Resources

About Us

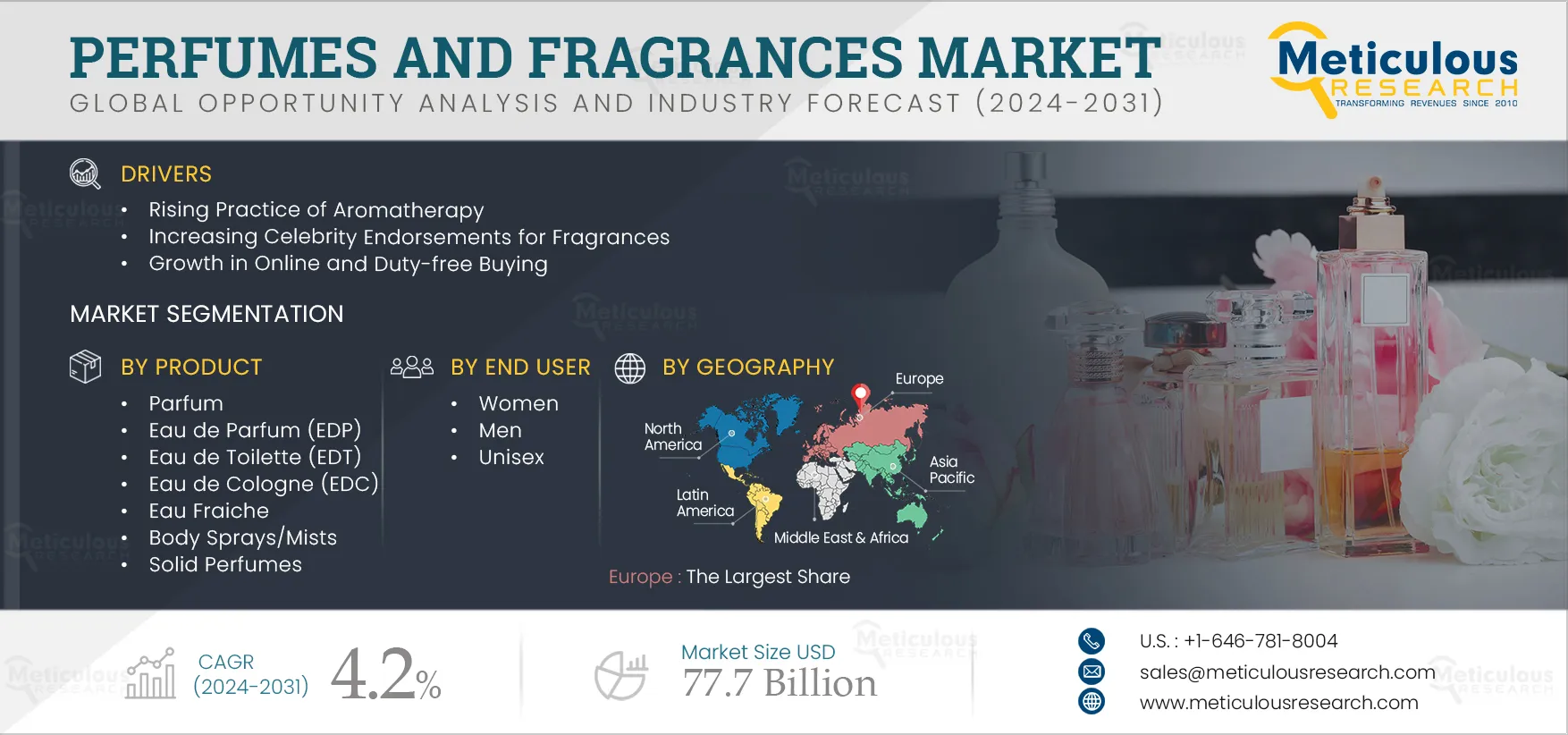

Perfumes and Fragrances Market Size, Share, Forecast, & Trends Analysis by Category (Luxury, Non-luxury), Product (Parfum, Eau de Parfum, Eau de Toilette, Eau de Cologne, Fraiche), Ingredient Type, Distribution Channel, End User - Global Forecast to 2032

Report ID: MRCHM - 1041131 Pages: 210 Sep-2024 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportThe Perfumes and Fragrances Market is expected to reach $77.7 billion by 2032, at a CAGR of 4.2% from 2025 to 2032. The growth of this market is driven by the rising practice of aromatherapy, increasing celebrity endorsements for fragrances, and growth in online and duty-free buying. However, issues related to allergic reactions from fragrance ingredients may restrain the growth of this market. Additionally, the high demand for perfumes with natural ingredients and the rising demand for gender-neutral fragrances are expected to create market growth opportunities. However, counterfeit fragrances are a major challenge for the players operating in this market.

Additionally, consumer demand for customizable fragrance experiences and advancements in fragrance creation techniques and ingredients are key trends in the perfumes and fragrances market.

Aromatherapy is the use of essential oils for their therapeutic benefits. It has been used for centuries as a holistic healing practice to promote physical, mental, and emotional well-being. Aromatherapy has gained widespread popularity due to its numerous therapeutic benefits, including stress relief, mood enhancement, improved sleep quality, and alleviation of various physical ailments. Today, customers are seeking alternatives to conventional treatments and medications, thereby focusing on aromatherapy as a natural and complementary approach to healthcare. Perfumes offer fragrance notes such as lavender (for relaxation), peppermint (for mental clarity), and citrus oils (for mood upliftment). Hence, consumers are seeking perfumes for their aromatherapeutic properties.

Perfume and fragrance companies are responding to this trend by incorporating natural essential oils and marketing their products as wellness-enhancing. In October 2024, ĒLYSCE (U.S.) launched a full line of aromatherapy products with a core mission of promoting the power of natural therapeutics. The products offer a vast selection of aromas that provide emotional relief and aid in improving mental health. The products also support the immune system, provide relief from respiratory discomfort, improve focus and memory, and promote healthy skin. All such factors, along with rising awareness regarding the potential benefits of aromatherapy and the increasing demand for fragrances formulated with essential oils, are supporting the growth of the perfumes and fragrances market.

Online and duty-free buying have emerged as significant sales channels in the perfumes and fragrances market. Duty-free stores are a beneficial aspect of international travel, as they allow consumers to purchase items without paying import, sales, value-added, or other taxes. Duty-free buying involves purchasing products, including fragrances, at airports, border crossings, and other designated duty-free zones with tax-free deals. Online buying refers to the purchase of products through e-commerce platforms and digital channels. According to an article published on china-briefing.com, up to ~70% of Chinese urban consumers have purchased perfumes online, followed by brand counters/specialty stores (52%) and stores specialized in beauty product collections (27%). The growing popularity of e-commerce platforms, the growth in international travel and tourism, and the appeal of duty-free buying and discounted luxury goods, along with the convenience and accessibility of online shopping, are supporting the growth of the perfumes and fragrances market.

Click here to: Get a Free Sample Copy of this report

Customizable fragrances allow individuals to create personalized scent profiles tailored to their unique preferences and tastes. They allow consumers to mix, match, and blend different scent components to create a unique fragrance that reflects their individual style, personality, and mood. This trend is an outcome of consumers’ desire for self-expression and uniqueness, which is driving the demand for perfumes and fragrances. In November 2022, Scent Lab (U.S.) launched shopscentlab.com, an online platform designed to leverage video experiences and Artificial Intelligence (AI) technology to enhance consumer engagement and offer personalized scent curation. Such innovative approaches align with the growing demand for customizable fragrance experiences. The growing influence of niche and indie fragrance brands, advancements in fragrance technology, and the rise of experiential retail concepts that prioritize immersive and interactive shopping experiences are expected to further boost the demand for customizable perfumes and fragrances in the coming years.

Growing consumer preference for natural products is driving the demand for perfumes with natural ingredients such as essential oils, botanicals, fruits, flowers, and spices. Natural fragrances are gaining popularity among consumers as they offer a more authentic sensory experience and are perceived as a safer and more environmentally friendly option compared to synthetic alternatives. Hence, the high demand for perfumes with natural ingredients is creating growth opportunities for market players.

Companies can benefit from this trend by offering a diverse range of natural fragrance options, highlighting the quality and purity of their ingredients, and emphasizing sustainability and ethical sourcing practices. In October 2024, HoMedics® (U.S.) launched the SereneScent™ Waterless Home Fragrance Diffuser and SereneScent™ Fragrance Oils. SereneScent is equipped with the latest diffuser technology that delivers a waterless, mess-free method of providing tailored scents to any space. The SereneScent collection of clean and natural fragrance oils is designed to provide users with an immersive experience and sensorial aromas. Such developments, along with increasing consumer awareness and concerns about synthetic chemicals in fragrances, the rising demand for wellness-oriented and holistic fragrance options, and the influence of natural and organic beauty trends, are expected to create growth opportunities for market players during the forecast period.

Based on category, the perfumes and fragrances market is broadly segmented into luxury and non-luxury. In 2025, the non-luxury segment is expected to account for the larger share of ~72.0% of the perfumes and fragrances market. The large market share of this segment can be attributed to the increasing accessibility of non-luxury fragrances through diverse distribution channels, including drugstores, supermarkets, and online retailers, the increasing demand for non-luxury fragrances that provide premium-inspired experiences at low pricing, and the growing popularity of customizable and personalized fragrances as gifting options.

However, the luxury segment is projected to record the higher growth rate during the forecast period 2025–2032. This growth is driven by the rising demand for premium quality and craftsmanship in fragrance choices, the desire for status symbols from renowned brands, and rising disposable incomes in emerging markets. Furthermore, endorsements and collaborations with celebrities and influencers are also increasing the demand for luxury fragrances.

Based on product, the perfumes and fragrances market is broadly segmented into Parfum, Eau de Parfum (EDP), Eau de Toilette (EDT), Eau de Cologne (EDC), Eau Fraiche, body sprays/mists, and solid perfumes. In 2025, the parfum segment is expected to account for the largest share of ~34.0% of the perfumes and fragrances market. The segment’s large market share can be attributed to the growing need for long-lasting scents with a high concentration of fragrance oils, the increasing emphasis on luxury & prestige brands, and the growing preference for fragrances with intense projection & lasting impression. Furthermore, limited edition releases, artisanal craftsmanship, and niche fragrance companies offering rare and distinctive scents are also driving the demand for Parfum products.

However, the solid perfumes segment is projected to witness the highest growth rate during the forecast period 2025–2032. This growth is driven by the increasing need for portable fragrance options that can be easily carried in purses, pockets, or travel bags, the trend toward minimalism and multifunctional beauty products, and the need for long-lasting and intense fragrances that can provide extended wear time and fragrance longevity throughout the day.

Based on ingredient type, the perfumes and fragrances market is broadly segmented into synthetic, natural, combination, and other ingredient types. In 2025, the synthetic segment is expected to account for the largest share of the perfumes and fragrances market. The large market share of this segment can be attributed to the increasing demand for synthetic fragrance ingredients known for their uniformity and reliability in fragrance formulations, the increasing need to reduce reliance on endangered or overharvested botanicals used as natural ingredients in perfumes, the growing demand for cost-effective alternatives to perfumes with natural ingredients, the increasing need for precise control over scent characteristics, and the growing demand for synthetic fragrance ingredients that offer hypoallergenic and non-irritating formulations.

However, the natural segment is projected to witness the highest growth rate during the forecast period 2025–2032. This growth is driven by the increasing need for natural fragrance ingredients with therapeutic properties including aromatherapy benefits, stress relief, and skin nourishment, and the increasing preference for non-allergenic and skin-safe formulations commonly associated with synthetic fragrances.

Based on distribution channel, the perfumes and fragrances market is broadly segmented into online channels and offline channels. In 2025, the offline channels segment is expected to account for the larger share of ~75.0% of the perfumes and fragrances market. The large market share of this segment can be attributed to consumers’ preference to test fragrance samples and experience scent profiles and textures in person, the availability of personalized assistance and expert guidance when selecting fragrances, and the growing trend of try-before-you-buy policies that allow customers to sample fragrances, test wearability, and assess compatibility.

However, the online channels segment is projected to witness the higher growth rate during the forecast period 2025–2032. This growth is driven by the increasing digitization of retail, the growing demand for online channels that offer 24/7 access to a diverse range of fragrance brands, and consumers’ growing preference for competitive pricing and discounts offered by online channels, including exclusive online-only offers, such as flash sales, and limited-time promotions.

Based on end user, the perfumes and fragrances market is broadly segmented into women, men, and unisex. In 2025, the women segment is expected to account for the largest share of ~62.0% of the perfumes and fragrances market. The large market share of this segment can be attributed to the increasing demand for diverse scent options, including feminine and floral fragrances, the growing female workforce across the globe, and women’s desire for self-expression and confidence enhancement.

However, the men segment is projected to witness the highest growth rate during the forecast period 2025–2032. This growth is driven by the growing demand for signature scent options with distinctive and sporty scent profiles, the increasing demand for fragrances with woody and spicy notes, and men’s growing focus on grooming and self-care.

Based on geography, the perfumes and fragrances market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Europe is expected to account for the largest share of ~35.0% of the perfumes and fragrances market, followed by Asia-Pacific, North America, the Middle East & Africa, and Latin America. Europe’s significant market share can be attributed to several key factors, including the increasing demand for high-end perfume brands and prestige fragrances, the growing demand for fragrances made from natural and ethically sourced ingredients, rising interest in wellness, personal grooming and aromatherapy, and growth in online fragrance retailers, virtual fragrance consultations, and digital fragrance discovery platforms.

Furthermore, Asia-Pacific is slated to register the highest growth rate of ~5.5% during the forecast period. The growth of this regional market is driven by rapid urbanization and rising disposable incomes in countries such as China and India, growing adoption of Western lifestyles and fashion trends, rapid growth in e-commerce platforms and digital channels, the growing cultural significance of fragrances in ceremonies, rituals, and traditional practices, and growth in duty-free shopping outlets located at airports and tourist hubs.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the perfumes and fragrances market are LVMH Moët Hennessy - Louis Vuitton (France), Chanel (U.K.), L’OREAL S.A. (France), Guccio Gucci S.p.A (Italy), Coty Inc. (U.S.), Avon (U.S.), The Estée Lauder Companies Inc. (U.S.), Giorgio Armani S.p.A. (Italy), Burberry Group PLC (U.K.), PVH Corp. (U.S.), Dolce & Gabbana S.r.l. (Italy), Clarins Pte Ltd (France), Raer Scents (Germany), Firmenich SA (Switzerland), Elizabeth Arden Inc. (Switzerland), Givaudan (Switzerland), and Perf Opco, LLC. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

210 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

4.2% |

|

Market Size (Value) |

USD 77.7 Billion by 2032 |

|

Segments Covered |

By Category

By Product

By Ingredient Type

By Distribution Channel

By End User

|

|

Countries Covered |

Europe (France, Germany, U.K., Italy, Spain, Russia, Netherlands, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Thailand, Singapore, and Rest of Asia-Pacific), North America (U.S., Canada), Latin America (Brazil, Argentina, Mexico, and Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of the Middle East & Africa) |

|

Key Companies Profiled |

LVMH Moët Hennessy - Louis Vuitton (France), Chanel (U.K.), L’OREAL S.A. (France), Guccio Gucci S.p.A (Italy), Coty Inc. (U.S.), Avon (U.S.), The Estée Lauder Companies Inc. (U.S.), Giorgio Armani S.p.A. (Italy), Burberry Group PLC (U.K.), PVH Corp. (U.S.), Dolce & Gabbana S.r.l. (Italy), Clarins Pte Ltd (France), Raer Scents (Germany), Firmenich SA (Switzerland), Elizabeth Arden Inc. (Switzerland), Givaudan (Switzerland), and Perf Opco, LLC. (U.S.) |

Key questions answered in the perfumes and fragrances market report:

The perfumes and fragrances market study focuses on market assessment and opportunity analysis based on the sales of perfumes and fragrances across different regions, countries, and market segments. The study also provides a competitive analysis for perfumes and fragrances based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years.

The perfumes and fragrances market is projected to reach $77.7 billion by 2032, at a CAGR of 4.2% during the forecast period.

Based on product, in 2025, the parfum segment is expected to account for the largest share of ~34.0% of the perfumes and fragrances market.

The men segment is projected to witness the highest growth rate during the forecast period 2025–2032. This growth is driven by the rising demand for signature fragrance options with distinctive and sporty scent profiles, the increasing demand for fragrances with woody and spicy notes, and men’s growing focus on grooming and self-care.

Factors such as the rising practice of aromatherapy, increasing celebrity endorsements for fragrances, and growth in online and duty-free buying are driving the growth of this market. Additionally, the high demand for perfumes with natural ingredients and the rising demand for gender-neutral fragrances are expected to create growth opportunities for the players in this market.

The key players operating in the perfumes and fragrances market are TE LVMH Moët Hennessy - Louis Vuitton (France), Chanel (U.K.), L’OREAL S.A. (France), Guccio Gucci S.p.A (Italy), Coty Inc. (U.S.), Avon (U.S.), The Estée Lauder Companies Inc. (U.S.), Giorgio Armani S.p.A. (Italy), Burberry Group PLC (U.K.), PVH Corp. (U.S.), Dolce & Gabbana S.r.l. (Italy), Clarins Pte Ltd (France), Raer Scents (Germany), Firmenich SA (Switzerland), Elizabeth Arden Inc. (Switzerland), Givaudan (Switzerland), and Perf Opco, LLC. (U.S.).

Asia-Pacific is expected to offer significant growth opportunities for the vendors operating in the perfumes and fragrances market during the analysis period. Countries such as China, Japan, India, South Korea, Thailand, and Singapore boast large consumer bases, rising disposable incomes, increasing urbanization, and a growing interest in luxury goods and personal grooming.

Key market players are focused on product launches & product enhancements to strengthen their product portfolios and enhance their geographic reach in the perfumes and fragrances market.

Published Date: May-2024

Published Date: May-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates