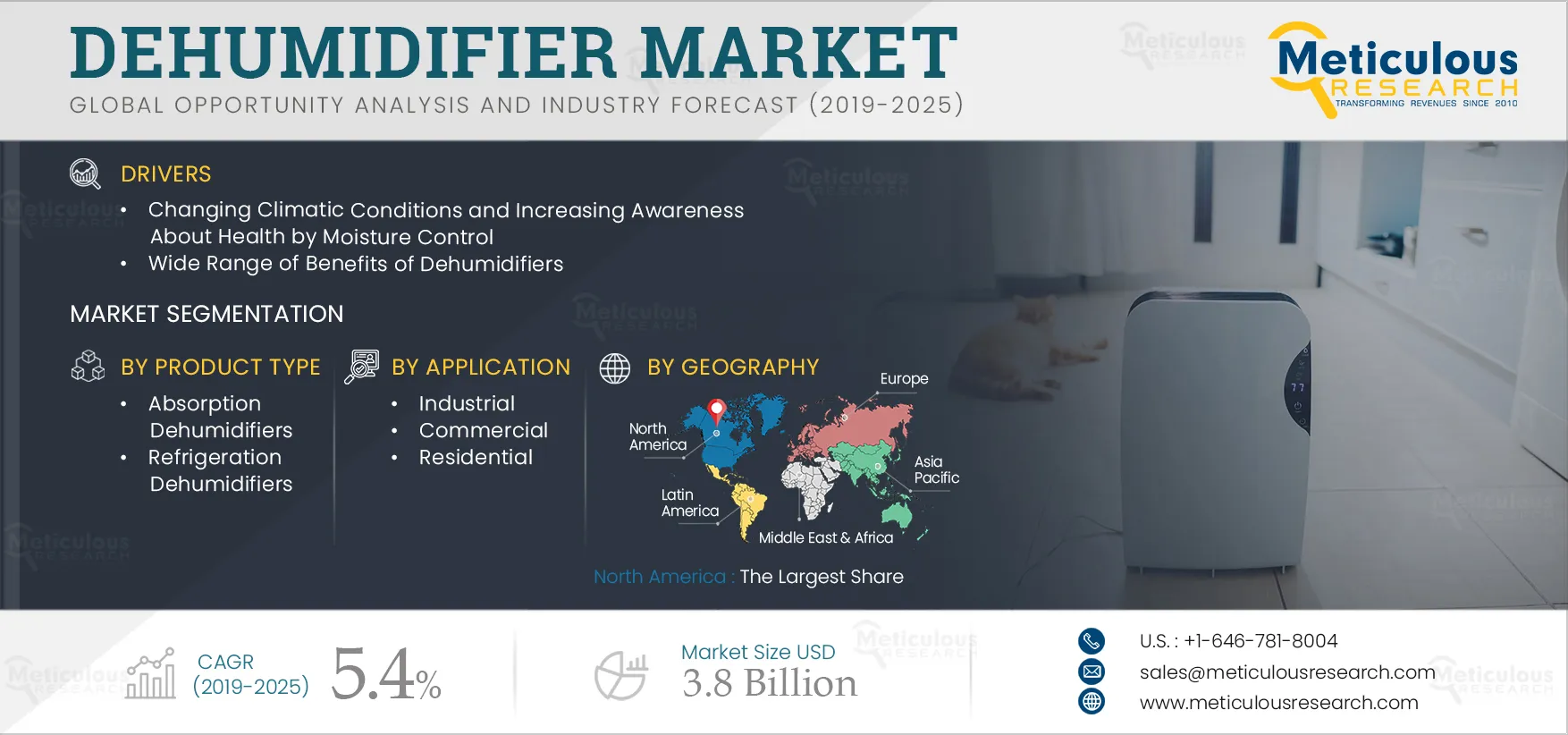

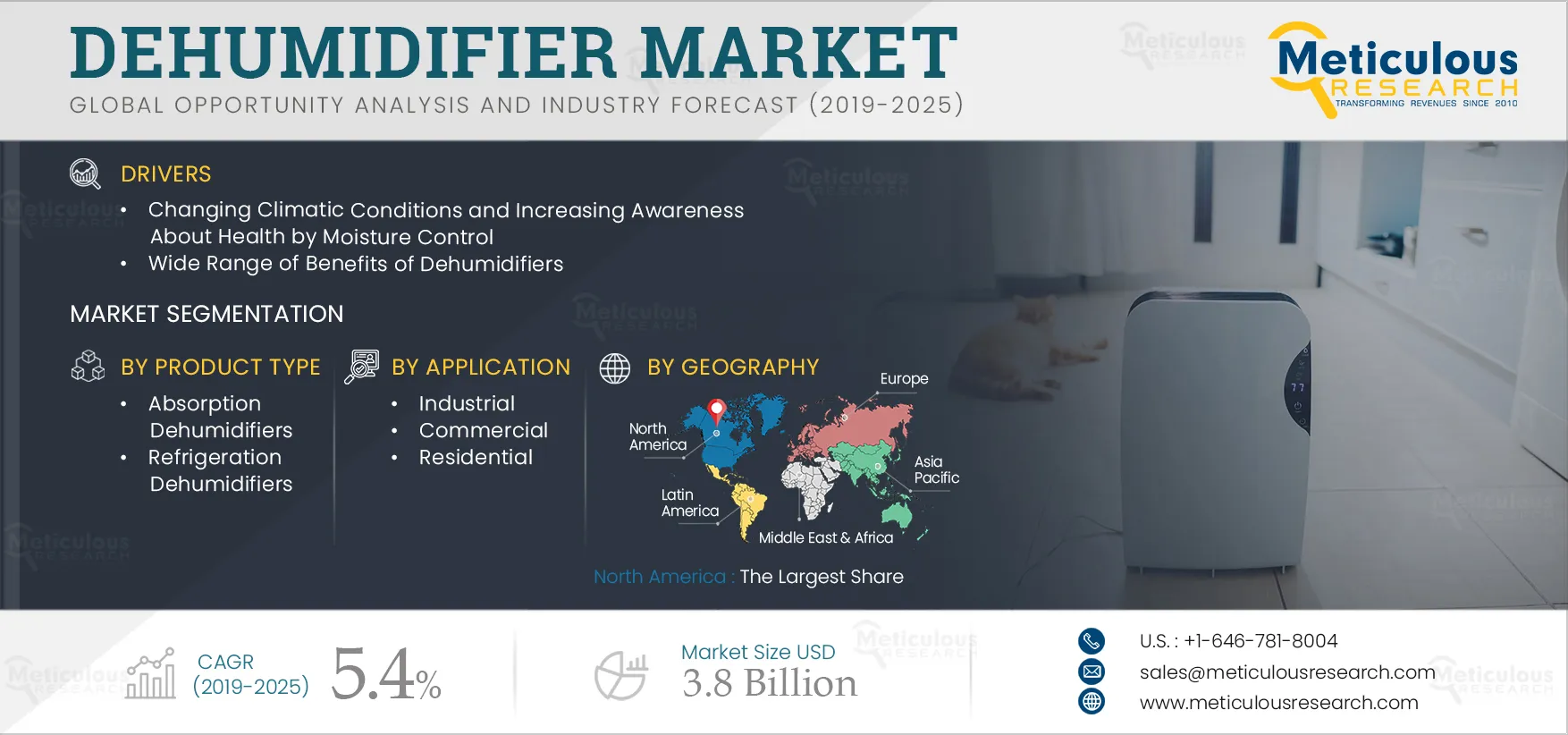

The Dehumidifier Market is expected to grow at a CAGR of 5.4% from 2019 to 2025 to reach $3.8 billion by 2025. It is regarded that the humidity in the environment can lead to many problems of human health. Humidity control is also critical in many other areas such as manufacturing and storage of certain equipment, food processing, and storage, and in also certain areas such as diagnostic and research labs and hospitals. Thus, to maintain humidity levels in the atmosphere, dehumidification systems, including dehumidifiers are widely used across residential, commercial, and industrial sectors, across the globe. Humidifiers are used to control moisture levels in the air, and help inavoiding corrosion problems in the industrial sector by preventing condensation on equipment and machineries as well as other electronics tools. In the residential sector, dehumidifiers reduce the humidity level, making the area less welcoming to allergy-causing agents, such as dust mites, black mold, and yeast. Dehumidifiers also help in eliminating musty smell commonly associated with the growth of mold and mildew; as well as lowers energy costs by enabling the air conditioner to run more efficiently.

Increasing use of dehumidifiers in the research and development labs propelling the growth of dehumidifier market

Humidity and temperature control are of critical importance in the field of research and development as the surrounding environmental condition of lab affects measurement device characteristics, performance, and can cause structural damage to expensive equipment. This may lead to unnecessary downtime, resulting in economic and financial losses. Therefore, all scientific instruments used in research laboratories, require protection against humidity and temperature fluctuations to maintain accuracy and performance. Many commercial facilities, industrial instrumentation rooms, and educational facilities require humidity control solutions.

Therefore, there is strong need for dehumidifiers in the R&D labs. AC systems can offer a condition over a range of 18ºC to 23ºC with a range of 40% to 60% relative humidity, which is suitable for human body. However, sensitive research and development methods, and manufacturing of products, such as pharmaceuticals or medical devices, often require control of temperature and humidity at much tighter limits, typically ±1ºC and ±2%RH, respectively. This degree of control cannot be achieved with standard AC systems, and it is only possible with specialist humidification and dehumidification systems.

Click here to: Get Free Request Sample Copy of this report

Key findings in the global dehumidifier market study:

Absorption dehumidifiers continue to remain the largest product category

On the basis of product type, absorption dehumidifiers segment is estimated to account for the largest share of the overall dehumidifiers market in 2019. This segment is also slated to grow at a faster CAGR over the forecast period. The overall growth of this segment is mainly attributed to its extensive applications in a wide range of industries due to its high efficiency and cost-effectiveness to control the air moisture and humidity level. In addition, increasing adoption of this dehumidifier in hotels, restaurants, dining rooms, and other cooking places to meet the concerns regarding the high moisture levels generated by cooking also supports the growth of this market. Further, the growing demand of this dehumidifier in the locations having temperatures below 30oC, such as garages, unoccupied properties, and caravans, among others, are responsible for the rapid growth in the adoption of the absorption dehumidifier.

Industrial application dominates the global dehumidifier market

Based on the application, the overall dehumidifier market research report is segmented into industrial, commercial, and residential applications. Owing to the growing global economy and rapid industrialization, industrial applications segment is estimated to command the largest share of the global dehumidifier market in 2019. Government initiatives, rules, and regulations to overcome issues related to global warming and the need for moisture control in manufacturing, processing, packaging, and warehousing industries further supports the growth of this market.

North America dominates the global dehumidifier market, while Asia-Pacific leads the growth

North America commanded the largest share of the global dehumidifier market, followed by Europe and Asia-Pacific regions. The major share of this region is mainly attributed to rapid growth of the construction industry, changing climate conditions, high industrialization, rising consumer inclination towards a healthy environment, and various government initiatives.

However, Asia Pacific region is slated to register the fastest CAGR during the forecast period. The growth in this region is primarily attributed to rapid urbanization, rising demand for compact and maintenance-free dehumidifiers, growing construction industry, growing industrialization and the need to maintain humidity levels in different areas of industrial production. In addition, increasing disposable income and improving standard of living in Asia-Pacific region is also expected to propel the demand dehumidifiers for household applications over the coming years.

Key Players

The report includes competitive landscape based on extensive assessment of the key strategic developments adopted by leading market participants in the industry over the past 4 years (2016-2019). Some of the key players operating in the global dehumidifier market are Honeywell International Inc. (U.S.), Whirlpool Corporation (U.S.), Bry-Air Pvt. Ltd. (India), Seresco Dehumidifiers (Canada), Danby Products Inc. (Canada), Microwell, spol. s.r.o. (Slovakia), Carrier Corporation (U.S.), Mitsubishi Electric Corporation (Japan), LG Electronics (South Korea), Condair Group (Switzerland), AB Electrolux (Sweden), Sunpentown International Inc. (U.S.), Therma-Stor LLC (U.S.), De’Longhi Group (Italy), and General Filters, Inc. (U.S.), among others.

Scope of the Report:

Dehumidifiers Market, by Product Type

- Absorption Dehumidifiers

- Refrigeration Dehumidifiers

Dehumidifiers Market, by Application

- Industrial

- Commercial

- Residential

Dehumidifiers Market, by Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe (RoE)

- Asia-Pacific (APAC)

- China

- Japan

- India

- Australia

- Rest of APAC (RoAPAC)

- South America

- Middle East and Africa

Key questions answered in the report-

Growing construction industry will propel the dehumidifier market

- How does the growth in manufacturing of industrial appliances increase the adoption of dehumidifiers?

- How does the growth of the construction industry across different regions/countries affect the adoption of dehumidifiers?

Absorption dehumidifiers accounted for the largest share of the dehumidifier market

- What factors are contributing to the frequent usage of absorption dehumidifiers in several industrial and residential applications?

- How does the adoption of dehumidifiers in the construction industry differ in developing and developed nations?

The North America dehumidifier market favors both larger and local manufacturers that compete in multiple segments

- Who are the top competitors in this market and what strategies do they employ to gain shares?

- What is driving growth and which market segments have the high potential for revenue expansion over the forecast period?

- What strategies should new companies look to enter this market and to compete effectively?

- What are the major drivers, restraints, and opportunities for global dehumidifier market?

- What are the key geographical trends and which are the high growth regions/ countries?

Recent new product launches, agreements, acquisitions, partnerships, collaborations, and expansions have taken place in the dehumidifier market space

- What companies have recently merged/acquired and how will these unions affect the competitive landscape of the dehumidifier market?

- What companies have created partnerships and how will these partnerships promote a competitive advantage?

- Who are the major players in the global dehumidifier market and what share of the market do they hold?