future growth of this market marginally.

The outbreak of COVID-19 has had a significant impact not only on public health but also on various industries' supply chains. Home care and personal care are a few of such industries, where manufacturers are facing disruptions in raw material supply as a consequence of the coronavirus pandemic. With nationwide lockdowns, international travel bans, and shuttered retail businesses, consumer behaviors have changed drastically across the beauty and personal care space, leading to diminished sales in many beauty segments. Also, imports and exports in many countries have either been restricted or delayed since the outbreak, creating hurdles for home care and personal care product suppliers. According to the Kantar World Panel`s most recent purchase panel data for the four weeks ending April 19, 2020, personal care products had dropped down in the U.K.’s priority list. For example, sales of toiletries decreased by 7.8% in volume as compared to the previous year. However, the impact on some home care products like surface disinfectants and hand sanitizers was completely inverse with a significant surge in demand during 2020.

Click here to: Get a Free Request Sample Copy of this report

The health officials haven`t determined the exact cause of COVID-19, which has infected more than 4,799,988 people and killed 200, 587 as of 18 October 2020 across EU/EEA and the U.K., according to the European Centre for Disease Prevention and Control (ECDC). The COVID-19 outbreak has positively impacted the microencapsulation market majorly in terms of home care products. The demand for these products is expected to increase due to the boosted preventive measures and rising health concerns among the consumers. Higher hygiene standards have led to the stockpiling of home disinfection and cleaning products, which has fueled both value and volume sales of these categories.

People across the European countries have become more conscious regarding home and personal cleanliness during the pandemic, increasing the demand for home care and laundry products. The COVID-19 outbreak highlights the need to prevent the virus's spread by decreasing the risk of contamination. Disinfectants and other home cleaning products play a key role in doing so. The cleaning and disinfection of homes and clothes have gained priority as people look to protect themselves and their families. People have more than doubled the frequency of cleaning their homes and changing the way they wash their clothes. The demand for fragrance microencapsulation in the manufacture of home care products has increased with the increasing demand for home care products. Some of the related examples of the impact on sales, product prices, and production in this category are as follows:

The COVID-19 pandemic has compelled consumers to clean their surroundings more frequently, while shelter-in-place orders have increased their exposure to home cleaning products. As a result, consumers are increasingly demanding products that use natural ingredients.

Millions of microcapsules are manufactured for homecare, laundry, skincare, and cosmetic products every year. Barely visible to the naked eye, suspended in liquids and lotions, these hidden microplastics preserve and release active ingredients, such as droplets of perfume in fabric softeners and detergents.

Thus, strong demand for home care products due to COVID-19 will support the growth of the fragrance microencapsulation market for home care products, as many millions of tonnes of microcapsules are manufactured and added to homecare and laundry products to preserve and release active ingredients, such as fragrances

Microencapsulation plays a vital role in the cosmetics industry. This technology protects active ingredients, masks unpleasant odors, and enables controlled release, making it a critical facilitator of the formulation, storage, and application of cosmetic products. Nowadays, consumers worldwide are increasingly focused on health and beauty. The renewed consumer interest in cosmetics with long-lasting fragrances and the demand for various innovative & exotic fragrances that can provide longer freshness and soothing effect is expected to increase the demand for innovative encapsulated fragrances in the cosmetics industry. The European cosmetic industry was valued at €79.8 billion in 2019. The cosmetics industry's growth is mainly attributed to the rising disposable income levels, changing lifestyles, rising demand for skin and sun care products, the continuous increase in online spending on beauty products, the expansion of social networks, and rising consumer interest in premium products.

Moreover, the cosmetics industry's progress is impacted by a wide range of factors, including climate change, pollution, skin diseases, and aging populations. Nowadays, consumers are more concerned regarding their skin appearance and health. Hence, new cosmetic ingredients need to be optimized to their maximum potential. Encapsulation technology helps control and improve the delivery of cosmetic ingredients to increase their effects on human skin. Microencapsulation shields the surrounding environment's fragrances and provides effective protection against any degrading factors, light or heat radiation, chemical aggression, or incompatibility with other products.

Thus, strong growth in the cosmetic industry will increase the fragrance microencapsulation's adoption for cosmetics products.

Key Findings in the European Fragrances Microencapsulation Market for Home and Personal Care Products:

The Physico-Mechanical Methods Segment Dominates the European Fragrances Microencapsulation Market for Home and Personal Care Products

The physico-mechanical methods segment is estimated to generate the largest proportion of revenue of the European fragrances microencapsulation market for home and personal care products in 2020. Key factors contributing to this segment’s major share include the wide range of benefits offered by these technologies, including high production capacity, high recovery efficiency, cost-effectiveness, and simplicity of the process with safety. The spray drying segment is estimated to account for the largest share of the European physico-mechanical method of microencapsulation market for home and personal care products in 2020. The spray drying method is largely used in the microencapsulation of fragrances used in home and personal care products mainly due to the rapid processing at low cost, a wide choice of coating material, good encapsulation efficiency, and stability of the finished product, and the possibility of large-scale production in the continuous mode.

Personal Care Application to Witness the Highest Demand through 2027

The personal care application segment is estimated to command the largest share of the European fragrances microencapsulation market for home and personal care products in 2020. This application segment is also poised to register the fastest growth during the forecast period due to the changing lifestyles & consumer trends, burgeoning population, and rising consumer expenditure on personal care & cosmetic products.

Germany: The Fastest-Growing Country Market

Germany is estimated to command the largest share of the European fragrances microencapsulation market for home and personal care products in 2020, followed by France and the U.K. Germany’s large market share is majorly attributed to the increasing innovation in its personal care and cosmetics industry and strong growth in the home & personal care industry.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments by leading market participants in the industry over the past four years (2017-2020). Some of the key players operating in the European fragrances microencapsulation market for home and personal care products are Givaudan S.A. (Switzerland), International Flavors & Fragrances, Inc.(U.S.), Calyxia S.A.(France), Follmann GmbH & Co. KG (Germany), Firmenich Incorporated (Switzerland), Symrise AG (Germany), Ingredion Incorporated (U.S.), MikroCaps d.o.o (Slovenia), Koehler Innovative Solutions (Germany), Ashland Global Holdings Inc. (U.S.), Robertet Group (France), Vantage Specialty Chemicals (U.S.), Euracli (France), Capsulæ SAS (France), Robert Blondel Cosmetiques (France), Lambson Ltd. (U.K.), and Micropore Technologies Limited (U.K.), among others.

Scope of the Report:

European Fragrances Microencapsulation Market for Home and Personal Care Products, by Technology/Method

European Fragrances Microencapsulation Market for Home and Personal Care Products, by Application

European Fragrances Microencapsulation Market for Home and Personal Care Products, by Geography

Key questions answered in the report:

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates