Resources

About Us

Automotive Infotainment Market by Component (Display Units, Head Units, Navigation Systems, Audio & Entertainment Systems), Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles), Operating System (Linux, QNX, Android, Others), and Sales Channel (OEM, Aftermarket) - Global Forecast to 2036

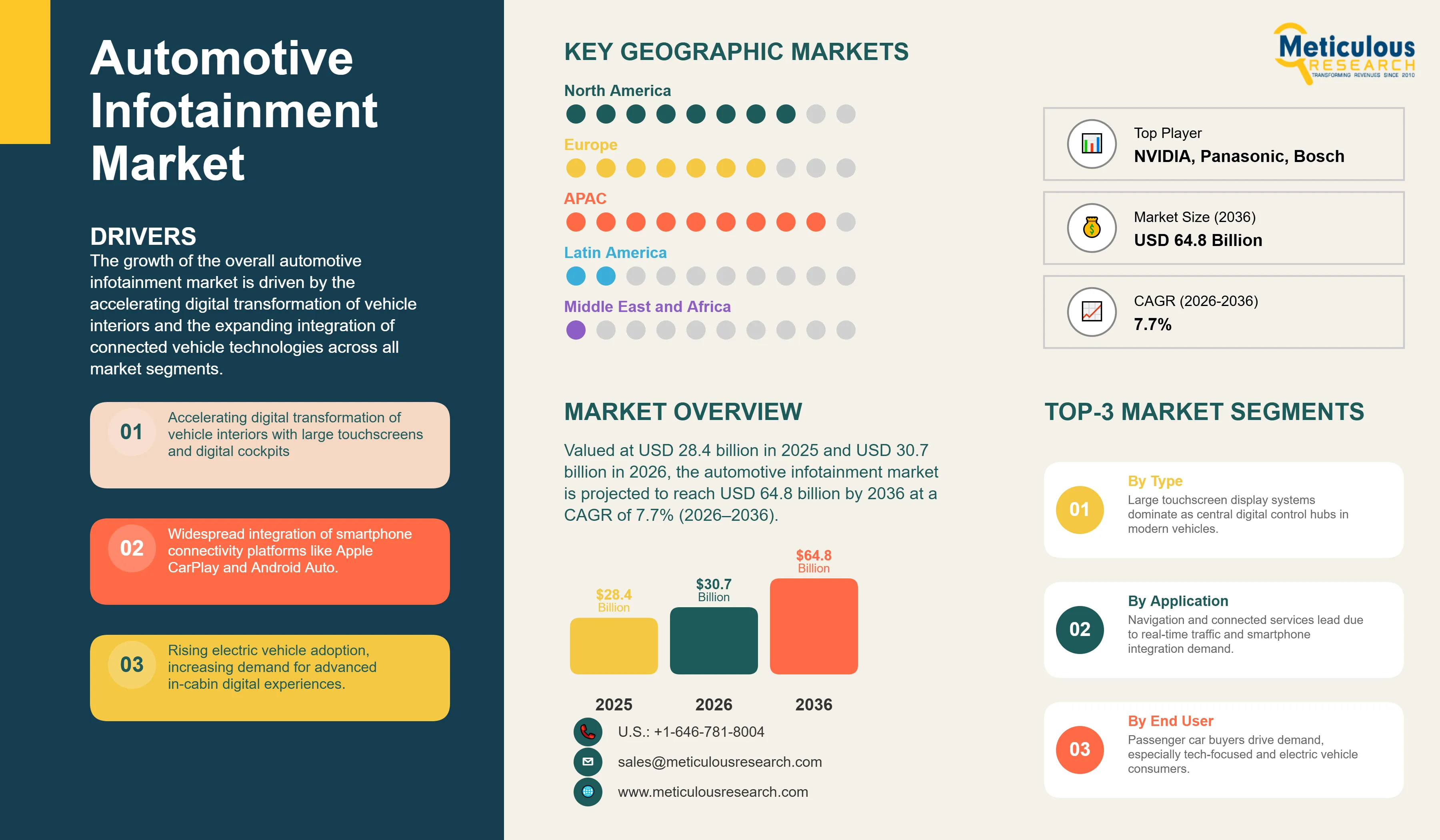

Report ID: MRICT - 1041723 Pages: 277 Feb-2026 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global automotive infotainment market was valued at USD 28.4 billion in 2025. The market is expected to reach approximately USD 64.8 billion by 2036 from USD 30.7 billion in 2026, growing at a CAGR of 7.7% from 2026 to 2036. The growth of the overall automotive infotainment market is driven by the accelerating digital transformation of vehicle interiors and the expanding integration of connected vehicle technologies across all market segments. As automotive manufacturers increasingly recognize infotainment systems as critical differentiators in competitive markets, advanced display technologies, software-defined architectures, and seamless smartphone connectivity have become essential features across vehicle categories from entry-level to premium segments. The rapid expansion of electric vehicle adoption and the evolving expectations of digitally-native consumer demographics continue to fuel significant investments in next-generation infotainment platforms across all major automotive markets.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Automotive infotainment systems represent integrated hardware and software platforms that serve as the central digital interface for vehicle occupants, encompassing entertainment, navigation, communication, and vehicle control functions within unified user experiences. These sophisticated systems combine multiple technologies including high-resolution display units, advanced processing architectures, connectivity modules supporting cellular and wireless protocols, audio subsystems, and navigation capabilities integrated with real-time traffic and mapping services. The market is characterized by rapid technological advancement driven by consumer electronics convergence, with modern infotainment platforms incorporating touchscreen interfaces, voice recognition, gesture controls, and seamless integration with smartphone ecosystems through standards including Apple CarPlay and Android Auto. These systems increasingly serve as foundational elements of connected vehicle architectures, enabling over-the-air software updates, cloud-based services, and integration with advanced driver assistance systems and autonomous driving capabilities.

The market encompasses diverse implementation approaches ranging from embedded systems with proprietary software architectures to open-platform solutions leveraging Android Automotive OS, Linux, or QNX operating systems. Contemporary infotainment platforms integrate advanced components including multi-core processors enabling concurrent application execution, high-bandwidth memory supporting graphics-intensive interfaces, and connectivity modules providing 4G/5G cellular, Wi-Fi, Bluetooth, and emerging vehicle-to-everything (V2X) communication capabilities. The evolution from basic audio systems to comprehensive digital cockpits reflects broader automotive industry transformation toward software-defined vehicles where functionality, features, and user experiences can be continuously enhanced through software updates rather than hardware replacement. This architectural shift enables new business models including feature-on-demand subscriptions, personalized content delivery, and integration with broader digital service ecosystems spanning entertainment, navigation, and vehicle management applications.

The global automotive sector is experiencing fundamental transformation in vehicle interior design and user interface paradigms, with traditional mechanical controls increasingly replaced by digital interfaces consolidating multiple functions through touchscreen displays and voice commands. This transition has accelerated adoption of large-format displays—ranging from 10-12 inch screens in mainstream vehicles to 15-17 inch configurations in premium and electric vehicle segments—serving as primary control surfaces for climate, audio, navigation, and vehicle settings. Simultaneously, the expansion of electric vehicle production creates differentiated requirements and opportunities for infotainment systems, as the absence of internal combustion engine noise enables enhanced audio experiences, while longer charging times increase emphasis on entertainment features and productivity applications. The convergence of automotive and consumer electronics industries drives continuous feature enhancement, with capabilities initially exclusive to luxury segments—including wireless smartphone integration, multi-zone audio, augmented reality navigation, and AI-powered voice assistants—progressively migrating to volume market segments through manufacturing scale and component cost reduction.

Software-Defined Vehicle Architecture and Over-the-Air Update Capabilities

The automotive industry is undergoing fundamental transformation toward software-defined vehicle architectures where infotainment platforms serve as continuously evolving systems rather than static hardware implementations. Over-the-air (OTA) update capabilities—pioneered by Tesla and now widely adopted across manufacturers including Ford, General Motors, Volkswagen, and BMW—enable remote software deployment for feature enhancement, bug remediation, security patching, and user interface improvements without requiring physical service visits. This paradigm shift fundamentally alters vehicle lifecycle economics and ownership experiences, as systems can gain functionality post-purchase through software additions including new entertainment applications, enhanced navigation features, improved voice recognition algorithms, and integration with emerging services. The implementation requires robust cloud infrastructure supporting secure software distribution, comprehensive vehicle data collection enabling performance monitoring and predictive maintenance, and fail-safe update mechanisms preventing system corruption during deployment.

The strategic implications extend beyond technical capability to encompass new revenue models and competitive differentiation strategies. Manufacturers increasingly view software and services as profit centers complementing traditional hardware sales, implementing subscription-based feature activation for premium audio systems, advanced navigation services, performance enhancements, and entertainment content. This creates ongoing customer relationships extending throughout vehicle ownership rather than ending at initial sale, while generating recurring revenue streams potentially totaling thousands of dollars per vehicle over typical ownership periods. The approach requires significant investment in software development capabilities, cybersecurity infrastructure preventing unauthorized access and malicious code injection, and customer communication ensuring update acceptance and feature discovery. Leading implementations demonstrate software update deployment reaching millions of vehicles simultaneously, delivering measurable improvements in system performance, user satisfaction, and feature utilization while establishing competitive advantages through rapid innovation cycles impossible with traditional hardware-dependent development timelines.

Advanced Voice Recognition and Artificial Intelligence Integration

Voice-based interaction has emerged as critical interface modality for automotive infotainment systems, addressing fundamental safety considerations by enabling hands-free, eyes-free operation of complex vehicle functions while reducing driver distraction compared to touchscreen interfaces requiring visual attention and manual interaction. Contemporary voice recognition implementations leverage cloud-based natural language processing achieving accuracy rates exceeding 95% for common commands, support for conversational interactions rather than rigid command structures, multi-language capabilities spanning major global markets, and personalization learning individual driver speech patterns and preferences over time. Leading systems including Mercedes-Benz MBUX, BMW Intelligent Personal Assistant, and integration with consumer AI platforms (Amazon Alexa, Google Assistant) demonstrate sophisticated capabilities encompassing navigation destination entry, climate control adjustment, entertainment selection, messaging composition, and smart home device control accessed from vehicle environment.

The technological foundation combines multiple advanced capabilities including far-field microphone arrays isolating driver voice from ambient cabin noise and passenger conversations, acoustic echo cancellation preventing system audio from triggering false activations, natural language understanding interpreting intent from conversational requests rather than requiring precise command syntax, and contextual awareness enabling follow-up queries referencing previous interactions. Artificial intelligence enhancement extends beyond voice recognition to encompass predictive assistance proactively suggesting actions based on learned patterns—automatically navigating to frequent destinations at typical times, adjusting climate settings to preferred temperatures, or selecting music aligned with listening history. The safety imperative driving voice interface adoption is receiving increasing regulatory attention, with jurisdictions worldwide implementing or considering restrictions on touchscreen interaction while driving, creating compliance pressures favoring voice-first interface designs. The challenge involves balancing comprehensive functionality enabling voice control of all vehicle features against cognitive load concerns where complex hierarchical voice menus become equally distracting, requiring careful user experience design optimizing command discoverability and execution efficiency.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 64.8 Billion |

|

Market Size in 2026 |

USD 30.7 Billion |

|

Market Size in 2025 |

USD 28.4 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 7.7% |

|

Dominating Region |

Asia-Pacific |

|

Fastest Growing Region |

North America |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Component, Vehicle Type, Operating System, Sales Channel, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Consumer Digital Ecosystem Integration and Smartphone Connectivity Standards

The primary market driver is the convergence of automotive and consumer electronics ecosystems, manifested through ubiquitous adoption of smartphone integration platforms Apple CarPlay and Android Auto achieving penetration exceeding 80% of new vehicles in major markets. These standards address fundamental consumer expectations that vehicle infotainment systems provide seamless access to smartphone applications, contacts, media libraries, and services through familiar interfaces reducing learning curves and enabling immediate productivity. The integration extends beyond simple display mirroring to encompass deep system integration where smartphone platforms access vehicle sensors (speed, GPS), control outputs (audio, displays), and provide contextual services (navigation with live traffic, messaging with voice dictation). This dependency on smartphone connectivity has transformed purchasing criteria, with infotainment system quality and smartphone integration capability ranking among top factors influencing vehicle purchase decisions according to consumer surveys, particularly among younger demographics for whom digital connectivity represents non-negotiable requirement rather than optional feature.

Opportunity: Electric Vehicle Proliferation and Premium Experience Differentiation

Electric vehicle expansion creates substantial opportunities for infotainment market growth as EV manufacturers position in-cabin digital experiences as primary differentiation vectors in increasingly competitive markets. The fundamental differences in EV cabin environments—including dramatically reduced noise and vibration from electric powertrains, elimination of traditional engine-related controls creating available space for larger displays and alternative interface locations, and distinct user requirements including charge management, range optimization, and charging station navigation—enable and necessitate infotainment implementations diverging from internal combustion vehicle conventions. Leading EV platforms demonstrate this differentiation through deployment of exceptionally large displays (Tesla's 17-inch landscape orientation, Mercedes EQS's 56-inch Hyperscreen spanning dashboard width, BMW iX's curved display panel), integration of EV-specific applications (charge station locators with real-time availability, battery preconditioning controls, energy consumption visualization), and features exploiting extended dwell times during charging sessions (streaming video, gaming, productivity applications).

Display Units Segment Dominance and Technology Evolution

The display units segment commands the largest market share within automotive infotainment components, driven by the architectural evolution of vehicle interiors toward screen-centric interfaces consolidating previously discrete physical controls into unified digital control surfaces. Contemporary vehicle displays span sizes from 8-10 inches in entry-level segments to 12-15 inches in mainstream vehicles, with premium and electric vehicles deploying 15-17 inch configurations and specialized implementations including Mercedes-Benz Hyperscreen's 56-inch panel spanning entire dashboard width. This progression reflects multiple concurrent trends: increasing display technology cost-effectiveness enabling larger screens at acceptable price points, user interface design evolution favoring graphical representations over physical buttons, and functional consolidation integrating climate controls, audio settings, navigation, vehicle configurations, and ADAS controls through touchscreen interaction. Display technology advancement encompasses resolution improvements (transitioning from 720p to 1080p and 4K in premium applications), enhanced brightness specifications enabling outdoor visibility under direct sunlight, faster refresh rates supporting smooth animations and responsive touch interactions, and OLED adoption in luxury segments providing superior contrast ratios and deeper blacks compared to traditional LCD implementations.

Passenger Car Market Leadership with Electric Vehicle Acceleration

Passenger cars represent the predominant vehicle type segment for infotainment systems, accounting for approximately 75-80% of total market volume driven by substantially larger production volumes compared to commercial vehicles and broader adoption of advanced infotainment features across price segments. The segment demonstrates significant feature democratization trends, with capabilities previously exclusive to premium vehicles—including large touchscreen displays, wireless smartphone connectivity, voice recognition, and connected services—progressively migrating to volume market segments through component cost reduction and competitive pressures. Electric vehicles, while representing smaller absolute volumes, exhibit highest growth rates and disproportionate influence on infotainment development trajectories. EV implementations demonstrate several differentiating characteristics: substantially larger average display sizes (13-17 inches versus 8-12 inches in comparable ICE vehicles), higher content value per vehicle reflecting premium positioning and buyer demographic preferences, integration of EV-specific applications including charge management and battery optimization, and architectural approaches treating infotainment as core vehicle identity rather than auxiliary feature. This creates bifurcated development priorities where innovations debut in EV platforms before cascading to broader passenger car applications, exemplified by Tesla's influence establishing consumer expectations subsequently adopted across industry.

Operating System Platform Competition and Strategic Positioning

The automotive infotainment operating system landscape reflects strategic competition between established automotive-grade platforms and consumer technology ecosystems seeking automotive market penetration. QNX (BlackBerry subsidiary) maintains significant market presence based on safety certification heritage, real-time operating system capabilities, and proven reliability in mission-critical automotive applications, deployed by manufacturers including Ford, General Motors, Volkswagen Group, and Honda valuing stability and regulatory compliance. Android Automotive OS represents Google's automotive-specific implementation distinct from Android Auto smartphone projection, gaining substantial adoption through partnerships with General Motors, Volvo/Polestar, Renault-Nissan-Mitsubishi alliance, and Honda, offering integrated Google services (Maps, Assistant, Play Store), extensive developer ecosystem, and continuous feature enhancement through Google's software development capabilities. Linux-based implementations provide open-source foundation enabling manufacturer customization and avoiding platform vendor lock-in, deployed in Toyota/Lexus vehicles and various Chinese manufacturers prioritizing proprietary differentiation. Proprietary systems—including Tesla's custom platform, Mercedes-Benz MBUX, and BMW iDrive—enable complete manufacturer control over user experience, feature implementation, and brand differentiation, though requiring substantial ongoing software development investment justifiable primarily for premium manufacturers or companies with software development core competencies.

OEM Channel Dominance Through Integration and Feature Complexity

Original Equipment Manufacturer (OEM) installations dominate automotive infotainment market share, commanding approximately 85-90% of total market value driven by increasing system integration complexity making aftermarket replacement increasingly impractical for contemporary vehicles. Modern infotainment systems integrate deeply with vehicle electrical architectures, accessing CAN bus data for vehicle speed, door status, parking sensor inputs, camera feeds, and steering wheel controls, while providing outputs controlling audio amplification, climate displays, and driver information systems. This integration creates substantial replacement barriers as aftermarket systems typically cannot replicate full OEM functionality, particularly regarding advanced driver assistance system integration, vehicle-specific features, and warranty considerations discouraging modification. The OEM dominance intensifies with each vehicle generation as manufacturers deploy increasingly sophisticated factory systems matching or exceeding aftermarket capabilities in display quality, processing power, and feature sets, while maintaining integration advantages aftermarket cannot replicate. The aftermarket channel maintains relevance primarily for older vehicle populations lacking modern connectivity features, commercial fleet applications requiring specialized functionality, and niche enthusiast segments pursuing premium audio upgrades, though even these applications increasingly favor integration with existing OEM systems rather than wholesale replacement reflecting technical and economic realities of contemporary vehicle architectures.

Asia-Pacific maintains dominant market position accounting for approximately 45-50% of global automotive infotainment revenue, driven primarily by China's position as world's largest vehicle production and sales market with annual volumes exceeding 25 million units. Chinese market characteristics include rapid technology adoption rates, strong consumer preference for large displays and advanced connectivity features, and robust domestic infotainment supplier ecosystem serving both local manufacturers (BYD, Geely, Great Wall) and international brands producing in-market. Japanese manufacturers (Toyota, Honda, Nissan) contribute substantial volumes while Korean automakers (Hyundai, Kia, Genesis) increasingly emphasize infotainment differentiation as competitive strategy. The region demonstrates particular strength in display manufacturing capabilities through Samsung Display, LG Display, and Chinese panel manufacturers supporting cost-effective implementation of large-format screens. India represents emerging high-growth market where increasing vehicle affordability and smartphone penetration drive demand for connected vehicle features, though at lower price points than developed markets necessitating cost-optimized implementations. Southeast Asian markets show growing adoption of infotainment features in new vehicle segments, particularly in Thailand, Indonesia, and Malaysia where automotive assembly activity expands.

North America exhibits distinct market characteristics emphasizing premium features, large display sizes, and deep smartphone ecosystem integration reflecting consumer preferences and higher average transaction prices. The United States market demonstrates particularly strong penetration of Apple CarPlay and Android Auto, with implementation rates approaching 90% in new vehicles across all segments from economy to luxury. American consumers allocate significant time to vehicle usage for commuting and long-distance travel, increasing value placed on infotainment quality, audio system performance, and entertainment capabilities. The market shows strong growth in premium audio system adoption, with branded systems from Bose, Harman Kardon, Bang & Olufsen, and others commanding substantial premiums. Electric vehicle adoption acceleration in California and other progressive states drives infotainment innovation as manufacturers including Tesla, Rivian, Lucid, and traditional OEMs launching EV programs emphasize digital experience differentiation. Canada mirrors U.S. patterns while Mexico's growing automotive production base increasingly incorporates advanced infotainment systems even in vehicles destined for export markets, reflecting global feature standardization trends.

Europe demonstrates sophisticated infotainment market characterized by premium brand concentration, stringent regulatory environment regarding driver distraction, and strong emphasis on design quality and user experience refinement. German manufacturers (Mercedes-Benz, BMW, Audi, Volkswagen Group) maintain traditional leadership in infotainment innovation, though facing intensifying competition from new entrants and technology companies. European regulatory framework including type approval requirements and increasing attention to driver distraction influences interface design, potentially constraining certain touchscreen-centric implementations while favoring voice control and simplified interaction patterns. The region shows strong adoption of embedded navigation systems compared to North America's greater reliance on smartphone-based navigation, reflecting different consumer preferences and longer average vehicle retention periods justifying navigation system investment. European market also demonstrates growing interest in subscription-based connected services including real-time traffic information, online media streaming, and remote vehicle management features, creating recurring revenue opportunities for manufacturers. Eastern European markets show increasing feature adoption as economic development supports vehicle upgrade cycles and consumer demand for connectivity features grows, though at generally lower specification levels than Western Europe.

The companies such as Harman International Industries (Samsung Electronics), Continental AG, Robert Bosch GmbH, and Panasonic Automotive Systems lead the global automotive infotainment market with comprehensive integrated system solutions spanning hardware, software, and cloud services, particularly serving multiple OEM customers across passenger car and commercial vehicle segments. Meanwhile, players including Alpine Electronics, Pioneer Corporation, Denso Corporation, and Visteon Corporation provide specialized components and subsystems including display units, audio amplification, navigation modules, and head unit assemblies targeting diverse vehicle platforms and price points. Technology platform providers such as Google (Android Automotive OS), Apple (CarPlay integration), Qualcomm Technologies (Snapdragon automotive processors), and NVIDIA Corporation (automotive computing platforms) supply foundational technologies enabling advanced infotainment capabilities including AI processing, voice recognition, and graphics rendering. The competitive landscape reflects industry transformation toward software-defined architectures where traditional tier-one suppliers increasingly partner with technology companies to deliver integrated solutions combining automotive-grade hardware reliability with consumer electronics user experience quality and continuous software enhancement capabilities.

The global automotive infotainment market is expected to grow from USD 30.7 billion in 2026 to USD 64.8 billion by 2036.

The global automotive infotainment market is projected to grow at a CAGR of 7.7% from 2026 to 2036.

Display units dominate the market in 2026 due to their central role as the primary user interface. Audio & entertainment systems are showing strong growth as consumers increasingly value premium sound experiences and streaming integration.

EVs are accelerating innovation by treating infotainment as a core differentiator rather than an accessory. The quieter cabin environment, tech-savvy buyer demographic, and need for sophisticated battery and charging management are driving development of more advanced, integrated systems.

Asia-Pacific holds the largest share in 2026, driven by massive vehicle production in China and strong technology adoption across the region. North America is expected to show strong growth rates, particularly in the premium and EV segments.

Leading companies include Harman International (Samsung), Continental AG, Robert Bosch GmbH, Panasonic Automotive Systems, and Alpine Electronics, along with technology providers like Google, Apple, and Qualcomm.

Published Date: Jan-2025

Published Date: Oct-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates