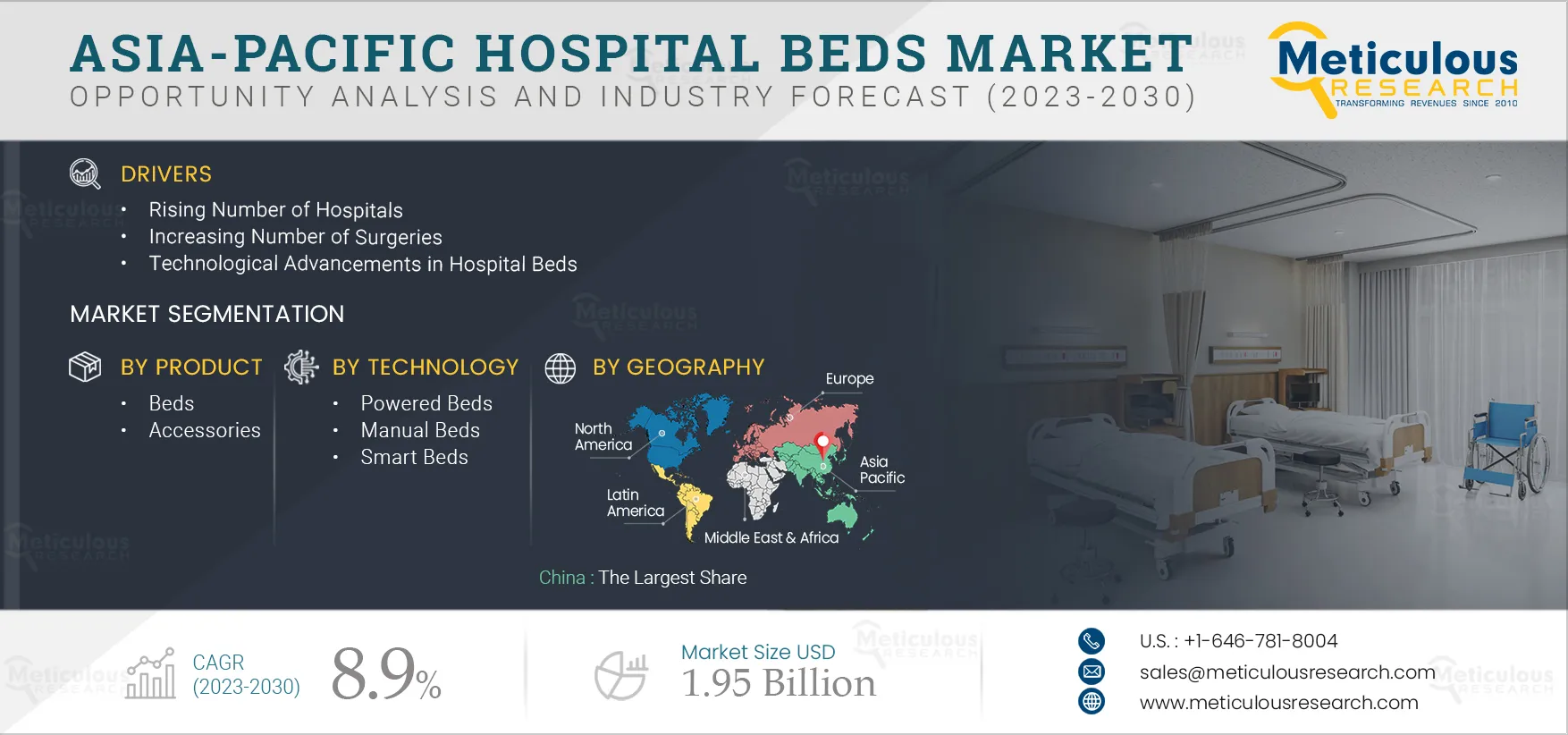

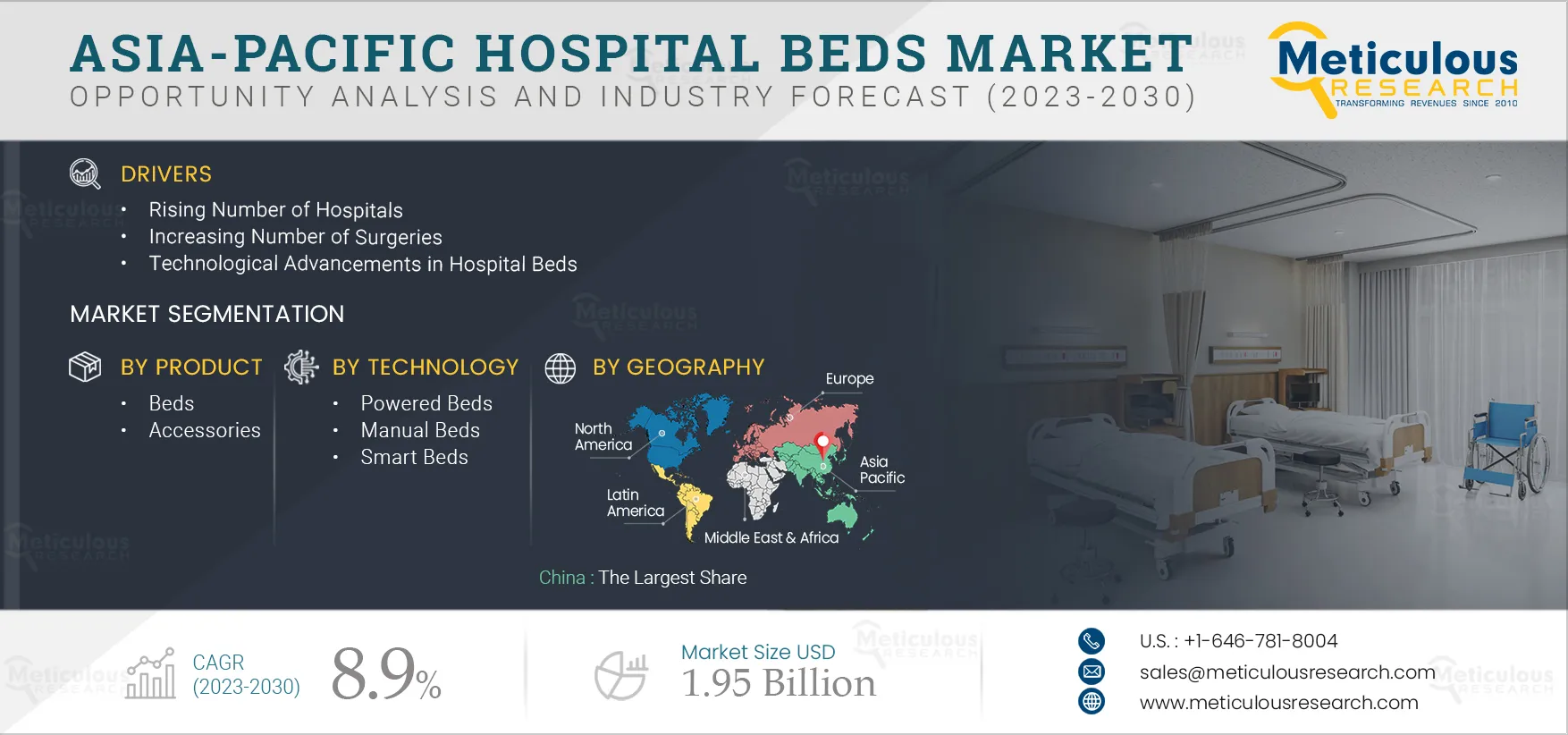

The Asia-Pacific Hospital Beds Market is projected to reach $1.95 billion by 2030, at a CAGR of 8.9% from 2023 to 2030. Hospital beds are indispensable components required at healthcare facilities, as most patients are often immobile and in need of proper rest during treatment. Traditionally used beds are mostly manual and lack additional features. However, with the advancement of technology, smart beds have been developed, which can effectively track and monitor patients' vital signs and movements.

The growth of the Asia-Pacific hospital beds market is primarily driven by factors such as the increasing number of hospitals, the rising number of surgical procedures, technological advancements in hospital beds, and the growing elderly population, coupled with the subsequent increase in the prevalence of chronic diseases. Furthermore, the growth of medical tourism, the high demand for home care, the rising popularity of smart and robotic beds, and the rising healthcare expenditures in countries like China and India are expected to create significant market growth opportunities. However, the growing preference for minimally invasive surgical procedures is expected to restrain the market’s growth.

Rising Popularity of Smart Beds and Robotic Beds Creates Significant Market Growth Opportunities

Modern hospital beds offer multiple benefits besides just providing patients with a place to rest. Beds are one of the most important components of healthcare facilities and play a vital role in patient care. Therefore, research studies are being conducted to advance the capabilities of hospital beds. Smart hospital beds are one of the emerging classes of beds. These beds have remote monitoring systems that track patient health by monitoring body temperature, blood pressure, heartbeat, and oxygen. The beds feature pressure sensors that continuously transfer patient information to the central system for physicians’ review, thus playing a vital role in cases requiring critical care. Some smart beds have percussion and vibration features, which are very useful for patients with/susceptible to pneumonia. These features help them clear their lungs of phlegm, reducing the probability of infection and the need for antibiotics. The adoption of smart hospital beds has been increasing in China and India over the past few years, and the demand is also expected to increase due to the beds’ growing affordability and the rising need for quality healthcare.

Furthermore, there is a growing need to address issues associated with the high level of manual patient handling and repetitive strain injuries (RSI) caused to caregivers by heavy patient lifting. Robotic beds are being increasingly researched as a promising tool that can offer efficient patient handling and reduce RSIs. In August 2022, Midmark India Pvt Ltd. (India) and Turtle Shell Technologies Private Limited (Dozee) (India) collaborated to develop a connected bed platform for patient monitoring in non-ICU environments. These beds provide uninterrupted patient monitoring in HDU, non-ICU, and step-down ICU settings, ensuring the delivery of next-level patient safety and driving operational efficiencies with enhanced clinical outcomes. Such developments are expected to boost the demand for advanced medical beds, creating opportunities for the players operating in this market.

Click here to: Get Free Sample Pages of this Report

Growing Number of Hospitals Driving the Growth of the Asia-Pacific Hospital/Medical Beds Market

As the burden of various diseases continues to increase, many nations are prioritizing the expansion of healthcare facilities and the enhancement of healthcare services to alleviate the burden of illness and improve the overall well-being of their populations.

According to Rural Health Statistics (RHS), in India, there is only one hospital bed for every 2,046 people, with a shortage of 9,231 primary health centers, 46,140 sub-centers, and 3,002 community health centers. The Government of India is undertaking various initiatives to overcome these challenges. For instance, India’s National Health Policy aims to have at least two beds per 1,000 people and build 3,000 to 5,000 hospitals with nearly 200 beds each by 2025. Similarly, the Chinese government is taking active steps to increase its intensive care capacity by 20%. Additionally, the government has been focused on strengthening its public health infrastructure by expanding hospitals and treatment facilities for infectious diseases. This is an addition to the National Development and Reform Commission, the National Health Commission, and the National Administration of Traditional Chinese Medicine’s plans to increase hospital capacities across the country.

Private healthcare providers are playing an important role in enhancing the healthcare sector in developing countries. In India, the private sector accounts for 58% of the hospitals and 29% of hospital beds in the country. Presently, India’s healthcare sector is witnessing an influx of investments, both foreign and domestic, supporting the proliferation of private hospitals. Furthermore, growing medical tourism is driving the expansion of private hospitals.

Moreover, the rates of new hospital construction are higher in developing countries due to the large patient populations, frequent disease outbreaks, and increasing healthcare budgets. Thus, the growing number of hospitals is expected to boost the demand for hospital beds, driving the growth of this market.

Key Findings in the Asia-Pacific Hospital/Medical Beds Market Study:

In 2023, the Beds Segment is Expected to Account for the Largest Share of the Market

Among the product types covered in the report, in 2023, the beds segment is expected to account for the largest share of the market. Factors such as the rising prevalence of acute and chronic diseases, outbreaks of infectious diseases, the increasing number of hospitals, the growing demand for long-term care, and government investments and support for the improvement of healthcare in emerging countries contribute to the large market share of this segment.

In 2023, the Powered Beds Segment is Expected to Account for the Largest Share of the Market

Among all the technologies covered in the report, in 2023, the powered beds segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the rising demand for technologically advanced beds from developed countries with high purchasing power and the increasing number of market players offering customized and multiple-featured powered beds for patient monitoring.

In 2023, the Curative Care Segment is Expected to Account for the Largest Share of the Market

Among all the types of care covered in the report, in 2023, the curative care segment is expected to account for the largest share of the market. Factors such as the high prevalence of infectious diseases and the rising number of hospitalizations due to road accidents contribute to the large market share of this segment.

In 2023, the Critical Care Unit Segment is Expected to Account for the Largest Share of the Market

Among all the healthcare facilities covered in the report, in 2023, the critical care unit segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the increasing number of accidents and the rising incidence of infectious diseases, chronic diseases, and fatal injuries, leading to increased admissions in ICUs and CCUs. Critical care includes services provided to patients facing an immediate life-threatening health condition who need support systems to maintain the functioning of vital organs.

China to Account for the Largest Share of the Asia-Pacific Hospital/Medical Beds Market

In 2023, China is expected to account for the largest share of the Asia-Pacific hospital beds market. Factors such as the growing healthcare expenditure, large patient population, growing geriatric population, growing prevalence of non-communicable diseases, and improving access to healthcare through the increasing number of hospitals contribute to China’s significant market share.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by major market players in the last 3–4 years. The key players profiled in the Asia-Pacific hospital beds market report are Stryker Corporation (U.S.), Hill-Rom Holdings Inc. (Part of Baxter International Inc.) (U.S.), Getinge AB (Sweden), Invacare Corporation (U.S.), Paramount Bed Holdings Co., Ltd. (Japan), Medline Industries, LP (U.S.), Stiegelmeyer GmbH & Co. KG (Germany), LINET Group SE (Netherlands), Joerns Healthcare LLC. (U.S.), Savaria Corporation (Canada), Drive DeVilbiss Healthcare (U.S.), Malvestio Spa (A Subsidiary of Malvestio Group) (Italy), Midmark Corporation (U.S.), Amico Corporation (U.S.), and Famed Zywiec Sp. z o.o. (Poland).

Scope of the Report:

Asia-Pacific Hospital/Medical Beds Market Assessment, by Product

Asia-Pacific Hospital/Medical Beds Market Assessment, by Technology

- Powered Beds

- Electric Beds

- Semi-electric Beds

- Manual Beds

- Smart Beds

Asia-Pacific Hospital/Medical Beds Market Assessment, by Type of Care

- Curative Care

- Long-term Care

- Rehabilitative Care

Asia-Pacific Hospital/Medical Beds Market Assessment, by Healthcare Facility

- Critical Care Unit

- Bariatric Care Unit

- Long-term Care Unit

- Homecare Settings

- Med-surg Care Unit

- Pediatric Care Unit

- Maternal Care Unit

Asia-Pacific Hospital/Medical Beds Market Assessment, by Country

- China

- Japan

- India

- Australia

- Singapore

- Indonesia

- South Korea

- New Zealand

- Rest of Asia-Pacific (RoAPAC)

Key questions answered in the report: