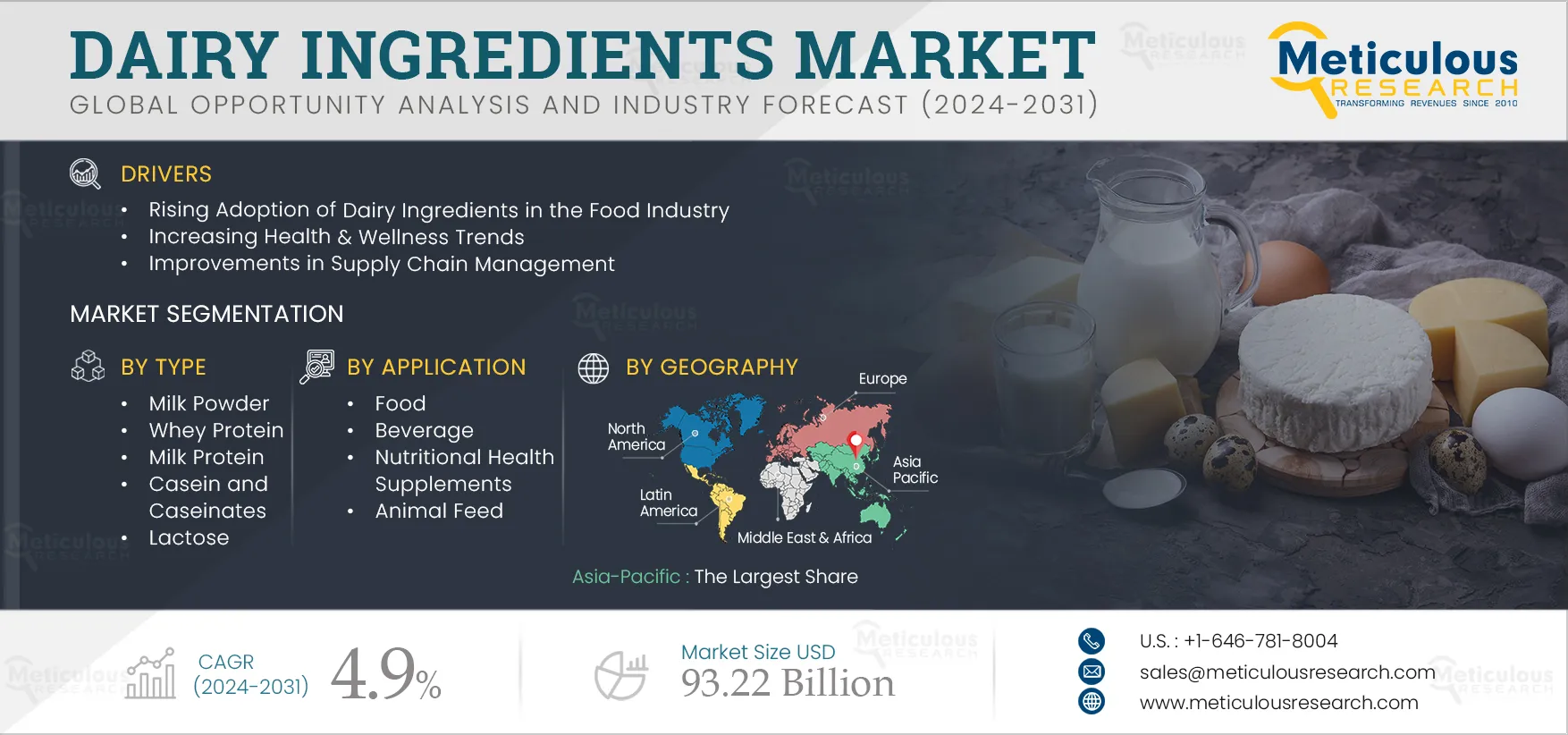

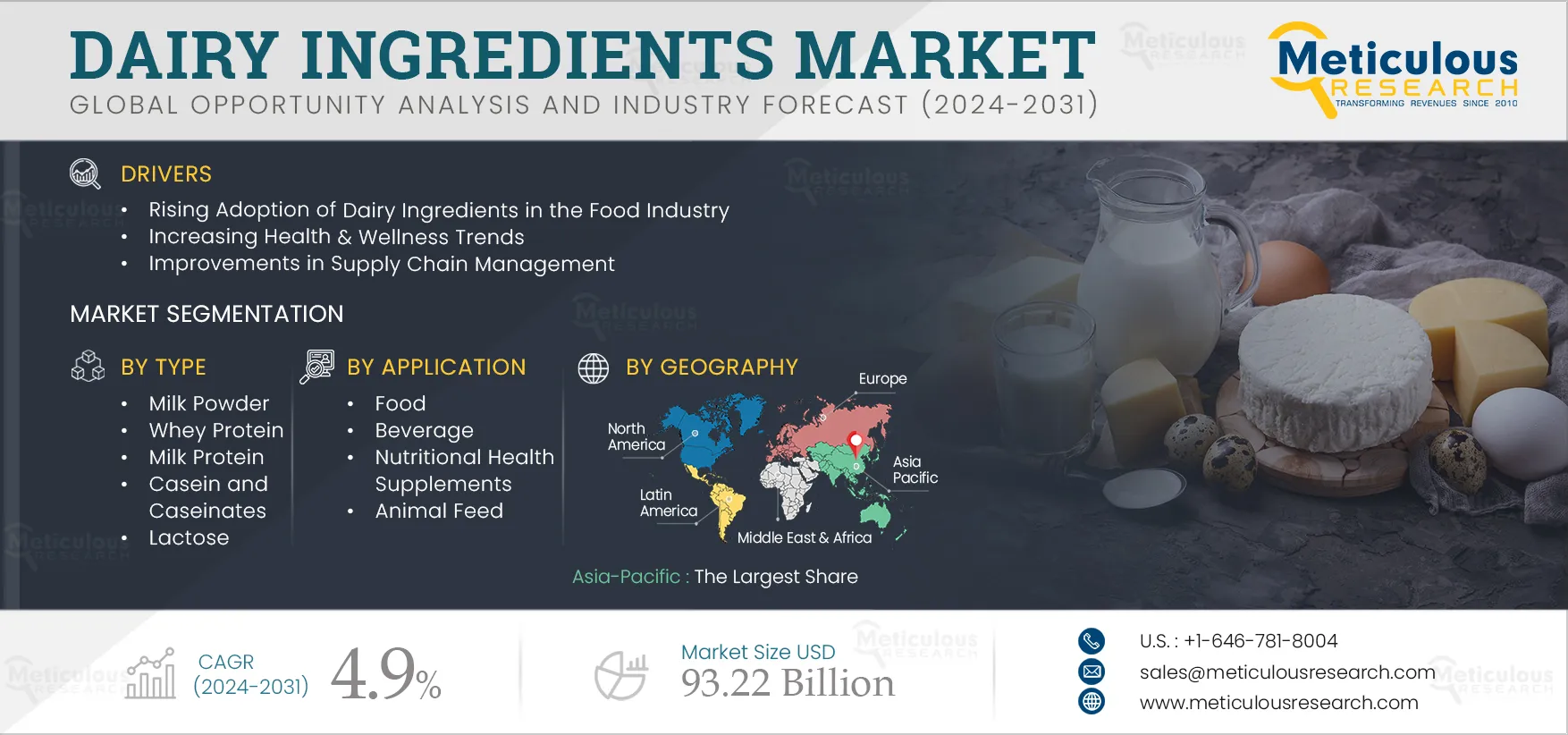

Dairy Ingredients Market Size & Forecast

The Dairy Ingredients Market is expected to reach $93.2 billion by 2031, at a CAGR of 4.9% during the forecast period of 2024 to 2031. This market's growth is driven by the growing adoption of dairy ingredients in the food industry, increasing health and wellness trends, improvement in supply chain management, rising consumer awareness towards nutritional food, and increasing milk production.

