Resources

About Us

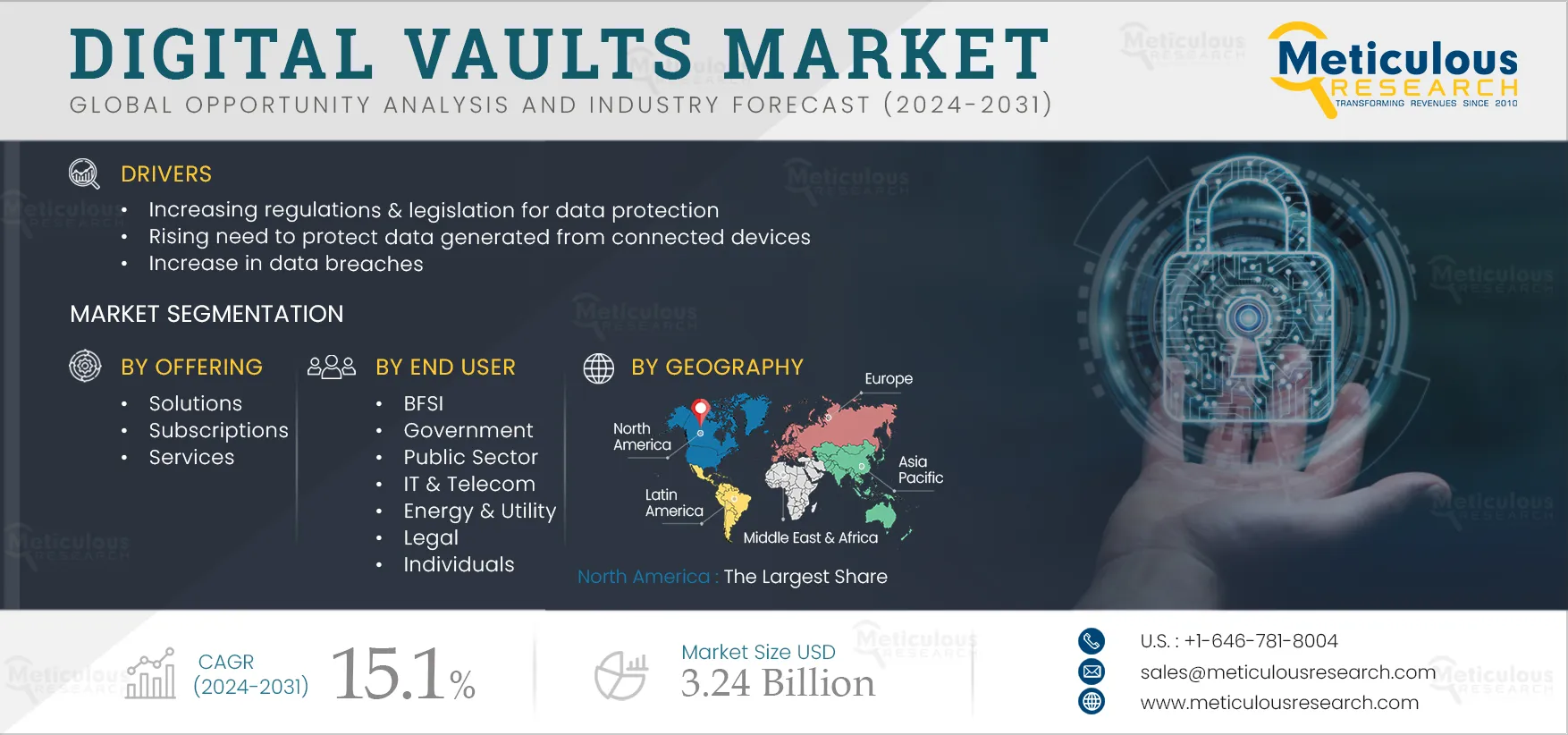

Digital Vaults Market Size, Share, Forecast, & Trends Analysis by Offering (Solutions, Services, Subscriptions), Deployment (Cloud, On-premise), End User (BFSI, Government, IT & Telecom, Aerospace & Defense, Energy & Utility, Legal, Individuals, Others), and Geography - Global Forecast to 2031

Report ID: MRICT - 104936 Pages: 170 Jul-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 48 Hours Download Free Sample ReportThe Digital Vaults Market is expected to reach $3.24 billion by 2031, at a CAGR of 15.1% from 2024 to 2031.The growth of the digital vaults market is driven by the increasing regulations & legislation for data protection, the rising need to protect data generated from connected devices, and the increase in data breaches. However, enterprises’ lack of awareness about data security restrains the growth of this market.

Moreover, the growing digitalization of businesses and the increasing use of digital vaults in the BFSI sector are expected to generate growth opportunities for the stakeholders in this market. However, the lack of digitalization in developing countries, the high costs of digital vaults, and the availability of alternative cybersecurity solutions are major challenges for market growth. Additionally, the growing adoption of cloud-based security solutions is a prominent trend in the digital vaults market.

Governments and organizations are gradually recognizing the significance of data privacy & security as social and commercial interactions are increasingly moving to online environments. The unethical practice of collecting, utilizing, and disclosing customers’ personal data to third parties without their knowledge or consent has raised data security & privacy concerns, driving the establishment of various regulations and legislation for data protection. According to the United Nations Conference on Trade and Development, out of 194 countries, 71% (137) have established data protection legislation, while 9% have draft legislation, 15% have no legislation, and 5% even lack the data to support data protection & privacy legislation. These numbers indicate countries’ high focus on implementing data privacy & security regulations.

Businesses are partnering with digital vault solution providers to secure customer data; for instance, in April 2021, Bailard, Inc. (U.S.), an independent wealth and investment management firm, partnered with FutureVault Inc. (U.S.), an industry leader in enterprise digital vault solutions, to deploy Bailard Vault. The solution provides crucial information faster and in a secure environment.

Governments’ increased focus on data protection drives the adoption of data protection & privacy solutions such as digital vaults. Organizations that do not comply with these regulations face penalties. Hence, enterprises are increasingly adopting data privacy & security solutions such as digital vaults to avoid heavy fines.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

Data breaches are becoming increasingly frequent and sophisticated. In 2022, over 392 million individuals worldwide were affected by 1,774 organizational data breaches. These data breaches compromised the information of individuals accessing financial, healthcare, and social services.

In 2020, the economic cost of information & technology asset security breaches accounted for 4-6% of the world’s GDP. In 2022, organizations had to incur USD 4.35 million in data breach costs on average globally. Also, the average cost of a data breach in the U.S. was USD 9.44 million, more than twice the global average. Approximately 82% of breaches were targeted at data stored on clouds. Organizations are seeking solutions that can provide visibility across hybrid environments and protect their data as it moves across clouds, databases, apps, and services. Thus, increasing data breaches are boosting the demand for digital vault solutions, driving the growth of this market.

The data generated across industries is growing rapidly, with database administrators facing scalability and security challenges. Many organizations experience security breaches despite safeguards and precautions. Also, human error has frequently been a major factor in enterprise data breaches. According to Verizon’s 2022 Data Breach Investigations Report, over 80% of breaches during the year involved human error and misuse of stolen credentials.

According to IBM’s Cost of a Data Breach Report 2021, companies took an average of 212 days to identify a breach, mainly due to a lack of expertise and knowledge about cybersecurity. Moreover, as opposed to large organizations, small & mid-sized enterprises lack the awareness required to evaluate their cyber-risk exposure and implement proper preventative and corrective measures. These enterprises’ lack of awareness about cybersecurity (including data security) limits the adoption of digital vault solutions, restraining the growth of this market.

Companies are under constant pressure to adapt and evolve to keep pace with technological advances and changing workplace cultures and customer demands. Hence, most enterprises are focused on their digital transformation to move workloads from on-premise to cloud infrastructure for better business scalability and agility. Advanced technologies, such as AI, big data, and IoT, are becoming increasingly essential for businesses. With the proliferation of smart devices, cloud infrastructure, and data structures are becoming increasingly complicated.

Furthermore, according to Microsoft Corporation (U.S.), 59% of SMBs using cloud services reported experiencing significant productivity benefits from IT compared to just 30% of SMBs not using the cloud. Also, 82% of SMBs reported reduced costs due to adopting cloud technology, and 70% reported reinvesting the saved money back into their business. However, the implementation of advanced technologies is increasing organizations’ vulnerability to cyberattacks. Cybercrimes result in businesses losing millions of dollars due to ransomware attacks or security breaches, creating opportunities for digital vault solution providers to expand their offerings and increase their market shares.

Based on offering, the digital vaults market is segmented into solutions, services, and subscriptions. In 2024, the solutions segment is expected to account for the largest share of above 52.0% of the digital vaults market. The large market share of this segment is attributed to the ability of solutions to safely store and organize documents containing sensitive client and company information; benefits to individuals and organizations such as access management; ensuring compliances; and growing security spending of organizations to store confidential data securely.

Moreover, the solutions segment is also expected to record the highest CAGR during the forecast period. The growth of this segment is driven by the rising focus of key players on product development and the growing security concern of organizations to store data. For instance, in January 2021, Digital Vault Services GmbH (Germany), a SaaS company, launched its solution for digital guarantees, Guarantee Vault. Guarantee Vault is a central register for issuing and safeguarding digital guarantees.

Based on deployment mode, the digital vaults market is segmented into cloud-based deployments and on-premise deployments. In 2024, the cloud-based deployments segment is expected to account for the larger share of above 80.0% of the digital vaults market. The large market share of this segment is attributed to the increasing avenues for cloud-based deployments, the superior flexibility and affordability offered by cloud-based deployments, and the increasing adoption of cloud-based solutions by small & medium-sized enterprises.

Moreover, the cloud-based deployments segment is also expected to record the highest CAGR during the forecast period. The rapid evolution of new security avenues for cloud-based deployments is expected to drive the growth of the cloud-based deployments segment in the coming years. For instance, in October 2022, the Dubai International Financial Centre (DIFC) Courts (UAE) launched a global digital vault, ‘tejouri’. Tejouri provides a unique platform that functions simultaneously as a cloud vault and an online safe for data.

Based on end user, the digital vaults market is segmented into BFSI, government, public sector, IT & telecom, aerospace & defense, energy & utility, healthcare & pharmaceuticals, legal, individuals, and other end users. In 2024, the IT & telecom segment is expected to account for the largest share of above 25.0% of the digital vaults market. The large market share of this segment is attributed to the rapid adoption of digital technologies, the rise in data breaches and cyber-attacks, and the strong focus of stakeholders to deploy digital vault services. Stakeholders are focusing on data security in the IT & Telecom sector to provide seamless customer services. For instance, in April 2023, the Telecommunications and Digital Government Regulatory Authority (TDRA) introduced the Digital Vault Project for the banking, insurance, and telecommunication sectors.

However, the BFSI segment is expected to record the highest CAGR during the forecast period. The growth of this segment is driven by factors such as the rising focus of key players on product development, growing security concerns in financial organizations, and rising digitization in the financial sector. For instance, in April 2021, Skyflow Inc. (U.S.), a vault provider, launched Payments Data Privacy Vault, the zero-trust data vault in the industry for handling sensitive payments and personal information securely.

In 2024, North America is expected to account for the largest share of 30.0% of the digital vaults market. The large market share of this segment is attributed to organizations' strong focus on cybersecurity, the presence of big tech companies, their strong emphasis on safeguarding valuable data, and increased data breach attacks. The top tech companies provide digital vault solutions to various industries to store valuable information securely. The presence of leading key players in the region contributes to a large market share.

However, the Asia-Pacific is expected to record the highest CAGR of 15.8% during the forecast period. Ongoing digital transformation in the banking and financial sector, increasing fintech businesses, and increased cyberattacks in the Asia-Pacific region are factors expected to drive the growth of the digital vaults market in the coming years. Countries in the Asia-Pacific region are working to strengthen their cybersecurity capabilities through increased investment, education, and international cooperation, contributing to market growth.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the digital vaults market are Microsoft Corporation (U.S.), IBM Corporation (U.S.), Oracle Corporation (U.S.), Fiserv, Inc. (U.S.), Google LLC (U.S.), Veritas Technologies LLC (U.S.), HashiCorp, Inc. (U.S.), Hitachi Vantara LLC (U.S.), Morgan Stanley (U.S.), CyberArk Software Ltd. (U.S.), FutureVault Inc. (U.S.), Johnson Controls International plc (Ireland), OPSWAT, Inc. (U.S.), Zoho Corporation Pvt. Ltd. (U.S.), Keeper Security, Inc. (U.S.), Safe4 Information Management Limited (U.K.), Virtual StrongBox, Inc. (U.S.), Hypervault (Belgium), ENC Security (U.S.), and Clocr Inc (U.S.).

In June 2023, Google LLC (U.S.) added new capabilities to Vault solutions. These features support custom and default file-level retention rules based on Google Drive labels.

In March 2023, IBM Corporation (U.S.) collaborated with Cohesity, Inc. (U.S.), a leading data security & data management platform provider, on IBM Storage Defender, a solution that increases data security and resiliency in hybrid cloud environments. IBM Storage Defender features a cyber vault and clean room features with automated recovery functions to restore business-critical data in hours or minutes from what used to take days.

|

Particulars |

Details |

|

Number of Pages |

170 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

15.1% |

|

Market Size (Value) |

USD 3.24 Billion by 2031 |

|

Segments Covered |

By Offering

By Deployment Mode

By End User

|

|

Countries Covered |

Europe (U.K., Germany, France, Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific), North America (U.S., Canada), Latin America and the Middle East & Africa |

|

Key Companies |

Microsoft Corporation (U.S.), IBM Corporation (U.S.), Oracle Corporation (U.S.), Fiserv, Inc. (U.S.), Google LLC (U.S.), Veritas Technologies LLC (U.S.), HashiCorp, Inc. (U.S.), Hitachi Vantara LLC (U.S.), Morgan Stanley (U.S.), CyberArk Software Ltd. (U.S.), FutureVault Inc. (U.S.), Johnson Controls International plc (Ireland), OPSWAT, Inc. (U.S.), Zoho Corporation Pvt. Ltd. (U.S.), Keeper Security, Inc. (U.S.), Safe4 Information Management Limited (U.K.), Virtual StrongBox, Inc. (U.S.), Hypervault (Belgium), ENC Security (U.S.), and Clocr Inc (U.S.) |

The digital vaults market study focuses on market assessment and opportunity analysis through the sales of digital vaults solutions, subscriptions, and services across different regions and countries. This study is also focused on competitive analysis for digital vaults based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The Digital Vaults Market is expected to reach $3.24 billion by 2031, at a CAGR of 15.1% from 2024 to 2031.

In 2024, the Solutions segment is expected to hold the larger share of the digital vaults market.

The BFSI segment is expected to register the highest CAGR during the forecast period.

The growth of the digital vaults market is driven by the increasing regulations & legislation for data protection, the rising need to protect data generated from connected devices, and the increase in data breaches. Moreover, the growing digitalization of businesses and the increasing use of digital vaults in the BFSI sector are expected to generate growth opportunities for the stakeholders in this market.

Key players operating in the digital vaults market are Microsoft Corporation (U.S.), IBM Corporation (U.S.), Oracle Corporation (U.S.), Fiserv, Inc. (U.S.), Google LLC (U.S.), Veritas Technologies LLC (U.S.), HashiCorp, Inc. (U.S.), Hitachi Vantara LLC (U.S.), Morgan Stanley (U.S.), CyberArk Software Ltd. (U.S.), FutureVault Inc. (U.S.), Johnson Controls International plc (Ireland), OPSWAT, Inc. (U.S.), Zoho Corporation Pvt. Ltd. (U.S.), Keeper Security, Inc. (U.S.), Safe4 Information Management Limited (U.K.), Virtual StrongBox, Inc. (U.S.), Hypervault (Belgium), ENC Security (U.S.), and Clocr Inc (U.S.).

Asia-Pacific is expected to record a higher CAGR during the forecast period.

Published Date: Aug-2025

Published Date: Jan-2025

Published Date: Apr-2023

Published Date: Nov-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates