1. Market Definition & Scope

1.1 Market Definition

1.2 Market Ecosystem

1.3 Currency and Limitations

1.4 Key Stakeholders

2. Research Methodology

2.1 Research Process

2.2 Data Collection & Validation

2.2.1 Secondary Research

2.2.2 Primary Research

2.3 Market Assessment

2.3.1 Market Size Estimation

2.3.2 Growth Forecast

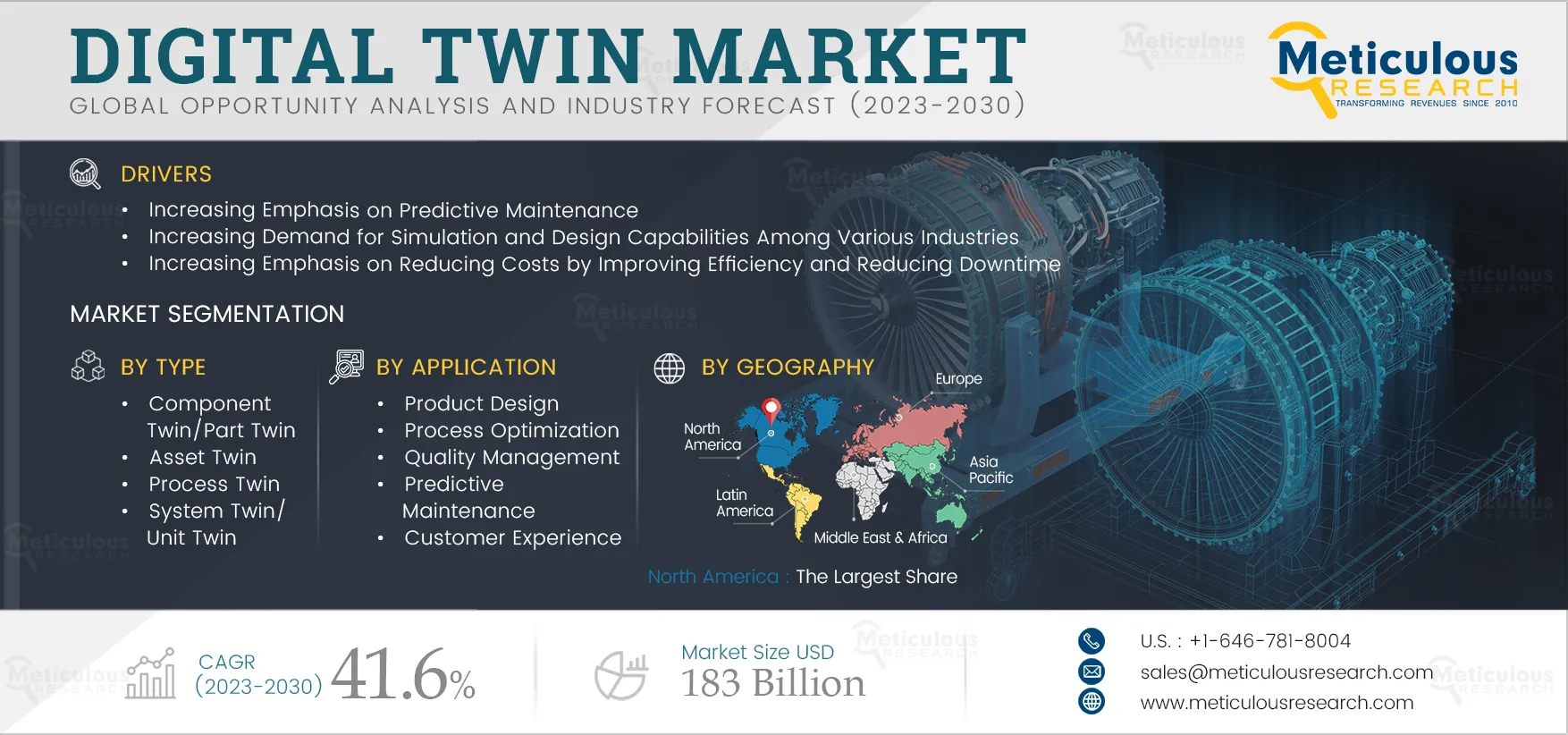

3. Executive Summary

4. Market Insights

4.1 Overview

4.2 Market Dynamics

4.3 Digital Twin Market Drivers: Impact Analysis (2023–2030)

4.3.1 Increasing Emphasis on Predictive Maintenance

4.3.2 Increasing Demand for Simulation and Design Capabilities Among Various Industries

4.3.3 Increasing Emphasis on Reducing Costs by Improving Efficiency and Reducing Downtime

4.4 Digital Twin Market Opportunities: Impact Analysis (2023–2030)

4.4.1 5G Implementation

4.4.2 Increasing Digitization and Automation of Manufacturing Facilities

4.5 Digital Twin Market Challenges: Impact Analysis (2023–2030)

4.5.1 Lack of Data Reliability to Create Digital Twins

4.5.2 Risks Associated with Data Security

4.5.3 Lack of Skilled Employees

4.5.4 Lack of Common Data Analysis and Security Standards

4.6 Digital Twin Market Trends: Impact Analysis (2023–2030)

4.6.1 Integration with Other Technologies

4.7 Case Studies

4.8 Value Chain Analysis

5. Digital Twin Market, by Component

5.1 Overview

5.2 Software

5.3 Services

5.3.1 Professional Services

5.3.2 Managed Services

6. Digital Twin Market, by Type

6.1 Introduction

6.2 Component Twin/Part Twin

6.3 Asset Twin

6.4 Process Twin

6.5 System Twin/Unit Twin

7. Digital Twin Market, by Application

7.1 Overview

7.2 Product Design

7.3 Process Optimization

7.4 Quality Management

7.5 Supply Chain Management

7.6 Predictive Maintenance

7.7 Enterprise Collaboration

7.8 Customer Experience

7.9 Other Applications

8. Digital Twin Market, by Deployment

8.1 Overview

8.2 Platform as a Service (PaaS)

8.3 Software as a Service (SaaS)

9. Digital Twin Market, by End-use Industry

9.1 Overview

9.2 Automotive

9.3 Logistics & Transportation

9.4 Energy & Utilities

9.5 Aerospace & Defense

9.6 Building & Construction

9.7 Healthcare

9.8 Oil & Gas

9.9 Fintech

9.10 Consumer Electronics

9.11 Other Industries

10. Digital Twin Market, by Geography

10.1 Overview

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia

10.4.5 Indonesia

10.4.6 Malaysia

10.4.7 Rest of Asia-Pacific

10.5 Latin America

10.6 Middle East & Africa

11. Competition Analysis

11.1 Overview

11.2 Key Growth Strategies

11.2.1. Market Differentiators

11.2.2. Synergy Analysis: Major Deals & Strategic Alliances

11.3 Competitive Dashboard

11.3.1 Industry Leaders

11.3.2 Market Differentiators

11.3.3 Vanguards

11.3.4 Emerging Companies

11.4 Vendor Market Positioning

11.5 Market Share Analysis (2022)

12. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic Developments)

12.1 General Electric Company (U.S.)

12.2 IBM Corporation (U.S.)

12.3 PTC, Inc. (U.S.)

12.4 Microsoft Corporation (U.S.)

12.5 Siemens AG (Germany)

12.6 Ansys, Inc. (U.S.)

12.7 SAP SE (Germany)

12.8 Oracle Corporation (U.S.)

12.9 Robert Bosch GmbH (Germany)

12.10 Swim. AI (U.S.)

12.11 Rescale, Inc (U.S).

12.12 Dassault Systemes (France)

12.13 ABB Ltd. (U.K.)

12.14 Honeywell International Corporation (U.S.)

12.15 Schneider Electric SE (France)

13. Appendix

13.1 Related Reports

13.2 Available Customizations

List of Tables

Table 1 Global Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 2 Global Digital Twin Software Market Size, by Country/Region, 2021–2030 (USD Million)

Table 3 Global Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 4 Global Digital Twin Services Market Size, by Country/Region, 2021–2030 (USD Million)

Table 5 Global Digital Twin Services Market Size for Professional Services, by Country/Region, 2021–2030 (USD Million)

Table 6 Global Digital Twin Services Market Size for Managed Services, by Country/Region, 2021–2030 (USD Million)

Table 7 Global Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 8 Global Component Twin/Part Twin Market Size, by Country/Region, 2021–2030 (USD Million)

Table 9 Global Asset Twin Market Size, by Country/Region, 2021–2030 (USD Million)

Table 10 Global Process Twin Market Size, by Country/Region, 2021–2030 (USD Million)

Table 11 Global System Twin/Unit Twin Market Size, by Country/Region, 2021–2030 (USD Million)

Table 12 Global Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 13 Global Digital Twin Market Size for Product Design, by Country/Region, 2021–2030 (USD Million)

Table 14 Global Digital Twin Market Size for Process Optimization, by Country/Region, 2021–2030 (USD Million)

Table 15 Global Digital Twin Market Size for Quality Management, by Country/Region, 2021–2030 (USD Million)

Table 16 Global Digital Twin Market Size for Supply Chain Management, by Country/Region, 2021–2030 (USD Million)

Table 17 Global Digital Twin Market Size for Predictive Maintenance, by Country/Region, 2021–2030 (USD Million)

Table 18 Global Digital Twin Market Size for Enterprise Collaboration, by Country/Region, 2021–2030 (USD Million)

Table 19 Global Digital Twin Market Size for Customer Experience, by Country/Region, 2021–2030 (USD Million)

Table 20 Global Digital Twin Market Size for Other Applications, by Country/Region, 2021–2030 (USD Million)

Table 21 Global Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 22 Global Digital Twin Platform as a Service (PaaS) Market Size, by Country/Region, 2021–2030 (USD Million)

Table 23 Global Digital Twin Software as a Service (SaaS) Market Size, by Country/Region, 2021–2030 (USD Million)

Table 24 Global Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 25 Global Digital Twin Market Size for Automotive, by Country/Region, 2021–2030 (USD Million)

Table 26 Global Digital Twin Market Size for Logistics & Transportation, by Country/Region, 2021–2030 (USD Million)

Table 27 Global Digital Twin Market Size for Energy & Utilities, by Country/Region, 2021–2030 (USD Million)

Table 28 Global Digital Twin Market Size for Aerospace & Defense, by Country/Region, 2021–2030 (USD Million)

Table 29 Global Digital Twin Market Size for Building & Construction, by Country/Region, 2021–2030 (USD Million)

Table 30 Global Digital Twin Market Size for Healthcare, by Country/Region, 2021–2030 (USD Million)

Table 31 Global Digital Twin Market Size for Oil & Gas, by Country/Region, 2021–2030 (USD Million)

Table 32 Global Digital Twin Market Size for Fintech, by Country/Region, 2021–2030 (USD Million)

Table 33 Global Digital Twin Market Size for Consumer Electronics, by Country/Region, 2021–2030 (USD Million)

Table 34 Global Digital Twin Market Size for Other End-use Industries, by Country/Region, 2021–2030 (USD Million)

Table 35 North America: Digital Twin Market Size, by Country, 2021–2030 (USD Million)

Table 36 North America: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 37 North America: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 38 North America: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 39 North America: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 40 North America: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 41 North America: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 42 U.S.: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 43 U.S.: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 44 U.S.: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 45 U.S.: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 46 U.S.: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 47 U.S.: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 48 Canada: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 49 Canada: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 50 Canada: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 51 Canada: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 52 Canada: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 53 Canada: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 54 Europe: Digital Twin Market Size, by Country/Region, 2021–2030 (USD Million)

Table 55 Europe: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 56 Europe: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 57 Europe: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 58 Europe: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 59 Europe: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 60 Europe: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 61 U.K.: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 62 U.K.: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 63 U.K.: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 64 U.K.: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 65 U.K.: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 66 U.K.: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 67 Germany: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 68 Germany: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 69 Germany: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 70 Germany: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 71 Germany: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 72 Germany: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 73 France: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 74 France: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 75 France: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 76 France: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 77 France: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 78 France: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 79 Italy: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 80 Italy: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 81 Italy: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 82 Italy: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 83 Italy: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 84 Italy: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 85 Spain: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 86 Spain: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 87 Spain: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 88 Spain: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 89 Spain: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 90 Spain: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 91 Rest of Europe: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 92 Rest of Europe: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 93 Rest of Europe: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 94 Rest of Europe: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 95 Rest of Europe: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 96 Rest of Europe: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 97 Asia-Pacific: Digital Twin Market Size, by Country/Region, 2021–2030 (USD Million)

Table 98 Asia-Pacific: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 99 Asia-Pacific: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 100 Asia-Pacific: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 101 Asia-Pacific: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 102 Asia-Pacific: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 103 Asia-Pacific: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 104 China: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 105 China: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 106 China: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 107 China: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 108 China: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 109 China: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 110 Japan: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 111 Japan: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 112 Japan: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 113 Japan: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 114 Japan: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 115 Japan: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 116 India: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 117 India: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 118 India: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 119 India: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 120 India: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 121 India: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 122 Australia: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 123 Australia: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 124 Australia: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 125 Australia: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 126 Australia: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 127 Australia: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 128 Indonesia: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 129 Indonesia: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 130 Indonesia: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 131 Indonesia: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 132 Indonesia: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 133 Indonesia: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 134 Malaysia: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 135 Malaysia: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 136 Malaysia: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 137 Malaysia: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 138 Malaysia: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 139 Malaysia: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 140 Rest of Asia-Pacific: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 141 Rest of Asia-Pacific: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 142 Rest of Asia-Pacific: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 143 Rest of Asia-Pacific: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 144 Rest of Asia-Pacific: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 145 Rest of Asia-Pacific: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 146 Latin America: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 147 Latin America: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 148 Latin America: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 149 Latin America: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 150 Latin America: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 151 Latin America: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

Table 152 Middle East & Africa: Digital Twin Market Size, by Component, 2021–2030 (USD Million)

Table 153 Middle East & Africa: Digital Twin Services Market Size, by Type, 2021–2030 (USD Million)

Table 154 Middle East & Africa: Digital Twin Market Size, by Type, 2021–2030 (USD Million)

Table 155 Middle East & Africa: Digital Twin Market Size, by Application, 2021–2030 (USD Million)

Table 156 Middle East & Africa: Digital Twin Market Size, by Deployment, 2021–2030 (USD Million)

Table 157 Middle East & Africa: Digital Twin Market Size, by End-use Industry, 2021–2030 (USD Million)

List of Figures

Figure 1 Currency and Limitations

Figure 2 Research Process

Figure 3 Key Secondary Sources

Figure 4 Primary Research Techniques

Figure 5 Key Executives Interviewed

Figure 6 Market Size Estimation

Figure 7 Key Insights

Figure 8 Digital Twin Market, by Component, 2023 Vs. 2030 (USD Million)

Figure 9 Digital Twin Market, by Type, 2023 Vs. 2030 (USD Million)

Figure 10 Digital Twin Market, by Application, 2023 Vs. 2030 (USD Million)

Figure 11 Digital Twin Market, by Deployment, 2023 Vs. 2030 (USD Million)

Figure 12 Digital Twin Market, by End-use Industry, 2023 Vs. 2030 (USD Million)

Figure 13 Digital Twin Market, by Geography, 2023 Vs. 2030 (USD Million)

Figure 14 Geographic Snapshot: Digital Twin Market (Value Share & CAGR)

Figure 15 Porter's Five Forces Analysis

Figure 16 Digital Twin Value Chain

Figure 17 Digital Twin Market, by Component, 2023–2030 (USD Million)

Figure 18 Digital Twin Market, by Type, 2023–2030 (USD Million)

Figure 19 Digital Twin Market, by Application, 2023–2030 (USD Million)

Figure 20 Digital Twin Market, by Deployment, 2023–2030 (USD Million)

Figure 21 Digital Twin Market, by End-use Industry, 2023–2030 (USD Million)

Figure 22 Digital Twin Market, by Geography, 2023–2030 (USD Million)

Figure 23 Key Growth Strategies Adopted by Leading Players, 2020–2023

Figure 24 Market Share Analysis: Digital Twin Market, 2021

Figure 25 Competitive Dashboard: Digital Twin Market

Figure 26 General Electric Company: Financial Overview (2021)

Figure 27 IBM Corporation: Financial Overview (2021)

Figure 28 PTC, Inc.: Financial Overview (2021)

Figure 29 Microsoft Corporation: Financial Overview (2021)

Figure 30 Siemens AG: Financial Overview (2021)

Figure 31 Ansys, Inc.: Financial Overview (2021)

Figure 32 SAP SE: Financial Overview (2021)

Figure 33 Oracle Corporation: Financial Overview (2021)

Figure 34 Robert Bosch GmbH: Financial Overview (2021)

Figure 35 Swim. AI: Financial Overview (2021)

Figure 36 Rescale, Inc.: Financial Overview (2021)

Figure 37 Dassault Systemes: Financial Overview (2021)

Figure 38 ABB Ltd.: Financial Overview (2021)

Figure 39 Honeywell International Corporation: Financial Overview (2021)

Figure 40 Schneider Electric SE: Financial Overview (2021)