Resources

About Us

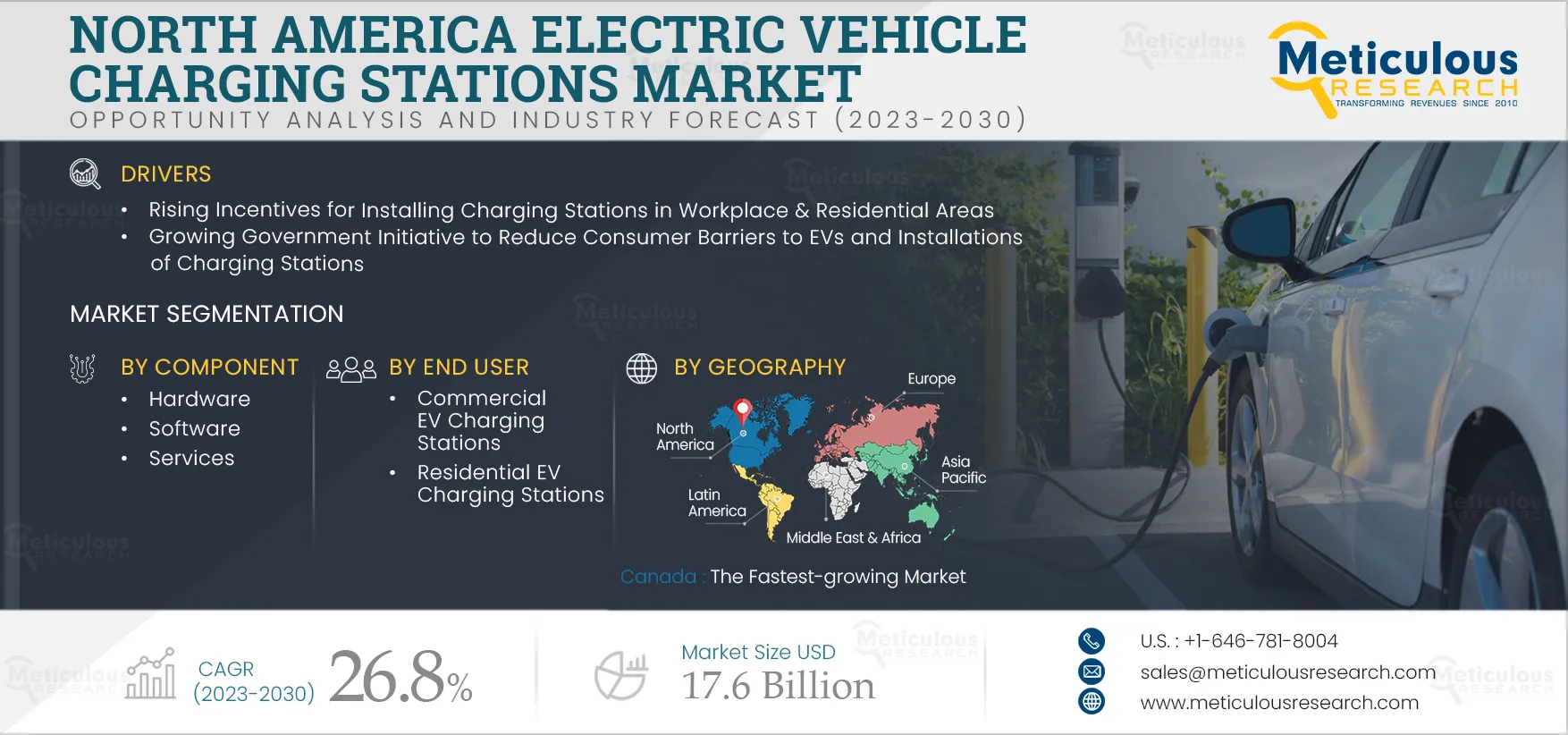

North America Electric Vehicle Charging Stations Market by Component, Charging Type, Connection Type (Connectors, Wireless Charging), Mounting Type, Vehicle Type (Passenger Cars, Two-wheelers & Scooters), End User and Geography - Forecast to 2030

Report ID: MRSE - 104535 Pages: 200 Jul-2023 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 48 Hours Download Free Sample ReportThe North America Electric Vehicle Charging Stations Market is projected to reach $17.6 billion by 2030, at a CAGR of 26.8% during the forecast period of 2023–2030. The growth of this market is driven by the rising incentives for installing charging stations in workplace & residential areas and the growing government initiative to reduce consumer barriers to EVs and installations of charging stations. However, the lack of grid capacities to support EV charging stations restrains the growth of this market. Furthermore, retail MNCs' growing deployment of charging stations and increasing electric mobility adoption is expected to create market growth opportunities. However, the uncertainty about financing charging station installations is a major challenge for players in this market. The latest trend in this market is electric vehicle charging stations powered by renewable energy.

Electric vehicles are rapidly evolving due to advancements in battery and drivetrain technologies. Consumers’ increasing preference for shared mobility, the growing adoption of mobility-as-a-service (MaaS), the declining prices of high-capacity batteries, and significant investments from EV manufacturers are driving the adoption of electric mobility. Several companies are focused on developing innovative solutions for electric mobility and charging infrastructure. The number of public EV charging stations has also risen significantly to support the increasing adoption of EVs. In developed countries with high EV adoption rates, public places, including retail stores, supermarkets, and hypermarkets, where consumers visit frequently, have started deploying EV charging stations. Moreover, retailers are considering deploying charging stations to attract more premium consumers. Thus, the increasing deployment of charging stations by retail stores and supermarkets, among other public places, is expected to accelerate the growth of the EV charging stations market.

Click here to: Get a Free Sample Copy of this Report

Key Findings in the North America Electric Vehicle Charging Stations Market Study:

The Software Segment to Register the Highest CAGR During the Forecast Period

Among the components studied in this report, the software segment is projected to register the highest CAGR during the forecast period. The growing need for managing EV fleets in real-time and increasing transparency in electricity consumption and demand charges are expected to support the growth of this segment.

The DC Fast Charging to Register the Highest CAGR During the Forecast Period

Among the charging types covered in this report, the DC fast charging segment is projected to register the highest CAGR during the forecast period. The increasing investments from automakers towards the development of DC fast charging station infrastructure to support their long-range battery-electric vehicle and increasing installation of DC fast chargers in public locations along highways are expected to support the growth of this segment.

The Connectors Segment to Register the Highest CAGR During the Forecast Period

Among all the connection types segmented in this report, the connectors segment is projected to register the highest CAGR during the forecast period. The increasing development and adoption of standardized connector types ensure compatibility between charging stations and electric vehicles. The growing need for reliable connectors to minimize the risk of electrical faults, overheating, and other potential hazards, is further expected to support this segment's growth.

The Heavy Commercial Vehicles Segment to Register the Highest CAGR During the Forecast Period

Based on vehicle type, the heavy commercial vehicles segment is projected to register the highest CAGR during the forecast period. The rising government subsidies & tax rebates for promoting EV adoption and the increasing adoption of electric buses and trucks for public transport and freight services are expected to support the growth of this segment.

The Commercial EV Charging Stations Segment to Register the Highest CAGR During Forecast Period

Based on end user, the commercial EV charging stations segment is projected to register the highest CAGR during the forecast period. The increasing government regulations and incentives for electric vehicle adoption in commercial fleets and increasing Infrastructure development for shared mobility services is expected to support the growth of this segment.

Canada to be the Fastest-growing Market

Canada is projected to register the highest CAGR during the forecast period. The increasing EV deployment by shared mobility operators, growing government initiative for implementing a zero-emission vehicle plan, and rising government in EV charging infrastructure, as well as research and development to develop faster and more efficient charging methods, are expected to support the market growth in the country during the forecast period.

Key Players

The key players operating in the North America electric vehicle charging station market include ChargePoint Holdings, Inc. (U.S.), Blink Charging Co. (U.S.), ABB Ltd. (Switzerland), Tesla, Inc. (U.S.), BP p.l.c. (U.K.), EVgo Inc.(U.S.), Shell Plc (U.K.), EVBox Group (Netherlands), Electrify America LLC (U.S.), AddÉnergie Technologies Inc. (Canada), HANGZHOU AONENG POWER SUPPLY EQUIPMENT CO., LTD. (China), Webasto Group (Germany), EV Charging Installers America LLC, and Siemens AG (Germany).

Scope of the report:

North America Electric Vehicle Charging Stations Market Assessment, by Component

North America Electric Vehicle Charging Stations Market Assessment, by Charging Type

North America Electric Vehicle Charging Stations Market Assessment, by Connection Type

North America Electric Vehicle Charging Stations Market Assessment, by Mounting Type

North America Electric Vehicle Charging Stations Market Assessment, by Vehicle Type

North America Electric Vehicle Charging Stations Market Assessment, by End User

North America Electric Vehicle Charging Stations Market Assessment, by Country

Key questions answered in the report:

The North America electric vehicle charging station market is projected to reach $17.6 billion by 2030, at a CAGR of 26.8% during the forecast period.

In 2023, the pedestal mount is expected to account for the largest share of the North America electric vehicle charging station market. The large market share of this segment is attributed to the increasing installation of Level 2 pedestal mounts in retail stores, supermarkets, and fuel stations and the growing adoption of industrial EV fleet management and commercial charging stations.

The growth of this market is driven by the rising incentives for installing charging stations in workplace & residential areas, growing government initiatives to promote EV adoption and the development of associated infrastructure, and the increasing EV deployment by shared mobility operators. Furthermore, the increasing adoption of electric mobility and growing government support for zero-emission vehicles (ZEVs) are expected to create market growth opportunities.

The key players operating in the North America electric vehicle charging station market include ChargePoint Holdings, Inc. (U.S.), Blink Charging Co. (U.S.), ABB Ltd. (Switzerland), Tesla, Inc. (U.S.), BP p.l.c. (U.K.), Shell Plc (U.K.), Électricité De France (France), EVBox Group (Netherlands), Connected Kerb Limited (U.K.), HANGZHOU AONENG POWER SUPPLY EQUIPMENT CO., LTD. (China), Webasto Group (Germany), and Siemens AG (Germany).

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates