1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency & Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.3.3. Market Share Analysis

2.4. Assumption for the Study

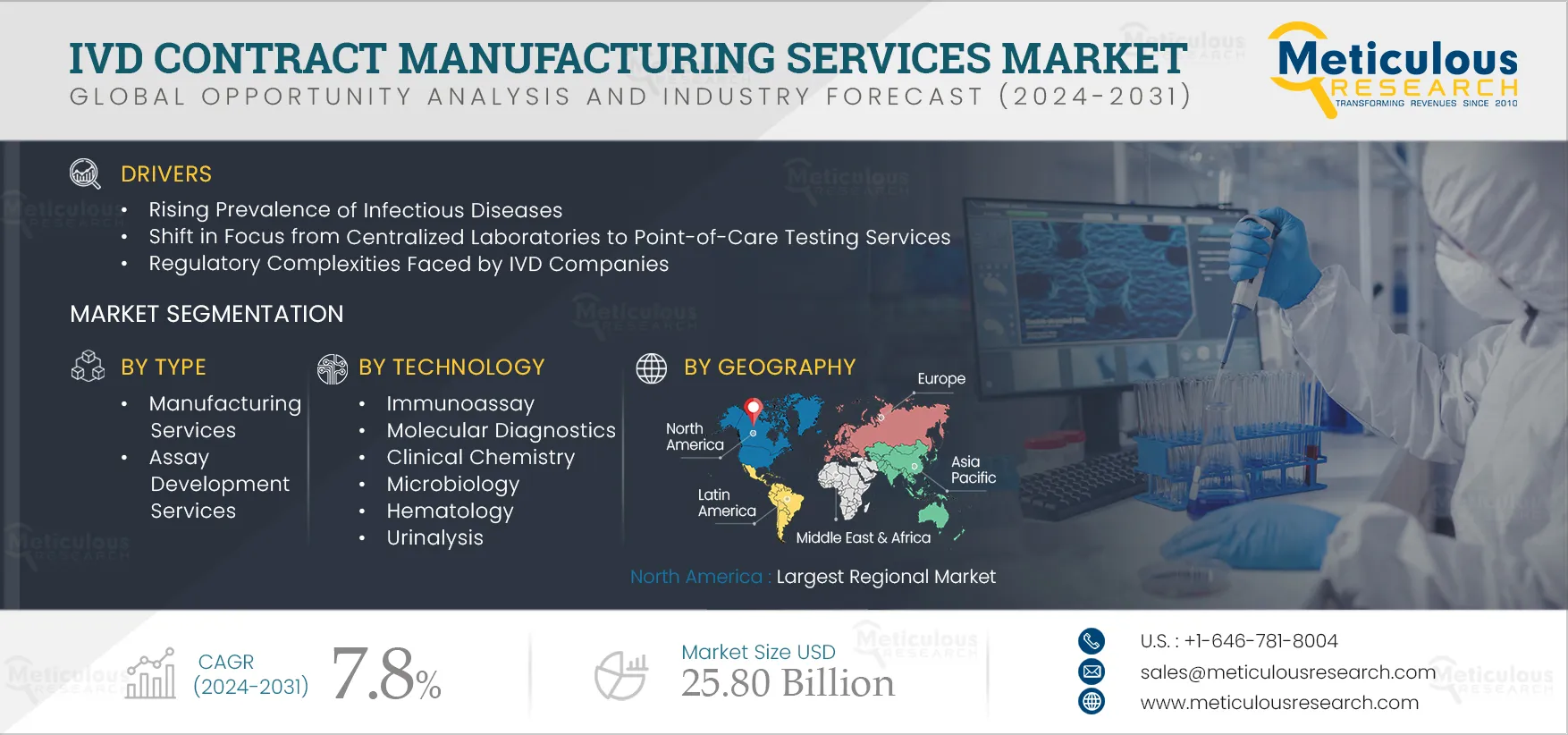

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Drivers

4.2.1. Rising Prevalence of Infectious Diseases

4.2.2. Shift in Focus from Centralized Laboratories to Point-of-Care Testing Services

4.2.3 Regulatory Complexities Faced by IVD Companies

4.2.4. Need for Cost-Effective Manufacturing of IVD Tests

4.3. Restraints

4.3.1. Maintaining Product Quality and Protection of Proprietary Information

4.4. Opportunities

4.4.1. High Economic Growth and Increased Outsourcing to Emerging Countries

4.5. Challenges

4.5.1. Lack of Skilled Professionals

4.6. Industry & Technology Trends

4.7. Regulatory Scenario

4.8. Pricing Analysis

4.9. Porter’s Five Force Analysis

4.10. Adjacent/Related Market Analysis

5. Global IVD Contract Manufacturing Services Market Assessment—by Type

5.1. Overview

5.2. Manufacturing Services

5.3. Assay Development Services

5.4. Other Services

6. Global IVD Contract Manufacturing Services Market Assessment—by Category

6.1. Overview

6.2. Reagents & Consumables

6.3. Instruments & Systems

7. Global IVD Contract Manufacturing Services Market Assessment—by Technology

7.1. Overview

7.2. Immunoassay

7.3. Molecular Diagnostics

7.4. Clinical Chemistry

7.5. Hematology

7.6. Microbiology

7.7. Urinalysis

8. IVD Contract Manufacturing Services Market Assessment—by Geography

8.1. Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Rest of Europe

8.4. Asia-Pacific

8.4.1. Japan

8.4.2. China

8.4.3. India

8.4.4. Rest of Asia-Pacific

8.5. Latin America

8.6. Middle East & Africa

9. Competitive Analysis

9.1. Overview

9.2. Competitive Benchmarking

9.3. Competitive Dashboard

9.3.1 Market Leaders

9.3.2 Market Differentiators

9.3.3. Vanguards

9.3.4. Emerging Companies

9.5. Vendor Market Positioning

9.6. Market Share Analysis/Market Ranking, By Key Players (2023)

10. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic Developments)

10.1. Cenogenics Corporation

10.2. In-Vitro Diagnostic Developers, Inc. (IDxDI)

10.3. Savyon Diagnostics

10.4. KMS Systems, Inc.

10.5. Nova Biomedical

10.6. LRE Medical

10.7. Cone Bioproducts

10.8. Invetech, Inc.

10.9. Avioq, Inc.

10.10. TCS Biosciences Ltd.

10.11. Affinity Life Sciences, Inc.

10.12. Coris BioConcept

10.13. Meridian Bioscience, Inc.

10.14. Affinity Biologicals, Inc.

10.15. Biokit S.A.

10.16. Merck KgaA

10.17. Thermo Fisher Scientific, Inc.

10.18. Maxim Biomedical, Inc.

10.19. Other Companies

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1 Global IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 2 Global Manufacturing Services Market, by Country/Region, 2022–2031 (USD Million)

Table 3 Global Assay Development Services Market, by Country/Region, 2022–2031 (USD Million)

Table 4 Global Other Services Market, by Country/Region, 2022–2031 (USD Million)

Table 5 Global IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 6 Global IVD Contract Manufacturing Services Market for Reagents & Consumables, by Country/Region, 2022–2031 (USD Million)

Table 7 Global IVD Contract Manufacturing Services Market for Instruments & Systems, by Country/Region, 2022–2031 (USD Million)

Table 8 Global IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 9 Global IVD Contract Manufacturing Services Market for Immunoassay, by Country/Region, 2022–2031 (USD Million)

Table 10 Global IVD Contract Manufacturing Services Market for Molecular Diagnostics, by Country/Region, 2022–2031 (USD Million)

Table 11 Global IVD Contract Manufacturing Services Market for Clinical Chemistry, by Country/Region, 2022–2031 (USD Million)

Table 12 Global IVD Contract Manufacturing Services Market for Hematology, by Country/Region, 2022–2031 (USD Million)

Table 13 Global IVD Contract Manufacturing Services Market for Microbiology, by Country/Region, 2022–2031 (USD Million)

Table 14 Global IVD Contract Manufacturing Services Market for Urinalysis, by Country/Region, 2022–2031 (USD Million)

Table 15 Global IVD Contract Manufacturing Services Market, by Country/Region, 2022–2031 (USD Million)

Table 16 North America: IVD Contract Manufacturing Services Market, by Country, 2022–2031 (USD Million)

Table 17 North America: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 18 North America: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 19 North America: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 20 U.S.: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 21 U.S.: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 22 U.S.: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 23 Canada: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 24 Canada: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 25 Canada: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 26 Europe: IVD Contract Manufacturing Services Market, by Country/Region, 2022–2031 (USD Million)

Table 27 Europe: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 28 Europe: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 29 Europe: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 30 Germany: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 31 Germany: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 32 Germany: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 33 U.K.: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 34 U.K.: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 35 U.K.: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 36 France: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 37 France: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 38 France: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 39 Italy: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 40 Italy: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 41 Italy: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 42 Spain: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 43 Spain: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 44 Spain: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 45 Rest of Europe: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 46 Rest of Europe: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 47 Rest of Europe: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 48 Asia-Pacific: IVD Contract Manufacturing Services Market, by Country/Region, 2022–2031 (USD Million)

Table 49 Asia-Pacific: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 50 Asia-Pacific: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 51 Asia-Pacific: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 52 China: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 53 China: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 54 China: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 55 Japan: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 56 Japan: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 57 Japan: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 58 India: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 59 India: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 60 India: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 61 Rest of Asia-Pacific: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 62 Rest of Asia-Pacific: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 63 Rest of Asia-Pacific: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 64 Latin America: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 65 Latin America: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 66 Latin America: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 67 Middle East & Africa: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 68 Middle East & Africa: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 69 Middle East & Africa: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 70 Recent Developments, by Company, 2020—2023

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Global IVD Contract Manufacturing Services Market, by Type, 2024 VS. 2031 (USD Million)

Figure 8 Global IVD Contract Manufacturing Services Market, by Category, 2024 VS. 2031 (USD Million)

Figure 9 Global IVD Contract Manufacturing Services Market, by Technology, 2024 VS. 2031 (USD Million)

Figure 10 IVD Contract Manufacturing Services Market, by Region

Figure 11 Impact Analysis of Market Dynamics

Figure 12 Global IVD Contract Manufacturing Services Market, by Type, 2024 VS. 2031 (USD Million)

Figure 13 Global IVD Contract Manufacturing Services Market, by Category, 2024 VS. 2031 (USD Million)

Figure 14 Global IVD Contract Manufacturing Services Market, by Technology, 2024 VS. 2031 (USD Million)

Figure 15 Global IVD Contract Manufacturing Services Market, by Region, 2024 VS. 2031 (USD Million)

Figure 16 North America: IVD Contract Manufacturing Services Market Snapshot

Figure 17 Europe: IVD Contract Manufacturing Services Market Systems Snapshot

Figure 18 Asia-Pacific: IVD Contract Manufacturing Services Market Snapshot

Figure 19 Key Growth Strategies Adopted by Leading Players, 2021—2024

Figure 20 IVD Contract Manufacturing Services Market: Competitive Benchmarking, by Type

Figure 21 IVD Contract Manufacturing Services Market: Competitive Benchmarking, by Region

Figure 22 Competitive Dashboard: IVD Contract Manufacturing Services Market

Figure 23 Global IVD Contract Manufacturing Services Market Share Analysis, By Key Players (2023)

Figure 24 KMC Systems, Inc.: Financial Overview (2022)

Figure 25 Invetech, Inc.: Financial Overview (2022)

Figure 26 Meridian Bioscience, Inc.: Financial Overview (2022)

Figure 27 Biokit S.A.: Financial Overview (2022)

Figure 28 Merck KgaA: Financial Overview (2022)

Figure 29 Thermo Fisher Scientific, Inc.: Financial Overview (2022)