1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research / Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

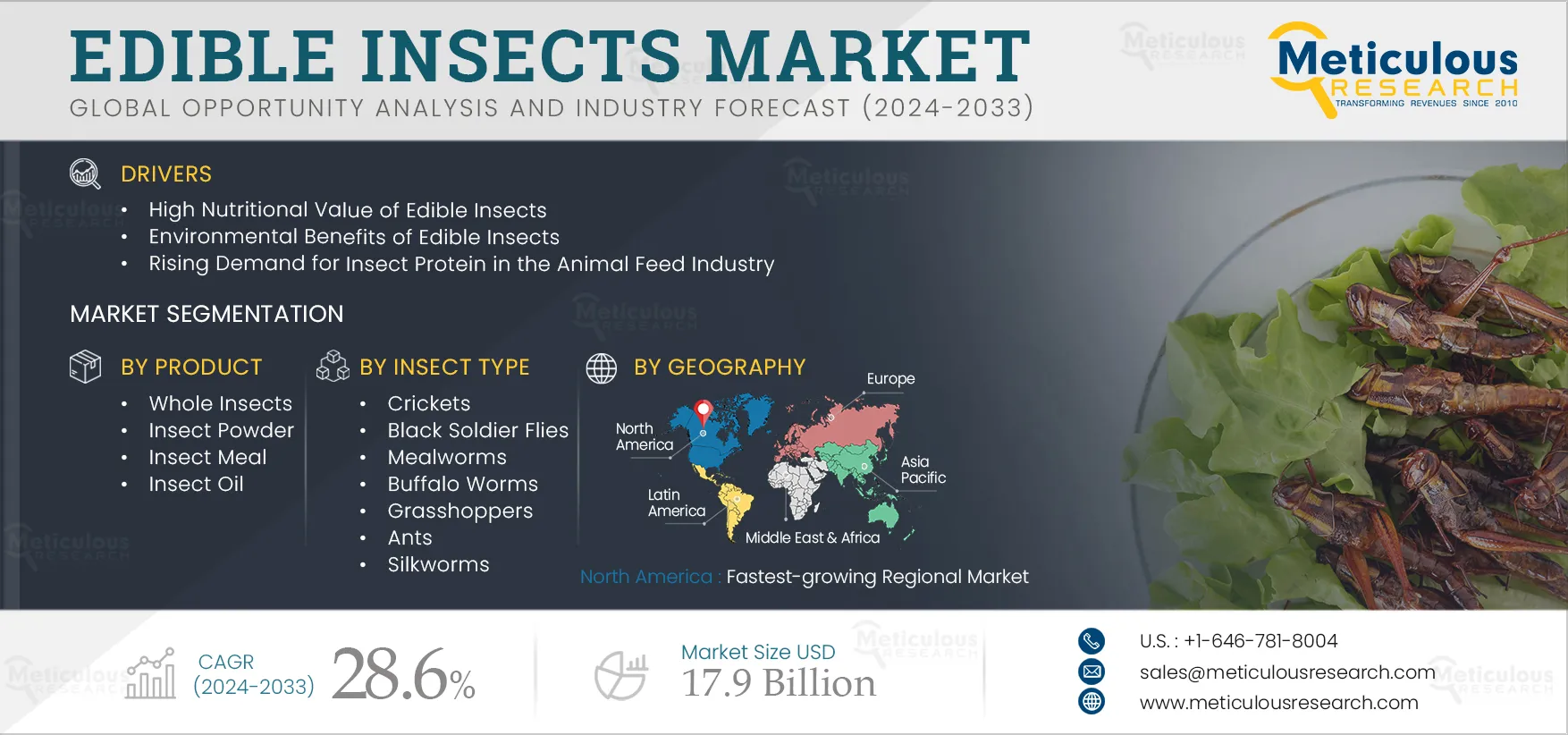

3. Executive Summary

3.1. Overview

3.2. Segment Analysis

3.2.1. Edible Insects Market, by Product

3.2.2. Edible Insects Market, by Insect Type

3.2.3. Edible Insects Market, by Application

3.2.4. Edible Insects Market, by End Use

3.3. Edible Insects Market Regional Analysis

3.4. Competitive Landscape & Market Competitors

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Growing Greenhouse Gas Emissions from the Livestock and Poultry Industries

4.2.1.2. High Nutritional Value of Insects

4.2.1.3. Environmental Benefits of Edible Insects Consumption

4.2.1.4. Rising Demand for Insect Protein in the Animal Feed Industry

4.2.1.5. Low Risk of Transmitting Zoonotic Diseases with the Consumption of Edible Insects

4.2.2. Restraints

4.2.2.1. Lack of a Standardized Regulatory Framework

4.2.2.2. Psychological and Ethical Barriers to Consuming Insects as Food

4.2.2.3. Risk of Allergies Due to Insect Consumption

4.2.3. Opportunities

4.2.3.1. Emerging Economies

4.2.4. Challenges

4.2.4.1. Lack of Awareness

4.3. Pricing Analysis

4.3.1. Overview

4.3.2. Whole Insects

4.3.3. Insect Powder

4.3.4. Insect Meal

4.3.5. Insect Oil

4.4. Key Edible Insect Companies and Their Production Capacities (Tons/Year)

4.5. Regulatory Analysis

4.5.1. North America

4.5.1.1. U.S.

4.5.1.2. Canada

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Rest of the World

4.6. Edible Insects Market: Venture Investments/Funding Scenario

5. Edible Insects Market Assessment—by Product

5.1. Overview

5.2. Whole Insects

5.3. Insect Powder

5.4. Insect Meal

5.5. Insect Oil

6. Edible Insects Market Assessment—by Insect Type

6.1. Overview

6.2. Crickets

6.3. Black Soldier Flies

6.4. Mealworms

6.5. Buffalo Worms

6.6. Grasshoppers

6.7. Ants

6.8. Silkworms

6.9. Cicadas

6.10. Other Edible Insects

7. Edible Insects Market Assessment—by Application

7.1. Overview

7.2. Food & Beverages

7.2.1. Processed Whole Insects

7.2.2. Processed Insect Powder

7.2.3. Protein Bars & Protein Shakes

7.2.4. Baked Products & Snacks

7.2.5. Insect Confectioneries

7.2.6. Insect Beverages

7.2.7. Other Food & Beverage Applications

7.3. Feed

7.3.1. Animal Feed

7.3.2. Aquaculture Feed

7.3.3. Pet Food

8. Edible Insects Market Assessment—by End Use

8.1. Overview

8.2. Human Consumption

8.3. Animal Nutrition

9. Edible Insects Market Assessment—by Geography

9.1. Overview

9.2. Asia-Pacific

9.2.1. Thailand

9.2.2. China

9.2.3. South Korea

9.2.4. Vietnam

9.2.5. Rest of Asia-Pacific (RoAPAC)

9.3. Europe

9.3.1. Netherlands

9.3.2. Belgium

9.3.3. France

9.3.4. Denmark

9.3.5. Finland

9.3.6. Germany

9.3.7. Rest of Europe (RoE)

9.3.7.1. U.K.

9.3.7.2. Spain

9.3.7.3. Poland

9.3.7.4. Ireland

9.3.7.5. Sweden

9.3.7.6. Other European Countries

9.4. North America

9.4.1. U.S.

9.4.2. Canada

9.5. Latin America

9.6. Middle East & Africa

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.3.1. Industry Leaders

10.3.2. Market Differentiators

10.3.3. Vanguards

10.3.4. Emerging Companies

10.5. Vendor Market Positioning

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments)

11.1. Ÿnsect (SAS)

11.2. Protix B.V.

11.3. Innovafeed SAS

11.4. EnviroFlight, LLC

11.5. Nutrition Technologies Group

11.6. Entomo Farms

11.7. Hargol FoodTech

11.8. Aspire Food Group

11.9. All Things Bugs, LLC

11.10. Beta Hatch

11.11. EntoCube Oy

11.12. Armstrong Crickets Georgia

11.13. Global Bugs Asia Co., Ltd.

11.14. Jr Unique Foods Ltd.

11.15. BIOFLYTECH S.L.

11.16. TEBRIO

11.17. nextProtein SA

11.18. Enorm Biofactory A/S

11.19. Hexafly

11.20. HiProMine S.A.

11.21. SFly Comgraf SAS

11.22. Protenga Pte Ltd.

(Note: SWOT Analysis for the Top 5 Companies will be provided)

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Global Edible Insects Market: Key Stakeholders

Table 2 Average Selling Prices of Whole Insects, by Country, 2021–2032 (USD/Kg)

Table 3 Average Selling Prices of Insect Powder, by Country, 2021–2032 (USD/Kg)

Table 4 Average Selling Prices of Insect Meal, by Country, 2021–2032 (USD/Kg)

Table 5 Average Selling Prices of Insect Oil, by Country, 2021–2032 (USD/Kg)

Table 6 Insect Application and Approval Status

Table 7 Insect Application and Approval Status

Table 8 Insect Application and Approval Status

Table 9 Investments/Funding in the Edible Insects Market till December 2022

Table 10 Global Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 11 Global Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 12 Global Edible Whole Insects Market, by Country/Region, 2021–2032 (USD Million)

Table 13 Global Edible Whole Insects Market, by Country/Region, 2021–2032 (Tonnes)

Table 14 Global Edible Insect Powder Market, by Country/Region, 2021–2032 (USD Million)

Table 15 Global Edible Insect Powder Market, by Country/Region, 2021–2032 (Tonnes)

Table 16 Global Edible Insect Meal Market, by Country/Region, 2021–2032 (USD Million)

Table 17 Global Edible Insect Meal Market, by Country/Region, 2021–2032 (Tonnes)

Table 18 Global Edible Insect Oil Market, by Country/Region, 2021–2032 (USD Million)

Table 19 Global Edible Insect Oil Market, by Country/Region, 2021–2032 (Tonnes)

Table 20 Global Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 21 Cricket Species as Feed for Animals and Pets

Table 22 Global Crickets Market, by Country/Region, 2021–2032 (USD Million)

Table 23 Global Black Soldier Flies Market, by Country/Region, 2021–2032 (USD Million)

Table 24 Global Mealworms Market, by Country/Region, 2021–2032 (USD Million)

Table 25 Global Buffalo Worms Market, by Country/Region, 2021–2032 (USD Million)

Table 26 Global Grasshoppers Market, by Country/Region, 2021–2032 (USD Million)

Table 27 Global Ants Market, by Country/Region, 2021–2032 (USD Million)

Table 28 Global Silkworms Market, by Country/Region, 2021–2032 (USD Million)

Table 29 Global Cicadas Market, by Country/Region, 2021–2032 (USD Million)

Table 30 Global Other Edible Insects Market, by Country/Region, 2021–2032 (USD Million)

Table 31 Global Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 32 Global Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 33 Global Edible Insects Market for Food & Beverages, by Country/Region, 2021–2032 (USD Million)

Table 34 Global Edible Insects Market for Processed Whole Insects, by Country/Region, 2021–2032 (USD Million)

Table 35 Global Edible Insects Market for Processed Insect Powder, by Country/Region, 2021–2032 (USD Million)

Table 36 Global Edible Insects Market for Protein Bars & Protein Shakes, by Country/Region, 2021–2032 (USD Million)

Table 37 Global Edible Insects Market for Baked Products & Snacks, by Country/Region, 2021–2032 (USD Million)

Table 38 Global Edible Insects Market for Insect Confectioneries, by Country/Region, 2021–2032 (USD Million)

Table 39 Global Edible Insects Market for Insect Beverages, by Country/Region, 2021–2032 (USD Million)

Table 40 Global Edible Insects Market for Other Food & Beverage Applications, by Country/Region, 2021–2032 (USD Million)

Table 41 Global Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 42 Global Edible Insects Market for Feed, by Country/Region, 2021–2032 (USD Million)

Table 43 Global Edible Insects Market for Animal Feed, by Country/Region, 2021–2032 (USD Million)

Table 44 Global Edible Insects Market for Aquaculture Feed, by Country/Region, 2021–2032 (USD Million)

Table 45 Global Edible Insects Market for Pet Food, by Country/Region, 2021–2032 (USD Million)

Table 46 Global Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 47 Key Players Offering Insect-Based Products for Human Consumption

Table 48 Global Edible Insects Market for Human Consumption, by Country/Region, 2021–2032 (USD Million)

Table 49 Key Players Offering Insect-Based Products for Animal Nutrition

Table 50 Global Edible Insects Market for Animal Nutrition, by Country/Region, 2021–2032 (USD Million)

Table 51 Edible Insects Market, by Region, 2021–2032 (USD Million)

Table 52 Edible Insects Market, by Region, 2021–2032 (USD Million)

Table 53 Asia-Pacific: Edible Insects Market, by Country/Region, 2021–2032 (USD Million)

Table 54 Asia-Pacific: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 55 Asia-Pacific: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 56 Asia-Pacific: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 57 Asia-Pacific: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 58 Asia-Pacific: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 59 Asia-Pacific: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 60 Asia-Pacific: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 61 Thailand: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 62 Thailand: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 63 Thailand: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 64 Thailand: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 65 Thailand: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 66 Thailand: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 67 Thailand: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 68 China: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 69 China: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 70 China: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 71 China: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 72 China: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 73 China: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 74 China: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 75 South Korea: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 76 South Korea: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 77 South Korea: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 78 South Korea: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 79 South Korea: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 80 South Korea: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 81 South Korea: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 82 Vietnam: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 83 Vietnam: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 84 Vietnam: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 85 Vietnam: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 86 Vietnam: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 87 Vietnam: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 88 Vietnam: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 89 Rest of Asia-Pacific: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 90 Rest of Asia-Pacific: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 91 Rest of Asia-Pacific: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 92 Rest of Asia-Pacific: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 93 Rest of Asia-Pacific: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 94 Rest of Asia-Pacific: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 95 Rest of Asia-Pacific: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 96 Europe: Edible Insects Market, by Country/Region, 2021–2032 (USD Million)

Table 97 Europe: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 98 Europe: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 99 Europe: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 100 Europe: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 101 Europe: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 102 Europe: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 103 Europe: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 104 Netherlands: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 105 Netherlands: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 106 Netherlands: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 107 Netherlands: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 108 Netherlands: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 109 Netherlands: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 110 Netherlands: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 111 Belgium: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 112 Belgium: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 113 Belgium: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 114 Belgium: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 115 Belgium: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 116 Belgium: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 117 Belgium: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 118 France: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 119 France: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 120 France: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 121 France: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 122 France: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 123 France: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 124 France: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 125 Denmark: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 126 Denmark: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 127 Denmark: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 128 Denmark: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 129 Denmark: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 130 Denmark: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 131 Denmark: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 132 Finland: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 133 Finland: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 134 Finland: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 135 Finland: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 136 Finland: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 137 Finland: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 138 Finland: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 139 Germany: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 140 Germany: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 141 Germany: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 142 Germany: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 143 Germany: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 144 Germany: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 145 Germany: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 146 Rest of Europe: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 147 Rest of Europe: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 148 Rest of Europe: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 149 Rest of Europe: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 150 Rest of Europe: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 151 Rest of Europe: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 152 Rest of Europe: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 153 North America: Edible Insects Market, by Country, 2021–2032 (USD Million)

Table 154 North America: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 155 North America: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 156 North America: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 157 North America: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 158 North America: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 159 North America: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 160 North America: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 161 U.S.: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 162 U.S.: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 163 U.S.: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 164 U.S.: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 165 U.S.: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 166 U.S.: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 167 U.S.: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 168 Canada: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 169 Canada: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 170 Canada: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 171 Canada: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 172 Canada: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 173 Canada: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 174 Canada: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 175 Latin America: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 176 Latin America: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 177 Latin America: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 178 Latin America: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 179 Latin America: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 180 Latin America: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 181 Latin America: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 182 Middle East & Africa: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 183 Middle East & Africa: Edible Insects Market, by Product, 2021–2032 (Tonnes)

Table 184 Middle East & Africa: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 185 Middle East & Africa: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 186 Middle East & Africa: Edible Insects Market for Food & Beverages, by Product Type, 2021–2032 (USD Million)

Table 187 Middle East & Africa: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 188 Middle East & Africa: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 189 Number of Developments by Major Players During 2019–2023

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Whole Insects Segment to Dominate the Global Edible Insects Market in 2023

Figure 8 Crickets Segment to Dominate the Global Edible Insects Market in 2023

Figure 9 Food & Beverage Segment to Dominate the Global Edible Insects Market in 2023

Figure 10 Human Consumption Segment to Dominate the Market During the Forecast Period of 2023–2032

Figure 11 Asia-Pacific: A Lucrative and Growing Market for Global Stakeholders

Figure 12 Factors Affecting Market Growth

Figure 13 Resources Required: Livestock Farming Vs. Insect Farming

Figure 14 North America: Regulatory Approval for Insect Use in Animal Feed, 2022

Figure 15 Novel Food Authorization Workflow

Figure 16 Europe: Regulatory Approval for Insect Use in Animal Feed, 2022

Figure 17 Asia-Pacific: Regulatory Approval for Insect Use in Animal Feed, 2022

Figure 18 Global Edible Insects Market, by Product, 2023 Vs. 2032 (USD Million)

Figure 19 Global Edible Insects Market, by Product, 2023 Vs. 2032 (Tonnes)

Figure 20 Global Edible Insects Market, by Insect Type, 2023 Vs. 2032 (USD Million)

Figure 21 Global Edible Insects Market, by Application, 2023 Vs. 2032 (USD Million)

Figure 22 Global Edible Insects Market, by End Use, 2023 Vs. 2032 (USD Million)

Figure 23 Edible Insects Market, by Region, 2023–2032 (USD Million)

Figure 24 Edible Insects Market, by Region, 2023–2032 (Tonnes)

Figure 25 Asia-Pacific: Edible Insects Market Snapshot (2023)

Figure 26 Europe: Edible Insects Market Snapshot (2023)

Figure 27 North America: Edible Insects Market Snapshot (2023)

Figure 28 Latin America: Edible Insects Market Snapshot (2023)

Figure 29 Middle East & Africa: Edible Insects Market Snapshot (2023)

Figure 30 Key Growth Strategies Adopted by Leading Players, 2019–2023

Figure 31 Competitive Dashboard: Global Edible Insects Market

Figure 32 Global Edible Insects Market Competitive Benchmarking, by Product