This report is executed in collaboration with the European Algae Biomass Association (EABA). Combining Meticulous Research®’ market intelligence services with EABA’s broad expertise in the development of research, technology and industrial capacities in the field of algae, the two organizations have leveraged their research capabilities to come up with the most reliable and accurate market assessments in this field.

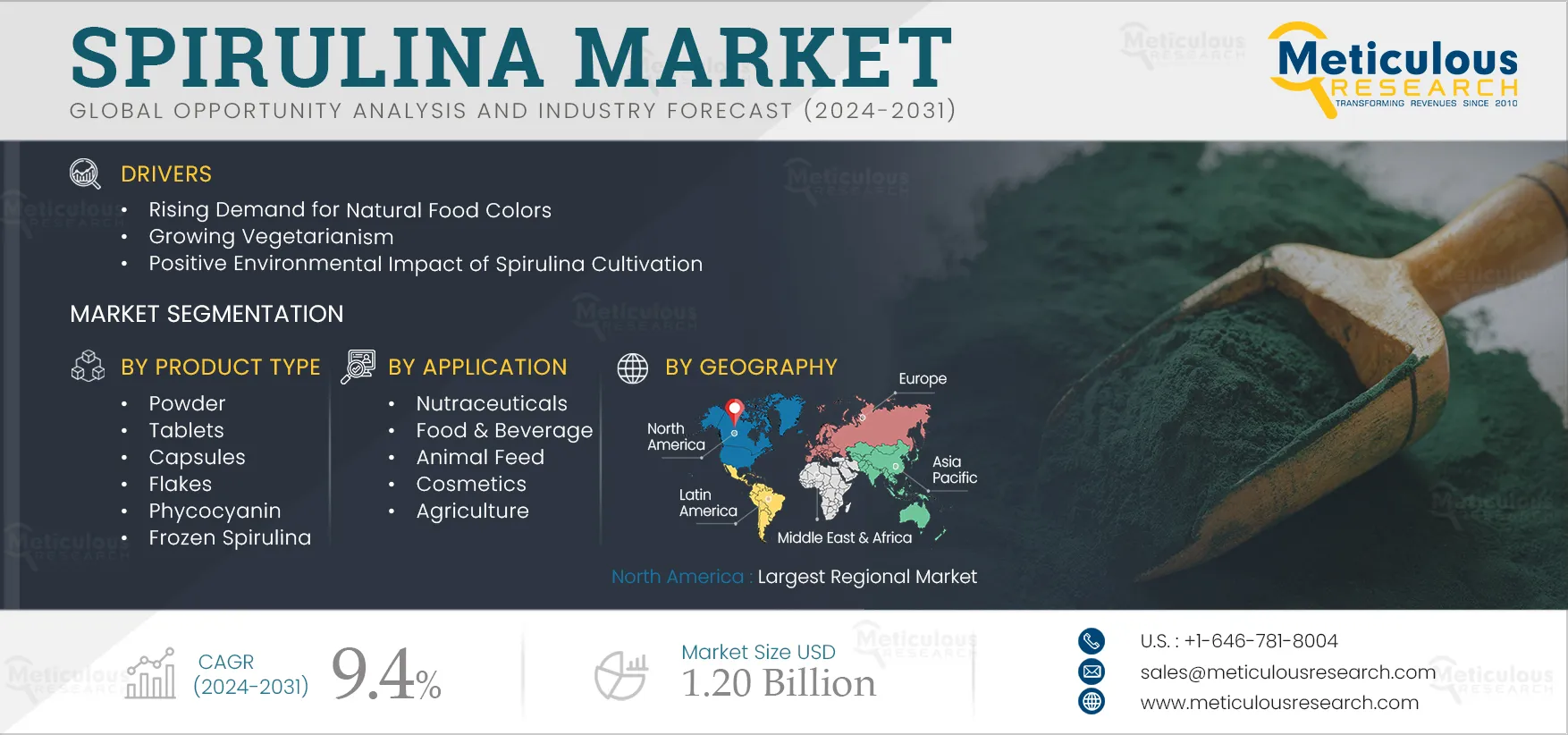

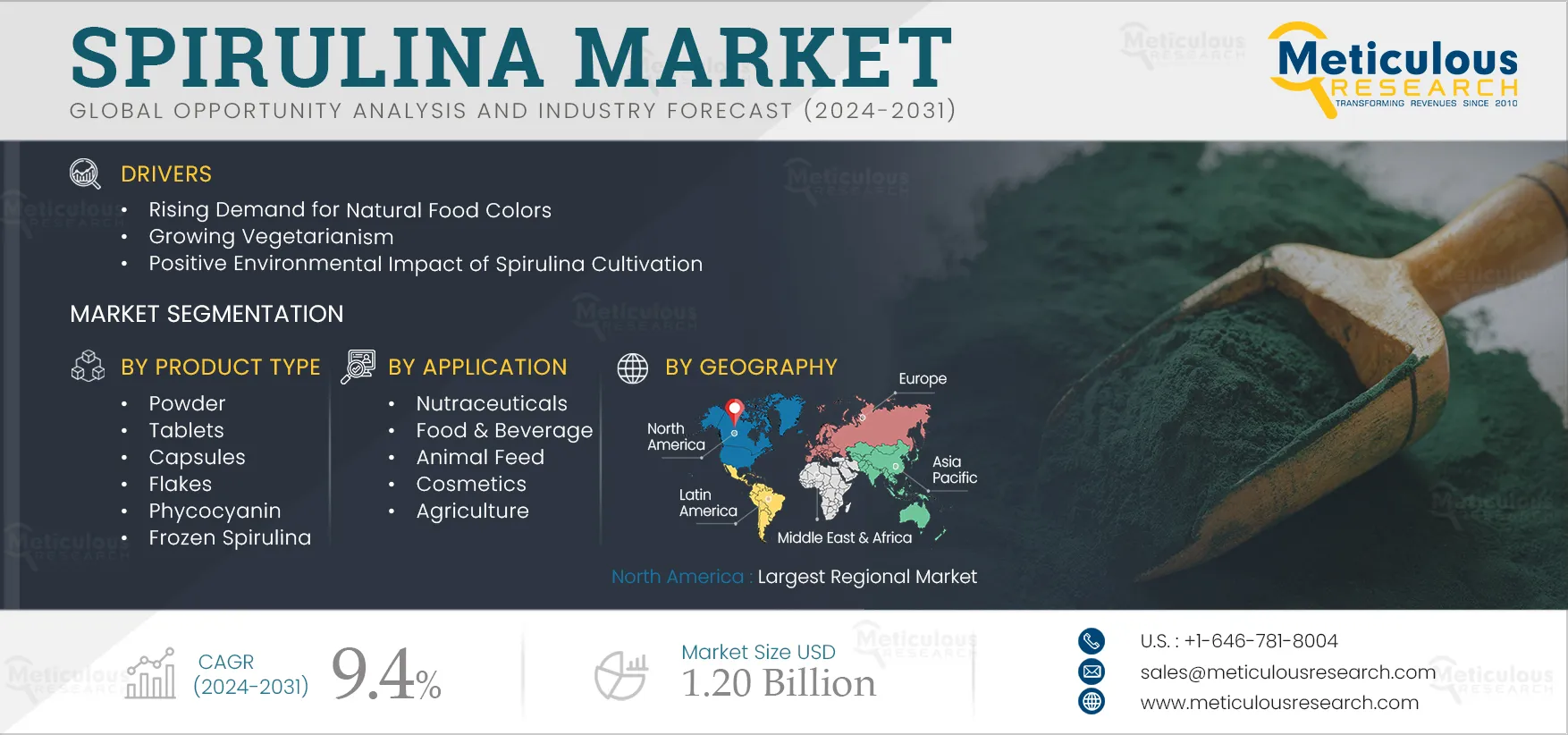

The Spirulina Market is expected to reach $1.1 billion by 2030, at a CAGR of 9.4% from 2023 to 2030, while in terms of volume, the market is expected to reach 102,381.3 tons by 2030, at a CAGR of 8% from 2023 to 2030. The increasing health & wellness trends and dietary supplements industry, rising demand for natural food colors, growing vegetarianism, positive impact on the environment with spirulina cultivation, strict regulations regarding the inclusion of synthetic colors and flavors, growing preference for spirulina-sourced products, increasing use of spirulina in aquaculture, and growing investments from natural-color manufacturers are the key factors driving the growth of the spirulina market. Furthermore, the emergence of new application areas, growing demand for phycocyanin, rising demand for spirulina from biorefineries, and increasing demand for fresh/frozen spirulina are expected to offer significant opportunities for the players operating in this market.

Increasing Health & Wellness Trends and Dietary Supplements Industry to Drive the Growth of the Spirulina Market

In the last few decades, the use of dietary supplements (DSs), such as vitamins, minerals, and nutritional and herbal supplements (VMHS), has been steadily increasing, and additionally, the sales of dietary supplements have dynamically increased during the COVID-19 pandemic. According to the American National Standards Institute, global dietary supplement sales increased from USD 220 billion in 2021 and are expected to reach USD 252 billion in 2025. Factors such as the aging population, increased consumer awareness for preventative healthcare, the rising self-directed consumer (self-diagnosis over health practitioner diagnosis), channel proliferation (variety of marketing techniques and E-commerce), and shift from ingredient-focused messaging to broader brand positioning (grouping of supplements together to form a healthy benefits package) are supporting the growth of this supplements industry, globally.

Spirulina is widely used as a food supplement and is certified as generally recognized as safe (GRAS) by the U.S. FDA for consumption among all age groups. It contains a combination of nutrients. Many people use spirulina as a self-care strategy for more energy, nutritional insurance, weight control, and cleansing. Apart from its use as a food supplement in ameliorating nutritional deficiencies, spirulina is gaining more attention from medical scientists as a nutraceutical. It was also successfully used by the National Aeronautics and Space Administration (NASA) as a dietary supplement for astronauts on space missions, as it can modulate immune functions and exhibits anti-inflammatory properties.

Moreover, spirulina is considered a nutrient powerhouse due to its unique nutrient blend. It has a high protein concentration, including all eight essential amino acids in a balanced proportion. It is rich in beta-carotene, vitamin E, and iron.

Owing to its diverse nutritional value and antioxidant and protective health benefits, spirulina is gaining more attention from health-conscious consumers worldwide, driving the growth of the global spirulina market.

Click here to: Get a Free Sample Copy of this report

Key Findings in the Spirulina Market Study:

In 2023, the Powder Segment to Dominate the Spirulina Market

Based on product type, in 2023, the powder segment is expected to account for the largest share of the spirulina market. The large market share of this segment is attributed to its rising demand from nutraceutical manufacturers due to the growing health consciousness among consumers, the increasing use of spirulina powder as an ingredient in various food & beverage products, the growing popularity of the vegan diet, and adoption of herbal ingredients in cosmetic products.

In 2023, the Business Channel Segment to Dominate the Spirulina Market

Based on distribution channel, in 2023, the business channel segment is expected to account for the largest share of the spirulina market. The large market share of this segment is attributed to the direct purchase of bulk spirulina in large quantities by various manufacturers, such as nutraceuticals, food & beverages, and animal feed, among others, for further product development.

The Food & Beverages Segment to Witness Highest Demand During the Forecast Period

Based on application, in 2023, the food & beverages segment is projected to witness significant growth during the forecast period of 2023–2030. The rapid growth of this segment is mainly driven by the growing demand for spirulina natural food color in confectionery products (including candy and chewing gum), frostings, ice cream and frozen desserts, dessert coatings and toppings, beverage mixes and powders, yogurts, custards, puddings, cottage cheese, gelatin, breadcrumbs, and ready-to-eat cereals.

Europe: Fastest-growing Regional Market

Based on geography, in 2023, North America is expected to account for the largest share of the spirulina market, followed by Asia-Pacific, Europe, Latin America, and the Middle East & Africa. The large market share of North America is attributed to growing awareness among consumers for natural food products, rising strict regulations against synthetic colors, growing demand for nutraceuticals, growth of subsidiary industries, like cosmetics and biofertilizers, increasing preference for natural protein sources, and presence of key spirulina manufacturers with huge production capacities, especially in the U.S.

However, the market in Europe is slated to register the fastest growth rate during the forecast period. The growth of this regional market is driven by the scientific and technological advances in microalgae research for health food and dietary supplement applications, rising consumer awareness regarding the benefits of natural food products, growing reluctance towards the usage of synthetic colors, the increased adoption of phycocyanin in the manufacturing of therapeutic & nutritional products, rising demand for natural blue colorants, and investments from leading color houses in the phycocyanin space.

Key Players:

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants in the spirulina market between 2019 and 2023. The key players profiled in this spirulina market study are Clos Sainte Aurore (France), Spirulina Viva (Mexico), SPIFORM (France), Spirulina La Capitelle (France), Aurospirul (India), Far East Microalgae Industries, Co., Ltd. (Taiwan), Fuqing King Dnarmsa Spirulina Co., Ltd. (China), DIC Corporation (Japan), E.I.D. - Parry (India) Limited (a subsidiary of M/s. Ambadi Investments Limited) (India), Cyanotech Corporation (U.S.), C.B.N. Bio-engineering Co., Ltd (China), Yunnan Green A Biological Project Co., Ltd. (a Subsidiary of Yunnan Spirin Biotechnology Co. Ltd) (China), Jiangshan Comp Spirulina Co., Ltd (China), Inner Mongolia Rejuve Biotech Co., Ltd. (China), Zhejiang Binmei Biotechnology Co., Ltd. (China), Bluetec Naturals Co., Ltd. (China), Taiwan Chlorella Manufacturing Company (TCMC) (Taiwan), Roquette Klötze GmbH & Co. KG (Germany), Vedan Biotechnology Corporation (Taiwan), AlgoSource (France), Tianjin Norland Biotech Co., Ltd. (China), Allmicroalgae Natural Products S.A. (Portugal), Aliga Microalgae (Denmark), Taiwan Wilson Enterprise Inc. (Taiwan), Algalimento SL (Spain), Seagrass Tech Private Limited (India), Plankton Australia Pty Limited (Australia), Hangzhou Ouqi Food Co., Ltd. (China), JUNE Spirulina (a Part of JUNE Group of Companies) (Myanmar), Ordos Xinyuli Spirulina Industry Group Co., Ltd. (China), Qingdao Haizhijiao Biotechnology Co., Ltd. (China), BlueBioTech Group (Germany), Sea & Sun Organic GmbH (subsidiary of Sea & Sun Technology GmbH) (Germany), Pond Technologies Inc. (Canada), Far East Bio-Tec. Co., Ltd. (FEBICO) (Taiwan), Givaudan SA (Switzerland), Nutragreenlife Biotechnology Co. Ltd. (branch of Greenlife Biotechnology Co., Ltd.) (China), Xi’an Fengzu Biological Technology Co., Ltd. (FZBIOTECH) (China), and Necton S.A. (Portugal).

Scope of the Report:

Spirulina Market, by Product Type

- Powder

- Tablets

- Capsules

- Flakes

- Phycocyanin

- Frozen Spirulina

Spirulina Market, by Distribution Channel

- Business Channel

- Consumer Channel

Spirulina Market, by Application

- Nutraceuticals

- Food & Beverage

- Animal Feed

- Cosmetics

- Agriculture

Spirulina Market, by Geography

- North America

- Europe

- France

- Germany

- U.K.

- Italy

- Spain

- Netherlands

- Denmark

- Sweden

- Rest of Europe (RoE)

- Asia-Pacific (APAC)

- China

- India

- Japan

- Australia

- Thailand

- Rest of Asia-Pacific (RoAPAC)

- Latin America (LATAM)

- Brazil

- Mexico

- Rest of Latin America (RoLATAM)

- Middle East & Africa (MEA)

- Egypt

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa (RoMEA)

Key Questions Answered in the Report: