1. Introduction

1.1. Market Ecosystem

1.2. Currency

1.3. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.3.5. Market Share Analysis

2.4. Assumptions for The Study

2.5. Limitations for The Study

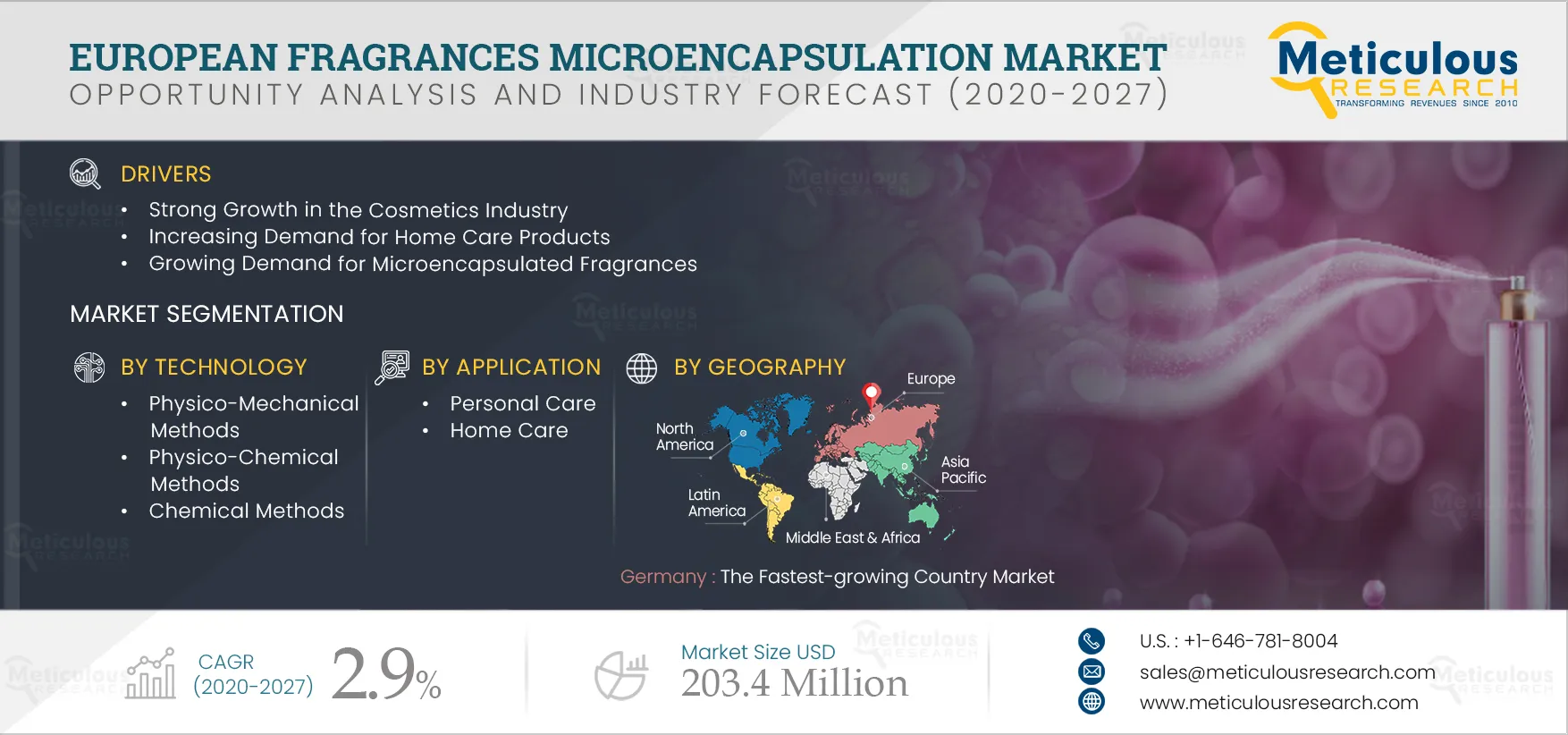

3. Executive Summary

3.1. Introduction

3.2. Segment Analysis

3.2.1. Application Segment Analysis

3.2.2. Personal Care Segment Analysis

3.3. Regional Analysis

3.4. Key Players

4. Market Insights

4.1. Introduction

4.2. Drivers

4.2.1. Strong Growth in the Cosmetics Industry

4.2.2. Increasing Demand for Home Care Products

4.2.3. Growing Demand for Microencapsulated Fragrances

4.2.4. Rising R&D Investments for Improving Process Efficiency

4.3. Restraints

4.3.1. High Production Costs of Microencapsulation Processes

4.3.2. Stringent Regulatory Requirements

4.4. Trends

4.4.1. Increasing Demand for Natural Ingredients in the Manufacture of Cosmetics and Home Care Products

4.5. Opportunities

4.5.1. Technological Advancements

4.5.2. Plastic-Free Encapsulation Technology

4.6. Regulatory Analysis

4.7. Patent Analysis

4.8. Value Chain Analysis

4.8.1. Upstream Suppliers

4.8.2. The Fragrance Industry

4.8.3. Downstream Customers

5. The Impact of Covid-19 on the European Fragrances Microencapsulation Market

6. European Fragrances Microencapsulation Market for Home and Personal Care Products, by Method/Technology

6.1. Introduction

6.2. Physico-Mechanical Methods

6.2.1. Spray Drying

6.2.2. Fluidized Bed Spray Coating

6.2.3. Coextrusion

6.2.4. Spray Chilling or Congealing

6.2.5. Other Physico-Mechanical Methods

6.3. Physico-Chemical Methods

6.3.1. Coacervation Or Phase Separation Methods

6.3.2. Other Physico-Chemical Methods

6.4. Chemical Methods

6.4.1. In-Situ Polymerization

6.4.2. Interfacial Polymerization

6.5. Other Microencapsulation Methods

7. European Fragrances Microencapsulation Market for Home and Personal Care, by Application

7.1. Introduction

7.2. Personal Care

7.2.1. Skincare Products

7.2.2. Haircare Products

7.2.3. Deodorants and Perfumes

7.2.4. Other Personal Care Products

7.3. Home Care

7.3.1. Laundry Detergents and Fabric Conditioners

7.3.2. House Cleaning Agents

7.3.3. Other Home Care Products

8. European Fragrances Microencapsulation Market for Home and Personal Care, by Country

8.1. Introduction

8.2. Germany

8.3. France

8.4. U.K.

8.5. Italy

8.6. Spain

8.7. Rest of Europe (RoE)

9. Competitive Landscape

9.1. Introduction

9.2. Competitive Benchmarking (Fragrances Market)

9.3. Market Share Analysis (Fragrances Market)

10. Company Profiles

10.1. Givaudan S.A.

10.2. Firmenich Incorporated

10.3. Symrise AG

10.4. Ingredion Incorporated

10.5. Mikrocaps d.o.o.

10.6. Koehler Innovative Solutions

10.7. Ashland Global Holdings, Inc.

10.8. Robertet Group

10.9. Vantage Specialty Chemicals

10.10. Euracli

10.11. Capsulæ SAS

10.12. Robert Blondel Cosmétiques

10.13. Lambson, Ltd.

10.14. Micropore Technologies Limited

10.15. International Flavors & Fragrances, Inc. (IFF)

10.16. Calyxia S.A.

10.17. Follmann GmbH & Co. KG

11. Appendix

11.1. Questionnaire

11.2. Some of the Strategic Developments by Key Players in Other Regions Except Europe

11.2.1. Givaudan S.A.

11.2.1.1. Expansions

11.2.2. Firmenich Incorporated

11.2.2.1. Acquisitions

11.2.3. Symrise AG

11.2.3.1. Expansions

11.2.4. Ashland Global Holdings Inc.

11.2.4.1. Acquisitions

11.2.5. Robertet Group

11.2.5.1. Expansions

11.2.6. Capsulæ Sas

11.2.6.1. Collaborations

List of Tables

Table 1 European Fragrances Microencapsulation Market Drivers: Impact Analysis for (2020-2027)

Table 2 European Fragrances Microencapsulation Market Restraints: Impact Analysis for (2020-2027)

Table 3 Patent Analysis

Table 4 European Fragrances Microencapsulation Market Size for Home and Personal Care Products, by Technology/Method, 2018–2027 (USD Million)

Table 5 Europe: Physico-Mechanical Microencapsulation Methods Market Size, by Type, 2018–2027 (USD Million)

Table 6 Europe: Physico-Mechanical Method Microencapsulation Market Size, by Country, 2018–2027 (USD Million)

Table 7 Europe: Spray Drying Method Microencapsulation Market Size, by Country, 2018–2027 (USD Million)

Table 8 Europe: Fluidized Bed Spray Coating Method Microencapsulation Market Size, by Country, 2018–2027 (USD Million)

Table 9 Europe: Coextrusion Method Microencapsulation Market Size, by Country, 2018–2027 (USD Million)

Table 10 Europe: Spray Chilling or Congealing Method Microencapsulation Market, by Country, 2018–2027 (USD Million)

Table 11 Europe: Other Physico-Mechanical Methods Microencapsulation Market Size, by Country, 2018–2027 (USD Million)

Table 12 Europe: Physico-Chemical Method Microencapsulation Market Size, by Type, 2018–2027 (USD Million)

Table 13 Europe: Physico-Chemical Method Microencapsulation Market Size, by Country, 2018–2027 (USD Million)

Table 14 Europe: Coacervation Or Phase Separation Method Microencapsulation Market Size, by Country, 2018–2027 (USD Million)

Table 15 Other Physico-Chemical Method Microencapsulation Market Size, by Country, 2018–2027 (USD Million)

Table 16 Europe: Chemical Microencapsulation Methods Market Size, by Type, 2018–2027 (USD Million)

Table 17 Europe: Chemical Microencapsulation Methods Market Size, by Country, 2018–2027 (USD Million)

Table 18 Europe: In-Situ Polymerization Method Microencapsulation Market Size, by Country, 2018–2027 (USD Million)

Table 19 Europe: Interfacial Polymerization Method Microencapsulation Market Size, by Country, 2018–2027 (USD Million)

Table 20 Europe: Other Microencapsulation Methods Market Size, by Country, 2018–2027 (USD Million

Table 21 European Fragrances Microencapsulation Market Size for Home and Personal Care, by Application, 2018 2027 (USD Million)

Table 22 European Fragrances Microencapsulation Market Size for Personal Care, by Type, 2018-2027 (USD Million)

Table 23 European Fragrances Microencapsulation Market Size for Personal Care, by Country, 2018-2027 (USD Million)

Table 24 European Fragrances Microencapsulation Market Size for Skincare, by Country, 2018-2027 (USD Million)

Table 25 European Fragrances Microencapsulation Market Size for Haircare Products, by Country, 2018-2027 (USD Million)

Table 26 European Fragrances Microencapsulation Market Size for Haircare Products, by Type, 2018-2027 (USD Million)

Table 27 European Fragrances Microencapsulation Market Size for Deodorants and Perfumes, by Country, 2018-2027 (USD Million)

Table 28 European Fragrances Microencapsulation Market Size for Other Personal Care Products, by Country, 2018-2027 (USD Million)

Table 29 European Fragrances Microencapsulation Market Size for Home Care, by Type, 2018–2027 (USD Million)

Table 30 European Fragrances Microencapsulation Market Size for Home Care, by Country, 2018–2027 (USD Million)

Table 31 European Fragrances Microencapsulation Market Size for Laundry Detergents and Fabric Conditioners, by Country, 2018–2027 (USD Million)

Table 32 European Fragrances Microencapsulation Market Size for House Cleaning Agents, by Country, 2018–2027 (USD Million)

Table 33 European Fragrances Microencapsulation Market Size for Other Home Care Products, by Country, 2018–2027 (USD Million)

Table 34 European Fragrances Microencapsulation Market Size for Home and Personal Care, by Country, 2018–2027 (USD Million))

Table 35 Germany: Fragrances Microencapsulation Market Size for Home and Personal Care, by Technology/Method, 2018-2027 (USD Million)

Table 36 Germany: Fragrances Microencapsulation Market Size by Chemical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 37 Germany: Fragrances Microencapsulation Market Size by Physico-Chemical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 38 Germany: Fragrances Microencapsulation Market Size by Physico-Mechanical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 39 Germany: Fragrances Microencapsulation Market for Home and Personal Care Size, by Application, 2018-2027 (USD Million)

Table 40 Germany: Fragrances Microencapsulation Market Size for Personal Care, by Type, 2018-2027 (USD Million)

Table 41 Germany: Fragrances Microencapsulation Market Size for Hair Care, by Type, 2018-2027 (USD Million)

Table 42 Germany: Fragrances Microencapsulation Market Size for Home Care, by Type, 2018-2027 (USD Million)

Table 43 France: Fragrances Microencapsulation Market Size for Home and Personal Care, by Technology/Method, 2018-2027 (USD Million)

Table 44 France: Fragrances Microencapsulation Market Size by Chemical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 45 France: Fragrances Microencapsulation Market Size by Physico-Chemical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 46 France: Fragrances Microencapsulation Market Size by Physico-Mechanical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 47 France: Fragrances Microencapsulation Market for Home and Personal Care Size, by Application, 2018-2027 (USD Million)

Table 48 France: Fragrances Microencapsulation Market Size for Personal Care, by Type, 2018-2027 (USD Million)

Table 49 France: Fragrances Microencapsulation Market Size for Hair Care, by Type, 2018-2027 (USD Million)

Table 50 France: Fragrances Microencapsulation Market Size for Home Care, by Type, 2018-2027 (USD Million)

Table 51 U.K.: Fragrances Microencapsulation Market Size for Home and Personal Care, by Technology/Method, 2018-2027 (USD Million)

Table 52 U.K.: Fragrances Microencapsulation Market Size by Chemical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 53 U.K.: Fragrances Microencapsulation Market Size by Physico-Chemical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 54 U.K.: Fragrances Microencapsulation Market Size by Physico-Mechanical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 55 U.K.: Fragrances Microencapsulation Market for Home and Personal Care Size, by Application, 2018-2027 (USD Million)

Table 56 U.K.: Fragrances Microencapsulation Market Size for Personal Care, by Type, 2018-2027 (USD Million)

Table 57 U.K.: Fragrances Microencapsulation Market Size for Hair Care, by Type, 2018-2027 (USD Million)

Table 58 U.K.: Fragrances Microencapsulation Market Size for Home Care, by Type, 2018-2027 (USD Million)

Table 59 Italy: Fragrances Microencapsulation Market Size for Home and Personal Care, by Technology/Method, 2018-2027 (USD Million)

Table 60 Italy: Fragrances Microencapsulation Market Size by Chemical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 61 Italy: Fragrances Microencapsulation Market Size by Physico-Chemical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 62 Italy: Fragrances Microencapsulation Market Size by Physico-Mechanical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 63 Italy: Fragrances Microencapsulation Market for Home and Personal Care Size, by Application, 2018-2027 (USD Million)

Table 64 Italy: Fragrances Microencapsulation Market Size for Personal Care, by Type, 2018-2027 (USD Million)

Table 65 Italy: Fragrances Microencapsulation Market Size for Hair Care, by Type, 2018-2027 (USD Million)

Table 66 Italy: Fragrances Microencapsulation Market Size for Home Care, by Type, 2018-2027 (USD Million)

Table 67 Spain: Fragrances Microencapsulation Market Size for Home and Personal Care, by Technology/Method, 2018-2027 (USD Million)

Table 68 Spain: Fragrances Microencapsulation Market Size by Chemical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 69 Spain: Fragrances Microencapsulation Market Size by Physico-Chemical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 70 Spain: Fragrances Microencapsulation Market Size by Physico-Mechanical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 71 Spain: Fragrances Microencapsulation Market for Home and Personal Care Size, by Application, 2018-2027 (USD Million)

Table 72 Spain: Fragrances Microencapsulation Market Size for Personal Care, by Type, 2018-2027 (USD Million)

Table 73 Spain: Fragrances Microencapsulation Market Size for Hair Care, by Type, 2018-2027 (USD Million)

Table 74 Spain: Fragrances Microencapsulation Market Size for Home Care, by Type, 2018-2027 (USD Million)

Table 75 Rest of Europe: Fragrances Microencapsulation Market Size for Home and Personal Care, by Technology/Method, 2018-2027 (USD Million)

Table 76 Rest of Europe: Fragrances Microencapsulation Market Size by Chemical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 77 Rest of Europe: Fragrances Microencapsulation Market Size by Physico-Chemical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 78 Rest of Europe: Fragrances Microencapsulation Market Size by Physico-Mechanical Methods for Home and Personal Care, by Type, 2018-2027 (USD Million)

Table 79 Rest of Europe: Fragrances Microencapsulation Market for Home and Personal Care Size, by Application, 2018-2027 (USD Million)

Table 80 Rest of Europe: Fragrances Microencapsulation Market Size for Personal Care, by Type, 2018-2027 (USD Million)

Table 81 Rest of Europe: Fragrances Microencapsulation Market Size for Hair Care, by Type, 2018-2027 (USD Million)

Table 82 Rest of Europe: Fragrances Microencapsulation Market Size for Home Care, by Type, 2018-2027 (USD Million)

Table 83 Number of Developments by Major Players During 2017-2020

List of Figures

Figure 1 Market Ecosystem

Figure 2 Research Process

Figure 3 Key Secondary Sources

Figure 4 Primary Research Techniques

Figure 5 Key Executives Interviewed

Figure 6 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 7 Market Size Estimation

Figure 8 Physico-Mechanical Methods to Dominate the European Fragrances Microencapsulation Market for Home & Personal Care Products in 2020

Figure 9 Personal Care Segment to Dominate the European Fragrances Microencapsulation Market for Home and Personal Care in 2020

Figure 10 Skincare Products to Dominate the Market During the Forecast Period

Figure 11 Germany: Lucrative and Growing Market for European Fragrances Microencapsulation Market Stakeholders

Figure 12 Market Dynamics

Figure 13 Europe Natural Cosmetics Market, 2013-2018 (€ Billion)

Figure 14 The Fragrance Industry & The Fragrances Microencapsulation Sector Value Chain

Figure 15 Key Stakeholders in The Fragrances Microencapsulation Market

Figure 16 European Fragrances Microencapsulation Market Size for Home and Personal Care Products, by Technology/Method, 2020–2027 (USD Million)

Figure 17 European Fragrances Microencapsulation Market Size for Home and Personal Care, by Application, 2020–2027 (USD Million)

Figure 18 Europe: Cosmetics and Personal Care Market, by Country, 2019 (Euro Billion)

Figure 19 Europe: Household Care Products Market, by Category, 2019 (Euro Billion)

Figure 20 Europe: Laundry Care Products Market, by Type, 2019 (Euro Billion)

Figure 21 Europe: Laundry Care Segment Market, 2018 Vs. 2019 (Euro Billion)

Figure 22 Europe: Cosmetics Market Size, 2019 (Euro Billion)

Figure 23 European Cosmetic Products Market Size, by Country, 2019 (Retail Sales Price (RSP) in Euro Billion)

Figure 24 Number SMEs Operating in The European Cosmetics Industry, by Country, 2019

Figure 25 European Cosmetics Industry, by Category, 2019 (%)

Figure 26 European Fragrances Microencapsulation Market Size for Home and Personal Care, by Country, 2020–2027 (USD Million))

Figure 27 Key Growth Strategies Adopted by Leading Players, 2017-2020

Figure 28 European Fragrances Microencapsulation Market for Home and Personal Care: Competitive Benchmarking

Figure 29 European Fragrances Market Share, by Key Players, 2019 (%)

Figure 30 Givaudan S.A.: Financial Overview (2019)

Figure 31 Firmenich Incorporated: Financial Overview (2020)

Figure 32 Symrise AG: Financial Overview (2019)

Figure 33 Ingredion Incorporated: Financial Overview (2019)

Figure 34 Ashland Global Holdings, Inc.: Financial Overview (2019)

Figure 35 Robertet Group: Financial Overview (2019)

Figure 36 International Flavors & Fragrances, Inc.: Financial Overview (2019)