1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency and Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection and Validation Process

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecasting

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.3.3. Market Share Analysis

2.4. Assumptions for the Study

3. Executive Summary

4. Market Insights

4.1. Overview

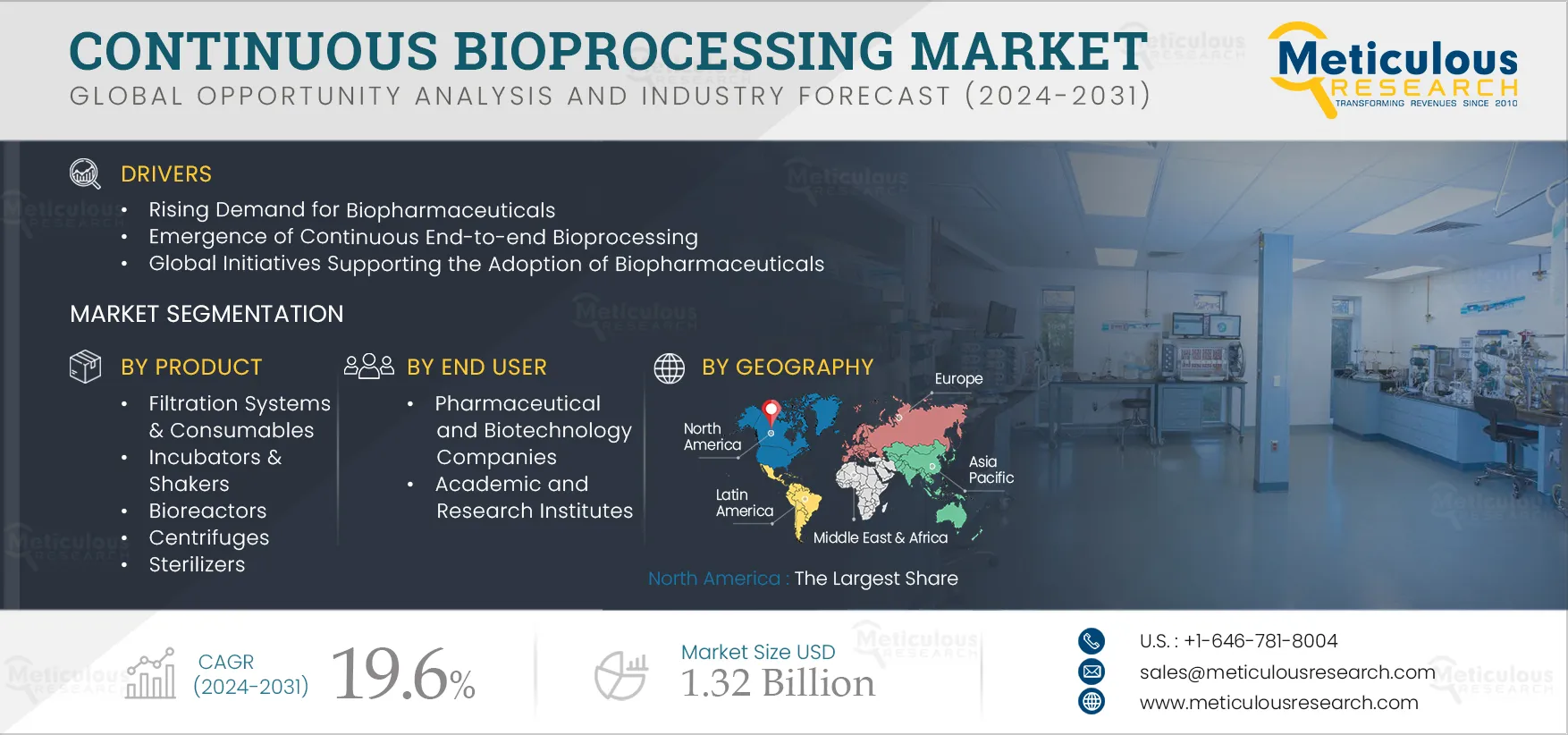

4.2. Drivers

4.2.1. Rising Demand for Biopharmaceuticals

4.2.2. Emergence of Continuous End-to-end Bioprocessing

4.2.3. Global Initiatives Supporting the Adoption of Biopharmaceuticals

4.2.4. Advantages of Continuous Bioprocessing over Batch Manufacturing

4.3. Restraints

4.3.1. High Capital Investment Requirements

4.3.2. Operational Complexities in Continuous Bioprocessing

4.4. Opportunities

4.4.1. Shift Toward Bioprocessing 4.0

4.4.2. Increasing Use of Continuous Bioprocessing for Monoclonal Antibody Production

4.5. Challenges

4.5.1. Risk of Cross Contamination

4.5.2. Process Development Control

4.5.3. Manufacturers’ Reluctance to Shift from Batch Manufacturing to Continuous Manufacturing

4.6. Factor Analysis

4.7. Key Trends

4.8. Regulatory Analysis

4.9. Pricing Analysis

4.10. Porter’s Five Forces Analysis

5. Continuous Bioprocessing Market Assessment—by Product

5.1. Overview

5.2. Filtration Systems & Consumables

5.3. Chromatography Systems & Consumables

5.4. Cell Culture Media, Buffers, and Reagents

5.5. Incubators & Shakers

5.6. Bioreactors

5.7. Centrifuges

5.8. Sterilizers

5.9. Other Instruments & Consumables

6. Continuous Bioprocessing Market Assessment—by Process Type

6.1. Overview

6.2. Upstream Processes

6.3. Downstream Processes

7. Continuous Bioprocessing Market Assessment—by Application

7.1. Overview

7.2. Commercial Applications

7.2.1. Monoclonal Antibodies (mAb) Production

7.2.2. Cell & Gene Therapy Production

7.2.3. Vaccine Manufacturing

7.2.4. Plasma Fractionation

7.2.5. Recombinant Protein Production

7.3. Research & Development (R&D) Applications

8. Continuous Bioprocessing Market Assessment—by End User

8.1. Overview

8.2. Pharmaceutical & Biotechnology Companies

8.3. Contract Development & Manufacturing Organizations (CDMOs) & Contract Research Organizations (CROs)

8.4. Academic & Research Institutes

9. Continuous Bioprocessing Market Assessment—by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.3.6. Switzerland

9.3.7. Ireland

9.3.8. Denmark

9.3.9. Belgium

9.3.10. Rest of Europe (RoE)

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.4.4. South Korea

9.4.5. Rest of Asia-Pacific (RoAPAC)

9.5. Latin America

9.6. Middle East & Africa

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Share Analysis/Market Rankings of Key Players (2023)

11. Company Profiles (Company Overview, Financial Snapshot, Product Portfolio, Strategic Developments, and SWOT Analysis)

11.1. 3M Company

11.2. Thermo Fisher Scientific, Inc.

11.3. Sartorius AG

11.4. Eppendorf AG

11.5. Danaher Corporation

11.6. Merck KGaA

11.7. Repligen Corporation

11.8. Getinge AB

11.9. Bionet

11.10. Corning Incorporated

11.11. Fujifilm Holdings Corporation

11.12. Entegris, Inc.

11.13. Meissner Corporation

(Note: SWOT analyses will be provided for the top 5 companies.)

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Global Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 2 Global Filtration Systems & Consumables Market, by Country/Region, 2022–2031 (USD Million)

Table 3 Global Chromatography Systems & Consumables Market, by Country/Region, 2022–2031 (USD Million)

Table 4 Global Cell Culture Media, Buffers, and Reagents Market, by Country/Region, 2022–2031 (USD Million)

Table 5 Global Incubators & Shakers Market, by Country/Region, 2022–2031 (USD Million)

Table 6 Global Bioreactors Market, by Country/Region, 2022–2031 (USD Million)

Table 7 Global Centrifuges Market, by Country/Region, 2022–2031 (USD Million)

Table 8 Global Sterilizers Market, by Country/Region, 2022–2031 (USD Million)

Table 9 Global Other Instruments & Consumables Market, by Country/Region, 2022–2031 (USD Million)

Table 10 Global Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 11 Global Upstream Processes Market, by Country/Region, 2022–2031 (USD Million)

Table 12 Global Downstream Processes Market, by Country/Region, 2022–2031 (USD Million)

Table 13 Global Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 14 Global Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 15 Global Continuous Bioprocessing Market for Commercial Applications, by Country/Region, 2022–2031 (USD Million)

Table 16 Global Continuous Bioprocessing Market for Monoclonal Antibodies Production, by Country/Region, 2022–2031 (USD Million)

Table 17 Global Continuous Bioprocessing Market for Cell & Gene Therapy Production, by Country/Region, 2022–2031 (USD Million)

Table 18 Global Continuous Bioprocessing Market for Vaccine Manufacturing, by Country/Region, 2022–2031 (USD Million)

Table 19 Global Continuous Bioprocessing Market for Plasma Fractionation, by Country/Region, 2022–2031 (USD Million)

Table 20 Global Continuous Bioprocessing Market for Recombinant Protein Production, by Country/Region, 2022–2031 (USD Million)

Table 21 Global Continuous Bioprocessing Market for R&D Applications, by Country/Region, 2022–2031 (USD Million)

Table 22 Global Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 23 Global Continuous Bioprocessing Market for Pharmaceutical & Biotechnology Companies, by Country/Region, 2022–2031 (USD Million)

Table 24 Global Continuous Bioprocessing Market for CDMOs & CROs, by Country/Region, 2022–2031 (USD Million)

Table 25 Global Continuous Bioprocessing Market for Academic & Research Institutes, by Country/Region, 2022–2031 (USD Million)

Table 26 Global Continuous Bioprocessing Market, by Region, 2022–2031 (USD Million)

Table 27 North America: Continuous Bioprocessing Market, by Country, 2022–2031 (USD Million)

Table 28 North America: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 29 North America: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 30 North America: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 31 North America: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 32 North America: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 33 U.S.: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 34 U.S.: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 35 U.S.: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 36 U.S.: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 37 U.S.: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 38 Canada: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 39 Canada: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 40 Canada: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 41 Canada: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 42 Canada: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 43 Europe: Continuous Bioprocessing Market, by Country/Region, 2022–2031 (USD Million)

Table 44 Europe: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 45 Europe: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 46 Europe: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 47 Europe: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 48 Europe: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 49 Germany: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 50 Germany: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 51 Germany: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 52 Germany: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 53 Germany: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 54 France: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 55 France: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 56 France: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 57 France: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 58 France: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 59 U.K.: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 60 U.K.: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 61 U.K.: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 62 U.K.: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 63 U.K.: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 64 Italy: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 65 Italy: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 66 Italy: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 67 Italy: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 68 Italy: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 69 Spain: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 70 Spain: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 71 Spain: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 72 Spain: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 73 Spain: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 74 Switzerland: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 75 Switzerland: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 76 Switzerland: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 77 Switzerland: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 78 Switzerland: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 79 Ireland: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 80 Ireland: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 81 Ireland: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 82 Ireland: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 83 Ireland: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 84 Denmark: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 85 Denmark: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 86 Denmark: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 87 Denmark: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 88 Denmark: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 89 Belgium: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 90 Belgium: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 91 Belgium: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 92 Belgium: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 93 Belgium: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 94 Rest of Europe: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 95 Rest of Europe: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 96 Rest of Europe: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 97 Rest of Europe: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 98 Rest of Europe: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 99 Asia-Pacific: Continuous Bioprocessing Market, by Country/Region, 2022–2031 (USD Million)

Table 100 Asia-Pacific: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 101 Asia-Pacific: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 102 Asia-Pacific: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 103 Asia-Pacific: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 104 Asia-Pacific: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 105 China: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 106 China: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 107 China: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 108 China: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 109 China: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 110 Japan: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 111 Japan: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 112 Japan: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 113 Japan: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 114 Japan: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 115 India: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 116 India: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 117 India: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 118 India: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 119 India: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 120 South Korea: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 121 South Korea: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 122 South Korea: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 123 South Korea: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 124 South Korea: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 125 Rest of Asia-Pacific: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 126 Rest of Asia-Pacific: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 127 Rest of Asia-Pacific: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 128 Rest of Asia-Pacific: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 129 Rest of Asia-Pacific: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 130 Latin America: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 131 Latin America: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 132 Latin America: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 133 Latin America: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 134 Latin America: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 135 Middle East & Africa: Continuous Bioprocessing Market, by Product, 2022–2031 (USD Million)

Table 136 Middle East & Africa: Continuous Bioprocessing Market, by Process Type, 2022–2031 (USD Million)

Table 137 Middle East & Africa: Continuous Bioprocessing Market, by Application, 2022–2031 (USD Million)

Table 138 Middle East & Africa: Continuous Bioprocessing Market for Commercial Applications, by Type, 2022–2031 (USD Million)

Table 139 Middle East & Africa: Continuous Bioprocessing Market, by End User, 2022–2031 (USD Million)

Table 140 Recent Developments, by Company, 2020–2024

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Size Estimation

Figure 7 Global Continuous Bioprocessing Market, by Product, 2024 Vs. 2031 (USD Million)

Figure 8 Global Continuous Bioprocessing Market, by Process Type, 2024 Vs. 2031 (USD Million)

Figure 9 Global Continuous Bioprocessing Market, by Application, 2024 Vs. 2031 (USD Million)

Figure 10 Global Continuous Bioprocessing Market, by End User, 2024 Vs. 2031 (USD Million)

Figure 11 Global Continuous Bioprocessing Market, by Geography

Figure 12 Global Continuous Bioprocessing Market, by Product, 2024 Vs. 2031 (USD Million)

Figure 13 Global Continuous Bioprocessing Market, by Process Type, 2024 Vs. 2031 (USD Million)

Figure 14 Global Continuous Bioprocessing Market, by Application, 2024 Vs. 2031 (USD Million)

Figure 15 Global Continuous Bioprocessing Market, by End User, 2024 Vs. 2031 (USD Million)

Figure 16 Global Continuous Bioprocessing Market, by Geography, 2024 Vs. 2031 (USD Million)

Figure 17 North America: Continuous Bioprocessing Market Snapshot

Figure 18 Europe: Continuous Bioprocessing Market Snapshot

Figure 19 Asia-Pacific: Continuous Bioprocessing Market Snapshot

Figure 20 Key Growth Strategies Adopted by Leading Players, 2020–2024

Figure 21 Global Continuous Bioprocessing Market: Competitive Benchmarking, by Product

Figure 22 Global Continuous Bioprocessing Market: Competitive Dashboard

Figure 23 Global Continuous Bioprocessing Market: Market Share Analysis/Market Rankings (2023)

Figure 24 3M Company: Financial Snapshot (2023)

Figure 25 Thermo Fisher Scientific Inc.: Financial Snapshot (2023)

Figure 26 Sartorius AG: Financial Snapshot (2023)

Figure 27 Eppendorf AG: Financial Snapshot (2022)

Figure 28 Danaher Corporation: Financial Snapshot (2023)

Figure 29 Merck KGaA: Financial Snapshot (2023)

Figure 30 Repligen Corporation: Financial Snapshot (2023)

Figure 31 Getinge AB: Financial Snapshot (2023)

Figure 32 Corning Incorporated: Financial Snapshot (2023)

Figure 33 Fujifilm Holdings Corporation: Financial Snapshot (2023)

Figure 34 Entegris, Inc.: Financial Snapshot (2023)

Figure 35 Fujifilm Holdings Corporation: Financial Snapshot (2023)