Resources

About Us

Gimbal Market: Size & Forecast by Type (3-Axis, Smart Gimbals), End User (Content Creators, Mobile Filmmakers) & Region - Global Forecast and Analysis to 2035

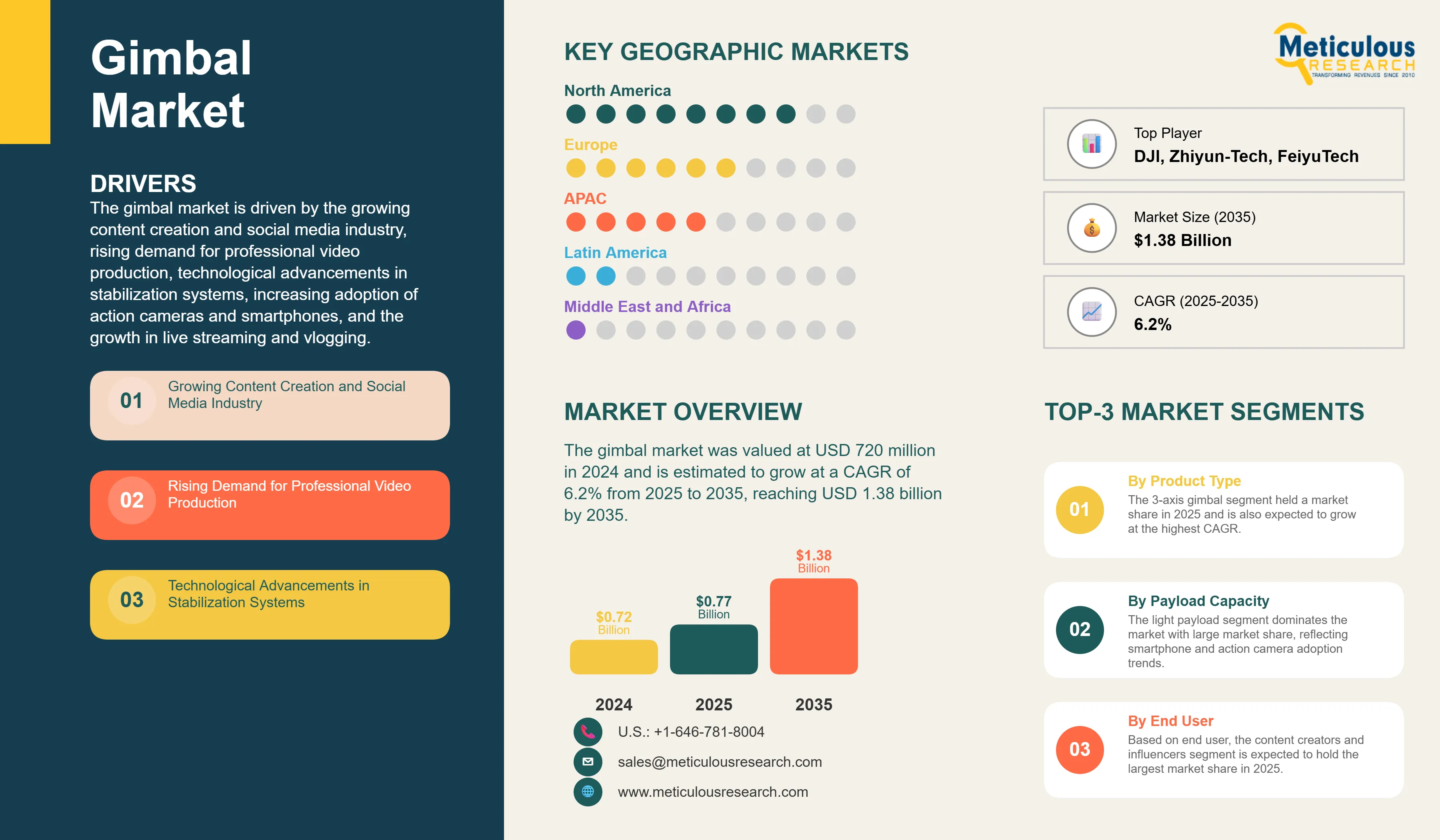

Report ID: MRSE - 1041508 Pages: 225 Jun-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe gimbal industry continues to expand rapidly as content creators, professional videographers, and technology enthusiasts increasingly recognize the importance of camera stabilization for high-quality video production. With the surge in live streaming, social media content creation, and virtual events, the demand for advanced stabilization systems is driving unprecedented market growth. The integration of smartphones and action cameras with portable gimbal systems has democratized professional-quality video production, making it accessible to individual consumers and small content creators.

For instance, the growing popularity of platforms like TikTok, Instagram Reels, and YouTube has created a massive demand for smooth, cinematic footage among content creators. The proliferation of 4K and 8K recording capabilities in consumer devices has further amplified the need for precise stabilization systems to maximize video quality potential.

The industry is experiencing significant technological transformation through AI-powered stabilization algorithms, wireless control integration, and modular design approaches. Leading gimbal manufacturers are investing heavily in lightweight materials, extended battery life, and smart features to improve user experience and expand market reach. These technological advances are enabling users to achieve professional-grade results while maintaining portability and ease of use.

For instance, recent developments in brushless motor technology and IMU sensors have significantly improved stabilization precision while reducing power consumption. The integration of follow focus systems and wireless control apps has transformed gimbals from simple stabilizers into comprehensive camera control platforms.

3-Axis Gimbals Segment Projected to Showcase the Largest Growth During the Forecast Period

3-axis gimbals are projected to show significant growth of the total gimbal market during the forecast period. These systems provide stabilization across pan, tilt, and roll axes, offering superior image stability compared to 2-axis alternatives. The complexity and precision of 3-axis systems make them ideal for professional applications including filmmaking, broadcasting, and commercial video production.

The growth in 3-axis gimbals is attributed to declining costs of sophisticated motor systems and increasing demand for professional-quality content across social media platforms. Content creators now require cinema-grade stabilization for smartphone and mirrorless camera setups, driving adoption of advanced 3-axis systems. The segment benefits from continuous innovation in payload capacity, battery life, and smart tracking features.

Major gimbal manufacturers such as DJI, Zhiyun-Tech, and FeiyuTech have significantly expanded their 3-axis gimbal portfolios. These providers have collectively increased their 3-axis model offerings by 40% in 2024 to meet diverse payload requirements from smartphone users to professional cinema camera operators. The integration of AI-powered subject tracking and gesture control is enabling 3-axis gimbals to serve broader market segments while maintaining professional performance standards.

Asia-Pacific Region to Exhibit the Highest Growth During the Forecast Period

The Asia-Pacific region is estimated to show remarkable growth during the forecast period, driven by rapid smartphone adoption, growing social media penetration, and expanding content creation ecosystems. Countries like China, South Korea, and India are experiencing unprecedented demand for gimbal systems as mobile video consumption and user-generated content creation continue to surge.

China leads the region with the world's largest manufacturing base for gimbal systems and consumer electronics. The country's domestic market for content creation tools is projected to grow at a highest CAGR through 2035, driven by platforms like Douyin (TikTok) and expanding live streaming markets. Major Chinese manufacturers including DJI and Zhiyun-Tech benefit from both domestic demand and global export opportunities.

The region's growth is also supported by major investments in 5G infrastructure and mobile technology adoption. South Korea's advanced 5G network deployment is enabling new applications for mobile video streaming and real-time content creation, driving demand for professional-grade stabilization equipment. Similarly, India's expanding creator economy and smartphone penetration create substantial opportunities for affordable gimbal solutions.

Gimbal Market Analysis

The gimbal industry faces challenges from intense price competition, particularly in the consumer segment, with margin pressure from low-cost manufacturers and counterfeit products. Rapid technological evolution requires continuous R&D investment to maintain competitive positioning, while compatibility issues across different camera systems create integration challenges for users. Battery life limitations and weight considerations continue to impact user experience, particularly for extended shooting sessions.

Despite these constraints, the market offers substantial growth opportunities through expanding applications beyond traditional videography, including drone integration, surveillance systems, and industrial inspection equipment. The adoption of AI-powered features and wireless connectivity is helping manufacturers differentiate their products while improving user experience. Growing demand for live streaming and virtual event production provides sustainable growth pathways for innovative gimbal solutions.

Based on product type, the gimbal market is segmented into 2-axis gimbals, 3-axis gimbals, and multi-axis gimbals (4+ axis), with mechanism-based segmentation including motorized and manual gimbals. The 3-axis gimbal segment held a market share in 2024 and is expected to grow at the highest CAGR.

Based on payload capacity, the market is segmented into light payload (up to 500g), medium payload (500g-2kg), heavy payload (2kg-5kg), and professional payload (above 5kg). The light payload segment dominates the market with large market share, reflecting smartphone and action camera adoption trends.

Based on end user, the market is segmented into professional videographers and filmmakers, content creators and influencers, photography studios, broadcasting companies, corporate and commercial users, government and military, educational institutions, individual consumers/enthusiasts, and rental and leasing companies. The content creators and influencers segment is experiencing the highest growth rate, driven by the expanding creator economy and social media monetization opportunities across platforms like YouTube, TikTok, and Instagram.

Based on distribution channel, the market is segmented into online sales, offline sales, and direct sales. The online sales segment dominates the market, driven by e-commerce platform growth and direct-to-consumer strategies from major manufacturers. Online channels offer extensive product comparisons, customer reviews, and competitive pricing, making them preferred by both consumers and professionals seeking gimbal solutions.

Regional Market Analysis

North America leads the gimbal market with significant professional video production activity and high consumer spending on camera accessories. The region's mature content creation ecosystem and early adoption of new technologies drive demand for advanced gimbal systems across professional and consumer segments.

Europe continues to expand its gimbal market through growing demand for travel and lifestyle content creation. The region's emphasis on quality video production and professional broadcasting standards supports adoption of high-end gimbal systems among media companies and independent creators.

Asia-Pacific demonstrates the strongest growth potential in gimbal adoption, with China's manufacturing dominance and expanding domestic market creating a global hub for gimbal innovation. The region's young demographic and social media penetration drive consumer demand for affordable yet capable stabilization solutions.

Latin America focuses on expanding access to professional video tools through affordable gimbal options and growing content creator communities. The region's increasing smartphone penetration and social media adoption create opportunities for entry-level gimbal manufacturers.

Middle East & Africa demonstrates emerging growth potential in gimbal adoption, driven by expanding digital media industries and growing tourism sectors requiring professional video content. The United Arab Emirates leads regional demand with its thriving entertainment industry and high disposable income levels supporting premium gimbal system adoption. South Africa's developing content creation ecosystem and increasing mobile connectivity create opportunities for both consumer and professional gimbal solutions across the broader African market.

Gimbal Market Share

Major players like DJI Technology Co., Ltd., Zhiyun-Tech Co., Ltd., FeiyuTech, Freefly Systems, and MOZA (Gudsen Technology Co., Ltd.) compete strongly in the gimbal industry. These companies focus on technological innovation, strategic partnerships, and expanding product portfolios to strengthen their market positions and capture emerging opportunities across consumer and professional segments. As demand grows for sophisticated stabilization across diverse applications, companies invest heavily in R&D, manufacturing efficiency, and global distribution networks.

Leading manufacturers are forming strategic partnerships with camera manufacturers, smartphone brands, and content creation platforms to create integrated ecosystem solutions. These collaborations enable better product compatibility, improved user experience, and access to larger customer bases. The market is also witnessing increased investment in AI and machine learning capabilities to enhance automated tracking and stabilization performance.

Gimbal Market Companies

Major players operating in the gimbal industry include:

Gimbal Industry News

February 2025: DJI Technology announced the launch of their RS 4 Mini, an all-new compact and lightweight gimbal for cameras and smartphones that weighs just 890g (less than 2 pounds) and can carry payloads up to 2kg (4.4 pounds). The RS 4 Mini offers the automated axis locks, allowing for faster setups, transitions, and breakdowns.

July 2024: UAVOS has launched the Gimbal 155, a new gimbaled camera purpose-built for the UAS Survey Mission program. The new launch aims to enables users to acquire intricate visuals across visible and infrared spectrums, ultimately improving mission success.

October 2025: ZHIYUN's launched Mini Lens Reflector to enhances illumination for video and photography. The launch significantly boosts center illuminance while delivering a smoother, more refined light spot, but without visible break lines.

Gimbal Industry Segmentation

The gimbal market includes motorized and manual stabilization systems designed for cameras, smartphones, and specialized equipment across consumer, professional, and industrial applications. The report covers handheld, wearable, and vehicle-mounted gimbal systems while excluding fixed installation stabilization equipment.

The gimbal market is segmented by product type, payload capacity, end user, distribution channel, and geography. By product type, the market includes 2-axis gimbals, 3-axis gimbals, and multi-axis gimbals with both motorized and manual mechanisms. By payload capacity, the market covers light (up to 500g), medium (500g-2kg), heavy (2kg-5kg), and professional (above 5kg) categories. The report provides comprehensive market analysis and forecasts for each segment.

For each segment, market size is provided in terms of value (USD million) and growth projections through 2035.

|

Product Type |

|

|---|

|

Payload Capacity |

|

|---|

|

End User |

|

|---|---|

|

Distribution Channel |

|

|

Geography |

North America (U.S., Canada) Europe (Germany, U.K., France, Italy, Spain, Netherlands, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Australia, Rest of Asia-Pacific) Latin America (Brazil, Mexico), Middle East & Africa (UAE, South Africa) |

|---|

The Gimbal Market size is expected to reach USD 760 million in 2025 and grow at a CAGR of 6.2% to reach USD 1.2 billion by 2035.

In 2025, the Gimbal Market size is expected to reach USD 760 million.

DJI Technology Co., Ltd., Zhiyun-Tech Co., Ltd., FeiyuTech, Freefly Systems, and MOZA (Gudsen Technology Co., Ltd.) are the major companies operating in the Gimbal Market.

The Asia-Pacific region is estimated to grow at the highest CAGR over the forecast period (2025-2035).

In 2025, 3-axis gimbals account for the largest market share in the Gimbal Market.

In 2024, the Gimbal Market size was estimated at USD 720 million. The report covers historical market size data and forecasts through 2035.

Published Date: Jan-2026

Published Date: Jan-2026

Published Date: Jan-2026

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates