- 1. Introduction

- 1.1. Market Definition

- 1.2. Market Ecosystem

- 1.3. Currency

- 1.4. Key Stakeholders

- 2. Research Methodology

- 2.1. Research Process

- 2.2. Data Collection & Validation

- 2.2.1. Secondary Research

- 2.2.2. Primary Research

- 2.3. Market Assessment

- 2.3.1. Market Size Estimation

- 2.3.1.1. Bottom-up Approach

- 2.3.1.2. Top-down Approach

- 2.3.1.3. Growth Forecast

- 2.4. Assumptions for the Study

- 2.5. Limitations for the Study

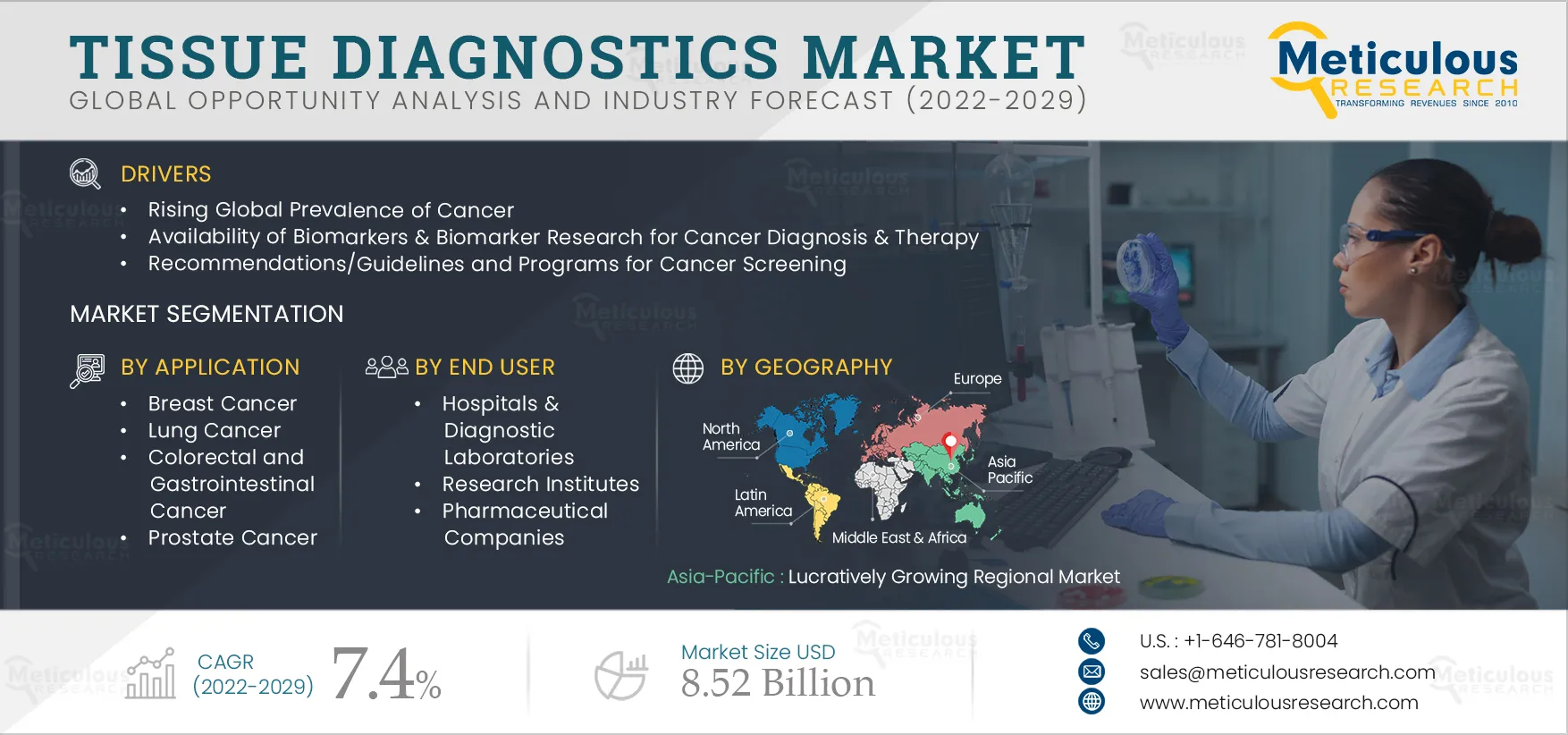

- 3. Executive Summary

- 4. Market Insights

- 4.1. Market Overview

- 4.2. Drivers

- 4.2.1. Rising Global Prevalence of Cancer

- 4.2.2. Availability of Biomarkers & Biomarker Research for Cancer Diagnosis & Therapy

- 4.2.3. Recommendations/Guidelines and Programs for Cancer Screening

- 4.2.4. Growing Number of Clinical Trials for Cancer Drugs

- 4.2.5. Availability of Advanced Tissue-based Companion Diagnostic Tests

- 4.2.6. Rising Global Geriatric Population

- 4.3. Restraints

- 4.3.1. Product Issues & Recalls

- 4.4. Opportunities

- 4.4.1. Rising Focus on Personalized Healthcare

- 4.4.2. Adoption of Digital Pathology & Automation in Tissue Diagnostics

- 4.4.3. Emerging Economies

- 4.5. Challenges

- 4.5.1. Shortage of Histopathologists

- 4.5.2. Low Awareness & Lack of Infrastructure in Low- & Middle-income Countries

- 4.6. The Impact of COVID-19 On the Tissue Diagnostics Market

- 5. Tissue Diagnostics Market, by Product Type

- 5.1. Introduction

- 5.2. Consumables

- 5.2.1. Kits & Reagents

- 5.2.2. Antibodies

- 5.3. Instruments

- 5.3.1. Slide Staining Systems

- 5.3.2. Tissue Microarrays

- 5.3.3. Slide Scanners

- 5.3.4. Tissue Processors

- 5.3.5. Other Instruments

- 6. Tissue Diagnostics Market, by Technique

- 6.1. Introduction

- 6.2. Immunohistochemistry (IHC)

- 6.3. In-Situ Hybridization (ISH)

- 6.4. Digital Pathology

- 6.5. H&E and Special Staining

- 6.6. Molecular Diagnostics

- 6.7. Other Techniques

- 7. Tissue Diagnostics Market, by Application

- 7.1. Introduction

- 7.2. Breast Cancer

- 7.3. Lung Cancer

- 7.4. Colorectal & Gastrointestinal Cancer

- 7.5. Prostate Cancer

- 7.6. Lymphoma

- 7.7. Other Applications

- 8. Tissue Diagnostics Market, by End User

- 8.1. Introduction

- 8.2. Hospitals & Diagnostic Laboratories

- 8.3. Research Institutes

- 8.4. Pharmaceutical Companies

- 8.5. Contract Research Organizations

- 9. Tissue Diagnostics Market, by Geography

- 9.1. Introduction

- 9.2. North America

- 9.2.1. U.S.

- 9.2.2. Canada

- 9.3. Europe

- 9.3.1. Germany

- 9.3.2. France

- 9.3.3. U.K.

- 9.3.4. Italy

- 9.3.5. Spain

- 9.3.6. Rest of Europe (RoE)

- 9.4. Asia-Pacific

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Rest of Asia Pacific (RoAPAC)

- 9.5. Latin America

- 9.6. Middle East & Africa

- 10. Competitive Landscape

- 10.1. Introduction

- 10.2. Key Growth Strategies

- 10.3. Competitive Benchmarking

- 11. Company Profiles

- 11.1. F. Hoffmann-La Roche Ltd

- 11.2. Thermo Fisher Scientific Inc.

- 11.3. Abbott Laboratories

- 11.4. Danaher Corporation

- 11.5. QIAGEN N.V.

- 11.6. Becton, Dickinson and Company

- 11.7. Abcam Plc

- 11.8. Agilent Technologies, Inc.

- 11.9. Merck KGaA

- 11.10. Sakura Finetek Japan Co., Ltd.

- 11.11. Cell Signaling Technology, Inc.

- 11.12. Bio-Genex Laboratories

- 11.13. Bio SB, Inc

- 11.14. 3DHISTECH

- 11.15. Hologic, Inc.

- 12. Appendix

- 12.1. Questionnaire

- 12.2. Available Customization

List of Tables

Table 1 Global Tissue Diagnostics Market: Impact Analysis of Market Drivers (2022–2029)

Table 2 Number of New Cancer Cases, by Region, 2020 VS. 2030 (In Million)

Table 3 Common Cancer Biomarkers (Tumor/Tumor Tissue Sample)

Table 4 Cancer Screening Recommendations

Table 5 Number of Oncology Drugs in the R&D Pipeline (2016–2021)

Table 6 Recently Approved Tissue-based Companion Diagnostic Tests

Table 7 Number of New Cancer Cases in People Aged 65 Years and Over, by Region, 2020 VS. 2040 (In Million)

Table 8 Global Tissue Diagnostics Market: Impact Analysis of Market Restraints (2022–2029)

Table 9 Tissue Diagnostics Market: Product Recalls

Table 10 Patients Per Pathologist, by Country (2019)

Table 11 Global Tissue Diagnostics Market Size, by Product, 2022–2029 (USD Million)

Table 12 Global Tissue Diagnostics Consumables Market Size, by Type, 2022–2029 (USD Million)

Table 13 Global Tissue Diagnostics Consumables Market Size, by Country/Region, 2022–2029 (USD Million)

Table 14 Global Tissue Diagnostics Consumables Market Size for Kits & Reagents, by Country/Region, 2022–2029 (USD Million)

Table 15 Global Tissue Diagnostics Consumables Market Size for Antibodies, by Country/Region, 2022–2029 (USD Million)

Table 16 Global Tissue Diagnostics Instruments Market Size, by Type, 2022–2029 (USD Million)

Table 17 Global Tissue Diagnostics Instruments Market Size, by Country/Region, 2022–2029 (USD Million)

Table 18 Global Tissue Diagnostics Instruments Market Size for Slide Staining Systems, by Country/Region, 2022–2029 (USD Million)

Table 19 Global Tissue Diagnostics Instruments Market Size for Tissue Microarrays, by Country/Region, 2022–2029 (USD Million)

Table 20 Global Tissue Diagnostics Instruments Market Size for Slide Scanners, by Country/Region, 2022–2029 (USD Million)

Table 21 Global Tissue Diagnostics Instruments Market Size for Tissue Processors, by Country/Region, 2022–2029 (USD Million)

Table 22 Global Tissue Diagnostics Instruments Market Size for Other Instruments, by Country/Region, 2022–2029 (USD Million)

Table 23 Global Tissue Diagnostics Market, by Technique, 2022–2029 (USD Million)

Table 24 Global Tissue Diagnostics Market Size for Immunohistochemistry, by Country/Region, 2020–2029 (USD Million)

Table 25 Global Tissue Diagnostics Market Size For In-situ Hybridization, by Country/Region, 2022–2029 (USD Million)

Table 26 Global Tissue Diagnostics Market Size for Digital Pathology, by Country/Region, 2020–2029 (USD Million)

Table 27 Global Tissue Diagnostics Market Size for H&E and Special Staining, by Country/Region, 2020–2029 (USD Million)

Table 28 Global Tissue Diagnostics Market Size for Molecular Diagnostics, by Country/Region, 2020–2029 (USD Million)

Table 29 Global Tissue Diagnostics Market Size for Other Techniques, by Country/Region, 2020–2029 (USD Million)

Table 30 Global Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 31 U.S. Fda-Approved Companion Diagnostic Devices for Breast Cancer (Tissue)

Table 32 Global Tissue Diagnostics Market Size for Breast Cancer, by Country/ Region, 2020–2029 (USD Million)

Table 33 Common Lung Cancer Biomarkers Used in Clinical Applications

Table 34 U.S. FDA-approved Companion Diagnostic Devices for NSCLC (Tissue)

Table 35 Global Tissue Diagnostics Market Size for Lung Cancer, by Country/ Region, 2020–2029 (USD Million)

Table 36 List of Some Cleared/Approved Companion Diagnostic Devices for Colorectal Cancer Tissue

Table 37 Global Tissue Diagnostics Market Size for Colorectal & Gastrointestinal Cancer, by Country/Region, 2020–2029 (USD Million)

Table 38 Global Tissue Diagnostics Market Size for Prostate Cancer, by Country/Region, 2022–2029 (USD Million)

Table 39 Global Tissue Diagnostics Market Size for Lymphoma, by Country/Region, 2020–2029 (USD Million)

Table 40 Global Tissue Diagnostics Market Size for Other Applications, by Country/Region, 2020–2029 (USD Million)

Table 41 Global Tissue Diagnostics Market, by End User, 2020–2029 (USD Million)

Table 42 Global Tissue Diagnostics Market Size for Hospitals & Diagnostic Laboratories, by Country/Region, 2020–2029 (USD Million)

Table 43 Global Tissue Diagnostics Market Size for Research Institutes, by Country/Region, 2020–2029 (USD Million)

Table 44 Global Tissue Diagnostics Market Size for Pharmaceutical Companies, by Country/Region, 2020–2029 (USD Million)

Table 45 Global Tissue Diagnostics Market Size for Contract Research Organization, by Country/Region, 2020–2029 (USD Million)

Table 46 Global Tissue Diagnostics Market Size, by Country/Region, 2020–2029 (USD Million)

Table 47 North America: Tissue Diagnostics Market Size, by Country, 2020–2029 (USD Million)

Table 48 North America: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 49 North America: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 50 North America: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 51 North America: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 52 North America: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 53 North America: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 54 U.S.: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 55 U.S.: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 56 U.S.: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 57 U.S.: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 58 U.S.: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 59 U.S.: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 60 Canada: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 61 Canada: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 62 Canada: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 63 Canada: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 64 Canada.: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 65 Canada: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 66 Europe: Tissue Diagnostics Market Size, by Country/Region, 2020–2029 (USD Million)

Table 67 Europe: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 68 Europe: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 69 Europe: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 70 Europe: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 71 Europe: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 72 Europe: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 73 Germany: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 74 Germany: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 75 Germany: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 76 Germany: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 77 Germany: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 78 Germany: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 79 France: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 80 France: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 81 France: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 82 France: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 83 France: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 84 France: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 85 U.K.: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 86 U.K.: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 87 U.K.: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 88 U.K.: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 89 U.K.: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 90 U.K.: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 91 Italy: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 92 Italy: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 93 Italy: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 94 Italy: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 95 Italy: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 96 Italy: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 97 Spain: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 98 Spain: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 99 Spain: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 100 Spain: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 101 Spain: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 102 Spain: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 103 Estimated Number of New Cancer Cases (2020)

Table 104 Healthcare Spending in the Rest of European Countries Relative to GDP, 2019

Table 105 Rest of Europe: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 106 Rest of Europe: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 107 Rest of Europe: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 108 Rest of Europe: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 109 Rest of Europe: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 110 Rest of Europe: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 111 Asia-Pacific: Tissue Diagnostics Market Size, by Country/Region, 2020–2029 (USD Million)

Table 112 Asia-Pacific: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 113 Asia-Pacific: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 114 Asia-Pacific: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 115 Asia-Pacific: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 116 Asia-Pacific: Tissue Diagnostics Market Size, by Application, 2020–2029(USD Million)

Table 117 Asia-Pacific: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 118 China: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 119 China: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 120 China: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 121 China: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 122 China: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 123 China: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 124 Japan: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 125 Japan: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 126 Japan: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 127 Japan: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 128 Japan: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 129 Japan: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 130 India: Tissue Diagnostics Market Size, by Product Type, 2020–2029 ( USD Million)

Table 131 India: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 132 India: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 133 India: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 134 India: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 135 India: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 136 Estimated Number of New Cancer Cases in Rest of Asia-Pacific Countries: 2020–2030

Table 137 Rest of Asia-Pacific: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 138 Rest of Asia-Pacific: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 139 Rest of Asia-Pacific: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 140 Rest of Asia-Pacific: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 141 Rest of Asia-Pacific: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 142 Rest of Asia-Pacific: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 143 Latin America: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 144 Latin America: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 145 Latin America: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 146 Latin America: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 147 Latin America: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 148 Latin America: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 149 New Cancer Cases and Deaths Reported in the Middle East in 2020 and 2040

Table 150 Middle East & Africa: Tissue Diagnostics Market Size, by Product Type, 2020–2029 (USD Million)

Table 151 Middle East & Africa: Tissue Diagnostics Consumables Market Size, by Type, 2020–2029 (USD Million)

Table 152 Middle East & Africa: Tissue Diagnostics Instruments Market Size, by Type, 2020–2029 (USD Million)

Table 153 Middle East & Africa: Tissue Diagnostics Market Size, by Technique, 2020–2029 (USD Million)

Table 154 Middle East & Africa: Tissue Diagnostics Market Size, by Application, 2020–2029 (USD Million)

Table 155 Middle East & Africa: Tissue Diagnostics Market Size, by End User, 2020–2029 (USD Million)

Table 156 Recent Developments, by Company (2019–2022)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Size Estimation

Figure 7 Global Tissue Diagnostics Market Size, by Product Type, 2022–2029 (USD Million)

Figure 8 Global Tissue Diagnostics Market Size, by Technique, 2022–2029 (USD Million)

Figure 9 Global Tissue Diagnostics Market Size, by Application, 2022–2029 (USD Million)

Figure 10 Global Tissue Diagnostics Market Size, by End User, 2022–2029 (USD Million)

Figure 11 Global Tissue Diagnostics Market, by Geography

Figure 12 Market Dynamics

Figure 13 Global Cancer Prevalence, by Type (2020)

Figure 14 Percentage of Oncology Drugs Among All Drugs in the R&D Pipeline (2015–2021)

Figure 15 Population Aged 65 Years Or Over, by Region, 2020 VS. 2030 (In Million)

Figure 16 Global Tissue Diagnostics Market Size, by Product, 2022 Vs 2029 (USD Million)

Figure 17 Global Tissue Diagnostics Market Size, by Technique, 2022 Vs 2029 (USD Million)

Figure 18 Global Tissue Diagnostics Market Size, by Application, 2022 Vs 2029 (USD Million)

Figure 19 Global Tissue Diagnostics Market, by End User, 2022 Vs 2029 (USD Million)

Figure 20 Global Tissue Diagnostics Market Size, by Region, 2022 VS 2029 (USD Million)

Figure 21 North America: Tissue Diagnostics Market Snapshot

Figure 22 U.S.: Number of New Cancer Cases (2010–2030)

Figure 23 Canada: Number of Breast Cancer Cases (2014–2030)

Figure 24 Europe: Tissue Diagnostics Market Snapshot

Figure 25 Italy: Number of Breast Cancer Cases (2020–2040)

Figure 26 Asia-Pacific: Tissue Diagnostics Market Snapshot

Figure 27 Japan: Estimated Number of People Over 65 Years of Age, 2010–2050

Figure 28 Japan: New Breast Cancer Cases 2012–2020

Figure 29 India: New Breast Cancer Cases 2012–2030

Figure 30 Mexico: Per Capita Healthcare Spending, 2017–2020 (USD)

Figure 31 Latin America: Age Standardised Cancer Incidence Rates (Asrs), Per 100,000 Population, 2020

Figure 32 Latin America: Estimated Number of Cancer Cases, 2020

Figure 33 Key Growth Strategies Adopted by Leading Players (2019–2022)

Figure 34 Tissue Diagnostics Market: Competitive Benchmarking

Figure 35 F. HOFFMAN-LA ROCHE LTD.: FINANCIAL OVERVIEW (2021)

Figure 36 Thermo Fisher Scientific Inc.: FINANCIAL OVERVIEW (2021)

Figure 37 Abbott Laboratories: FINANCIAL OVERVIEW (2021)

Figure 38 Danaher Corporation: FINANCIAL OVERVIEW (2021)

Figure 39 QIAGEN N.V.: FINANCIAL OVERVIEW (2021)

Figure 40 Becton, Dickinson And Company: FINANCIAL OVERVIEW (2021)

Figure 41 Abcam Plc: Financial Overview (2021)

Figure 42 Agilent Technologies, Inc.: Financial Overview (2021)

Figure 43 Merck KGaA: Financial Overview (2021)

Figure 44 Hologic Inc.: FINANCIAL OVERVIEW (2021)