1. Introduction

1.1 Market Definition

1.2 Market Ecosystem

1.3 Currency

1.4 Key Stakeholders

2. Research Methodology

2.1 Research Process

2.2 Data Collection & Validation

2.2.1 Secondary Research

2.2.2 Primary Research

2.3 Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.2.1 top-Down Approach

2.3.2.2 Growth forecast

2.3.3 Market Share Analysis

2.4 Assumptions for this Study

2.5 Limitations for the Study

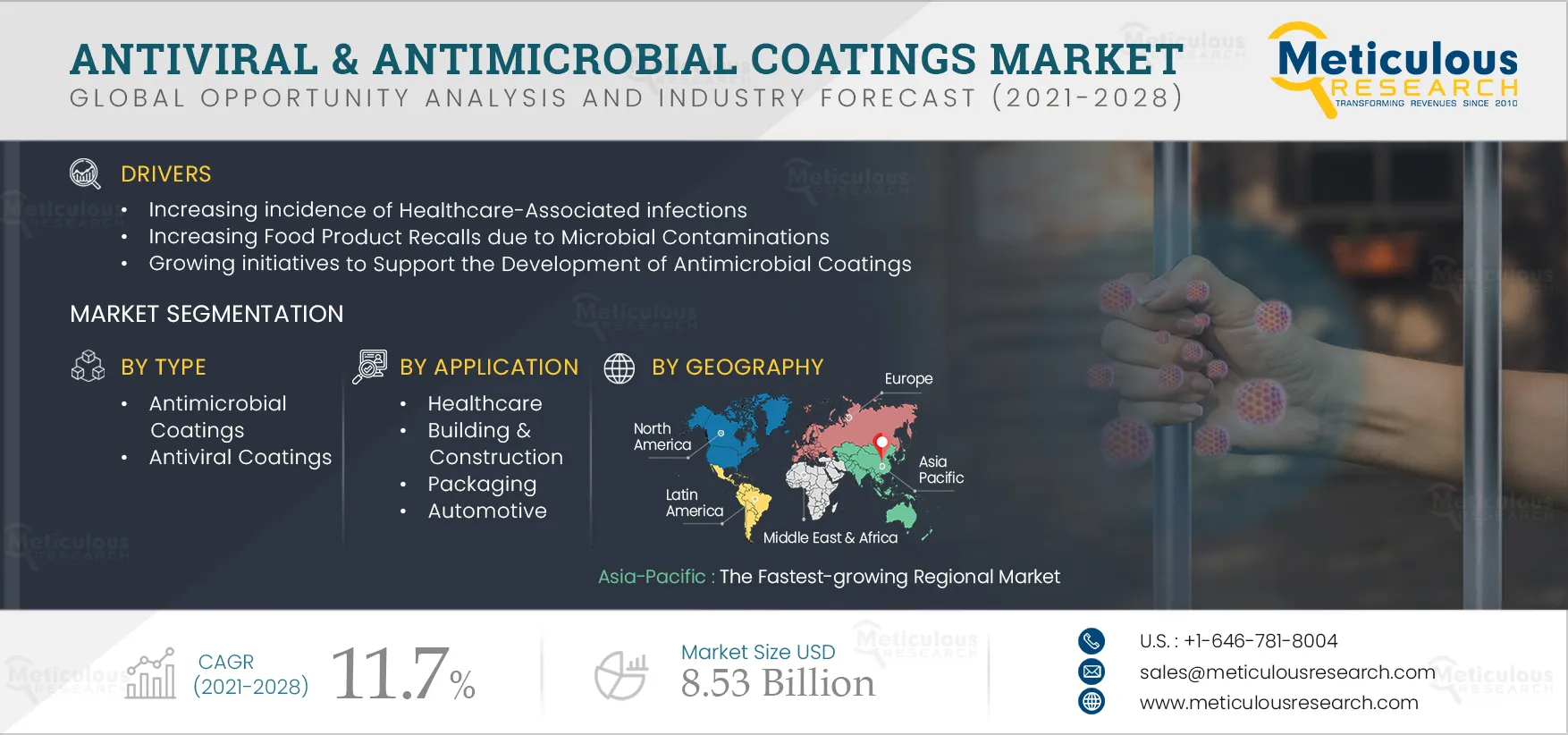

3. Executive Summary

4. Market insights

4.1 Introduction

4.2 Drivers

4.2.1 Increasing incidence of Healthcare-Associated infections

4.2.2 Increasing Food Product Recalls due to Microbial Contaminations

4.2.3 Growing initiatives to Support the Development of Antimicrobial Coatings

4.3 Restraints

4.3.1 Stringent Government Regulations on the Emission of Volatile Organic Compounds (VOCs)

4.4 Opportunities

4.4.1 Emerging Economies

4.5 Challenges

4.5.1 Development of Antimicrobial Resistance Among Microbes

4.6 Market Trend

4.6.1 Growing Adoption of Antimicrobial Coatings in Healthcare and Other industries Amid the Covid-19 Pandemic

4.7 Impact of Covid-19 on the Antiviral & Antimicrobial Coating Market

5. Regulatory Analysis

5.1 Introduction

5.2 North America

5.3 Europe

5.4 Asia-Pacific

6. Global Antiviral & Antimicrobial Coatings Market, by Type

6.1 Introduction

6.2 Antimicrobial Coatings

6.3 Antiviral Coatings

7. Global Antiviral & Antimicrobial Coatings Market, by Material

7.1 Introduction

7.2 Silver

7.3 Organic Materials

7.4 Copper

7.5 Aluminum

7.6 Silicon Dioxide

7.7 Other Materials

8. Global Antiviral & Antimicrobial Coatings Market, by Form

8.1 Introduction

8.2 Liquid

8.2.1 Solvent-Borne Coatings

8.2.2 Waterborne Coatings

8.3 Powder

8.4 Aerosol

9. Global Antiviral & Antimicrobial Coatings Market, by Application

9.1 Introduction

9.2 Healthcare

9.3 Building & Construction

9.4 Food & Beverage

9.5 Packaging

9.6 Air & Water Treatment

9.7 Automotive

9.8 Protective Clothing

9.9 Other Applications

10. Antiviral & Antimicrobial Coatings Market, by Geography

10.1 Introduction

10.2 North America

10.2.1. U.S.

10.2.2. Canada

10.3 Europe

10.3.1 Germany

10.3.2. U.K.

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe (RoE)

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Australia

10.4.6 Rest of Asia-Pacific (RoAPAC)

10.5 Latin America

10.6 Middle East & Africa

11. Competitive Landscape

11.1 Introduction

11.2 Key Growth Strategies

11.3 Competitive Benchmarking

11.4 Market Share Analysis

11.4.1 The Sherwin-Williams Company (U.S.)

11.4.2 Akzo Nobel N.V. (Netherlands)

11.4.3 Axalta Coatings Systems (U.S.)

11.4.4 BASF SE (Germany)

12. Company Profiles

12.1 Akzo Nobel N. V.

12.1.1 Business Overview

12.1.2 Financial Overview

12.1.3 Product Portfolio

12.1.4 Strategic Developments

12.2 Lonza Group, Ltd.

12.2.1 Business Overview

12.2.2 Financial Overview

12.2.3 Product Portfolio

12.3 PPG Industries, Inc.

12.3.1 Business Overview

12.3.2 Financial Overview

12.3.3 Product Portfolio

12.3.4 Strategic Developments

12.4 Axalta Coating Systems, Ltd.

12.4.1 Business Overview

12.4.2 Financial Overview

12.4.3 Product Portfolio

12.4.4 Strategic Developments

12.5 The Sherwin-Williams Company

12.5.1 Business Overview

12.5.2 Financial Overview

12.5.3 Product Portfolio

12.6 Nippon Paint Holdings Co., Ltd.

12.6.1 Business Overview

12.6.2 Financial Overview

12.6.3 Product Portfolio

12.6.4 Strategic Developments

12.7 RPM International, Inc.

12.7.1 Business Overview

12.7.2 Financial Overview

12.7.3 Product Portfolio

12.8 Sciessent LLC

12.8.1 Business Overview

12.8.2 Product Portfolio

12.8.3 Strategic Developments

12.9 Sika AG

12.9.1 Business Overview

12.9.2 Financial Overview

12.9.3 Product Portfolio

12.10 BASF SE

12.10.1 Business Overview

12.10.2 Financial Overview

12.10.3 Product Portfolio

12.11 Jotun Group

12.11.1 Business Overview

12.11.2 Financial Overview

12.11.3 Product Portfolio

12.12 NanoGraphene Inc.

12.12.1 Business Overview

12.12.2 Product Portfolio

12.13 DuPont De Nemours, Inc.

12.13.1 Business Overview

12.13.2 Financial Overview

12.13.3 Product Portfolio

13. Appendix

13.1 Questionnaire

13.2 Available Customization

List of Tables

Table 1 Global Antiviral & Antimicrobial Coatings Market Drivers: Impact Analysis (2021–2028)

Table 2 Global Antiviral & Antimicrobial Coatings Market Restraint: Impact Analysis (2021–2028)

Table 3 List of Companies Offering Coatings Against SARS-CoV-2

Table 4 Regulatory Pathways for Antiviral & Antimicrobial Coating Products

Table 5 Global Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 6 Antimicrobial Coatings Market Size, by Country/Region, 2019–2028 (USD Million)

Table 7 Antiviral Coatings Market Size, by Country/Region, 2019–2028 (USD Million)

Table 8 Global Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 9 Antiviral & Antimicrobial Silver Coatings Market Size, by Country/Region, 2019– 2028 (USD Million)

Table 10 Antiviral & Antimicrobial Organic Coatings Market Size, by Country/Region, 2019– 2028 (USD Million)

Table 11 Antiviral & Antimicrobial Copper Coatings Market Size, by Country/Region, 2019– 2028 (USD Million)

Table 12 Antiviral & Antimicrobial Aluminum Coatings Market Size, by Country/Region, 2019–2028 (USD Million)

Table 13 Antiviral & Antimicrobial Silicon Dioxide Coatings Market Size, by Country/Region, 2019–2028 (USD Million)

Table 14 Antiviral & Antimicrobial Coatings Market Size for Other Materials, by Country/Region, 2019–2028 (USD Million)

Table 15 Global Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 16 Global Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 17 Global Liquid Antiviral & Antimicrobial Coatings Market Size, by Country/Region, 2019–2028 (USD Million)

Table 18 Global Solvent-Borne Coatings Market Size, by Country/Region, 2019–2028 (USD Million)

Table 19 Global Waterborne Coatings Market Size, by Country/Region, 2019–2028 (USD Million)

Table 20 Global Powder Antiviral & Antimicrobial Coatings Market Size, by Country/Region, 2019–2028 (USD Million)

Table 21 Global Aerosol Antiviral & Antimicrobial Coatings Market Size, by Country/Region, 2019–2028 (USD Million)

Table 22 Global Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 23 Antiviral & Antimicrobial Coatings Market Size for Healthcare Applications, by Country/Region, 2019—2028 (USD Million)

Table 24 Antiviral & Antimicrobial Coatings Market Size for Building & Construction Applications, by Country/Region, 2019–2028 (USD Million)

Table 25 Food Recalls by the U.S. FDA Due to Microbial Contamination

Table 26 Antiviral & Antimicrobial Coatings Market Size for Food & Beverage Applications, by Country/Region, 2019–2028 (USD Million)

Table 27 Antiviral & Antimicrobial Coatings Market Size for Packaging Applications, by Country/Region, 2019–2028 (USD Million)

Table 28 Antiviral & Antimicrobial Coatings Market Size for Air & Water Treatment Applications, by Country/Region, 2019–2028 (USD Million)

Table 29 Antiviral & Antimicrobial Coatings Market Size for Automotive Applications, by Country/Region, 2019–2028 (USD Million)

Table 30 Antiviral & Antimicrobial Coatings Market Size for Protective Clothing, by Country/Region, 2019–2028 (USD Million)

Table 31 Antiviral & Antimicrobial Coatings Market Size for Other Applications, by Country/Region, 2019–2028 (USD Million)

Table 32 Global Antiviral & Antimicrobial Coatings Market Size, by Country/Region, 2019– 2028 (USD Million)

Table 33 North America: Antiviral & Antimicrobial Coatings Market Size, by Country, 2019– 2028 (USD Million)

Table 34 North America: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019– 2028 (USD Million)

Table 35 North America: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 36 North America: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019– 2028 (USD Million)

Table 37 North America: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 38 North America: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 39 Food Recalls Initiated by the U.S. FDA Due to Microbial Contamination

Table 40 Medical Devices and Cosmetics Recalls Due to Microbial Contamination

Table 41 U.S.: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 42 U.S.: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 43 U.S.: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 44 U.S.: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 45 U.S.: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 46 List of Food Recalls In Canada

Table 47 Canada: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 48 Canada: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 49 Canada: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 50 Canada: Liquid Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 51 Canada: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019– 2028 (USD Million)

Table 52 Europe: Antiviral & Antimicrobial Coatings Market Size, by Country/Region, 2019– 2028 (USD Million)

Table 53 Europe: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 54 Europe: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 55 Europe: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 56 Europe: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 57 Europe: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 58 Germany: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 59 Germany: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 60 Germany: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 61 Germany: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019– 2028 (USD Million)

Table 62 Germany: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019– 2028 (USD Million)

Table 63 U.K.: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 64 U.K.: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 65 U.K.: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 66 U.K.: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 67 U.K.: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 68 France: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 69 France: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 70 France: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 71 France: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 72 France: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 73 Italy: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 74 Italy: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 75 Italy: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 76 Italy: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 77 Italy: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 78 Spain: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 79 Spain: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 80 Spain: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 81 Spain: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 82 Spain: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 83 RoE: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 84 RoE: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 85 RoE: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 86 RoE: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 87 RoE: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 88 Asia-Pacific: Antiviral & Antimicrobial Coatings Market Size, by Country/Region, 2019–2028 (USD Million)

Table 89 Asia-Pacific: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 90 Asia-Pacific: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019– 2028 (USD Million)

Table 91 Asia-Pacific: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 92 Asia-Pacific: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019– 2028 (USD Million)

Table 93 Asia-Pacific: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 94 China: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 95 China: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 96 China: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 97 China: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 98 China: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 99 Japan: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 100 Japan: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 101 Japan: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 102 Japan: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 103 Japan: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 104 India: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 105 India: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 106 India: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 107 India: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 108 India: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 109 South Korea: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 110 South Korea: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019– 2028 (USD Million)

Table 111 South Korea: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 112 South Korea: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019– 2028 (USD Million)

Table 113 South Korea: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 114 Australia: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 115 Australia: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 116 Australia: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 117 Australia: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019– 2028 (USD Million)

Table 118 Australia: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019– 2028 (USD Million)

Table 119 RoAPAC: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 120 RoAPAC: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 121 RoAPAC: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 122 RoAPAC: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 123 RoAPAC: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 124 Latin America: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 125 Latin America: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019– 2028 (USD Million)

Table 126 Latin America: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 127 Latin America: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 128 Latin America: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 129 Middle East & Africa: Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 130 Middle East & Africa: Antiviral & Antimicrobial Coatings Market Size, by Material, 2019–2028 (USD Million)

Table 131 Middle East & Africa: Antiviral & Antimicrobial Coatings Market Size, by Form, 2019–2028 (USD Million)

Table 132 Middle East & Africa: Liquid Antiviral & Antimicrobial Coatings Market Size, by Type, 2019–2028 (USD Million)

Table 133 Middle East & Africa: Antiviral & Antimicrobial Coatings Market Size, by Application, 2019–2028 (USD Million)

Table 134 Number of Developments by the Major Players During 2018–2021

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side& Demand-Side)

Figure 6 Market Size Estimation

Figure 7 Global Antiviral & Antimicrobial Coatings Market Size, by Type 2021 Vs. 2028 (USD Million)

Figure 8 Global Antiviral & Antimicrobial Coatings Market Size, by Form, 2021 Vs. 2028 (USD Million)

Figure 9 Global Antiviral & Antimicrobial Coatings Market Size, by Material, 2021 Vs. 2028 (USD Million)

Figure 10 Global Antiviral & Antimicrobial Coatings Market Size, by Application, 2021 Vs. 2028 (USD Million)

Figure 11 Global Antiviral & Antimicrobial Coatings Market Size, by Geography

Figure 12 Global Antimicrobial & Antiviral Coatings Market: Market Dynamics

Figure 13 Food Recalls Due To Microbial Contamination in Australia, 2011–2020

Figure 14 China: Medical Devices Market, 2016-2019 (USD Billion)

Figure 15 EPA Review and Approval Process under Part 3

Figure 16 Global Antiviral & Antimicrobial Coatings Market Size, by Type, 2021 Vs. 2028 (USD Million)

Figure 17 Global Antiviral & Antimicrobial Coatings Market Size, by Material, 2021 Vs. 2028 (USD Million)

Figure 18 Global Antiviral & Antimicrobial Coatings Market Size, by Form, 2021 Vs. 2028 (USD Million)

Figure 19 Global Antiviral & Antimicrobial Coatings Market Size, by Application, 2021 Vs. 2028 (USD Million)

Figure 20 Global Antiviral & Antimicrobial Coatings Market Size, by Region, 2021 Vs. 2028 (USD Million)

Figure 21 North America: Antiviral & Antimicrobial Coatings Market Snapshot

Figure 22 Europe: Antiviral & Antimicrobial Coatings Market Snapshot

Figure 23 Asia-Pacific: Antiviral & Antimicrobial Coatings Market Snapshot

Figure 24 Key Growth Strategies Adopted by Leading Players 2018–2021

Figure 25 Antiviral & Antimicrobial Coatings Market: Competitive Benchmarking (Based on Type)

Figure 26 Antiviral & Antimicrobial Coatings Market: Competitive Benchmarking (Based on Form)

Figure 27 Antiviral & Antimicrobial Coatings Market: Competitive Benchmarking (Based on Geography)

Figure 28 Global Antiviral & Antimicrobial Coatings Market Share, by Key Players, 2020 (%)

Figure 29 Akzo Nobel N.V.: Financial Overview (2020)

Figure 30 Lonza Group, Ltd.: Financial Overview (2020)

Figure 31 PPG Industries, Inc.: Financial Overview (2020)

Figure 32 Axalta Coating Systems, Ltd.: Financial Overview (2020)

Figure 33 The Sherwin-Williams Company: Financial Overview (2020)

Figure 34 Nippon Paint Holdings Co., Ltd.: Financial Overview (2020)

Figure 35 RPM International, Inc.: Financial Overview (2021)

Figure 36 Sika AG: Financial Overview (2020)

Figure 37 BASF SE: Financial Overview (2020)

Figure 38 Jotun Group: Financial Overview (2020)

Figure 39 Du Pont De Nemours Inc., (2020)