Resources

About Us

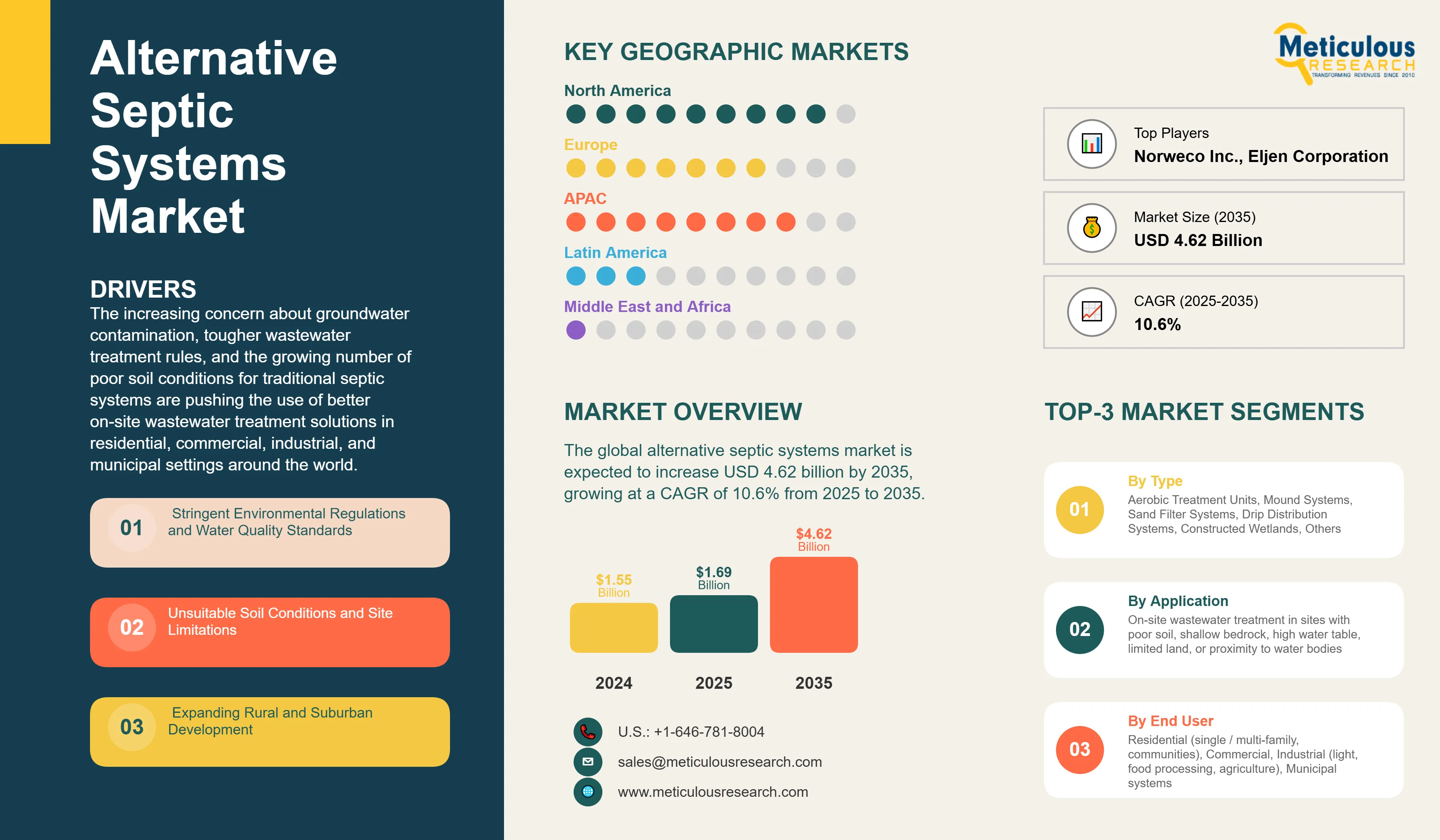

Alternative Septic Systems Market by System Type (Aerobic Treatment Units, Mound Systems, Sand Filter Systems, Drip Distribution Systems, Constructed Wetlands, Others), End User, and Geography – Global Forecast to 2035

Report ID: MRSE - 1041614 Pages: 213 Oct-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Alternative Septic Systems Market Size?

The global alternative septic systems market size was valued at USD 1.55 billion in 2024 and is expected to increase to approximately USD 1.69 billion in 2025, then expand to around USD 4.62 billion by 2035, growing at a CAGR of 10.6% from 2025 to 2035.

The increasing concern about groundwater contamination, tougher wastewater treatment rules, and the growing number of poor soil conditions for traditional septic systems are pushing the use of better on-site wastewater treatment solutions in residential, commercial, industrial, and municipal settings around the world.

Market Highlights: Alternative Septic Systems

Click here to: Get Free Sample Pages of this Report

The alternative septic systems market includes the design, manufacturing, installation, and maintenance of on-site wastewater treatment solutions that go beyond traditional septic tank and drain field systems. These systems are built to treat household and commercial wastewater in places where regular septic systems cannot work well due to poor soil conditions, high water tables, shallow bedrock, limited land space, or being close to water bodies. Alternative systems consist of aerobic treatment units that use oxygen to speed up bacterial breakdown, mound systems that raise drain fields above the natural soil, sand filter systems that add extra filtration, drip distribution systems that provide treated water through precise irrigation, and constructed wetlands that rely on natural processes for cleaning.

The market is primarily driven by stricter environmental rules requiring higher treatment standards, increased awareness of groundwater protection, growing rural and suburban development in difficult areas, aging infrastructure needing upgrades, and technological advancements that improve system efficiency and lessen maintenance needs. These systems are used in residential properties, commercial establishments, industrial facilities, and municipal applications where centralized sewage systems are not available or practical.

How is Technology Innovation Transforming the Alternative Septic Systems Market?

What are the Key Trends in the Alternative Septic Systems Market?

Decentralized wastewater management: A significant trend in the alternative septic systems market is the growing preference for decentralized wastewater treatment solutions. This is especially true in areas experiencing rapid residential and commercial development outside municipal service boundaries. Property owners, developers, and local authorities see that well-designed alternative systems can provide treatment quality similar to centralized plants while removing the need for extensive collection infrastructure. This trend is particularly strong in environmentally sensitive areas, lakefront communities, and regions with challenging landscapes where protecting water quality is crucial.

Nutrient removal capabilities: Another important trend driving the growth of the overall alternative septic system market is the development of alternative septic systems with better nutrient removal capabilities, focusing on reducing nitrogen and phosphorus. Regulatory agencies in watersheds, coastal zones, and regions with vulnerable aquifers are setting advanced treatment standards to prevent eutrophication and protect drinking water sources. Manufacturers are adding denitrification zones, improved biological processes, and extra filtration steps to achieve nutrient removal efficiencies greater than 50-70% for nitrogen and 30-50% for phosphorus. This positions their systems to meet changing environmental requirements.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 4.62 Billion |

|

Market Size in 2025 |

USD 1.69 Billion |

|

Market Size in 2024 |

USD 1.55 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 10.6% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

System Type, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Stringent Environmental Regulations and Water Quality Standards

A key factor driving the growth of the alternative septic systems market is the increasing environmental regulations on on-site wastewater treatment and groundwater protection. Regulatory agencies at the federal, state, and local levels are setting higher performance standards for wastewater discharge, especially in sensitive watersheds, coastal areas, and groundwater recharge zones.

In the U.S., the Environmental Protection Agency supports state and local programs that require advanced treatment systems in areas with failing conventional systems or vulnerable water resources. European Union directives on wastewater treatment and water framework implementation demand proper treatment solutions, no matter the population density. Countries like Canada, Australia, and Japan have adopted performance-based regulations that support alternative systems capable of meeting specific effluent quality criteria.

These regulations often include requirements for nitrogen and phosphorus removal, pathogen reduction, and regular monitoring. This regulatory climate pushes property owners, developers, and municipalities to invest in alternative septic technologies that can reliably meet compliance standards while protecting public health and environmental quality.

Restraint

High Installation Costs and Maintenance Requirements

Despite its growth potential, the alternative septic systems market faces major challenges due to higher upfront costs and ongoing maintenance compared to traditional septic systems. Alternative systems usually need specialized equipment like aerators, pumps, control panels, and distribution parts. This can significantly raise installation costs, often making them two to four times more expensive than traditional systems. Hiring certified contractors for professional installation also adds to the total costs. Many alternative systems need electrical power to operate, which increases utility bills and creates a risk of power outages.

Regular maintenance, including inspections, testing, component replacement, and service contracts, is necessary for proper function and to meet regulations. Homeowners and small property owners, especially in rural areas with lower property values, may find these expenses too high. The complexity of some systems requires specialized service providers, who may not be readily available in certain regions, leading to higher service costs and possible delays. These financial issues can slow down adoption rates and restrict market growth in price-sensitive areas.

Opportunity

Expanding Development in Non-Sewered Areas

The ongoing growth of residential and commercial development in areas without access to centralized sewer systems offers a significant chance for the alternative septic systems market. Population growth, the rise of remote work, and changing lifestyle choices are increasing construction in rural, suburban, and recreational areas where municipal infrastructure is not available or too costly to expand.

Lakefront properties, mountain towns, islands, and farming regions are seeing more development pressure. Alternative septic systems are the only practical wastewater solution for these places, particularly when soil conditions, lot sizes, or environmental concerns make traditional systems unsuitable.

Commercial uses, such as restaurants, resorts, campgrounds, wineries, and small industrial sites in remote areas, also need dependable on-site treatment. The market benefits from a rising awareness of environmental issues among property buyers who appreciate sustainable development practices. These buyers are willing to invest in effective treatment technology that safeguards local water resources while keeping property functionality and value intact.

System Type Insights

Why are Aerobic Treatment Units Gaining Widespread Acceptance?

The aerobic treatment units segment commands the largest share of xx% of the overall alternative septic systems market in 2025. Aerobic treatment units lead the market because they have better treatment efficiency, a smaller footprint, and can produce high-quality effluent suitable for surface discharge or subsurface distribution in tough site conditions. These systems use mechanical aeration to keep oxygen-rich environments that support aerobic bacteria. This process speeds up the breakdown of organic matter and reduces biochemical oxygen demand and suspended solids by 85-95%. Aerobic treatment units work especially well for residential applications on small lots, properties with poor soil drainage, and locations near sensitive water bodies. Their smaller size compared to other alternative systems makes them a good fit for retrofitting and sites with limited space. Improvements in technology have made them more reliable, reduced their energy use, and made maintenance easier, which has helped homeowners, regulators, and installers accept them more widely.

End User Insights

How do Residential Applications Dominate the Alternative Septic Systems Market?

The residential segment holds the largest share of xx% of the alternative septic systems market in 2025. This is mainly because many homes in rural and suburban areas rely on on-site wastewater treatment instead of municipal sewer connections. Millions of properties around the world depend on septic systems, and more of them are turning to alternative technologies to meet specific challenges or comply with tougher environmental rules.

Ongoing demand comes from new home construction in areas without sewer access, replacing failing conventional systems, and required upgrades. Homeowners dealing with water quality problems, septic failures, or property sales often see advanced systems as the only compliant option. This segment includes single-family homes, multi-family units, and residential communities of all sizes. Increasing environmental awareness and stronger permitting rules also boost the adoption of alternative septic technologies in residential settings.

At the same time, the commercial segment is expected to grow at the fastest CAGR during the forecast period. This includes places like restaurants, hotels, resorts, retail centers, office buildings, healthcare facilities, and schools that are not connected to municipal sewer systems. The growth in tourism and hospitality in scenic or remote locations with strict environmental regulations supports this expansion. Commercial sites generate larger and more varied volumes of wastewater, sometimes with higher pollutant levels, which need strong and reliable treatment solutions. Businesses risk reputational damage and operational problems from system failures, pushing them to invest more in advanced technologies for compliance and reliability. Additionally, corporate sustainability goals and green building certifications are increasing demand for high-performance alternative septic systems in the commercial sector.

U.S. Alternative Septic Systems Market Size and Growth 2025 to 2035

The U.S. alternative septic systems market is projected to be worth around USD 1.7 billion by 2035, growing at a CAGR of 9.5% from 2025 to 2035.

How is North America Maintaining Dominance in the Alternative Septic Systems Market?

North America is expected to hold the largest share of about 40 -45% of the global alternative septic system market in 2025. This comes from a large number of on-site wastewater systems, significant rural and suburban development, and strong regulations on wastewater treatment in this region.

The U.S. has around 26 million homes and businesses using on-site systems. Many areas need alternative technologies due to environmental protection laws. Federal agencies like the Environmental Protection Agency offer technical guidance and financial support for better on-site systems through programs such as the Clean Water State Revolving Funds. State and local health departments set performance standards that often require alternative technologies.

In Canada, rural areas and vacation regions also depend on on-site treatment. Provincial regulations encourage the use of advanced systems there. The region has a well-developed market, with established manufacturers, a broad network of dealers and installers, and trained service providers. People are more aware of water quality issues and property values, which makes them willing to invest in quality treatment systems.

Which Factors Support the Asia Pacific Alternative Septic Systems Market Growth?

The alternative septic systems market in the Asia Pacific region is expected to grow at the fastest CAGR from 2025 to 2035. This growth is primarily attributed to the rapid urbanization reaching into peri-urban and rural areas. Increased environmental awareness and tougher wastewater treatment regulations are also significant factors. Countries like China, India, Indonesia, the Philippines, and Vietnam are experiencing major residential and commercial development in places without centralized sewage systems. The rising middle class, with higher environmental standards and purchasing power, is fueling market growth.

Governments are putting stricter measures in place to control water pollution as water scarcity and contamination become pressing issues. Japan and South Korea, with their established markets and strong environmental standards, continue to adopt new on-site treatment technologies for scattered development. In Australia, large rural areas and strict state-level regulations that require nutrient removal in sensitive watersheds are encouraging the use of alternative systems.

Tourism growth in coastal and island destinations throughout Southeast Asia and the Pacific is increasing the demand for reliable wastewater treatment. Growing awareness of waterborne diseases and the need for groundwater protection, along with government programs that promote better sanitation, are further supporting market growth across the region.

Recent Developments

Segments Covered in the Report

By System Type

By End User

By Region

The alternative septic systems market is expected to increase from USD 1.69 billion in 2025 to USD 4.62 billion by 2035.

The alternative septic systems market is expected to grow at a CAGR of 10.6% from 2025 to 2035.

The major players in the alternative septic systems market include Norweco Inc., Consolidated Treatment Systems Inc., Orenco Systems Inc., Infiltrator Water Technologies LLC, BioMicrobics Inc., Premier Tech Aqua, Eljen Corporation, Clearstream Wastewater Systems Inc., SeptiTech Inc., Delta Environmental Products, Roth Global Plastics, Marsh Industries LLC, Jet Inc., Ecological Tanks Inc., and Simple Solutions Distributing LLC. These companies provide a broad range of technologies such as aerobic treatment units, mound systems, sand filters, constructed wetlands, drip distribution systems, peat systems, and media filters with advanced wastewater treatment solutions.

The key factors driving the growth of the alternative septic systems market are stringent environmental regulations for wastewater treatment, growing concerns over groundwater contamination, expanding rural and suburban development in areas lacking centralized sewage infrastructure, unsuitable soil conditions requiring advanced treatment solutions, and technological advancements improving system efficiency and reliability.

North America region will lead the global alternative septic systems market during the forecast period 2025 to 2035.

Published Date: Jun-2023

Published Date: Feb-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates