Resources

About Us

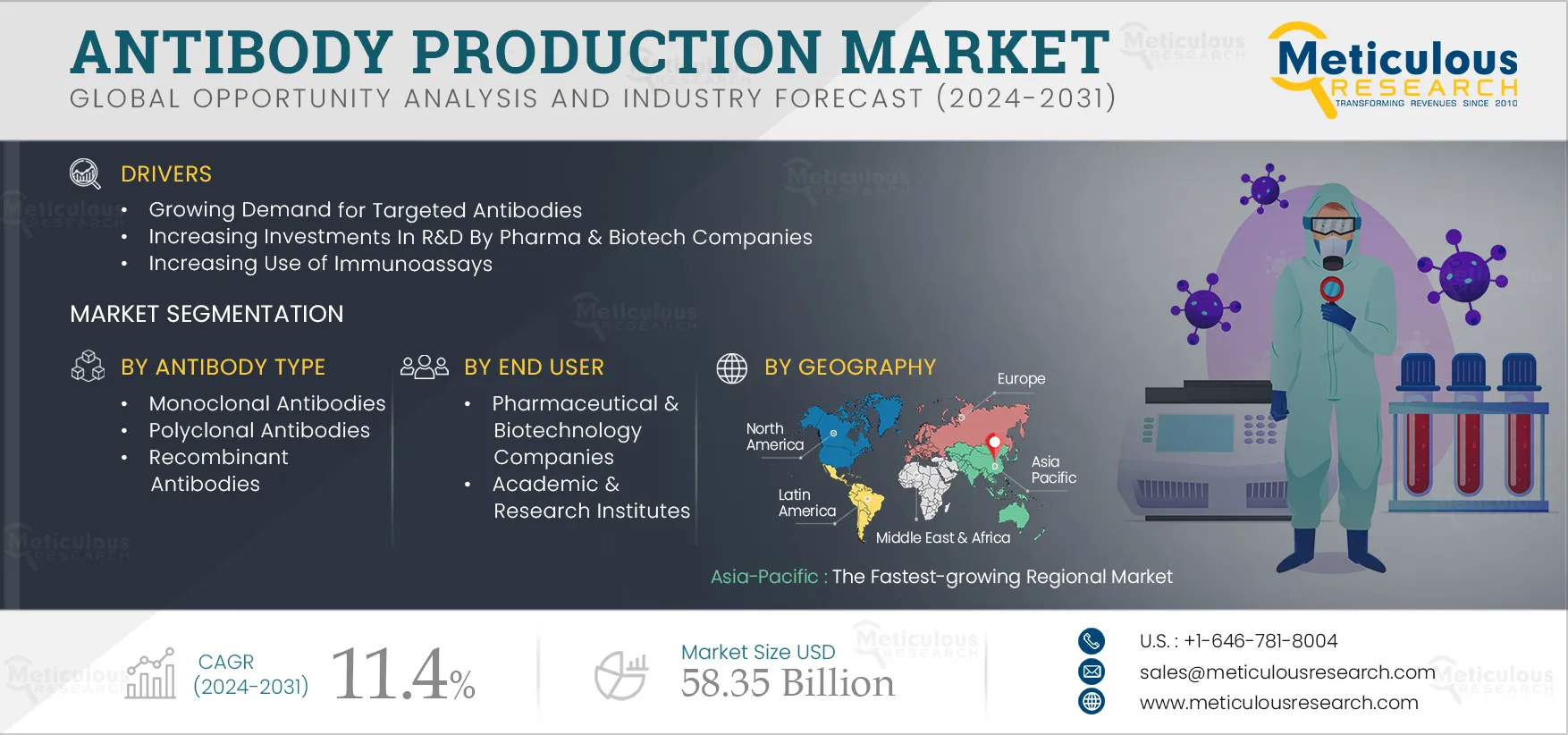

Antibody Production Market by Product [Bioreactors (Single use, Reusable), Chromatography, Filtration, Cell Lines, Media, Buffers, Resins], Antibody [Monoclonal, Polyclonal], Source [Mice, Rabbit], Process [Downstream, Upstream] – Global Forecast to 2032

Report ID: MRHC - 1041086 Pages: 200 Aug-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportAntibodies have therapeutics as well as diagnostic applications. Antibodies are majorly used for therapeutics for several diseases and conditions, such as cancer, autoimmune diseases, infectious diseases, and other conditions. The production of antibodies involves processes such as the downstream process and upstream process. Antibodies can be derived from sources such as mice and rabbit, among other sources.

The growth of this market is attributed to growing demand for targeted antibodies, increasing investments in R&D by pharma & biotech companies, growing prevalence of cancer and autoimmune diseases, increasing use of immunoassays, and advancements in bioprocessing technologies. However, the high cost of antibody production and stringent regulatory framework restrain the growth of this market.

Furthermore, growing applications of antibodies in clinical trials and medical research, significant opportunities from developing countries, and growing risk and prevalence of infectious diseases are expected to generate growth opportunities for the players operating in this market. However, the complex nature of monoclonal antibodies poses a challenge for market stakeholders during antibody production.

Antibodies are key to diagnosing and treating infectious diseases in the form of a detection or capture agent in an ELISA, a biomarker of interest, or a key vaccine component. The normal immune response to a viral or a microbial infection is the production of antibodies towards the antigens of the infection. Passive immunization for post-exposure prophylaxis or adjunct therapy has been successfully used for over a century to treat suspected exposure or infection against a range of diseases, such as rabies, diphtheria, tetanus, and hepatitis B. For most of these diseases, the immunoglobulin preparations administered to patients have been derived from immunized horses, immunized humans, and in some cases, from convalescent patients. Moreover, immunization with monoclonal antibodies has some advantages over active immunization with vaccines, such as protection afforded via passive immunization is immediate, and such protection can be induced in immunosuppressed individuals who are often at the highest risk of infection.

The growing prevalence and increasing risk of outbreaks of infectious diseases is expected to drive the adoption of antibodies for immunization, further leading to the demand for their production. According to an article published in the United Nations’ Africa Renewal digital magazine in July 2022, the risk of outbreaks caused by zoonotic pathogens such as the Ebola & monkeypox viruses that originate in animals and infect humans is rising. There has been a 63.0% increase in the number of zoonotic disease outbreaks in Africa from 2012–2022 compared to 2001– 2011.

Click here to: Get Free Sample Pages of this Report

Cancer poses a major burden on the global population and is further estimated to increase cancer cases, leading to mortality and degradation of quality of life. For instance, by 2032 the total number of new cancer cases is estimated to account for 24.6 million from 19.3 million in 2020 (Source: International Agency for Research on Cancer). Monoclonal antibodies (mABs) are used for the treatment of cancer as mABs are a type of targeted drug therapy. These drugs recognize and find specific proteins and cancer cells and help in the inhibition of their growth. Governments and several organizations and associations strive towards making better treatments and preventing cancer in people. Similarly, pharmaceutical & biopharmaceutical companies are developing newer drugs and biologics for the treatment of cancer. Pharma & biopharma companies are developing and gaining approvals for monoclonal antibodies for cancer. For instance, according to the Antibody Society, as of 2020, 43 monoclonal antibodies were approved or under review in the European Union or the U.S. Growing cancer prevalence and initiatives towards approval and development of mABs for cancer further lead to the increased production of antibodies.

Similarly, monoclonal antibodies are used to treat autoimmune diseases, a condition in which antibodies in an individual attack its own body, causing inflammation. Several anti-inflammatory monoclonal antibodies are used in the treatment of autoimmune diseases. For instance, monoclonal antibodies used to treat arthritis are known as tumor necrosis factor (TNF) inhibitors. TNF is a protein involved in causing inflammation and damage of rheumatoid arthritis. According to Lancet Diabetes & Endocrinology, in 2021, around 8.4 million people were affected with type-1 diabetes (one of the most common autoimmune diseases) globally. This number is estimated to increase to 13.5–17.4 million people by 2040. Also, as of 2022, around 1-1.5% of the European population (7 million) had celiac disease. (Source: European Parliament). Similarly, as of 2020, around 44 people per 100,000 population were affected with multiple sclerosis globally (Source: MS Atlas). The growing prevalence of autoimmune diseases is further expected to drive the demand for monoclonal antibodies for their treatment, driving the need for antibody production.

The instrument segment is further segmented into bioreactors, chromatography systems, filtration systems, and other instruments. Antibodies are widely used as diagnostic reagents and for therapeutic purposes, and their demand is increasing extensively. To produce these antibodies in sufficient quantities for commercial use, it is necessary to raise the output by scaling up the production processes. Bioreactors allow for better control of culture conditions, which can lead to higher cell densities and increased antibody yield. This can result in fewer runs needed to manufacture the desired amount of antibody, leading to the largest share of the segment. Furthermore, the chromatography systems are crucial in the quality control and filtration of the antibodies, leading to their high adoption.

The factors contributing to the segment’s large share are the wide array of applications of monoclonal antibodies in therapeutics for various diseases and conditions, the growing prevalence of chronic diseases, and the growing focus of pharm & biopharma companies on the development of monoclonal antibodies-based therapeutics.

Due to the availability, low cost, and quick production time for mouse mAbs, humanization of mouse mAbs has been implemented on a large scale. Furthermore, mouse husbandry is easier than rabbit husbandry, and the genetic approaches to engineering antibodies through recombinant technologies are more established for mice than other animals such rabbits, making mice a preferred choice for antibody production.

Downstream processing constitutes a critical step in manufacturing antibodies with regard to product purity, cost, and environmental impact. The purpose of downstream processing is to isolate, purify, and concentrate the previously synthesized antibody from the complex bulk matrix.

The large share of the segment is attributed to the growing R&D investments by pharma & biotech companies, increasing demand for biological therapeutics, high prevalence of chronic diseases, and capacity & geographic expansion of production facilities by the pharma & biopharma companies. Several pharma & biopharma are taking initiatives for the expansion of their production facilities, leading to the adoption of products for antibody production. For instance, in 2022, Seagen Inc. (U.S.), a biotechnology company focused on developing and commercializing monoclonal antibody-based therapies for the treatment of cancer, announced the building of a new biologics facility. This facility will start its production in 2025 and will include monoclonal antibody production, fill & finish, quality control labs, package & labeling, warehouse, and office space.

In 2025, North America is expected to dominate the antibody production market, while Asia-Pacific is expected to record the highest CAGR during the forecast period. The high growth of the Asia-Pacific antibody production market is attributed to the growing pharmaceutical and biotech industry, supporting government initiatives, a large number of clinical trials conducted in the Asia-Pacific region, and growing demands and biologics for chronic & infectious diseases.

The report offers a competitive landscape based on an extensive assessment of the product portfolio offerings, geographic presence, and key strategic developments adopted by leading market players in this market in the last three to four years. The key players profiled in the antibody production market are Thermo Fisher Scientific Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Merck KgaA (Germany), Eppendorf SE (Germany), Sartorius AG (Germany), Danaher Corporation (U.S.), Waters Corporation (U.S.), Shimadzu Corporation (Japan), Solaris Biotechnology Srl (Italy), and Infors AG (Switzerland).

|

Particular |

Details |

|

Page No |

~200 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

11.4% |

|

2032 Market Size (Value) |

$58.35 billion by 2032 |

|

Segments Covered |

By Product

By Antibody Type

By Source

By Process

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Spain, Italy, Rest of Europe), Asia-Pacific (China, Japan, India, Rest of APAC), Latin America (Brazil, Mexico, Rest of LATAM), Middle East & Africa |

|

Key Companies |

Thermo Fisher Scientific Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Merck KgaA (Germany), Eppendorf SE (Germany), Sartorius AG (Germany), Danaher Corporation (U.S.), Waters Corporation (U.S.), Shimadzu Corporation (Japan), Solaris Biotechnology Srl (Italy), Infors AG (Switzerland) |

The antibody production market report covers market sizes & forecasts for instruments, consumables, and software. The antibody production market study includes the value analysis of various segments and subsegments of the antibody production market at the regional and country levels.

The antibody production market is projected to reach $58.35 billion by 2032, at a CAGR of 11.4% from 2025 to 2032.

The instruments segment is estimated to account for the largest share of the antibody production market in 2025. Moreover, this segment is expected to record the highest CAGR during the forecast period.

The monoclonal antibodies segment is projected to gain more traction in the antibody production market.

The high growth of the antibody production market is mainly attributed to the growing demand for targeted antibodies, increasing investments in R&D by pharma & biotech companies, the high burden and growing prevalence of cancer and autoimmune diseases, increasing use of immunoassays, and advancements in bioprocessing technologies.

Furthermore, growing applications of antibodies in clinical trials and medical research, significant opportunities from developing countries, and growing risk and prevalence of infectious diseases are expected to generate growth opportunities for the players operating in this market.

The key players operating in the antibody production market are Thermo Fisher Scientific Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Merck KgaA (Germany), Eppendorf SE (Germany), Sartorius AG (Germany), Danaher Corporation (U.S.), Waters Corporation (U.S.), Shimadzu Corporation (Japan), Solaris Biotechnology Srl (Italy), Infors AG (Switzerland)

The emerging Asian-Pacific countries are expected to offer significant growth opportunities for the vendors in this market due to the growing pharmaceutical and biotech industry, supporting government initiatives, large number of clinical trials conducted in the Asia-Pacific region, and growing demands and biologics for chronic & infectious diseases.

Published Date: Jul-2020

Published Date: Jul-2022

Published Date: Jul-2022

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates