Resources

About Us

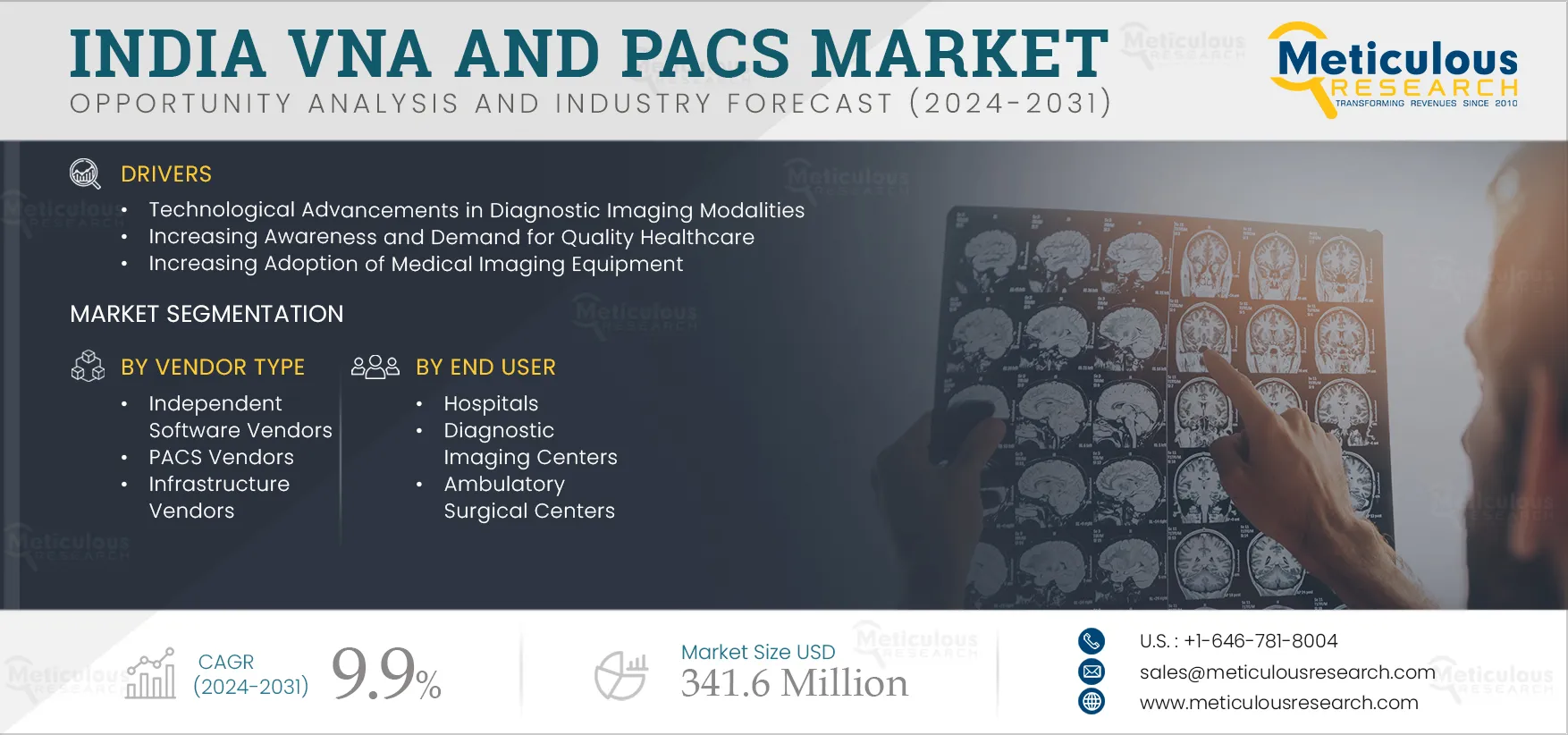

India VNA & PACS Market Size, Share, Forecast, & Trends Analysis by Procurement (PACS [Departmental {Radiology, Mammography} Enterprise], VNA [Enterprise, Multi-site]), Imaging [CT, MRI], Delivery (On-premise, Hybrid), Vendor Type - Forecast to 2031

Report ID: MRHC - 104260 Pages: 220 Sep-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of this market can be attributed to several factors, including advancements in diagnostic imaging technologies, heightened awareness and demand for quality healthcare, increased adoption of medical imaging equipment, a rising need for a filmless environment, growing adoption of health IT and Electronic Health Records (EHR), and an expanding geriatric population. However, budget constraints and a shortage of skilled professionals may restrain the market’s growth.

In addition, the integration of artificial intelligence (AI) in medical imaging and the rapidly growing telehealth market are expected to generate growth opportunities for market stakeholders. However, inadequate infrastructure and high out-of-pocket expenses resulting from gaps in health insurance coverage are challenges that impede the market's growth.

Additionally, the rising adoption of cloud-based solutions and the emphasis on developing diagnostic imaging centers are prominent trends in the India VNA and PACS market.

The increasing demand for imaging services is driven by the need to enhance diagnosis and treatment while avoiding unnecessary surgical procedures. Imaging, once primarily a diagnostic tool, is now leveraged for the treatment, management, and prediction of various illnesses. It has become essential for a wide range of major medical conditions, including cancer, cardiovascular diseases, trauma, and neurological disorders.

Technological advancements in modalities such as MRI, PET, CT, and Ultrasound have significantly transformed modern healthcare. The integration of 3D and 4D technologies has further improved image quality, facilitating better diagnostics in radiology. In addition, advancements in automation, reproducibility, and portability have increased complexity and generated vast amounts of data, necessitating advanced solutions for effective data management.

Technological advancements like Digital Breast Tomosynthesis (DBT), or 3D mammography, have become the new standard in breast imaging due to their significant improvements in lesion visibility and early cancer detection. Additionally, the evolution of Digital Radiography (DR) has increasingly transitioned into mobile applications, allowing healthcare providers to conduct imaging exams anywhere by equipping digital X-ray systems on mobile carts. These advancements in imaging modalities are anticipated to drive the demand for efficient data storage solutions, such as PACS and VNA, in India.

Click here to: Get Free Sample Pages of this Report

Growing Digitalization in India

The IT revolution in India has significantly enhanced cellular coverage and wireless connectivity in urban and many rural areas, creating an ideal platform for the development of telehealth services and improving healthcare accessibility across the country. This growth in telehealth services enables faster turnaround times in outpatient departments and patient wards. However, these digital healthcare services require immediate access to a chronological series of archived images during patient follow-ups, necessitating robust archiving systems like PACS and VNA.

In December 2022, the Government of India launched the Digital India plan, aimed at transforming the country into a digitally empowered society and a knowledge-based economy through enhanced digital access, inclusion, and efforts to bridge the digital divide. This initiative focuses on three key areas: governance and on-demand services, digital infrastructure as a fundamental utility for all citizens, and empowering digital citizens. Ultimately, the goal is to ensure that digital technologies enhance the lives of all individuals, drive investment and job creation, expand India's digital economy, and develop digital skills across the nation.

As a result, the ongoing technological advancement and digitalization in the healthcare sector are expected to create significant growth opportunities for various digital healthcare technologies, including Electronic Health Records (EHR), Electronic Medical Records (EMR), PACS, and VNA. This will facilitate the effective management of medical images in healthcare organizations, thereby strengthening the PACS and VNA market in India.

Telehealth services rely heavily on digital imaging and remote consultations, both of which require advanced storage and management systems for medical images and data. The rising popularity of telehealth, fueled by the demand for remote healthcare services, improved internet access, and increased smartphone penetration, has led to a growing demand for VNA and PACS systems in India. These systems are essential for the secure retrieval, storage, and transmission of medical images and data between healthcare facilities and remote clinicians.

Additionally, data published by the Indian Brand Equity Foundation (IBEF) in November 2023 indicates that the Indian telemedicine market is projected to grow significantly, from USD 830 million to USD 5.5 billion by 2025, reflecting a 31% CAGR during this period. The integration of VNA and PACS with telehealth platforms enhances the efficiency of telemedicine services by enabling instant access to patient data and facilitating real-time consultations with specialists. This integration improves diagnostic accuracy, workflow efficiency, and patient outcomes. As India's telehealth sector continues to expand, the demand for advanced VNA and PACS solutions is expected to rise, driving innovation in the healthcare IT space and improving access to high-quality healthcare services in the country.

The increasing application of AI and machine learning (ML) in medical imaging is anticipated to yield numerous benefits, including enhancements in diagnostic accuracy and efficiency. Radiologists leverage AI to improve workflow and diagnostic capabilities and support predictive healthcare initiatives. However, developing these image-analyzing algorithms requires the collection of substantial volumes of curated medical images, which must be processed to enable the algorithm to learn and identify distinguishing features.

AI plays a crucial role in medical image analysis by detecting changes in scans and streamlining treatment planning through the analysis of large datasets. It also enhances operational efficiency by preventing experts from repetitive tasks. Major radiology PACS and diagnostic imaging vendors, such as Philips Healthcare, Siemens Healthineers, and GE Healthcare, are actively developing their own AI solutions. Notably, in January 2024, Koninklijke Philips N.V. launched an AI-driven enterprise imaging portfolio at the 76th Annual Conference of the Indian Radiological and Imaging Association (IRIA) 2024. This portfolio includes next-generation Ultrasound, MRI, and CT systems, enabling healthcare providers to enhance operational performance and workflow efficiency while supporting more informed clinical decision-making.

Healthcare data is experiencing exponential growth in both volume and complexity, driven by diverse sources and applications. This trend has prompted healthcare vendors to develop innovative solutions utilizing cloud platforms. Growing awareness of the advantages of open systems, coupled with an increased industry focus on interoperability and collaborative solution design, is fostering a heightened demand for vertically integrated cloud platforms that facilitate data sharing among multiple stakeholders.

The adoption of cloud-based clinical applications is expected to peak within the next five years. Key opportunities for cloud platforms include the storage, management, and analytics of imaging data. The benefits of cloud computing—such as data backup and disaster recovery, economies of scale, scalability, flexibility, and lower upfront and maintenance costs—make cloud PACS and VNA attractive deployment options, particularly for small and medium-sized enterprises (SMEs) that may struggle with the total on-site cost of ownership. Furthermore, increasing confidence in cloud platforms, along with the need to reduce costs, enhance workflow speed and efficiency, manage security and image access, and leverage meaningful business intelligence, is driving the adoption of hybrid models, especially in developed markets.

Therefore, the growing availability of flexible deployment options for PACS and VNA, along with the increasing acceptance and recognition of cloud and hybrid PACS/VNA models, will present significant growth opportunities for Indian VNA and PACS companies in the near future.

Based on type, the India VNA and PACS market is segmented into Picture Archive Communication Systems (PACS) and Vendor Neutral Archive (VNA). In 2024, the Picture Archive Communication Systems (PACS) segment is expected to account for the larger share of 79.2% of the India VNA and PACS market. The substantial market share of this segment is primarily driven by its widespread adoption in radiology, cardiology, and other departments, as it replaces traditional film-based methods for image retrieval, distribution, and display.

Based on procurement model, the India PACS market is segmented into departmental PACS, and enterprise PACS. In 2024, the departmental PACS segment is expected to account for the largest share of the India PACS market. This segment's significant market share is primarily attributed to the growing adoption of PACS for processing large volumes of images. Radiology departments leverage these systems to address radiology-related challenges by digitizing traditional workflows, enhancing efficiency, ensuring data privacy and security, and improving image accessibility. Most PACS include built-in image viewing and annotation tools that facilitate accurate conclusions and treatment planning, further driving their widespread adoption.

Based on delivery mode, the India PACS market is segmented into on-premise PACS and web/cloud-based PACS. In 2024, the on-premise segment is expected to account for a larger share of the market. This segment's substantial market share is primarily attributed to the numerous advantages of on-premise PACS, including enhanced security, greater control over images, and lower latency compared to web/cloud-based PACS. These factors significantly contribute to the segment's dominance in the market.

Based on procurement model, the India VNA market is segmented into enterprise VNA, and departmental VNA. In 2024, the enterprise VNA segment is expected to account for a larger share of the India VNA market. The substantial market share of this segment can be attributed to the growing need to aggregate data across multiple sites to enhance care coordination. The emergence of Integrated Delivery Networks (IDNs), Accountable Care Organizations (ACOs), and Health Information Exchanges (HIEs), along with rapid globalization and consolidation, further drives the demand for collaborative care and seamless access to shared data across healthcare settings. Additionally, the connection of multiple hospitals to central repositories and the mobility of patients between local hospitals and centers are expected to boost the growth of the multi-site VNA market.

Based on delivery mode, the India VNA market is segmented into on-premise VNA, hybrid VNA, and web/cloud-based VNA. In 2024, the on-premise VNA segment is expected to account for the largest share of 14.7% of the India VNA market. On-premise VNA enables a multi-vendor architecture that mitigates the risk of data breaches and external attacks. This model also allows buyers complete control over the timing of software upgrades, providing them the opportunity to test new features and train employees accordingly. Factors driving the growth of this segment include the ability to reuse existing servers and storage hardware, lower latency compared to cloud storage, and enhanced security and control over image data.

Based on imaging modalities, the India VNA & PACS market is segmented into x-ray & angiography, Computed Tomography (CT), mammography, Magnetic Resonance Imaging (MRI), and ultrasound. In 2024, the Computed Tomography (CT) segment is expected to account for the largest share of the India VNA & PACS market. The substantial market share of this segment can be attributed to the increasing demand for imaging services and technological advancements in CT, which have significantly enhanced image resolution, quality, and diagnostic capabilities. These improvements have established CT scanning as an essential tool in medical imaging, leading to heightened demand for storage and management solutions such as VNA and PACS.

Based on vendor types, the India VNA & PACS market is segmented into independent software vendors, PACS vendors, and infrastructure vendors. In 2024, the independent software vendors segment is expected to account for the largest share of 11.0% of the India VNA & PACS market. The substantial market share of this segment can be attributed to the growing number of hospitals, community centers, and diagnostic imaging centers turning to independent software vendors, such as Merge Healthcare (IBM), Dejarnette Research Systems, Hyland Software (Acuo), and TeraMedica (Fujifilm). These vendors are favored for their extensive experience and the superior functionality, scalability, integration, and support they offer for VNA solutions.

Based on end users, the India VNA & PACS market is segmented into hospitals, diagnostic imaging centers, ambulatory surgical centers & clinics, and other end users. In 2024, the hospitals segment is expected to account for the largest share of the India VNA & PACS market. The substantial market share of this segment can be attributed to the increase in patient visits and admissions, effective management of patient data, and initiatives aimed at implementing advanced technologies.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the India VNA & PACS market are GE HealthCare Technologies Inc. (U.S.), Siemens Healthineers AG (Germany), Fujifilm Holdings Corporation (Japan), Agfa-Gevaert NV (Belgium), Carestream Health, Inc. (U.S.), Koninklijke Philips N.V. (Netherlands), Amrita Technologies (India), SoftTeam Solutions Pvt Ltd. (India), Medsynaptic Pvt. Ltd. (India), INFINITT Healthcare Co., Ltd. (South Korea), and Merative L.P. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

220 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2024 |

|

CAGR (Value) |

9.9% |

|

Market Size (Value) |

USD 341.6 million by 2031 |

|

Segments Covered |

India VNA & PACS Market Assessment, by Type

India PACS Market Assessment, by Procurement Model

India PACS Market Assessment —by Delivery Mode

India VNA Market Assessment—by Procurement Model

India VNA Market Assessment—by Delivery Mode

India VNA & PACS Market Assessment—by Imaging Modality

India VNA & PACS Market Assessment—by Vendor Type

India VNA & PACS Market Assessment—by End User

|

|

Key Companies |

GE HealthCare Technologies Inc. (U.S.), Siemens Healthineers AG (Germany), Fujifilm Holdings Corporation (Japan), Agfa-Gevaert NV (Belgium), Carestream Health, Inc. (U.S.), Koninklijke Philips N.V. (Netherlands), Amrita Technologies (India), SoftTeam Solutions Pvt Ltd. (India), Medsynaptic Pvt. Ltd. (India), INFINITT Healthcare Co., Ltd. (South Korea), and Merative L.P. (U.S.). |

This study offers a detailed assessment of the India VNA and PACS market. It analyzes market sizes and forecasts based on procurement model, delivery mode, imaging modality, vendor type, and end user. It also involves the value analysis of various segments and subsegments of the VNA and PACS market at the regional and country levels.

The India VNA & PACS market is projected to reach $ 341.6 million by 2031, at a CAGR of 9.9% during the forecast period.

In 2024, the departmental PACS segment is expected to hold a major share of the India PACS market.

The on-premise PACS segment is expected to hold a major share of the India PACS market.

Technological advancements in diagnostic imaging modalities, increasing awareness and demand for quality healthcare, increasing adoption of medical imaging equipment, increasing need for a filmless environment, growing health IT and EHR adoption, and rising geriatric population are the key factors supporting the growth of this market. Moreover, the integration of Artificial intelligence (AI) in medical imaging and the rapidly growing telehealth market create opportunities for players operating in this market.

The key players operating in the India VNA & PACS market are GE HealthCare Technologies Inc. (U.S.), Siemens Healthineers AG (Germany), Fujifilm Holdings Corporation (Japan), Agfa-Gevaert NV (Belgium), Carestream Health, Inc. (U.S.), Koninklijke Philips N.V. (Netherlands), Amrita Technologies (India), SoftTeam Solutions Pvt Ltd. (India), Medsynaptic Pvt. Ltd. (India), INFINITT Healthcare Co., Ltd. (South Korea), and Merative L.P. (U.S.).

Published Date: Aug-2024

Published Date: Mar-2024

Published Date: Mar-2019

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates