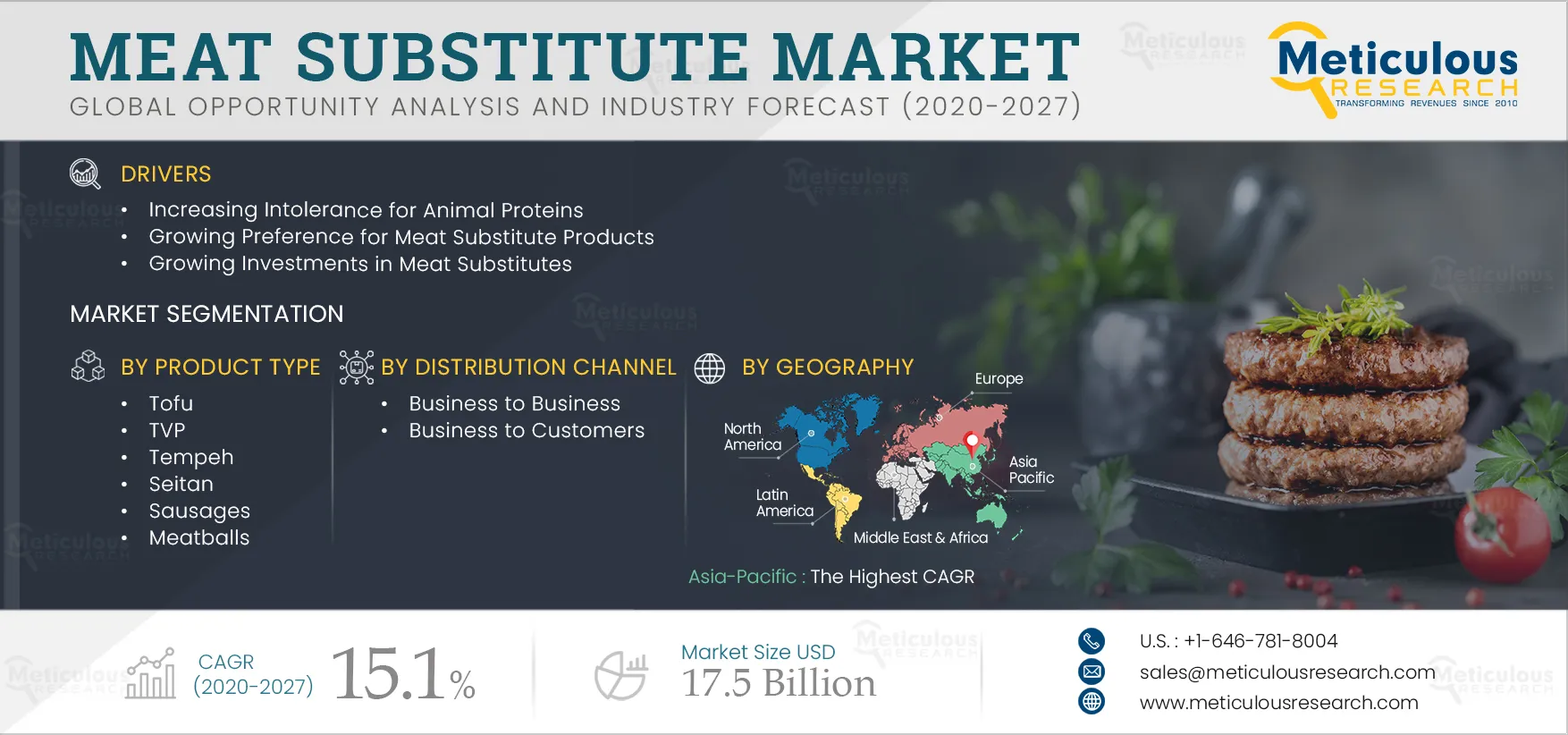

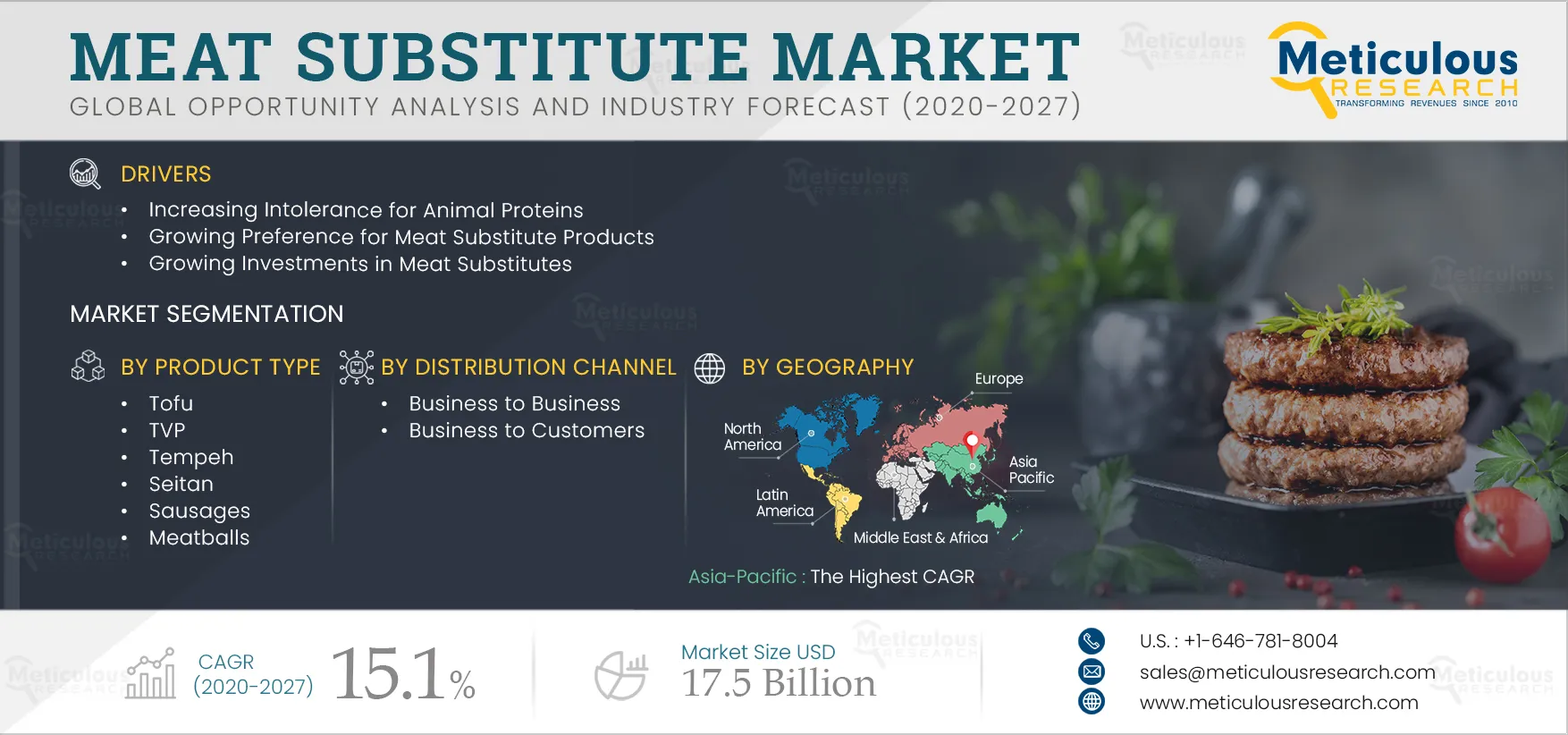

The Meat Substitute Market is expected to reach $17.5 billion by 2027, at a CAGR of 15.1% during the forecast period of 2020 to 2027. Due to the COVID-19 pandemic, there has been an exponential rise in demand for healthy protein foods. In addition, rising intolerance for animal protein, rising awareness about a healthy diet, increasing vegan population, and rising venture capital investments are the major factors accelerating the growth of this market. Moreover, the growing focus on R&D and new product launches by alternative protein manufacturers and growing demand from emerging economies are expected to create lucrative opportunities for players operating in this market.

Impact of COVID-19 on the Meat Substitute Market

The COVID-19 pandemic has affected more than 200 countries infecting more than 11,874,226 people and killing 545,481 as of 9th July 2020 (Source: European Centre for Disease Prevention and Control). This current situation has had a substantial impact on the traditional meat processing industry, which has led to many slaughterhouses closing shops due to disruption of the supply chain.

The meat supply in the U.S. is expected to be flogged by the COVID-19 outbreak, as major meat plants have been taken offline as factory workers have tested positive for the virus. It is estimated that meat plants responsible for 10% of all beef production in the U.S. and 25% of all pork production have closed in early 2020, with this having the potential to disrupt meat supply chains and lead to shortages. This potential shortage of meat supply is already leading to augment consumer demand for meat substitute in the U.S., with meat substitute sales reported to have jumped 200% in the country in April, compared to last year.

Click here to: Get Free Sample Pages of this Report

Consumer Preference for Soy and Gluten-free Products

The “free-from” is one of the fastest-growing trends in niche foods. Soy and a gluten-free diet has quickly become the fastest-growing nutritional movements, which is gaining popularity for its health and therapeutic benefits. The increase in the use of soy and gluten-free food products is mainly attributed to rising food sensitivities, regional dietary preferences, and increasing diagnosis of coeliac diseases. For instance, many people have allergies and intolerance of soy protein resulting in eye irritation, stomach upsets, and other symptoms, which in some cases require hospitalization.

The increasing demand for gluten-free products is mainly associated with increasing instances of diseases. However, the number of people who actually need to avoid gluten for medical reasons is relatively small. As a result, some of the people are avoiding food products containing or fortified with soy and wheat ingredients. Thus, rising consumer preference towards soy-free food products across the globe restricts the growth of the soy and wheat protein-based meat substitutes market to some extent.

Key Findings in the Global Meat Substitute Market Study:

In 2020, the plant-based tofu segment dominated the global meat substitute market

Based on product type, the tofu segment accounted for the largest share of the market due to its low cost, easy availability, and presence of a wide variety of tofu types and flavors. However, the burger patties segment is expected to grow at the fastest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to the increasing popularity and new product launches in the plant-based burger patties segment and their increasing availability in many restaurants.

The pea protein segment to witness the fastest growth during the forecast period

Based on source, the pea protein segment is expected to grow at the fastest CAGR during the forecast period due to growing consumer desire to find sustainable and good tasting alternatives to animal-based proteins and growing investments from leading manufacturers.

In 2020, the business to customers segment dominated the global meat substitute market

Based on distribution channel, the B2C segment commanded the largest share of the global meat substitute market in 2020. The large share of this market is mainly attributed to the growing number of supermarkets & hypermarkets, consumers preference for shopping from brick-and-mortar grocers, and increasing consumer preference for vegan food products.

The Asia-Pacific market is poised to grow at the highest CAGR during the forecast period

On the basis of region, the global meat substitute market is segmented into North America, Europe, APAC, Latin America, and the Middle and Africa. The APAC region is expected to grow at the highest CAGR during the forecast period. The rapid growth in urbanization, rising income levels, and growing awareness about the benefits of protein diet in daily nutrition are the drivers for this market.

Key Players

The meat substitute market is highly fragmented in nature with the presence of many small and medium-sized private companies in the market. Some of the key vendors operating in the global meat substitute market are Beyond Meat Inc. (U.S.), Impossible Foods Inc. (U.S.), Garden Protein International, Inc. (Canada), Amy’s Kitchen Inc. (U.S.), The Hain Celestial Group, Inc. (U.S.), Sahmyook Foods (South Korea), Axiom Foods (U.S.), Lightlife Foods, Inc. (U.S.), Marlow Foods Ltd. (U.K.), Taifun –Tofu GmbH (Germany), Atlantic Natural Foods LLC (U.S.), VBIte Food Ltd (U.K.), and Nutrisoy Pty Ltd. (Australia).

Scope of the report

Meat Substitute Market, by Product Type

- Tofu

- TVP

- Tempeh

- Seitan

- Burger Patties

- Sausages

- Ground Meat

- Meatballs

- Nuggets

- Crumbles

- Others

Meat Substitute Market, by Source

- Soy Protein

- Almond Protein

- Wheat Protein

- Pea Protein

- Rice Protein

- Others

Meat Substitute Market, by Distribution Channel

- Business to Business

- Business to Customers

- Modern Groceries

- Convenience Store

- Specialty Store

- Online Retail

- Others

Meat Substitute Market, by Geography

- North America

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- RoE

- Asia-Pacific (APAC)

- Latin America

- Middle East and Africa

Key questions answered in the report: