Resources

About Us

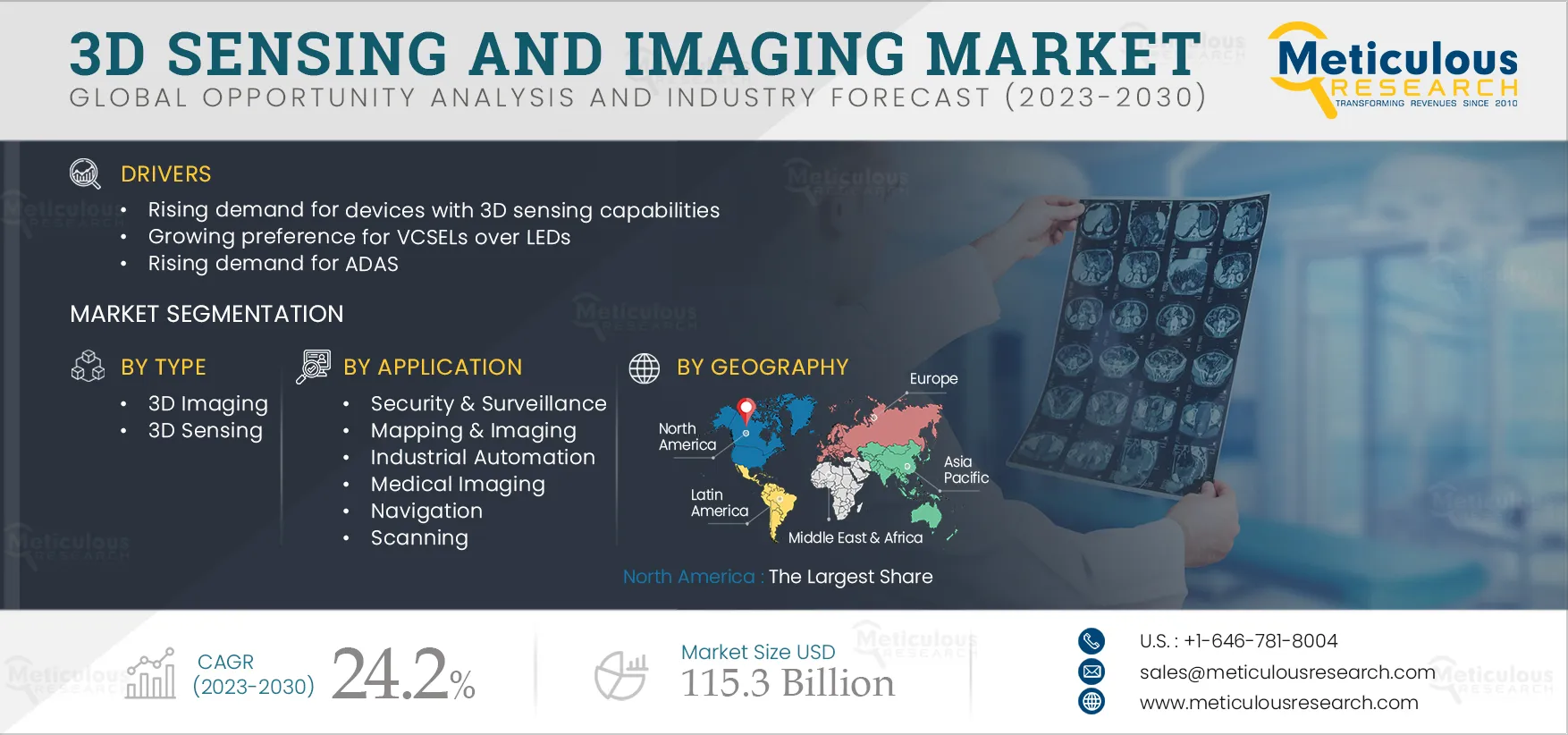

3D Sensing and Imaging Market, by Type (3D Sensing and 3D Imaging), Technology (LiDAR, Structured Light, Time-of-Flight), Application (Medical Imaging, Industrial Automation), and End-use Industry (Consumer Electronics, Healthcare, Others), and Geography - Global Forecast to 2030

Report ID: MRICT - 104674 Pages: 342 May-2023 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe 3D Sensing and Imaging Market is expected to reach $115.3 billion by 2030, at a CAGR of 24.2% during the forecast period of 2023–2030. The growth of the 3D sensing & imaging market is driven by the rising demand for devices with 3D sensing capabilities, growing preference for VCSELs over LEDs, rising demand for ADAS, and growing use of 3D imaging sensors across industries. Moreover, rising demand for optical 3D sensing capabilities in industrial applications, increasing government initiatives supporting industrial automation, rising awareness regarding the benefits of 3D imaging technology in medical applications, and increasing integration of 3D accelerometers in smartphones and gaming consoles.

However, the high installation cost restrains the market's growth to some extent. Additionally, the increasing need to improve the accuracy, effectiveness, and robustness of 3D sensing technologies poses challenges for the 3D sensing & imaging market growth. Besides, the increasing adoption of liquid lenses for better vision and the rise in adoption of Industry 4.0 technologies are the key trends observed in the 3D sensing & imaging market.

Liquid lenses are used in various applications, such as digital photography, industrial data capture, barcode reading, and biometric data acquisition. The adaptability, speed, and versatility of liquid lenses make them ideal for various machine vision, life science, and measuring & inspection applications.

The main benefits of liquid lenses are their flexibility to be used in several applications simultaneously, which is especially useful in high-volume production environments where different-sized objects are used. For example, a pharmaceutical company may use machine vision inspection for different capsules, pills, and soft gels. With traditional lenses, there would be a need for several image systems to be set up to inspect each product, or one image system would have to constantly have the depth of focus changed. Different object distances can be programmed into the imaging system, eliminating the need to stop production and change the depth of focus or set up for several imaging systems. This benefit of flexibility drives the demand for liquid lenses in various industrial applications.

Click here to: Get a Free Sample Copy of this report

Major applications of liquid lenses are as follows:

In 2023, the 3D Imaging Segment is Estimated to Dominate the 3D Sensing and Imaging Market

Based on type, the 3D sensing and imaging market is segmented into 3D sensing and 3D imaging. In 2023, the 3D imaging segment is expected to account for the larger share of the global 3D sensing and imaging market. The growth of this segment is attributed to the increasing adoption of cloud-based 3D imaging solutions and the rising demand for 3D image sensors from industries, including media & entertainment, architecture and construction, and archaeological studies. However, the 3D sensing segment is projected to register the highest CAGR during the forecast period.

In 2023, the LiDAR Technology/Modality Segment is Estimated to Dominate the 3D Sensing and Imaging Market

Based on technology/modality, the 3D sensing and imaging market is segmented into LiDAR, stereoscopic imaging/vision, Time-of-Flight (ToF), structured light, laser triangulation, radar, ultrasound, X-ray, and other technologies. In 2023, the LiDAR segment is expected to account for the largest share of the global 3D sensing & imaging market. The large market share of this segment is attributed to the rapid growth of automated driving vehicles, the rising adoption of UAVs, and a surge in the need for better geospatial solutions that provide essential information for reliable object detection and collision avoidance by generating precise 3D images of the vehicle. However, the structured light segment is expected to record the highest CAGR during the forecast period.

In 2023, the Security & Surveillance Segment is Estimated to Dominate the 3D Sensing and Imaging Market

Based on application, the 3D sensing & imaging market is segmented into security & surveillance, mapping & imaging, industrial automation, medical imaging, navigation, scanning, surveying, and other applications. In 2023, the security & surveillance segment is expected to account for the largest share of the global 3D sensing & imaging market. The large market share of this segment is attributed to the rising need for 3D imaging mobile surveillance, the increasing implementation of 3D LiDAR cameras to secure various temporary and remote sites, such as construction sites, storage areas, and parking areas, and the growing need for innovative outdoor remote security applications. However, the security & surveillance segment is also expected to record the highest CAGR during the forecast period.

In 2023, the Consumer Electronics Segment is Estimated to Dominate the 3D Sensing and Imaging Market

Based on end-use industry, the 3D sensing and imaging market is segmented into automotive, transportation & logistics, consumer electronics, defense & aerospace, healthcare, manufacturing & warehouses, media & entertainment, architecture, engineering & construction, and others. In 2023, the consumer electronics segment is expected to account for a share of the global 3D sensing and imaging market. The growth of this segment is mainly attributed to the rising adoption of smartphones, cameras, and laptops due to the growth in per capita income, remote work trend, and upgradation in the consumer lifestyle. However, the healthcare segment is projected to register the highest CAGR during the forecast period.

In 2023, the North American region is Estimated to Dominate the 3D Sensing and Imaging Market

Based on geography, the 3D sensing and imaging market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, North America is expected to account for the largest share of the global 3D sensing & imaging market. The major factors driving the market's growth are the rising demand for 3D sensing optical technologies such as face recognition, facial payments, and augmented/virtual reality in various sectors, including healthcare, a surge in demand for virtualized solutions in robotics, and high adoption of advanced technologies to ensure the security of remote areas. However, Asia-Pacific is projected to register the highest CAGR during the forecast period.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by the leading market participants in the industrial analytics market in the past few years. The key players profiled in the 3D sensing and imaging market report are STMicroelectronics N.V. (Switzerland), Infineon Technologies AG (Germany), Microchip Technology Inc. (U.S.), Viavi Solutions Inc. (U.S.), Rockwell Automation, Inc. (U.S.), KEYENCE CORPORATION (Japan), Suteng Innovation Technology Co., Ltd. (China), Autodesk Inc. (U.S.), Cognex Corporation (U.S.), OMNIVISION Technologies, Inc. (U.S.), SICK AG (Germany), Panasonic Holdings Corporation (Japan), Sony Group Corporation (Japan), Lumentum Holdings Inc. (U.S.), FARO Technologies, Inc. (U.S.), Occipital, Inc. (U.S.), LMI Technologies Inc. (Canada) (A Subsidiary of TKH Group N.V.), Trimble Inc. (U.S.), and Balluff GmbH (Germany).

Scope of the Report:

3D Sensing and Imaging Market, by Type

3D Sensing and Imaging Market, by Technology/Modality

3D Sensing and Imaging Market, by Application

3D Sensing and Imaging Market, by End-use Industry

3D Sensing and Imaging Market—by Geography

Key questions answered in the report:

The 3D sensing and imaging market is projected to reach $115.3 billion by 2030, at a CAGR of 24.2% during the forecast period 2023–2030.

In 2023, the LiDAR segment is estimated to account for the largest share of the 3D sensing and imaging market.

The growth of the 3D sensing & imaging market is driven by the rising demand for devices with 3D sensing capabilities, growing preference for VCSELs over LEDs, rising demand for ADAS, and growing use of 3D imaging sensors across industries. Moreover, rising demand for optical 3D sensing capabilities in industrial applications, increasing government initiatives supporting industrial automation, rising awareness regarding the benefits of 3D imaging technology in medical applications, and increasing integration of 3D accelerometers in smartphones and gaming consoles.

The key players operating in the 3D sensing and imaging market are STMicroelectronics N.V. (Switzerland), Infineon Technologies AG (Germany), Microchip Technology Inc. (U.S.), Viavi Solutions Inc. (U.S.), Rockwell Automation, Inc. (U.S.), KEYENCE CORPORATION (Japan), Suteng Innovation Technology Co., Ltd. (China), Autodesk Inc. (U.S.), Cognex Corporation (U.S.), OMNIVISION Technologies, Inc. (U.S.), SICK AG (Germany), Panasonic Holdings Corporation (Japan), Sony Group Corporation (Japan), Lumentum Holdings Inc. (U.S.), FARO Technologies, Inc. (U.S.), Occipital, Inc. (U.S.), LMI Technologies Inc. (Canada) (A Subsidiary of TKH Group N.V.), Trimble Inc. (U.S.), and Balluff GmbH (Germany).

Published Date: Aug-2024

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates