1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.1.3. Growth Forecast

2.3.2. Market Share Analysis

2.4. Assumptions for the Study

2.5. Limitations for the Study

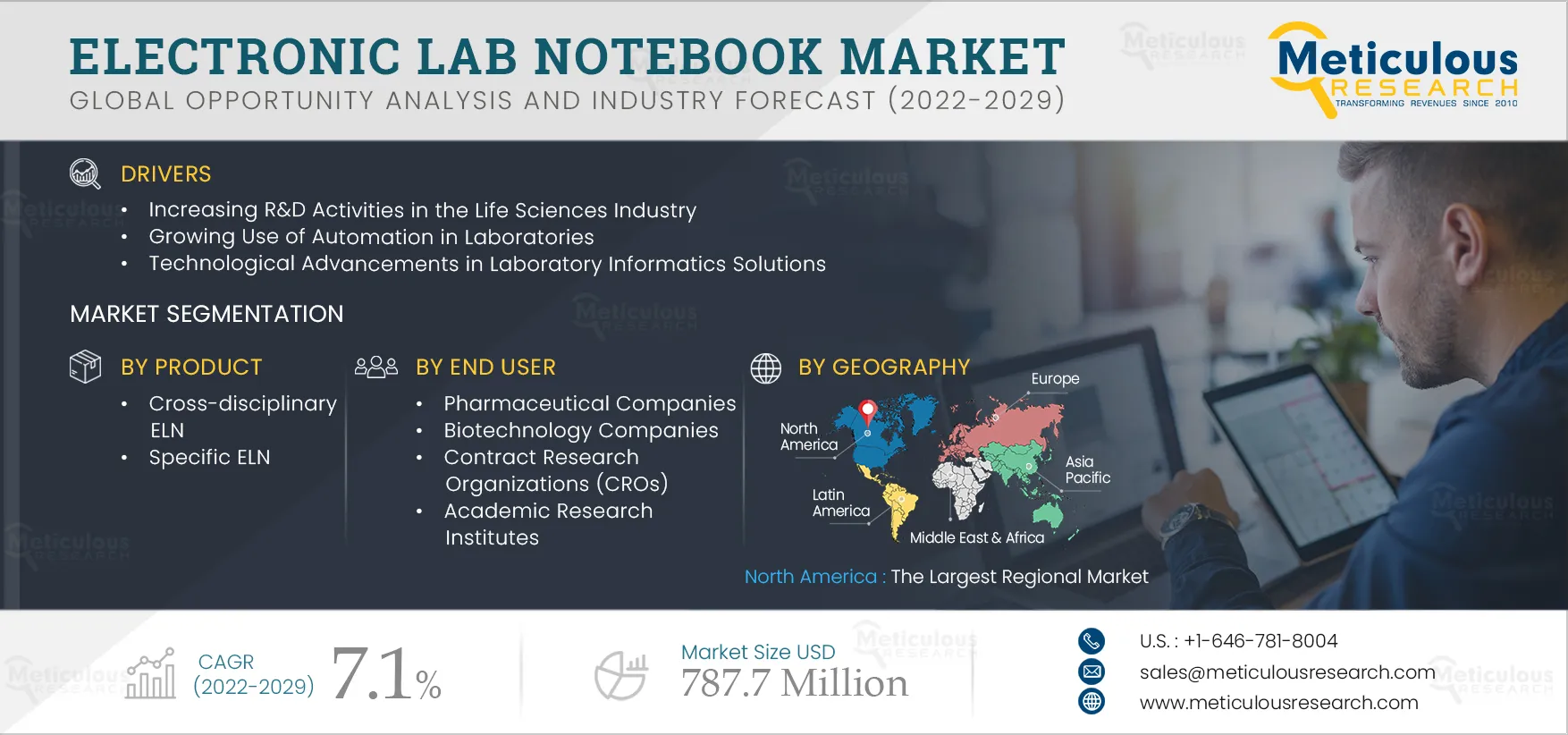

3. Executive summary

4. Market Insights

4.1. Market Overview

4.2. Drivers

4.2.1. Increasing R&D Activities in the Life Sciences Industry

4.2.2. Growing Use of Automation in Laboratories

4.2.3. Technological Advancements in Laboratory Informatics Solutions

4.2.4. Rising Need to Comply with Regulatory Frameworks

4.3. Restraints

4.3.1. Cost Constraints

4.3.2. Reluctance to Replace Traditional Lab Notebooks with Electronic Lab Notebooks

4.4. Opportunities

4.4.1. Growing Scope of Cloud-based Electronic Lab Notebooks

4.4.2. Untapped Markets in Emerging Economies

4.5. Challenges

4.5.1. Interfacing & Integration

4.5.2. Data Security & Privacy Concerns

4.6. Regulatory Analysis

4.7. COVID-19: Impact Assessment

5. Global Electronic Lab Notebook Market, by Product

5.1. Introduction

5.2. Cross-disciplinary ELN

5.3. Specific ELN

6. Global Electronic Lab Notebook Market, by Technology

6.1. Introduction

6.2. Proprietary ELN

6.3. Open-source ELN

7. Global Electronic Lab Notebook Market, by Channel

7.1. Introduction

7.2. Web & Cloud-Based ELN

7.3. On-premise ELN

8. Global Electronic Lab Notebook Market, by End User

8.1. Introduction

8.2. Pharmaceutical Companies

8.3. Biotechnology Companies

8.4. Food & Beverage Companies

8.5. contract research organizations (CROs)

8.6. Academic Research Institutes

8.7. Other End Users

9. Electronic Lab Notebook Market, by Geography

9.1. Introduction

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe (ROE)

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.4.4. Rest of Asia-Pacific (ROAPAC)

9.5. Latin America

9.6. Middle East & Africa

10. Competitive Landscape

10.1. Introduction

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Market Share Analysis (2021)

10.4.1. Overall Market Share Analysis

10.4.1.1. PerkinElmer, Inc.

10.4.1.2. Dassault Systemes SE

10.4.1.3. Waters Corporation

10.4.1.4. ID Business Solutions (IDBS) Ltd.

10.4.2. Market Share Analysis (For the Pharmaceutical Sector)

11. Company Profiles

11.1. Abbott Laboratories

11.2. Agilent Technologies, Inc.

11.3. Arxspan, LLC

11.4. Benchling, Inc.

11.5. Eppendorf AG

11.6. Dassault Systemes SE

11.7. ID Business Solutions (IDBS) Ltd (Subsidiary of Danaher Corporation)

11.8. KineMatik Inc.

11.9. Lab-Ally, LLC

11.10. Labforward GmbH

11.11. Labii Inc.

11.12. LabArchives, LLC. (Subsidiary of Insightful Science, LLC)

11.13. LabLynx, Inc.

11.14. LABTrack, LLC

11.15. LabVantage Solutions, Inc.

11.16. LabWare, Inc.

11.17. Mestrelab Research, S.L.

11.18. PerkinElmer, Inc.

11.19. Thermo Fisher Scientific Inc.

11.20. Waters Corporation

12. Appendix

12.1. Questionnaire

12.2. Available Customization

List of Tables

Table 1 Global Electronic Lab Notebook Market Drivers: Impact Analysis (2022–2029)

Table 2 Global Electronic Lab Notebook Market Restraints: Impact Analysis (2022–2029)

Table 3 Regulations/Guidelines Related to Electronic Lab Notebooks

Table 4 Global Electronic Lab Notebook Market Size, by Product, 2020–2029 (USD Million)

Table 5 Examples of Cross-disciplinary ELN

Table 6 Global Cross-disciplinary ELN Market Size, by Country/Region, 2020–2029 (USD Million)

Table 7 Non-Exhaustive List of Companies Offering Specific ELNs

Table 8 Global Specific ELN Market Size, by Country/Region, 2020–2029 (USD Million)

Table 9 Global Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 10 Global Proprietary ELN Market Size, by Country/Region, 2020–2029 (USD Million)

Table 11 Global Open-Source ELN Market Size, by Country/Region, 2020–2029 (USD Million)

Table 12 Global Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 13 Global Web & Cloud-Based ELN Market Size, by Country/Region, 2020–2029 (USD Million)

Table 14 Global On-premise ELN Market Size, by Country/Region, 2020–2029 (USD Million)

Table 15 Global Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 16 Global Electronic Lab Notebook Market Size for Pharmaceutical Companies, by Country/Region, 2020–2029 (USD Million)

Table 17 Global Electronic Lab Notebook Market Size for Biotechnology Companies, by Country/Region, 2020–2029 (USD Million)

Table 18 Global Electronic Lab Notebook Market Size for Food & Beverage Companies, by Country/Region, 2020–2029 (USD Million)

Table 19 Global Electronic Lab Notebook Market Size for Contract Research Organizations, by Country/Region, 2020–2029 (USD Million)

Table 20 Global Electronic Lab Notebook Market Size for Academic Research Institutes, by Country/Region, 2020–2029 (USD Million)

Table 21 Global Electronic Lab Notebook Market Size for Other End Users, by Country/Region, 2020–2029 (USD Million)

Table 22 Global Electronic Lab Notebook Market Size, by Country/Region, 2020–2029 (USD Million)

Table 23 North America: Electronic Lab Notebook Market Size, by Country, 2020–2029 (USD Million)

Table 24 North America: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 25 North America: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 26 North America: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 27 North America: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 28 R&D Expenditure in the U.S., by Source & Area of Research, 2017-2019

Table 29 U.S.: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 30 U.S.: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 31 U.S.: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 32 U.S.: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 33 Canada: Spending on Research and Development in the Higher Education Sector, 2019/2020

Table 34 Canada: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 35 Canada: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 36 Canada: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 37 Canada: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 38 Europe: Electronic Lab Notebook Market Size, by Country/Region, 2020–2029 (USD Million)

Table 39 Europe: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 40 Europe: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 41 Europe: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 42 Europe: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 43 Germany: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 44 Germany: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 45 Germany: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 46 Germany: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 47 U.K.: R&D Expenditure

Table 48 U.K.: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 49 U.K.: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 50 U.K.: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 51 U.K.: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 52 France: R&D Expenditure

Table 53 France: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 54 France: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 55 France: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 56 France: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 57 Italy: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 58 Italy: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 59 Italy: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 60 Italy: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 61 Spain: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 62 Spain: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 63 Spain: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 64 Spain: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 65 ROE: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 66 ROE: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 67 ROE: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 68 ROE: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 69 Asia-Pacific: Electronic Lab Notebook Market SIZE, by Country/Region, 2020–2029 (USD MILLION)

Table 70 Asia-Pacific: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 71 Asia-Pacific: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 72 Asia-Pacific: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 73 Asia-Pacific: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 74 Japan: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 75 Japan: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 76 Japan: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 77 Japan: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 78 China: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 79 China: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 80 China: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 81 China: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 82 India: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 83 India: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 84 India: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 85 India: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 86 Australia: Gross Expenditure on R&D

Table 87 ROAPAC: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 88 ROAPAC: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 89 ROAPAC: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 90 ROAPAC: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 91 Latin America: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 92 Latin America: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 93 Latin America: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 94 Latin America: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 95 Middle East &Africa: Electronic Lab Notebook Market Size, BY Product, 2020–2029 (USD Million)

Table 96 Middle East &Africa: Electronic Lab Notebook Market Size, by Technology, 2020–2029 (USD Million)

Table 97 Middle East &Africa: Electronic Lab Notebook Market Size, by Channel, 2020–2029 (USD Million)

Table 98 Middle East &Africa: Electronic Lab Notebook Market Size, by End User, 2020–2029 (USD Million)

Table 99 Recent Developments, by Company (2019–2022)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side &Demand-Side)

Figure 6 Market Size Estimation

Figure 7 Global Electronic Lab Notebook Market, by Product, 2022 VS. 2029 (USD Million)

Figure 8 Global Electronic Lab Notebook Market, by Technology, 2022 VS. 2029 (USD Million)

Figure 9 Global Electronic Lab Notebook Market, BY Channel, 2022 VS. 2029 (USD Million)

Figure 10 Global Electronic Lab Notebook Market, BY End User, 2022 VS. 2029 (USD MILLION)

Figure 11 Global Electronic Lab Notebook Market, by Geography

Figure 12 Market Dynamics

Figure 13 Pharmaceutical R&D Expenditure in The U.S., Europe, And Japan, 2000 VS. 2010 VS. 2019 (USD Million)

Figure 14 Global Pharmaceutical R&D Expenditure, 2012 VS. 2020 VS. 2026 (USD Billion)

Figure 15 Global Electronic Lab Notebook Market Size, by Product, 2022 VS. 2029 (USD Million)

Figure 16 Global Electronic Lab Notebook Market Size, by Technology, 2022 VS. 2029 (USD Million)

Figure 17 Global Electronic Lab Notebook Market Size, by Channel, 2022 VS. 2029 (USD Million)

Figure 18 Global Electronic Lab Notebook Market Size, by End User, 2022 VS. 2029 (USD Million)

Figure 19 Global Pharmaceutical R&D Spending, 2014–2026 (USD Billion)

Figure 20 Global Drug R&D Pipeline Size (2015–2020)

Figure 21 Number of Biologics Approved by The FDA Per Year (2010–2020)

Figure 22 R&D Costs for Developing New Molecular Entities (NMEs) (2014–2019)

Figure 23 Global Electronic Lab Notebook Market Size, by Geography, 2022–2029 (USD Million)

Figure 24 North America: Electronic Lab Notebook Market Snapshot

Figure 25 U.S.: Gross Domestic Spending on R&D (% Share of GDP)

Figure 26 Total Canadian Pharmaceutical Business R&D Expenditure (2014-2019)

Figure 27 Pharmaceutical Industry Research and Development Expenditure in Europe (2019)

Figure 28 Europe: Electronic Lab Notebook Market Snapshot

Figure 29 Gross Expenditure on R&D in Germany (2013-2019)

Figure 30 France: Indirect R&D Tax Incentives (USD Million)

Figure 31 R&D Spending by Pharmaceutical Industry in Spain, 2015-2019 (USD Million)

Figure 32 Pharmaceutical R&D Spending in ROE (2019)

Figure 33 Asia-Pacific: Electronic Lab Notebook Market Snapshot

Figure 34 Japan: R&D Expenditure as A Percentage of GDP (2015-2020)

Figure 35 Key Growth Strategies Adopted by Leading Players (2019–2022)

Figure 36 Electronic Lab Notebooks Market: Competitive Benchmarking, by Product

Figure 37 Electronic Lab Notebooks Market: Competitive Benchmarking, by End User

Figure 38 Electronic Lab Notebooks Market: Competitive Benchmarking, by Geography

Figure 39 Overall Market Share Analysis: Electronic Lab Notebooks Market (2021)

Figure 40 Market Share Analysis-Pharmaceutical Sector: Electronic Lab Notebooks Market (2021)

Figure 41 Abbott Laboratories: Financial Overview (2020)

Figure 42 Agilent Technologies, Inc.: Financial Overview (2020)

Figure 43 Eppendorf AG: Financial Overview (2020)

Figure 44 Dassault Systemes SE: Financial Overview (2020)

Figure 45 Danaher Corporation: Financial Overview (2020)

Figure 46 PerkinElmer, Inc.: Financial Overview (2020)

Figure 47 Thermo Fisher Scientific Inc.: Financial Overview (2020)

Figure 48 Waters Corporation: Financial Overview (2020)