1. Market Definition & Scope

1.1 Market Definition

1.2 Currency & Limitations

1.2.1 Currency

1.2.2 Limitations

2. Research Methodology

2.1 Research Approach

2.2 Data Collection & Validation Process

2.2.1 Secondary Research

2.2.2 Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3 Market Sizing & Forecasting

2.3.1 Market Size Estimation Approach

2.3.2 Growth Forecast Approach

2.4 Assumptions for the Study

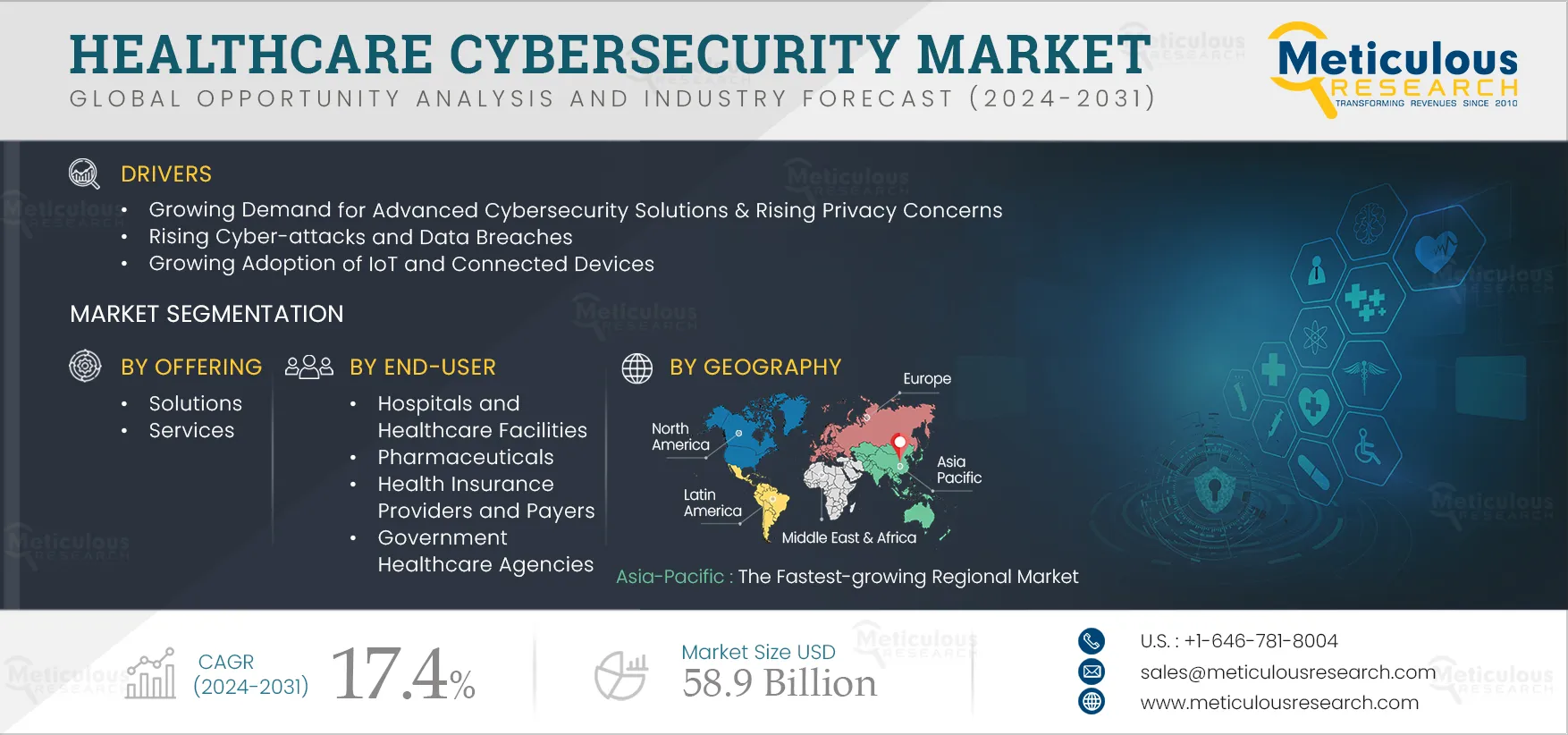

3. Executive Summary

3.1 Market Analysis—by Offering

3.2 Market Analysis—by Security Type

3.3 Market Analysis—by Deployment Mode

3.4 Market Analysis—by End User

` 3.5 Market Analysis—by Geography

3.6 Competitive Analysis

4. Market Insights

4.1 Overview

4.2 Factors Affecting Market Growth

4.2.1 Drivers

4.2.1.1 Growing Demand for Advanced Cybersecurity Solutions & Rising Privacy Concerns

4.2.1.2 Rising Cyber-attacks and Data Breaches

4.2.1.3 Growing Adoption of IoT and Connected Devices

4.2.2 Restraints

4.2.2.1 Lack of Cyber Security Policy Framework in Healthcare Organizations

4.2.3 Opportunities

4.2.3.1 Rising Adoption of Cloud-based Security Solutions in Healthcare Industry

4.2.3.2 Rising Government Initiatives Aimed at Encouraging the Adoption of Cybersecurity Solutions

4.2.4 Challenges

4.2.4.1 Lack of Awareness and Misconceptions Regarding Healthcare Cybersecurity Solutions

4.3 Case Studies

5. Healthcare Cybersecurity Market Assessment—by Offering

5.1 Overview

5.2 Solutions

5.2.1 Security Information and Event Management

5.2.2 Antivirus & Antimalware

5.2.3 Distributed Denial of Service (DDoS) Mitigation

5.2.4 Risk & Compliance Management

5.2.5 Identity and Access Management

5.2.6 Firewall

5.2.7 Unified Threat Management

5.2.8 Intrusion Detection System/Intrusion Prevention System

5.2.9 Data Loss Prevention

5.2.10 Other Solutions

5.3 Services

5.3.1 Professional Services

5.3.2 Managed Services

6. Healthcare Cybersecurity Market Assessment—by Security Type

6.1 Overview

6.2 Endpoint Security

6.3 Cloud Security

6.4 Application Security

6.5 Network Security

6.6 Other Security Types

7. Healthcare Cybersecurity Market Assessment—by Deployment Mode

7.1 Overview

7.2 Cloud-based Deployment

7.3 On-premise Deployment

8. Healthcare Cybersecurity Market Assessment—by End User

8.1 Overview

8.2 Hospitals and Healthcare Facilities

8.3 Pharmaceuticals

8.4 Health Insurance Providers and Payers

8.5 Government Healthcare Agencies

8.6 Telehealth and Digital Health Providers

9. Healthcare Cybersecurity Market Assessment—by Geography

9.1 Overview

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.3 Europe

9.3.1 U.K.

9.3.2 Germany

9.3.3 France

9.3.4 Italy

9.3.5 Spain

9.3.6 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3. India

9.4.4 South Korea

9.4.5 Singapore

9.4.6 Rest of Asia-Pacific

9.5 Latin America

9.6 Middle East & Africa

10. Competition Analysis

10.1 Overview

10.2 Key Growth Strategies

10.3 Competitive Benchmarking

10.4 Competitive Dashboard

10.4.1 Industry Leaders

10.4.2 Market Differentiators

10.4.3 Vanguards

10.4.4 Emerging Companies

10.5 Market Share Analysis

11. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic Developments)

11.1 Palo Alto Networks, Inc. (U.S.)

11.2 Fortinet, Inc. (U.S.)

11.3 Cisco Systems, Inc. (U.S.)

11.4 IBM Corporation (U.S.)

11.5 Check Point Software Technologies Ltd. (Israel)

11.6 Imperva, Inc. (U.S.)

11.7 Crowdstrike Holdings, Inc. (U.S.)

11.8 LogRhythm Inc. (U.S.)

11.9 Sophos Ltd. (U.K.)

11.10 Trend Micro Incorporated. (Japan)

11.11 McAfee, LLC. (U.S.)

11.12 Radware Ltd. (Israel)

11.13 F5, Inc. (U.S.)

11.14 Claroty Ltd. (U.S.)

11.15 Proofpoint, Inc. (U.S.)

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

12. Appendix

12.1 Available Customization

List of Tables

Table 1 Global Healthcare Cybersecurity Market, by Country/Region, 2022–2031 (USD Million)

Table 2 Global Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 3 Global Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 4 Global Healthcare Cybersecurity Solutions Market, by Country/Region, 2022–2031 (USD Million)

Table 5 Global Antivirus & Antimalware Market, by Country/Region, 2022–2031 (USD Million)

Table 6 Global Security Information and Event Management Market, by Country/Region, 2022–2031 (USD Million)

Table 7 Global Distributed Denial of Service Mitigation Market, by Country/Region, 2022–2031 (USD Million)

Table 8 Global Risk & Compliance Management Market, by Country/Region, 2022–2031 (USD Million)

Table 9 Global Identity and Access Management Market, by Country/Region, 2022–2031 (USD Million)

Table 10 Global Firewall Market, by Country/Region, 2022–2031 (USD Million)

Table 11 Global Unified Threat Management Market, by Country/Region, 2022–2031 (USD Million)

Table 12 Global Intrusion Detection System/Intrusion Prevention System Market, by Country/Region, 2022–2031 (USD Million)

Table 13 Global Data Loss Prevention Market, by Country/Region, 2022–2031 (USD Million)

Table 14 Global Other Healthcare Cybersecurity Solutions Market, by Country/Region, 2022–2031 (USD Million)

Table 15 Global Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 16 Global Healthcare Cybersecurity Services Market, by Country/Region, 2022–2031 (USD Million)

Table 17 Global Healthcare Cybersecurity Professional Services Market, by Country/Region, 2022–2031 (USD Million)

Table 18 Global Healthcare Cybersecurity Managed Services Market, by Country/Region, 2022–2031 (USD Million)

Table 19 Global Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 20 Global Healthcare Network Security Market, by Country/Region, 2022–2031 (USD Million)

Table 21 Global Healthcare Cloud Security Market, by Country/Region, 2022–2031 (USD Million)

Table 22 Global Healthcare Endpoint Security Market, by Country/Region, 2022–2031 (USD Million)

Table 23 Global Healthcare Application Security Market, by Country/Region, 2022–2031 (USD Million)

Table 24 Global Other Healthcare Security Types Market, by Country/Region, 2022–2031 (USD Million)

Table 25 Global Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 26 Global Healthcare Cybersecurity Market for Cloud-based Deployment, by Country/Region, 2022–2031 (USD Million)

Table 27 Global Healthcare Cybersecurity Market for On-premise Deployment, by Country/Region, 2022–2031 (USD Million)

Table 28 Global Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 29 Global Healthcare Cybersecurity Market for Hospitals and Healthcare Facilities, by Country/Region, 2022–2031 (USD Million)

Table 30 Global Healthcare Cybersecurity Market for Pharmaceuticals, by Country/Region, 2022–2031 (USD Million)

Table 31 Global Healthcare Cybersecurity Market for Health Insurance Providers and Payers, by Country/Region, 2022–2031 (USD Million)

Table 32 Global Healthcare Cybersecurity Market for Government Healthcare Agencies, by Country/Region, 2022–2031 (USD Million)

Table 33 Global Healthcare Cybersecurity Market for Telehealth and Digital Health Providers, by Country/Region, 2022–2031 (USD Million)

Table 34 Global Healthcare Cybersecurity Market, by Country/Region, 2022–2031 (USD Million)

Table 35 North America: Healthcare Cybersecurity Market, by Country, 2022–2031 (USD Million)

Table 36 North America: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 37 North America: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 38 North America: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 39 North America: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 40 North America: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 41 North America: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 42 U.S.: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 43 U.S.: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 44 U.S.: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 45 U.S.: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 46 U.S.: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 47 U.S.: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 48 Canada: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 49 Canada: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 50 Canada: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 51 Canada: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 52 Canada: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 53 Canada: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 54 Europe: Healthcare Cybersecurity Market, by Country, 2022–2031 (USD Million)

Table 55 Europe: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 56 Europe: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 57 Europe: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 58 Europe: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 59 Europe: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 60 Europe: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 61 Germany: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 62 Germany: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 63 Germany: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 64 Germany: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 65 Germany: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 66 Germany: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 67 U.K.: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 68 U.K.: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 69 U.K.: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 70 U.K.: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 71 U.K.: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 72 U.K.: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 73 France: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 74 France: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 75 France: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 76 France: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 77 France: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 78 France: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 79 Italy: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 80 Italy: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 81 Italy: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 82 Italy: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 83 Italy: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 84 Italy: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 85 Spain: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 86 Spain: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 87 Spain: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 88 Spain: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 89 Spain: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 90 Spain: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 91 Rest of Europe: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 92 Rest of Europe: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 93 Rest of Europe: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 94 Rest of Europe: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 95 Rest of Europe: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 96 Rest of Europe: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 97 Asia-Pacific: Healthcare Cybersecurity Market, by Country, 2022–2031 (USD Million)

Table 98 Asia-Pacific: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 99 Asia-Pacific: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 100 Asia-Pacific: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 101 Asia-Pacific: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 102 Asia-Pacific: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 103 Asia-Pacific: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 104 China: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 105 China: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 106 China: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 107 China: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 108 China: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 109 China: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 110 Japan: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 111 Japan: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 112 Japan: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 113 Japan: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 114 Japan: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 115 Japan: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 116 India: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 117 India: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 118 India: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 119 India: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 120 India: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 121 India: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 122 South Korea: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 123 South Korea: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 124 South Korea: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 125 South Korea: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 126 South Korea: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 127 South Korea: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 128 Singapore: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 129 Singapore: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 130 Singapore: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 131 Singapore: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 132 Singapore: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 133 Singapore: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 134 Rest of Asia-Pacific: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 135 Rest of Asia-Pacific: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 136 Rest of Asia-Pacific: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 137 Rest of Asia-Pacific: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 138 Rest of Asia-Pacific: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 139 Rest of Asia-Pacific: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 140 Latin America: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 141 Latin America: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 142 Latin America: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 143 Latin America: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 144 Latin America: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 145 Latin America: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

Table 146 Middle East & Africa: Healthcare Cybersecurity Market, by Offering, 2022–2031 (USD Million)

Table 147 Middle East & Africa: Healthcare Cybersecurity Solutions Market, by Type, 2022–2031 (USD Million)

Table 148 Middle East & Africa: Healthcare Cybersecurity Services Market, by Type, 2022–2031 (USD Million)

Table 149 Middle East & Africa: Healthcare Cybersecurity Market, by Security Type, 2022–2031 (USD Million)

Table 150 Middle East & Africa: Healthcare Cybersecurity Market, by Deployment Mode, 2022–2031 (USD Million)

Table 151 Middle East & Africa: Healthcare Cybersecurity Market, by End User, 2022–2031 (USD Million)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing & Growth Forecast Approach

Figure 7 Key Insights

Figure 8 The Solutions Segment Expected to Dominate the Global Healthcare Cybersecurity Market in 2024

Figure 9 The Network Security Segment Expected to Dominate the Global Healthcare Cybersecurity Market in 2024

Figure 10 The On-premise Deployment Segment Expected to Dominate the Global Healthcare Cybersecurity Market in 2024

Figure 11 The Hospitals and Healthcare Facilities Segment Expected to Dominate the Global Healthcare Cybersecurity Market in 2024

Figure 12 Global Healthcare Cybersecurity Market Size, by Geography, 2024 VS. 2031 (USD Million)

Figure 13 Healthcare Cybersecurity Market, by Region

Figure 14 Market Dynamics

Figure 15 Global Healthcare Cybersecurity Market Size, by Offering, 2024 VS. 2031 (USD Million)

Figure 16 Global Healthcare Cybersecurity Market Size, by Security Type, 2024 VS. 2031 (USD Million)

Figure 17 Global Healthcare Cybersecurity Market Size, by Deployment Mode, 2024 VS. 2031 (USD Million)

Figure 18 Global Healthcare Cybersecurity Market Size, by End User, 2024 VS. 2031 (USD Million)

Figure 19 Global Healthcare Cybersecurity Market Size, by Geography, 2024 VS. 2031 (USD Million)

Figure 20 North America: Healthcare Cybersecurity Market Snapshot

Figure 21 Europe: Healthcare Cybersecurity Market Snapshot

Figure 22 Asia-Pacific: Healthcare Cybersecurity Market Snapshot

Figure 23 Key Growth Strategies Adopted by Leading Players, 2021–2024

Figure 24 Global Healthcare Cybersecurity Market Share Analysis, by Key Player (2022)

Figure 25 Cisco Systems, Inc.: Financial Overview (2020–2022)

Figure 26 Fortinet, Inc.: Financial Overview (2020–2022)

Figure 27 Check Point Software Technologies Ltd.: Financial Overview (2020–2022)

Figure 28 IBM Corporation: Financial Overview (2020–2022)

Figure 29 Palo Alto Networks, Inc.: Financial Overview (2020–2022)

Figure 30 F5, Inc.: Financial Overview (2020–2022)