Additionally, technological developments in the dairy industry and emerging economies offer significant growth opportunities for dairy ingredient manufacturers. However, demand for plant-based non-dairy alternatives and the increasing incidence of lactose intolerance restrains market growth.

Dairy Ingredients Market: Competitive Analysis

The report includes a competitive analysis based on an extensive assessment of the key growth strategies adopted by leading market players in the past three to four years and the benchmarking of key players' product offerings by type. The key players profiled in the dairy ingredients market are Fonterra Co-Operative Group (New Zealand), Royal Frieslandcampina N.V. (Netherland), Arla Foods Amba (Denmark), Saputo Inc. (Canada), Dairy Farmers of America, Inc. (U.S.), Sodiaal International (France), Lactalis Group (France), Agropur Cooperative (Canada), Schreiber Foods Inc. (U.S.), Savencia S.A. (France), Yili Group (China), Glanbia Plc. (Ireland), Gujrat Cooperative Milk Marketing Federation Ltd (India), Meiji Holdings Co., Ltd. (Japan), Mengniu Dairy Co., Ltd. (China), Megmilk Snow Brand Co., Ltd. (Japan), and Morinaga Milk Co., Ltd. (Japan).

Rising Consumer Awareness Towards Nutritional Food Drives the Growth of Dairy Ingredients Market

In recent years, there has been a notable shift in consumer preferences towards healthier, more nutritious food choices. This change has been fueled by an increased awareness of the importance of nutrition in promoting overall well-being and preventing chronic diseases. The rise of nutritional foods has played a key role in healthy habits due to growing consumer concern about health and the perception that diet directly affects health. According to the NIH-funded study, a healthy eating diet is directly proportional to improvement in overall health and reduces the rate of death from heart disease, stroke, and type 2 diabetes. Therefore, a healthy eating trend is gaining traction and evoking the interest of the population which is significantly driving the development of healthful food formulation.

In the development of healthy food formulations, dairy ingredients are emerging as a vital ingredient in the food processing industry. For instance, dairy ingredients support basic areas of food formulations such as calcium enrichment, fat reduction, and sodium reduction. Dairy ingredients are rich in calcium, a mineral that is crucial for bone health. With an aging population and increasing concerns about osteoporosis and bone-related disorders, consumers are turning to dairy products fortified with calcium to meet their nutritional needs. This has led to a surge in demand for dairy ingredients. Further, whey protein stimulates fat globules, making low-fat content-based yogurts, cheese, desserts, and ice cream. As consumers become more informed about the health benefits of nutritional products, they are actively seeking out foods that are rich in essential nutrients such as protein, calcium, vitamins, and minerals and low in fat.

Furthermore, dairy ingredients are also known for their potential health-promoting properties beyond basic nutrition. For example, certain probiotic cultures found in yogurt and other dairy products can support digestive health by promoting the balance of beneficial bacteria in the gut. Consumers are increasingly turning to dairy-based probiotic products as a natural way to maintain gut health and overall well-being.

Thus, the growing consumer awareness about nutritional foods and their associated health benefits is driving the growth of the dairy ingredients market.

Click here to: Get Free Sample Pages of this Report

Key Findings in the Global Dairy Ingredients Market Study:

In 2024, the Milk Segment is Expected to Account for the Largest Share of the Dairy Ingredients Market by Source

Based on source, the dairy ingredients market is segmented into milk and whey. In 2024, the milk segment is expected to account for the largest share of the dairy ingredients market. The large market share of this segment is attributed to its broader applications and versatile functional properties. However, the whey segment is expected to register the highest CAGR during the forecast period. The rapid growth of this segment is attributed to the increasing application in sports nutrition products, functional foods, beverages, and dietary supplements and technological advancement in the dairy processing sector.

In 2024, the Milk Powder Segment is Expected to Account for the Largest Share of the Dairy Ingredients Market by Type

Based on type, the dairy ingredients market is segmented into milk powder, whey protein, milk protein, casein and caseinates, third-generation dairy ingredients, lactose and derivatives, buttermilk powder, and whey permeate. In 2024, the milk powder segment is expected to account for the largest share of the dairy ingredients market. The large market share of this segment is attributed to its nutritional benefits, longer shelf life, varied application areas, and reduced transportation & storage costs.

However, the milk protein segment is expected to register the highest CAGR during the forecast period. The rapid growth of this segment is attributed to its high protein content, versatile functional properties, and growing demand for sports nutrition and dietary supplements.

In 2024, the Food Segment is Expected to Account for the Largest Share of the Dairy Ingredients Market by Application

Based on application, the dairy ingredients market is segmented into food, beverage, nutritional health supplements, animal feed, and other applications. In 2024, the food segment is expected to account for the largest share of the dairy ingredients market. The large market share of this segment is attributed to rising per capita consumption of functional food products, increasing awareness about the multi-functionality of dairy ingredients for processed food products, and growing demand for nutritional and fortifying food products.

However, the beverage segment is expected to register the highest CAGR during the forecast period. The rapid growth of this segment is attributed to the rapid growth of the fitness industry, increasing demand for energy drinks and sports drinks, and innovative product development within the beverage sector.

Asia Pacific: The Dominating Regional Market

Based on geography, in 2024, Asia-Pacific is expected to account for the largest share of the dairy ingredients market. Asia-Pacific’s major market share is attributed to increasing demand for sport nutrition, greater involvement of milk and milk-based products in the diet, increasing focus on manufacturing functional food products, changing food consumption preferences, and government policies and programs to support dairy production & processing industries. Additionally, this region is expected to register the highest CAGR during the forecast period due to increasing demand for organic dairy ingredients and rising infant population.

Dairy Ingredients Market Report Summary:

|

Particular

|

Details

|

|

Page No.

|

~350

|

|

Format

|

PDF

|

|

Forecast Period

|

2024–2031

|

|

Base Year

|

2023

|

|

CAGR

|

4.9%

|

|

Market Size (Value)

|

USD 93.2 Billion

|

|

Segments Covered

|

By Source

By Type

- Milk Powder

- Whole Milk Powder (WMP)

- Skim Milk Powder (SMP)

- Fat Filled Milk Powder (FFMP)

- Whey Protein

- Whey Protein Isolate (WPI)

- Whey Protein Concentrate (WPC)

- Whey Protein Hydrolysate (WPH)

- Milk Protein

- Milk Protein Concentrate (MPC)

- Milk Protein Isolate (MPI)

- Milk Protein Hydrolysates (MPH)

- Casein and Caseinates

- Third Generation Dairy Ingredient

- Lactoferrin

- Lactoperoxidase

- Alpha Lactalbumin

- Lactose and Derivatives

- Butter Milk Powder

- Whey Permeate

By Application

- Food

- Bakery & Confectionery

- Dairy Products

- Infant Food

- Other Food Applications

- Beverage

- Energy Drinks

- Sports Drinks

- Dairy-based Beverages

- Other Beverage Applications

- Nutritional Health Supplements

- Animal Feed

- Other Applications

|

|

Countries/Regions Covered

|

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Russia, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, New Zealand, Thailand, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Rest of Latin America), and the Middle East & Africa

|

|

Key Companies

|

Fonterra Co-Operative Group (New Zealand), Royal Frieslandcampina N.V. (Netherland), Arla Foods Amba (Denmark), Saputo Inc. (Canada), Dairy Farmers of America, Inc. (U.S.), Sodiaal International (France), Lactalis Group (France), Agropur Cooperative (Canada), Schreiber Foods Inc. (U.S.), Savencia S.A. (France), Yili Group (China), Glanbia Plc. (Ireland), Gujrat Cooperative Milk Marketing Federation Ltd (India), Meiji Holdings Co., Ltd. (Japan), Mengniu Dairy Co., Ltd. (China), Megmilk Snow Brand Co., Ltd. (Japan), and Morinaga Milk Co., Ltd. (Japan).

|

Key questions answered in the report: