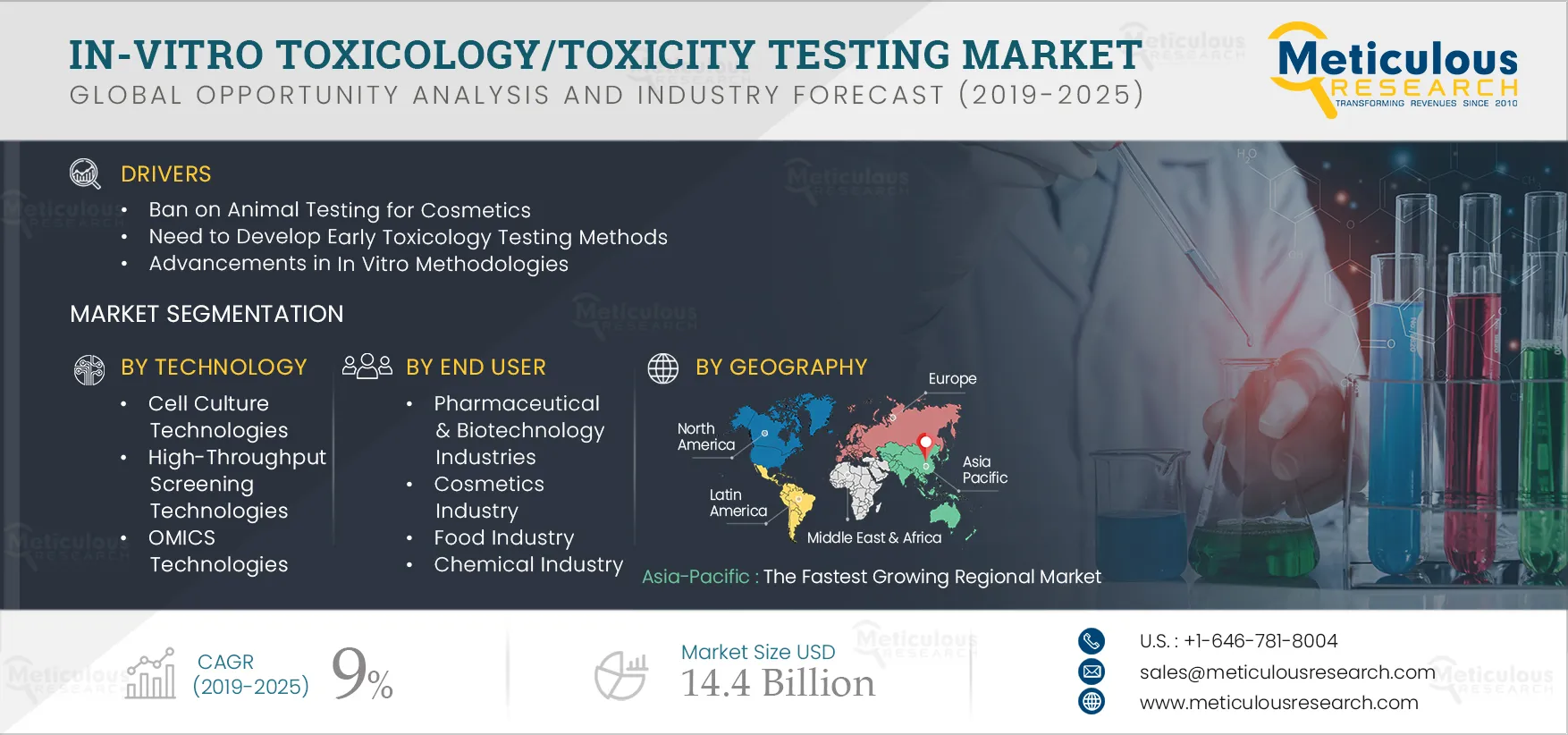

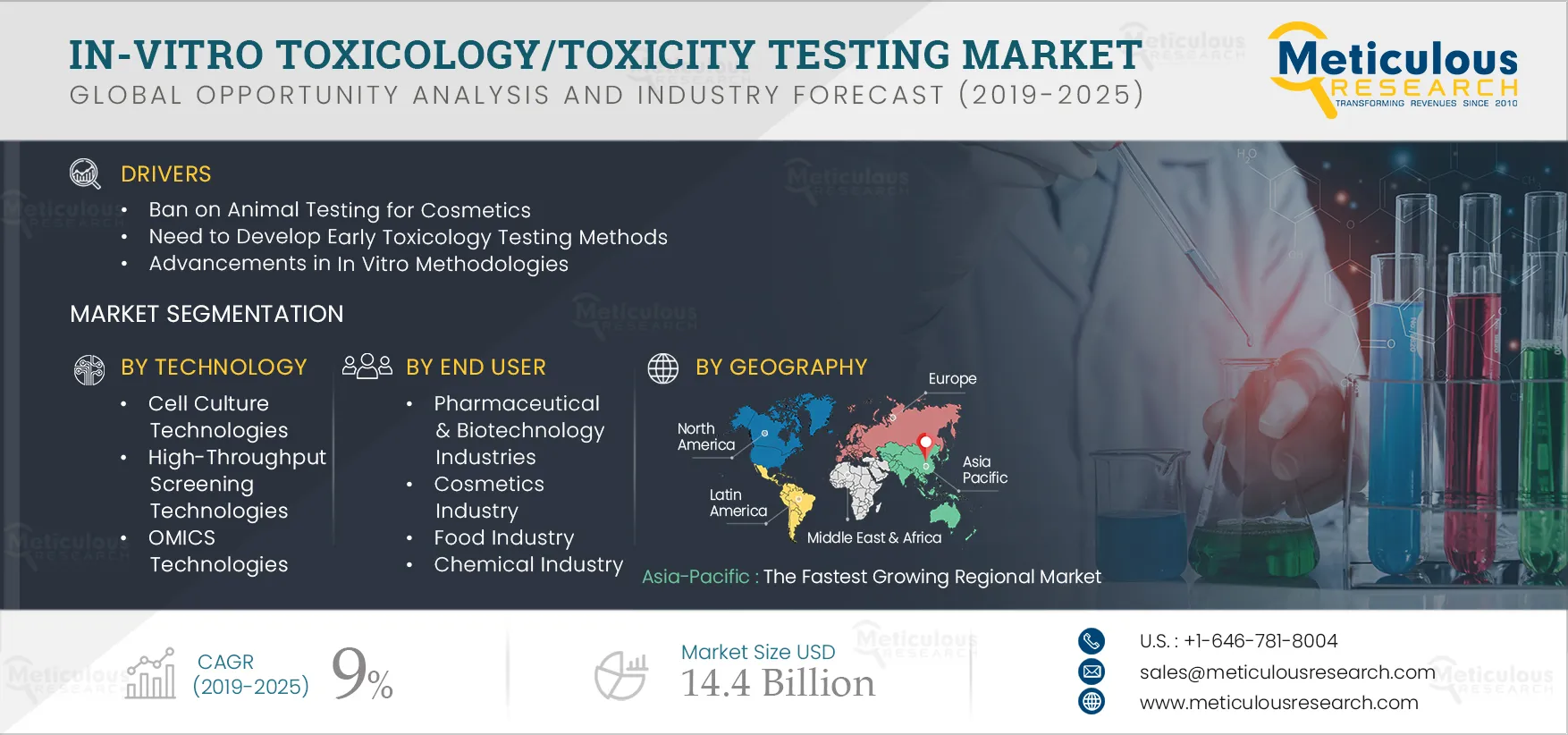

The In-Vitro Toxicology Testing Market is expected to grow at a CAGR of 9% from 2019 to reach $14.4 billion by 2025. Factors such as ethical issues and pressure from animal activists’ groups concerning the use of animals for testing, ban on animal testing on cosmetic products, support from regulatory bodies regarding the approval of in-vitro tests, low costs associated with in-vitro toxicology testing, and advancements in in-vitro methodologies are driving the growth of the overall in-vitro toxicology market. Synergetic relationships between various stakeholders of the industry and increasing toxicology databases to facilitate the use of in-vitro test methods are further expected to offer significant growth opportunities for the players operating in this market. Regulatory bodies such as ICCVAM, ECVAM, JaCVAM, and OECD have already approved and validated more than 60 in vitro toxicology tests.

Ban on Animal Testing for Cosmetics Fuels the Growth of the Global In-Vitro Toxicology Testing Market

In 2004, the EU passed a legislation prohibiting the use of finished cosmetic products on animals. In 2009, the testing of cometic ingredients on animals was prohibited within the EU. This was further ammended by forbidding the marketing of cosmetic products tested on animals from March 2013. Complex toxicity end-points such as repeated dose toxicity, reproductive toxicity, and toxicokinetics were exempted from this ban. Other similar initiatives taken by various governments are as below:

- In 2014, the Chinese government put an end to mandatory testing of cosmetics on animals; and increased the research into alternative methods for animal testing.

- In January 2014, the Ministry of Health and Family Welfare published draft ammendment seeking a ban on testing on cosmetics to the Drugs and Cosmetics rule in the Gazzette of India

- In 2015, India became the first South-Asian country to ban import of animal-tested beauty products

- In 2015, New Zealand government announced a ban on animal testing on cosmetics.

- The U.S. introduced the Humane Cosmetics Act to ban animal testing on cosmetics in 2015

- In March 2015, the U.K. government announced complete ban on testing of household products on animals which came into effect from October 2015

- In November 2015, the UK implemented ban on marketing on household products tested on animals

- In December 2016, the Swiss government banned the sale of cosmetics containing ingredients tested on animals

- In March 2016, Russia introduced a bill to replace all animal testing on cosmetics and ingredients by 2020.

- In July 2017, Australia imposed a testing and marketing ban on cosmetics tested on animals.

In 2013, The Humane Society of the United States (HSUS) and Humane Society International launched a global campaign “Be Cruelty-Free” in agreement with the EU ban on selling animal tested cosmetics. The HSUS and Humane Society Legislative Fund are partnering with scientists, government officials, and industry leaders to make the U.S. the next biggest cruelty-free nation. Such initiatives by various governments to ban the use of animals for cosmetics testing are contributing to the increasing adoption of in vitro toxicology tests.

Click here to: Get Free Sample Pages of this Report

Need to Develop Early Toxicology Testing Methods Supports the Market Growth

Drug development is always associated with the highest risk of failure in the later stages where the capital at stake is high. Toxicity testing accounts for ~30% of expensive, late-stage failures in drug development and market withdrawal, which may result in high attrition rate in the late-stages of the pharmaceutical drug discovery process. According to NCBI, for every 10,000 compounds synthesized in the discovery phase, only 250 reach the preclinical phase, ultimately resulting in one approved drug by the FDA. Therefore, to lower the risk of the same, it is very important to identify and prioritize efforts to bring the attrition of failing molecules at an early stage in drug development. According to the CMR International, 22% of the drug candidates that entered clinical development from 2006 to 2012 failed due to non-clinical toxicology or clinical safety issues. In preclinical development, toxicity and safety issues accounted for 54% of failures (18% of all preclinical candidates). These expensive late-stage failures account for a large proportion of the pharmaceutical R&D cost, and is estimated to be USD 1.8 billion per marketed drug.

The industry is seeking additional efficiencies in preclinical R&D by identifying solutions in the discovery phase to better qualify new molecular entities prior to animal and human testing. The goal of the new R&D model is to increase the chances of a phase I candidate to reach approval by increasing the rigor of qualifying compounds in the preclinical stages. In order to facilitate this, research is increasing in early stages, which is in turn driving the growth of in-vitro toxicology testing market. As the evolving technologies of in-vitro screening and modeling, various in-vitro assays are emerging as a rapid, high-efficient and cost-effective choice of estimating drug safety risks recommended by most regulatory authorities. In May 2019, Scientists in the Department of Biosystems Science and Engineering at ETH Zurich in Basel have now developed a test that allows them to examine a drug's embryotoxicity in cell cultures instead of animals. This new procedure is simple, fast, and inexpensive, enabling researchers to use it to test a large number of drug candidates at an early drug development stage.

Low Cost Associated with In-Vitro Methodologies is Catching the Attention

Animal tests are very expensive and time consuming. It can take anything from a few months to 4-5 years to conduct in-vivo toxicology, and can cost hundreds of thousands—and sometimes millions—of dollars per substance examined. In spite of such huge expenditure, many drugs fail at later stages of drug discovery phases. The inefficiency and exorbitant costs associated with animal testing makes it impossible for regulators to adequately evaluate the potential effects of more than 100 thousand chemicals. In contrast, in vitro methods are amenable to high throughput automation using robotics at a much lower cost than animal tests.

Key Findings in the Global In-Vitro Toxicology Testing Market Study:

OMICS Technologies to Post the Fastest Growth

OMICS technologies aim to understand and predict toxicity by using omics data in order to study systems-level responses. Recent years have witnessed a rapid increase in publicly available omics data, particularly gene expression data, and a corresponding development of methods for toxicological analysis. The application of omics-based technologies in toxicological research has the potential to provide tools to tackle uncertainties from in-vivo toxicological evaluations. As gene expression rapidly changes in response to toxic exposure, it can be used as a sensitive endpoint.

Cell-based Assays Dominates the Global In-Vitro Toxicology Testing Market

The cell-based assays segment is estimated to account for the largest share of the overall in-vitro toxicology testing market in 2019. Cell-based assays help detect and measure cell viability, functionality, and growth. This method of toxicity detection is faster, more effective, and less expensive as compared to biochemical and ex vivo methods. These assays allow integration of targets and pathways in a more physiological setting as compared to biochemical assays. Advancements in cell-based technologies such as high-content screening and label-free detection are expected to further drive the market growth for cell-based assays.

Cosmetics Industry to Witness the Fastest Growth through 2025

The increasing use of cosmetics owing to the rising disposable incomes and their easy availability to the public has driven the industry to invest in the research of breakthrough products and develop human safe products. The subsequent rise in the animal testing of cosmetics and household products during the 1980s and 1990s, especially in the EU, has stimulated the regulatory authorities to enforce strict laws that ban animal testing of these products. Additionally, the demand for cruelty-free cosmetics and personal care products has skyrocketed.

Asia Pacific: The Fastest Growing Regional Market

Asia-Pacific region is expected to grow at the fastest CAGR during the forecast period of 2019 to 2025, owing to increasing biotech investments in this region and increasing collaborations between local and foreign companies. Countries like China, India, South Korea etc. are a hub for biotechnology R&D investments in this region. Many countries in this region have already banned the use of animals for toxicity testing in cosmetics, while many are considering a ban. Thus, factors such as huge R&D investments and initiatives to develop in-vitro methods are expected to boost the in-vitro toxicology testing market in this region.

Key Players

The report includes competitive landscape based on extensive assessment of the key strategic developments adopted by the leading market participants in the industry over the past 5 years. The key players profiled in the global in-vitro toxicology testing market research report are SGS S.A., Covance, Inc. (A Part of Laboratory Corporation of America Holding), Bio-Rad Laboratories, Inc., Qiagen N.V., GE Healthcare, Eurofins Scientific SE, Merck KGAA, Thermo Fisher Scientific, Inc., Charles River Laboratories International, Inc., and Catalent, Inc. among others.

Scope of the Report:

Market by Product & Service

- Equipment

- Assay Kits

- Consumables

- Software

- Services

Market by Technology

- Cell Culture Technologies

- High-Throughput Screening Technologies

- OMICS Technologies

Market by Method

- Cell-based Assays

- Biochemical Assays

- In-Silico

- Ex-Vivo

Market by End-point

- ADME

- Skin Irritation, Corrosion, Sensitization

- Genotoxicity

- Cytotoxicity

- Ocular Toxicity

- Organ Toxicity

- Phototoxicity

- Dermal Toxicity

- Other Toxicity End-points

Market by End-user

- Pharmaceutical & Biotechnology Industries

- Cosmetics Industry

- Food Industry

- Chemical Industry

Market by Geography

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe (RoE)

- North America

- Asia-Pacific (APAC)

- China

- Japan

- India

- Rest of APAC (RoAPAC)

- Rest of World

- Latin America

- Middle East and Africa

Key questions answered in the report

Ban on animal testing for cosmetics and need to develop early toxicology testing methods will propel the in-vitro toxicology/toxicity testing Market

- How does the ban on animal testing for cosmetics and need to develop early toxicology testing methods drive the growth of the in-vitro toxicology/toxicity testing market?

- How advancements in in-vitro methodologies and low cost associated with in vitro methodologies bolstering the in-vitro toxicology/toxicity testing market in developing and developed regions?

Consumables segment accounted for the largest share of the in-vitro toxicology/toxicity testing market

- What factors are contributing to the frequent growth of the consumables segment among various product and services?

- What impact does this have on the adoption of in-vitro toxicology/toxicity testing in comparison to other segments?

The Europe in-vitro toxicology/toxicity testing market favors both larger and local manufacturers that compete in multiple segments

- Who are the top competitors in this market and what strategies do they employ to gain shares?

- What factors are driving growth and which market segments have the most potential for revenue expansion over the forecast period?

- What strategies should new companies look to enter this market use to compete effectively?

- What are the major drivers, restraints, challenges, and opportunities, in the global in-vitro toxicology/toxicity testing market?

- Who are the major players in various countries and what share of the global market do they hold?

- What are the geographical trends and high growth regions/countries?