1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for The Study

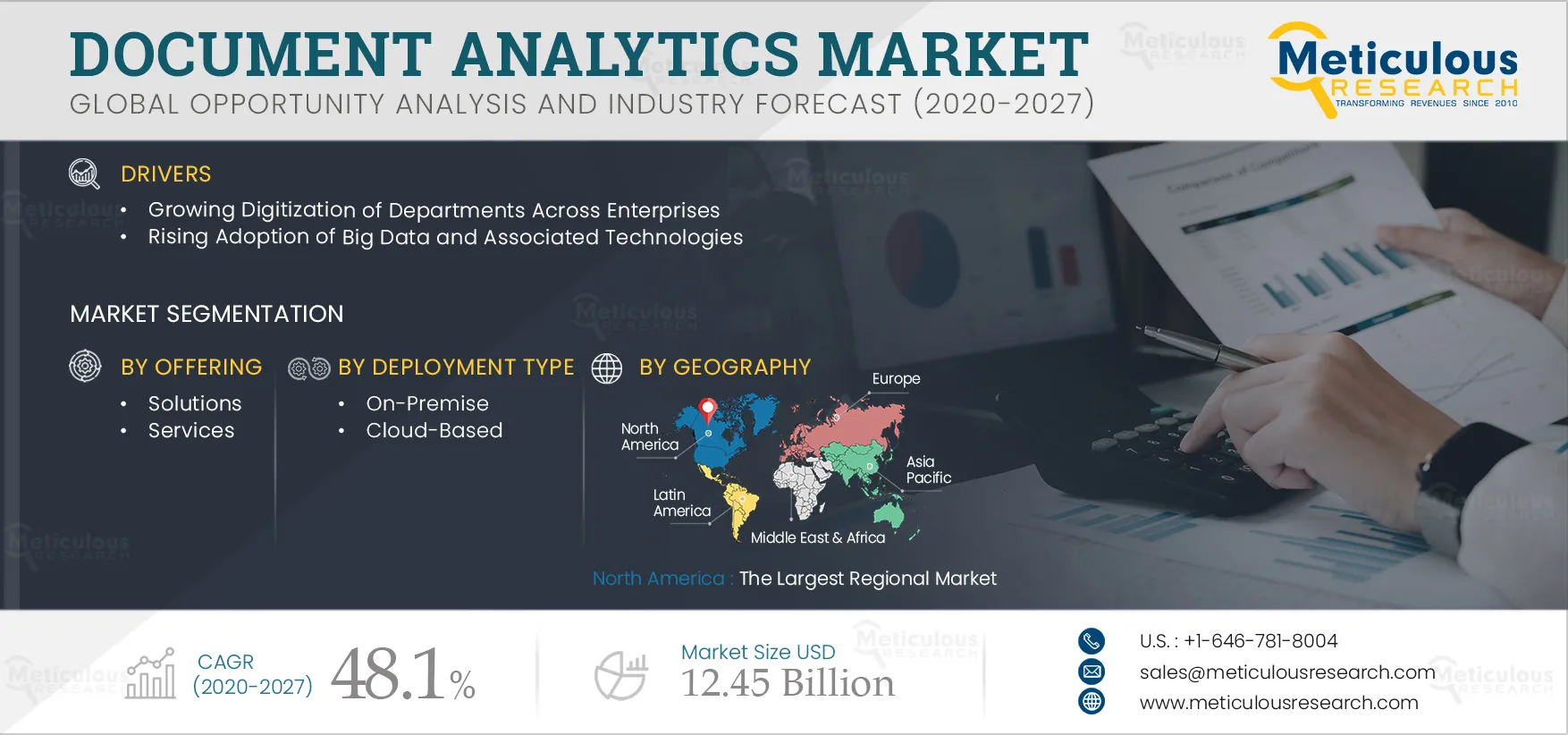

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by Offering

3.3. Market Analysis, by Deployment Mode

3.4. Market Analysis, by Organization Size

3.5. Market Analysis, by Vertical

3.6. Market Analysis, by Geography

3.7. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Drivers

4.2.1. Growing Digitization of Departments Across Enterprises

4.2.2. Rising Adoption of Big Data and Associated Technologies

4.3. Restraints

4.3.1. Legal and Data Privacy Issues

4.4. Opportunities

4.4.1. Integration of Ai & Ml with Document Analytics

4.4.2. Increasing Need to Improve Customer Experience

4.5. Challenges

4.5.1. High Cost of Implementation

4.6. Trends

4.6.1. Increasing Adoption of Cloud-Based Document Analytics Solutions

4.7. Impact of Covid-19 on the Document Analytics Market

5. Document Analytics Market, by Offering

5.1. Introduction

5.2. Solutions

5.3. Services

5.3.1. Professional Services

5.3.2. Managed Services

6. Document Analytics Market, by Deployment Mode

6.1. Introduction

6.2. On-Premise

6.3. Cloud-Based

7. Document Analytics Market, by Vertical

7.1. Introduction

7.2. BFSI

7.3. Healthcare and Life Sciences

7.4. Government

7.5. Retail and E-Commerce

7.6. Manufacturing

7.7. Transportation & Logistics

7.8. Other Verticals

8. Document Analytics Market, by Organization Size

8.1. Introduction

8.2. Large Enterprises

8.3. Small & Medium-Sized Enterprises

9. Document Analytics Market, by Geography

9.1. Introduction

9.2. North America

9.2.1. U.S

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.4.4. Rest of Asia-Pacific

9.5. Latin America

9.6. Middle East & Africa

10. Competitive Landscape

10.1. Introduction

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Market Ranking by Key Players

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments)

11.1. Abbyy

11.2. Kofax Inc.

11.3. WorkFusion, Inc.

11.4. Automation Anywhere

11.5. AntWorks Pte. Ltd.

11.6. Hyperscience

11.7. Celaton

11.8. Extract Systems

11.9. Parascript, Llc

11.10. Infrrd, Inc.

11.11. Hyland Software, Inc.

11.12. OpenText Corporation

11.13. Datamatics Global Services Ltd

11.14. HCL Technologies

11.15. IBM Corporation

12. Appendix

12.1. Questionnaire

12.1.1. Available Customization

List of Table

Table 1 Impact Assessment of Covid-19 On Document Analytics Market (USD Billion)

Table 2 Global Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 3 Global Document Analytics Solutions Market Size, by Country/Region, 2018–2027 (USD Million)

Table 4 Global Document Analytics Services Market Size, by Type, 2018–2027

Table 5 Global Document Analytics Services Market Size, by Country/Region, 2018–2027 (USD Million)

Table 6 Global Document Analytics Professional Services Market Size,

Table 7 Global Document Analytics Managed Services Market Size, by Country/Region, 2018–2027 (USD Million)

Table 8 Global Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 9 Global On-Premise Document Analytics Market Size, by Country/Region, 2018–2027 (USD Million)

Table 10 Global Cloud-Based Document Analytics Market Size, by Country/Region,

Table 11 Global Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 12 Global Document Analytics Market Size for BFSI, by Country/Region, 2018–2027 (USD Million)

Table 13 Global Document Analytics Market Size for Healthcare & Life Sciences,

Table 14 Global Document Analytics Market Size for Government, by Country/Region, 2018–2027 (USD Million)

Table 15 Global Document Analytics Market Size for Retail & E-Commerce,

Table 16 Global Document Analytics Market Size for Manufacturing, by Country/Region, 2018–2027 (USD Million)

Table 17 Global Document Analytics Market Size for Transportation, by Country/Region, 2018–2027 (USD Million)

Table 18 Global Document Analytics Market Size for Other Verticals, by Country/Region, 2018–2027 (USD Million)

Table 19 Global Document Analytics Market Size, by Organization Size, 2018–2027

Table 20 Global Document Analytics Market Size for Large Enterprises,

Table 21 Global Document Analytics Market Size for Small & Medium Enterprises,

Table 22 North America: Document Analytics Market Size, by Country, 2018–2027

Table 23 North America: Document Analytics Market Size, by Offering, 2018–2027

Table 24 North America: Document Analytics Services Market Size, by Type, 2018–2027

Table 25 North America: Document Analytics Market Size, by Deployment Mode, 2018–2027 (USD Million)

Table 26 North America: Document Analytics Market Size, by Vertical, 2018–2027

Table 27 North America: Document Analytics Market Size, by Organization Size,

Table 28 U.S.: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 29 U.S.: Document Analytics Services Market Size, by Type, 2018–2027 (USD Million)

Table 30 U.S.: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 31 U.S.: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 32 U.S.: Document Analytics Market Size, by Organization Size, 2018–2027

Table 33 Canada: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 34 Canada: Document Analytics Services Market Size, by Type, 2018–2027

Table 35 Canada: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 36 Canada: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 37 Canada: Document Analytics Market Size, by Organization Size, 2018–2027

Table 38 Europe: Document Analytics Market Size, by Country/Region, 2018–2027

Table 39 Europe: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 40 Europe: Document Analytics Services Market Size, by Type, 2018–2027

Table 41 Europe: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 42 Europe: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 43 Europe: Document Analytics Market Size, by Organization Size, 2018–2027

Table 44 Germany: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 45 Germany: Document Analytics Services Market Size, by Type, 2018–2027

Table 46 Germany: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 47 Germany: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 48 Germany: Document Analytics Market Size, by Organization Size, 2018–2027

Table 49 U.K: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 50 U.K: Document Analytics Services Market Size, by Type, 2018–2027 (USD Million)

Table 51 U.K: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 52 U.K: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 53 U.K: Document Analytics Market Size, by Organization Size, 2018–2027

Table 54 France: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 55 France: Document Analytics Services Market Size, by Type, 2018–2027

Table 56 France: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 57 France: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 58 France: Document Analytics Market Size, by Organization Size, 2018–2027

Table 59 Italy: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 60 Italy: Document Analytics Services Market Size, by Type, 2018–2027 (USD Million)

Table 61 Italy: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 62 Italy: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 63 Italy: Document Analytics Market Size, by Organization Size, 2018–2027

Table 64 Spain: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 65 Spain: Document Analytics Services Market Size, by Type, 2018–2027

Table 66 Spain: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 67 Spain: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 68 Spain: Document Analytics Market Size, by Organization Size, 2018–2027

Table 69 RoE: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 70 RoE: Document Analytics Services Market Size, by Type, 2018–2027 (USD Million)

Table 71 RoE: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 72 RoE: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 73 RoE: Document Analytics Market Size

Table 74 Asia-Pacific: Document Analytics Market Size, by Country, 2018–2027

Table 75 Asia-Pacific: Document Analytics Market Size, by Offering, 2018–2027

Table 76 Asia-Pacific: Document Analytics Services Market Size, by Type, 2018–2027

Table 77 Asia-Pacific: Document Analytics Market Size, by Deployment Mode, 2018–2027 (USD Million)

Table 78 Asia-Pacific: Document Analytics Market Size, by Vertical, 2018–2027

Table 79 Asia-Pacific: Document Analytics Market Size, by Organization Size, 2018–2027 (USD Million)

Table 80 Japan: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 81 Japan: Document Analytics Services Market Size, by Type, 2018–2027

Table 82 Japan: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 83 Japan: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 84 Japan: Document Analytics Market Size, by Organization Size, 2018–2027

Table 85 China: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 86 China: Document Analytics Services Market Size, by Type, 2018–2027

Table 87 China: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 88 China: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 89 China: Document Analytics Market Size, by Organization Size, 2018–2027

Table 90 India: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 91 India: Document Analytics Services Market Size, by Type, 2018–2027

Table 92 India: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 93 India: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 94 India: Document Analytics Market Size, by Organization Size, 2018–2027

Table 95 RoAPAC: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 96 RoAPAC: Document Analytics Services Market Size, by Type, 2018–2027

Table 97 RoAPAC: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 98 RoAPAC: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 99 RoAPAC: Document Analytics Market Size, by Organization Size, 2018–2027

Table 100 Latin America: Document Analytics Market Size, by Offering, 2018–2027

Table 101 Latin America: Document Analytics Services Market Size, by Type, 2018–2027

Table 102 Latin America: Document Analytics Market Size, by Deployment Mode, 2018–2027 (USD Million)

Table 103 Latin America: Document Analytics Market Size, by Vertical, 2018–2027

Table 104 Latin America: Document Analytics Market Size, by Organization Size, 2018–2027 (USD Million)

Table 105 MEA: Document Analytics Market Size, by Offering, 2018–2027 (USD Million)

Table 106 MEA: Document Analytics Services Market Size, by Type, 2018–2027 (USD Million)

Table 107 MEA: Document Analytics Market Size, by Deployment Mode, 2018–2027

Table 108 MEA: Document Analytics Market Size, by Vertical, 2018–2027 (USD Million)

Table 109 MEA: Document Analytics Market Size, by Organization Size, 2018–2027

Table 110 Recent Developments by Major Players During 2017–2020

Table 111 Market Ranking by Key Players

List of Figure

Figure 1 Research Process

Figure 2 Key Secondary Resources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Key Insights

Figure 8 Document Analytics Market, by Offering, 2020 Vs. 2027 (USD Million)

Figure 9 Document Analytics Market, by Deployment Mode, 2020 Vs. 2027 (USD Million)

Figure 10 Document Analytics Market, by Organization Size, 2020 Vs. 2027 (USD Million)

Figure 11 Manufacturing Segment Is Expected to Grow at The Highest CAGR

Figure 12 Geographic Snapshot: Document Analytics Market

Figure 13 Market Dynamics

Figure 14 Number of Data Breaches and Records Exposed, 2010-2019

Figure 15 Impact Assessment of Covid-19 On The Document Analytics Market (Market Growth)

Figure 16 Global Document Analytics Market Size, by Offering, 2020–2027 (USD Million)

Figure 17 Global Document Analytics Market Size, by Deployment Mode, 2020–2027 (USD Million)

Figure 18 Global Document Analytics Market Size, by Vertical, 2020–2027 (USD Million)

Figure 19 Global Document Analytics Market Size, by Organization Size, 2020–2027 (USD Million)

Figure 20 Global Document Analytics Market Size, by Geography, 2020–2027 (USD Million)

Figure 21 Geographic Snapshot: North American Document Analytics Market

Figure 22 Geographic Snapshot: European Document Analytics Market

Figure 23 Geographic Snapshot: Asia-Pacific Document Analytics Market

Figure 25 Growth Strategies Adopted by The Key Players

Figure 26 Document Analytics Market: Competitive Benchmarking

Figure 27 OpenText Corporation: Financial Overview, (2017-2019)

Figure 28 Datamatics Global Services Ltd.: Financial Overview, (2017-2019)

Figure 29 HCL Technologies: Financial Overview, (2017-2019)

Figure 30 IBM Corporation: Financial Overview, (2017-2019)

Figure 35 Verisk Analytics Inc.: Financial Overview (2017–2019)

Figure 36 Hexaware Technologies Limited: Financial Overview (2017–2019)

Figure 37 Salesforce.Com Inc.: Financial Overview (2017–2019)

Figure 38 Guidewire Software, Inc.: Financial Overview (2017–2019)

Figure 39 RELX Plc (LexisNexis Risk Solutions): Financial Overview (2017–2019)