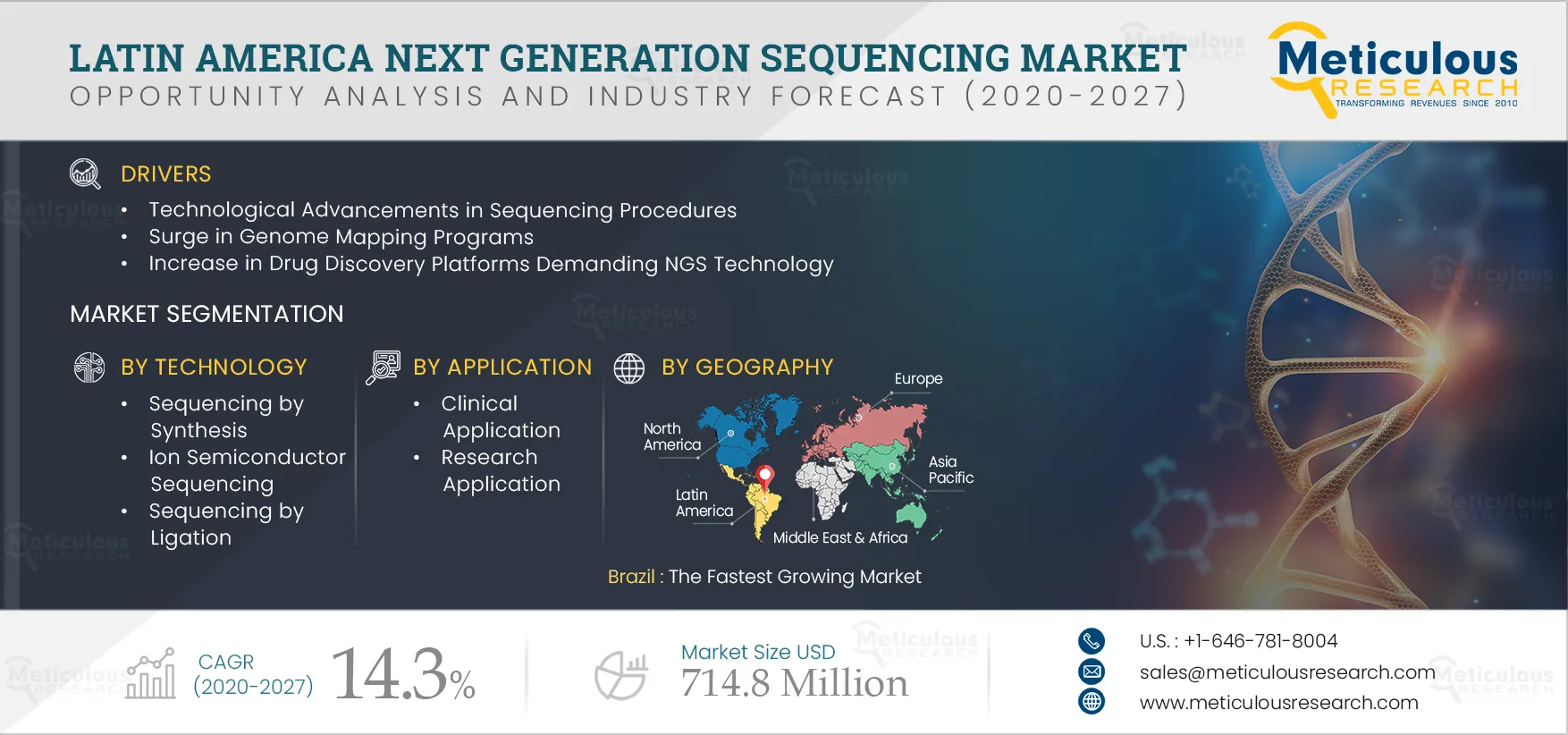

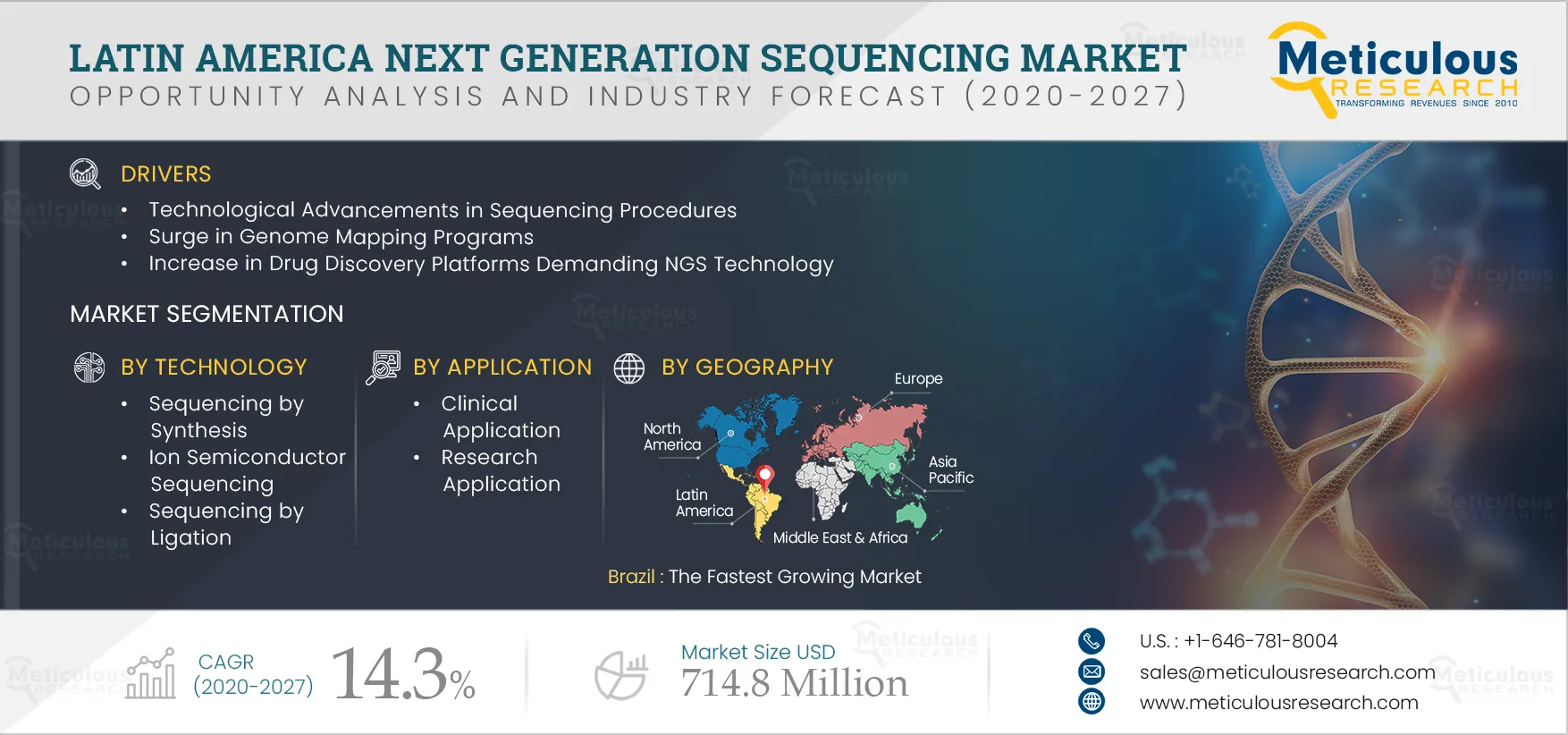

The Latin America NGS Market is expected to grow at a CAGR of 14.3% from 2020 to 2027 to reach $714.8 million by 2027. Next generation sequencing is a technology used to determine the sequence of DNA or RNA to study genetic variation associated with diseases. The speed, throughput, and accuracy of NGS has revolutionized genetic analysis and enabled its use in new applications in genomic and clinical research; reproductive health; and environmental, agricultural, and forensic science. The growth in this market is majorly driven by the technological advancements in sequencing procedures, surge in genome mapping programs, and increase in drug discovery platforms demanding NGS technology. Further, the growth in personalized medicine research, growing government initiatives for large-scale genomic sequencing projects, and emergence of cloud computing as a potential data management service supports the growth of the Latin America NGS market.

COVID-19 Impact on the Latin America Next Generation Sequencing (NGS) Market

Throughout the COVID-19 pandemic, uncertainty in tests and false positive results led to ingenuity and raised questions on the global healthcare system including Latin America. In such times, next generation sequencing turned out to be a blessing in disguise and helped the healthcare systems to effectively diagnose the disease. According to the U.S. Food and Drug Administration (FDA), the information about the sequence of viral genome can help the researchers to identify how the virus mutates, which will be crucial for ongoing efforts to continue to learn and fight this virus.

Realizing its importance, the key players have also shifted their focus towards development of advanced instruments and products, which could aid in COVID-19 diagnosis. For instance, recently in June 2020, Illumina, Inc. (U.S.) received an emergency authorization from the FDA for its COVID-19 test designed to sequence the full genome of the novel coronavirus. COVIDSeq test is capable of processing over 3,000 samples at once from nasopharyngeal and oropharyngeal swabs and gives results in 24 hours. Also, RNA sequencing was employed in positive samples to develop epidemiological, phylodynamic models of the spread of SARS-CoV-2 in various regions including the Latin America.

Owing to the advantages offered by this technology and rapidly rising cases of COVID-19, the demand for NGS instruments and test kits is exponentially increasing in Latin America, thereby supporting the growth of the NGS market in the region.

Click here to: Get Free Sample Pages of this Report

Surge in genome mapping programs is driving the growth of the Latin America NGS market

According to the Global Cancer Observatory (GLOBOCAN) and National Center for Biotechnology Information (NCBI), in 2018, 1,412,732 new cancer cases were detected in the region. Further, these numbers are expected to increase by 78% by 2040 to more than 2.5 million people diagnosed with cancer each year. Also, according to the same source, cancer burden is expected to increase among adults aged 65 years and older in Latin America and the Caribbean. Therefore, due to growing prevalence of genetic disorders in the region, the governments are launching genome mapping programs which are driving the demand for sequencing products. For instance:

-

In December 2019, a project called DNA do Brasil was launched with an aim to sequence DNA of 15,000 Brazilians. The major aim of the project was to treat and prevent genetic disorders in the country based on genetic analysis.

- Similarly, in Mexico, Mexican Biobank project was initiated to generate genomic data on nearly 10,000 Mexican individuals with linked demographics and medical data. The project was collaborated and brought together collaborators from Mexico (LANGEBIO, INSP, INCMNSZ), the U.K. (University of Oxford, the Jenner Institute, Wellcome Trust’s WTCHG), and the U.S. (Stanford University, University of Colorado).

- In June 2018, as a part of Peruvian Genome Project, team from the U.S., Peru, and Brazil analyzed the genomes of 280 Native American individuals from Peru. This study was done to analyze and understand the population dynamics of Peru.

Increase in drug discovery platforms demanding NGS technology supports the market growth

Due to NGS capabilities, increasing applications, and growing trend of personalized medicine, various projects related to drug development, research, and clinical diagnostics procedures are ongoing in the region. According to the National Center for Biotechnology Information (NCBI), as of 2017, 221 NGS platforms and 118 research groups in Latin America were involved in developing cancer genomics project. For instance:

- In Brazil, due to huge progress in the next-generation sequencing (NGS) techniques, various projects have been initiated to study HIV genetic diversity through generation of HIV complete or near full-length genomes (NFLG) and improving the characterization of intra- and interhost diversity of viral populations.

- Similarly, in Colombia, NGS is used to detect, diagnose, and control viral diseases in plants to generate plants resistant to viral infections.

- Also, in Chile, screening by Next Generation Sequencing (NGS) is used to detect porcine 3 circovirus type 3. The detection of viral species of porcine using its RNA and DNA genomes simultaneously can be useful for detection of swine viral emerging diseases worldwide.

Key findings in the Latin America NGS market study:

Targeted sequencing segment to dominate the NGS market through 2027

Based on sequencing type, the targeted sequencing segment is estimated to command the largest share of the next-generation sequencing technologies market in Latin America in 2020, owing to its capability to call variants, comparative cost effectiveness, and ability to generate manageable data volumes with reliable results.

Sequencing by synthesis to witness the fastest growth during the forecast period

Based on technology, the sequencing by synthesis segment is estimated to hold the major share of the Latin America next-generation sequencing market in 2020 and is also projected to grow at the fastest CAGR during the forecast period. The large share of this segment is attributed to the high accuracy of SBS technology in DNA sequencing, highest yield of error free throughput, and growing incorporation of this technology in NGS instrumentation.

Clinical application to witness the fastest growth during the forecast period

Based on application, clinical applications will register the fastest growth during the analysis period, mainly due to the growing incidence of cancer and increasing volume of diagnostic procedures and treatment rates for the disease.

Clinical diagnostic laboratories to dominate the overall NGS market in Latin America in 2020

Based on end-user, the clinical diagnostic laboratories segment is estimated to account for the largest share of the Latin America next-generation sequencing market in 2020. Rising pool of cancer patient population visiting diagnostic laboratories for diagnosis & treatment owing to easy accessibility is driving the growth of this end user segment. Also, the improving healthcare infrastructure across the countries in this region also supports the growth of the next-generation sequencing market for clinical diagnostic laboratories.

Brazil: The fastest growing market

Brazil is estimated to command the largest share of the Latin America NGS market in 2020 and will be the fastest growing market due to growing investments in genomic research, growing research activities related to treatment of viral and infectious diseases, and high focus of key players on this country.

Key Players

The report includes competitive landscape based on extensive assessment of the key strategic developments adopted by leading market participants in the industry over the past 4-5 years. The key players profiled in the Latin America NGS market report are Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Pacific Biosciences of California, Inc. (U.S.), Qiagen N.V. (Germany), Oxford Nanopore Technologies Ltd (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Beckman Coulter, Inc. (U.S.), PerkinElmer, Inc. (U.S.), F. Hoffmann-La Roche AG (Switzerland), and 10x Genomics, Inc. (U.S.).

Scope of the Report:

Latin America NGS Market by Type

- Consumables

- Sample Preparation Consumables

- DNA Fragmentation & Amplification

- Library Preparation & Target Enrichment

- Quality Control

- Other Consumables

(Note: Other consumables include vials, pipettes, containers, trays, tubes, and more)

- NGS Platforms/Instruments

- Illumina NGS Platforms/Instruments

- Thermo Fisher Scientific NGS Platforms/Instruments

- Pacific Biosciences NGS Platforms/Instruments

- Oxford Nanopore NGS Platforms/Instruments

- Others

(Note: Other instruments used during NGS include PCR systems, automated liquid handling systems, electrophoresis devices, library preparation devices, and more)

Latin America NGS Market by Sequencing Type

- Whole Genome Sequencing

- Whole Exome Sequencing

- Targeted Sequencing

- Others

(Note: Other sequencing approaches include RNA sequencing, de-novo sequencing, degradome sequencing, miRNA sequencing, chromatin immunoprecipitation (ChIP) sequencing, and methylation sequencing)

Latin America NGS Market by Technology

- Sequencing by Synthesis

- Ion Semiconductor Sequencing

- Sequencing by Ligation

- Single-Molecule Real-Time Sequencing

- Nanopore Sequencing

- Others

(Note: Other sequencing technologies include Polony sequencing, pyrosequencing, DNA nanoball sequencing, and true Single Molecule Sequencing (tSMS))

Latin America NGS Market by Application

- Clinical Application

- Oncology

- Reproductive Health Diagnostics

- Non-Invasive Pre-natal Testing

- Carrier Screening

- In-Vitro fertilization

- Newborn Screening

- Cardiovascular

- Others

(Note: Other clinical applications include detection of genetic aberrations in neurological disorders, rare diseases, metabolic and immune disorders, and food borne illness)

- Research Application

- Drug Discovery

- Agriculture & Animal Research

- Others

(Note: Other research applications include food microbiology, microbiota analysis in beverage industry, and environmental studies)

Latin America NGS Market by End user

- Clinical Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Others

(Note: Other end-users include forensic departments, food companies, and hospitals)

Latin America NGS Market by Country

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Areas of Focused Research Services in Latin America:

- Market Access

- Regulatory Scenario

- Top Technology Trends

- End User Perception Analysis

- Partner Identification

- Due Diligence

- Distribution Channel Assessment

- Supply Chain Analysis

- Procurement Practices

- Key Customer Assessment

- Others

Key questions answered in the report-