Resources

About Us

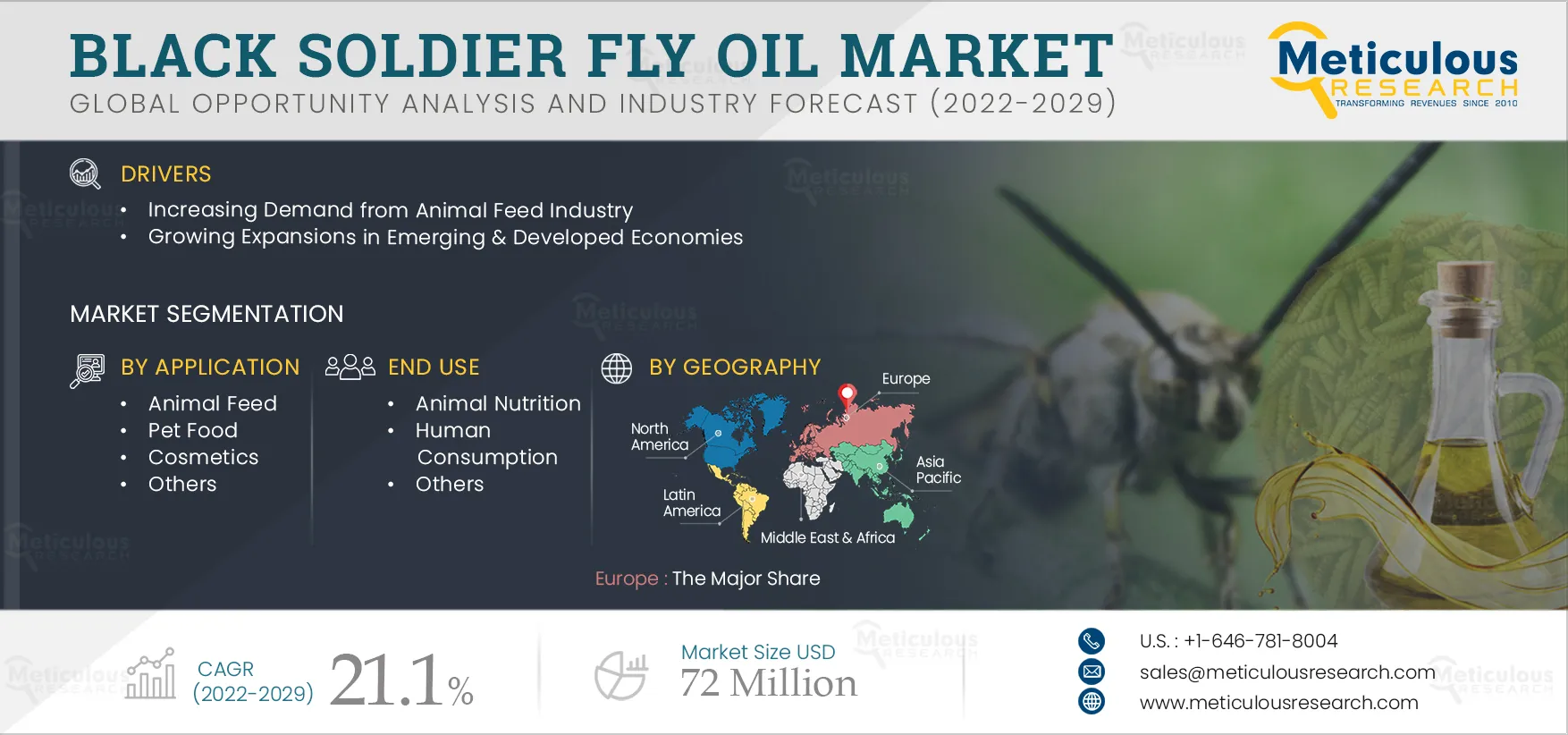

Black Soldier Fly Oil Market by Application (Animal Feed, Pet Food, Cosmetics, Others), End Use (Animal Nutrition, Human Consumption, Others) - Global Forecast to 2029

Report ID: MRFB - 104584 Pages: 130 Apr-2022 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe Black Soldier Fly (BSF) Oil Market is expected to grow at a CAGR of 21.1% from 2022–2029 to reach $72 million by 2029. The growth of this market is driven by the increasing demand from the animal feed industry and the growing expansions in emerging & developed economies. However, psychological and ethical barriers to consuming black soldier fly oil as food are expected to hinder the growth of this market. Additionally, the supply and demand gap of black soldier fly oil for biodiesel production and pricing competition from alternative ingredients in the cosmetic industry are some of the challenges for the growth of this market.

The outbreak of the COVID-19 pandemic has had a significant impact on public health and all stages of the supply chain and various industries. Since the COVID-19 outbreak in December 2019, the disease has spread worldwide, with the World Health Organization declaring it a public health emergency. The global impacts of the COVID-19 significantly affected the black soldier fly oil market in 2020.

As the governments of various countries across the globe implemented nationwide lockdowns and stay-at-home orders, many farmers resorted to panic-buying of animal feed in anticipation of potential shortages. Several concerns, such as truck shortages, reduced deliveries, and employees contracting COVID-19, compelled farmers to stock their animal feed supplies. In addition, truncated air freight capacity, port congestion, roadblocks, and logistic disruptions in Southeast Asia escalated due to governments' strict restrictions and measures to curb the spread of the outbreak. Furthermore, the consumption of fish, poultry, pork, and beef is expected to decline in Southeast Asian economies through the second quarter of 2021. Thus, the decline in fish consumption, poultry, pork, and beef is expected to decrease black soldier fly oil demand in the market.

The nationwide lockdowns to curb the spread of the outbreak impacted the movement of vehicles carrying livestock, feed, and feed ingredients. During the pandemic, farmers were concerned about slowing down or stopping slaughterhouse operations; hence, they kept their animals longer due to lower demand, requiring them to use more feed than usual. Purina Animal Nutrition LLC, which uses black soldier fly as a feed ingredient, witnessed a slight increase in its livestock business sales. In addition, Cargill reported that its global feed sales volume increased by 10% or more in March 2020. Thus, the rising preference for alternative ingredients over other animal-based ingredients and immunity boosters after the outbreak of the COVID-19 pandemic has created a new wave of interest in black soldier fly oil.

Click here to: Get Free Sample Copy of this report

Expansions in Emerging & Developed Economies Drive the Growth of the Black Soldier Fly Oil Market

Over the recent years, there has been a significant increase in the demand for high-quality meat in emerging economies, such as Southeast Asia, the Middle East & Africa, and Latin America, mainly attributed to the population growth in Asia and Africa and increasing urbanization. According to FAO, the global meat production is projected to expand to around 48 metric tons by 2025, predominantly in developing countries, accounting for approximately 73% of the total production. Thus, to fulfill this demand, meat producers are continuously focusing on improving the meat's production and quality with the help of high-quality ingredient-containing feed. Such factors are leading meat producers towards the adoption of BSF-derived oil. Hence, the high demand for BSF feed-in emerging economies encourages BSF oil producers to invest in developing countries.

In addition, the significant growth opportunities presented by emerging economies have resulted in major market players expanding in this market. For instance, in June 2019, Protix (Netherlands) opened the largest insect farm in Bergen, Netherlands, to build insect industry leadership. Furthermore, in March 2021, Nutrition Technologies opened an insect protein factory in Johor, Malaysia.

Thus, growing expansions in the emerging and developed economies are expected to provide lucrative growth opportunities for black soldier fly oil stakeholders.

Animal Feed Segment Dominated the Black Soldier Fly Oil Market in 2021

Based on application, the black soldier fly oil market is segmented into animal feed, pet food, cosmetics, and others. In 2021, the animal feed segment accounted for the largest share of the global black soldier fly oil market. The large market share of this segment is attributed to early regulatory approval of black soldier fly oil for use in animal feed and the increasing demand for black soldier fly oil as an alternative to fishmeal and fish oil in animal feed due to the volatile prices of fish oil. However, the pet food segment is expected to grow at the fastest CAGR during the forecast period. The rapid growth of this segment is driven by the growing interest of leading pet food companies in the edible insect space, the increasing number of product approvals, and the rising number of customers willing to provide high-quality food to their pets.

Animal Nutrition Segment Dominated the Black Soldier Fly Oil Market in 2021

Based on end use, the black soldier fly oil market is segmented into animal consumption, human consumption, and others. In 2021, the animal nutrition segment accounted for the largest share of the black soldier fly oil market. The large share of this segment is attributed to the increasing demand for meat products and innovative & sustainable feed ingredients. However, the human nutrition segment is expected to grow at the fastest CAGR during the forecast period due to the rising demand for insect-based foods to feed the growing global population, the high nutritional value of black soldier fly oil in human nutrition, and the growing demand for environment-friendly alternative sources of edible oil.

Europe Dominated the Black Soldier Fly Oil Market in 2022

Based on geography, the black soldier fly oil market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2021, Europe accounted for the major share of the black soldier fly oil market. The large market share of Europe is attributed to factors such as the high demand for animal feed and pet food products, the large supply of pre-consumer food waste from the agriculture and food & beverage sectors, government approvals for black soldier fly products to be used in animal feed and pet food, increased focus on product innovation in the cosmetics and food industries, and the presence of supportive policies for black soldier fly oil farming. This regional market is also expected to witness significant growth during the forecast period.

Key Players

The key players operating in the black soldier fly oil market include Protix B.V. (Netherlands), Enterra Feed Corporation (Canada), InnovaFeed (France), EnviroFlight LLC (U.S.), Nutrition Technologies Group (Malaysia), Bioflytech (Spain), Entobel Holding PTE. Ltd. (Singapore), Entofood Sdn Bhd (Malaysia), SFly (France), Hexafly (Ireland), F4F (Chile), and Protenga Pte Ltd (Singapore).

Scope of the report

Black Soldier Fly Oil Market, by Application

Black Soldier Fly Oil Market, by End Use

Black Soldier Fly Oil Market, by Geography

Key Questions Answered in the Report-

Published Date: Jul-2025

Published Date: May-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates