Resources

About Us

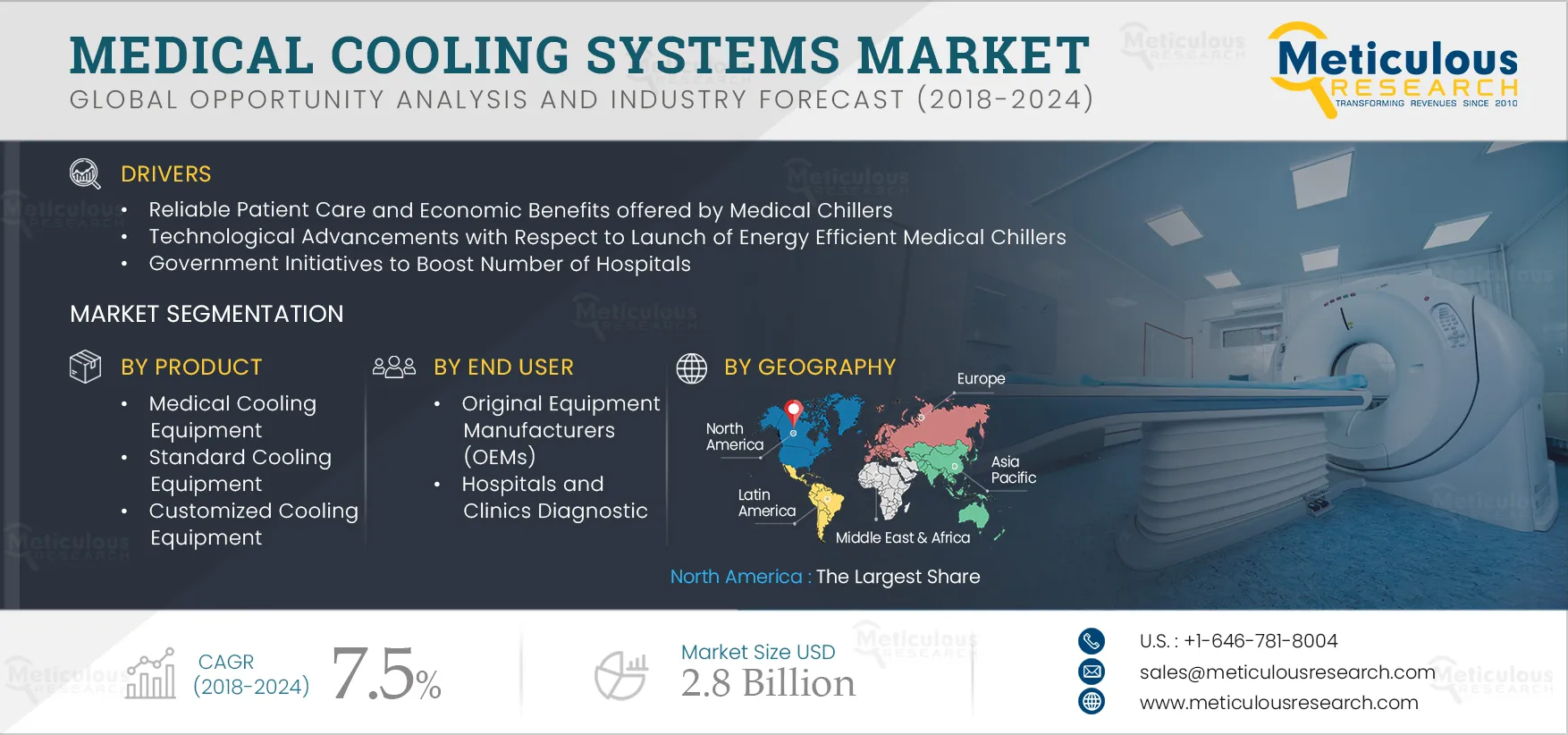

Medical Cooling Systems Market By Product [Equipment (Standard, Customize), Accessories], Type (Air Cooled), Model (Split, Modular System), Compressor (Scroll, Screw), Application (MRI, CT, PET, Laser), End User (OEM, Hospital)- Global Forecast To 2024

Report ID: MRHC - 104142 Pages: 202 Jan-2019 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe global medical cooling systems market is expected to reach $2.8 billion by 2024, at a CAGR of 7.5% from 2018. The prevalence of chronic diseases is rising along with the growing aging population. This, in turn, is leading to growth in the volume of medical diagnostic procedures across the globe. Owing to this, demand for medical imaging equipment such as MRI, CT, and PET is also on the rise. The growing usage and demand of medical equipment is subsequently generating the demand for medical cooling systems which are deployed to reduce their heat load.

Key findings in the medical cooling systems market study:

Medical cooling equipment dominates the global market

In healthcare industry, medical imaging systems are frequently used for diagnosis of diseases. These systems generate lot of heat during the procedures. The medical cooling systems help to reduce the heat produced by the equipment and thereby maintain the equipment in good working condition and achieve the healthcare organization’s objective of quality patient care. Medical cooling systems market consists of equipment and accessories, wherein, equipment dominated the market owing to high demand from medical imaging system manufacturers and higher revenue volume compared to accessories.

Air-cooled chillers are expected to grow at the fastest CAGR

Water-cooled medical cooling systems have been used since long. This is due to their advantages such as low compressor cost, greater life span, low noise, suitability for facilities with small space and restricted air flow, and absence of toxic refrigerants. However, the trend is rapidly shifting towards adoption of air-cooled medical cooling systems. Their growing efficiency and mounting shortage of water across the globe are two of the major driving factors for the shift in the trend.

Click here to: Get Free Request Sample Copy of this report

Modular systems are expected to grow at the fastest CAGR

Though, packaged systems is the dominating segment of the medical cooling systems, the modular systems are expected to grow at fastest rate due to growing demand attributed to compact size and multiple modes of operations within a single unit. Further, the technological advancement in modular systems have led to enhanced flexibility and multi-functional configurations as well as energy efficiency & cost saving compared to other systems.

Scroll compressors commanded the largest share in medical cooling systems

Scroll compressors due to their advantages such as higher efficiency in terms of heat rejection capacity and less vibrations & noise compared to other types, commanded the largest share. Moreover, the medical cooling systems comprising oil-free scroll compressors are likely to witness high demand from the medical industry.

Imaging application segment driving gains

Based on application, the market is segmented into imaging applications, cold storage and testing, dehumidification, and laser application. The imaging application segment including MRI, CT, Linear Accelerator, PET, and others represented more than 50% demand in 2017 and will continue to have the greatest impact on gains through 2024.

Original Equipment Manufacturers (OEMs) are the largest end users

OEMs are the major end users owing to the fact that the medical cooling systems are largely required by them for manufacturing of diagnostic imaging systems. In addition to this, the ample availability of imaging equipment specific cooling systems from various manufacturers and relatively high purchasing power of OEMs will further boost the demand for medical cooling equipment. OEMs such as General Electric (U.S.), Siemens (Germany), and Philips (the Netherlands) are some of the major customers of medical cooling system vendors.

Medical Cooling Systems Market Geographic Analysis

Geographically, the market is segmented into North America (U.S., and Canada), Europe (Germany, France, the U.K., Italy, Spain, and RoE), Asia-Pacific (Japan, China, India, and RoAPAC), Latin America, and Middle East & Africa. North America commanded the largest share of the global medical cooling systems market, followed by Europe and Asia-Pacific. The large share of this market is mainly attributed to the well-established healthcare system in the region, greater adoption of advanced technologies, growing prevalence of non-communicable diseases, and presence of key players. However, countries in Asia-Pacific and Latin America are expected to witness significant growth during the forecast period due to accelerated economic growth in many countries; growing government focus on healthcare sector; rising prevalence of chronic diseases; increasing number of hospitals & diagnostic centers; and growing geriatric population in the region.

Medical Cooling Systems Market Key Players

The key players profiled in the global medical cooling systems market research report are Lytron Inc. (U.S.), Filtrine Manufacturing Company (U.S.), Carrier Corporation (U.S.), Ecochillers Inc. (U.S.), Parker Hannifin Corporation (U.S.), Legacy Chiller Systems, Inc. (U.S.), Motivair Corporation (U.S.), Cold Shot Chillers (U.S.), American Chiller Service, Inc. (U.S.), General Air Products, Inc. (U.S.), Drake Refrigeration, Inc. (U.S.), KKT chillers, Inc. (U.S.), Glen Dimplex Group (Ireland), Johnson Thermal Systems Inc.(U.S.), and Whaley Products, Inc. (U.S.) among others.

Scope of Medical Cooling Systems Market Report:

Market, By Product

Market, By Type

Market, By Model

Market, By Compressor Type

Market, By Application

Market, By End User

Market by Geography

Key questions answered in Medical Cooling Systems Market report:

Growing penetration of medical cooling systems in developing countries will propel the overall medical cooling systems market

Original equipment manufacturers (OEMs) account for the largest share of the medical cooling systems market, globally

Medical cooling systems market favors both larger and local manufacturers that compete in multiple segments

Recent partnerships, acquisitions, and expansions have taken place in the global medical cooling systems market

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jun-2024

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates