1 Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2 Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.1.1. Bottom-Up Approach

2.3.1.2. Top-Down Approach

2.3.1.3. Growth Forecast

2.4. Assumptions for the Study

2.5. Limitations for the Study

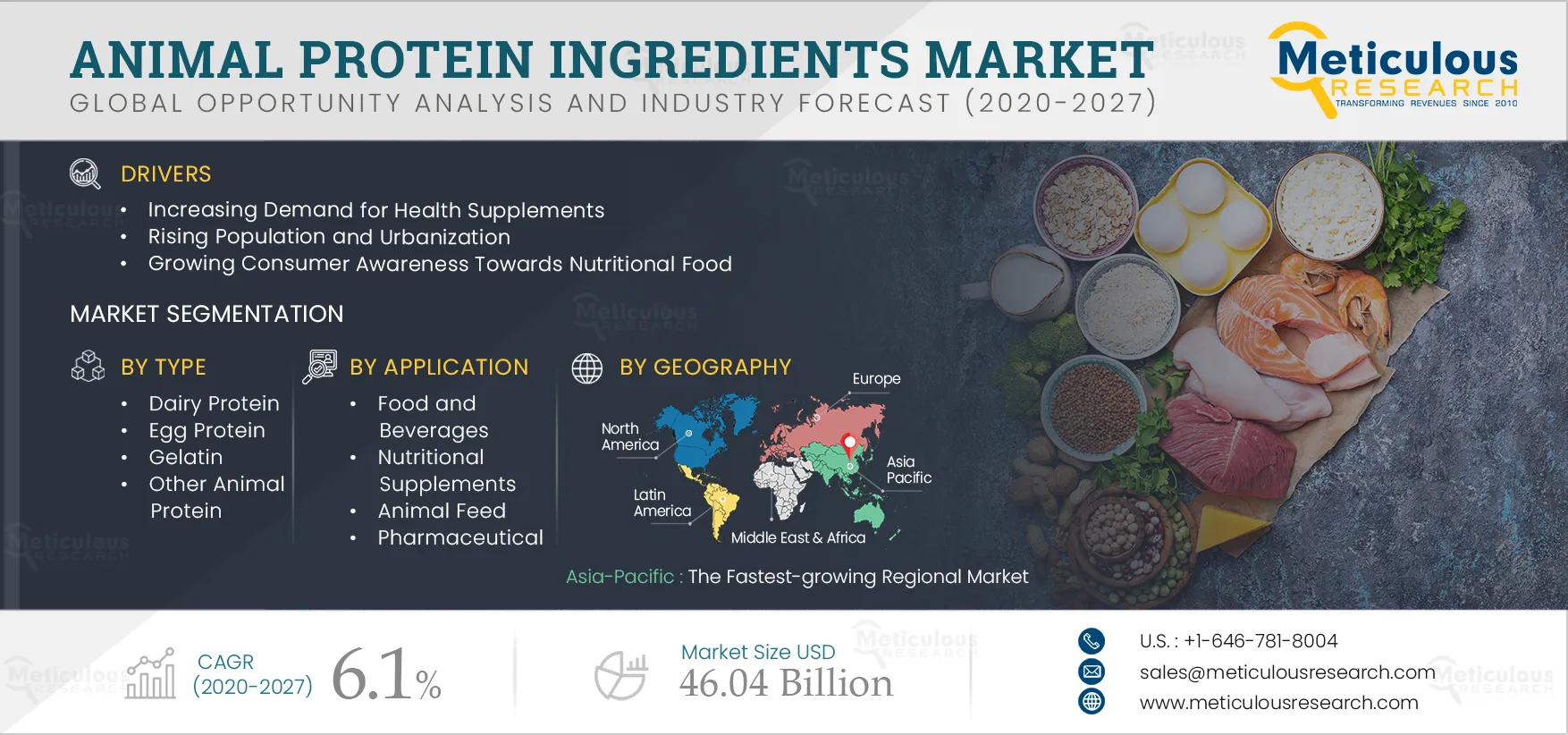

3 Executive Summary

3.1. Introduction

3.2. Segment Analysis

3.2.1. Protein Ingredients Market, Type Analysis

3.2.2. Protein Ingredients Market, Application Analysis

3.2.3. Protein Ingredients Market, Regional Analysis

3.2.4. Competitive Landscape & Market Competitors

4 Market Insight

4.1. Drivers

4.1.1. Increasing Demand for Health Supplements

4.1.2. Rising Population and Urbanization

4.1.3. Growing Consumer Awareness Towards Nutritional Food

4.1.4. Improvement in Supply Chain Management

4.2. Restraints

4.2.1. Increasing Demand for Alternative Protein Ingredients

4.2.2 Milk Allergies and Lactose Intolerance

4.3. Opportunities

4.3.1. Technological Development in Dairy Industry

4.4. Challenges

4.4.1. Increasing Consumer Awareness About the Benefits of Vegan Diet

5 Covid-19 Impact on Animal Protein Ingredients Market

6 Global Animal Protein Ingredients Market, by Type

6.1 Dairy Protein

6.1.1. Milk Protein

6.1.1.1. Milk Protein Concentrate

6.1.1.2. Milk Protein Isolates

6.1.1.3. Milk Protein Hydrolysates

6.1.2. Whey Protein

6.1.2.1. Whey Protein Concentrate

6.1.2.2. Whey Protein Isolates

6.1.2.3. Whey Protein Hydrolysates

6.1.3. Casein & Caseinates

6.2. Egg Protein

6.3. Gelatin

6.4. Other Animal Protein

7 Global Animal Protein Ingredients Market, by Application

7.1. Food and Beverages

7.2. Nutritional Supplements

7.3. Animal Feed

7.4. Pet Food

7.5. Pharmaceutical

7.6. Others

8 Animal Protein Ingredients Market, by Geography

8.1. North America

8.1.1 U.S.

8.1.2. Canada

8.2. Europe

8.2.1. Germany

8.2.2. U.K.

8.2.3. France

8.2.4. Italy

8.2.5. Spain

8.2.6. Rest of Europe

8.3. Asia-Pacific

8.3.1. china

8.3.2. India

8.3.3. Japan

8.3.4. Australia

8.3.5. Rest of Asia-pacific

8.4. Latin America

8.5. Middle East and Africa

9 Competitive Landscape

9.1. Introduction

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

10 Company Profiles

10.1. Kerry Group

10.2. Arla Foods Amba

10.3. Fonterra Co-Operative Group Limited

10.4. Royal FrieslandCampina N.V.

10.5. Saputo Inc

10.6. Sodilaal International

10.7. Lactalis Group

10.8. AMCO Proteins

10.9. Glanbia Plc

10.10. Hilmar Ingredients

10.11. Cargill, Incorporated

10.12. Kewpie Corporation

10.13. Savencia SA

10.15. Agropur Cooperative

List of Tables

Table 1 Global Animal Protein Ingredient Market Size, by Type, 2018-2027 (USD Million)

Table 2 Global Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 3 Dairy Protein Market Size, by Country/Region, 2018-2027 (USD Million)

Table 4 Global Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 5 Milk Protein Market Size, by Country/Region, 2018-2027 (USD Million)

Table 6 Milk Protein Concentrate Market Size, by Country/Region, 2018-2027 (USD Million)

Table 7 Milk Protein Isolates Market Size, by Country/Region, 2018-2027 (USD Million)

Table 8 Milk Protein Hydrolysates Market Size, by Country/Region, 2018-2027 (USD Million)

Table 9 Global Whey Protein Ingredient Market Size, by Type, 2018-2027 (USD Million)

Table 10 Whey Protein Ingredient Market Size, by Country/Region, 2018-2027 (USD Million)

Table 11 Whey Protein Concentrate Market Size, by Country/Region, 2018-2027 (USD Million)

Table 12 Whey Protein Isolates Market Size, by Country/Region, 2018-2027 (USD Million)

Table 13 Whey Protein Hydrolysates Market Size, by Country/Region, 2018-2027 (USD Million)

Table 14 Casein & Caseinates Market Size, by Country/Region, 2018-2027 (USD Million)

Table 15 Egg Protein Ingredients Market Size, by Country/Region, 2018-2027 (USD Million)

Table 16 Gelatin Market Size, by Country/Region, 2018-2027 (USD Million)

Table 17 Other Animal Protein Ingredient Market Size, by Country/Region, 2018-2027 (USD Million)

Table 18 Global Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 19 Animal Protein Ingredients Market Size for Food and Beverages, by Country/Region, 2018-2027 (USD Million)

Table 20 Animal Protein Ingredients Market Size for Nutritional Supplements, by Country/Region, 2018-2027 (USD Million)

Table 21 Animal Protein Ingredients Market Size for Animal Feed, by Country/Region, 2018-2027 (USD Million)

Table 22 Animal Protein Ingredients Market Size for Pharmaceutical, by Country/Region, 2018-2027 (USD Million)

Table 23 Animal Protein Ingredients Market Size for Other Applications, by Country/Region, 2018-2027 (USD Million)

Table 24 North America: Animal Protein Ingredients Market Size, by Country, 2018-2027 (USD Million)

Table 25 North America: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 26 North America: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 27 North America: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 28 North America: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 29 North America: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 30 U.S.: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 31 U.S.: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 32 U.S.: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 33 U.S.: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 34 U.S.: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 35 Canada: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 36 Canada: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 37 Canada: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 38 Canada: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 39 Canada: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 40 Europe: Animal Protein Ingredients Market Size, by Country, 2018-2027 (USD Million)

Table 41 Europe: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 42 Europe: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 43 Europe: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 44 Europe: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 45 Europe: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 46 Germany: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 47 Germany: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 48 Germany: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 49 Germany: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 50 Germany: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 51 France: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 52 France: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 53 France: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 54 France: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 55 France: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 56 U.K.: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 57 U.K.: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 58 U.K.: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 59 U.K.: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 60 U.K.: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 61 Italy: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 62 Italy: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 63 Italy: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 64 Italy: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 65 Italy: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 66 Spain: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 67 Spain: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 68 Spain: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 69 Spain: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 70 Spain: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 71 Rest of Europe: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 72 Rest of Europe: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 73 Rest of Europe: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 74 Rest of Europe: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 75 Rest of Europe: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 76 Asia-Pacific: Animal Protein Ingredients Market Size, by Country/Region, 2018-2027 (USD Million)

Table 77 Asia-Pacific: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 78 Asia-Pacific: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 79 Asia-Pacific: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 80 Asia-Pacific: Whey Protein Market Size, by Application, 2018-2027 (USD Million)

Table 81 Asia-Pacific: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 82 China: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 83 China: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 84 China: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 85 China: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 86 China: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 87 India: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 88 India: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 89 India: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 90 India: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 91 India: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 92 Japan: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 93 Japan: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 94 Japan: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 95 Japan: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 96 Japan: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 97 Australia: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 98 Australia: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 99 Australia: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 100 Australia: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 101 Australia: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 102 Rest of Asia-Pacific: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 103 Rest of Asia-Pacific: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 104 Rest of Asia-Pacific: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 105 Rest of Asia-Pacific: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 106 Rest of Asia-Pacific: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 107 Latin America: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 108 Latin America: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 109 Latin America: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 110 Latin America: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 111 Latin America: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

Table 112 Middle East and Africa: Animal Protein Ingredients Market Size, by Type, 2018-2027 (USD Million)

Table 113 Middle East and Africa: Dairy Protein Market Size, by Type, 2018-2027 (USD Million)

Table 114 Middle East and Africa: Milk Protein Market Size, by Type, 2018-2027 (USD Million)

Table 115 Middle East and Africa: Whey Protein Market Size, by Type, 2018-2027 (USD Million)

Table 116 Middle East and Africa: Animal Protein Ingredients Market Size, by Application, 2018-2027 (USD Million)

List of Figures

Figure 1 Research Process

Figure 2 Key Executives Interviewed

Figure 3 Primary Research Techniques

Figure 4 Competitive Landscape

Figure 5 Market Dynamics

Figure 6 Global Animal Protein Ingredients Market Size, by Type, 2020-2027 (USD Million)

Figure 7 Global Dairy Protein Market Size, by Type, 2020-2027 (USD Million)

Figure 8 Global Milk Protein Market Size, by Type, 2020-2027 (USD Million)

Figure 9 Global Whey Protein Market Size, by Type, 2020-2027 (USD Million)

Figure 10 Global Animal Protein Ingredient Market Size, by Application, 2020-2027 (USD Million)

Figure 11 Global Animal Protein Ingredient Market Size, by Region, 2020-2027 (USD Million)

Figure 12 North America: Animal Protein Ingredient Market Size, by Country, 2020-2027 (USD Million)

Figure 13 Europe: Animal Protein Ingredient Market Size, by Country/Region, 2020-2027 (USD Million)

Figure 14 Asia-Pacific: Animal Protein Ingredient Market Size, by Country/Region, 2020-2027 (USD Million)

Figure 15 Key Growth Strategies Adopted by Key Players

Figure 16 Kerry Group: Financial Overview (2019)

Figure 17 Arla Foods amba: Financial Overview (2019)

Figure 18 Fonterra Co-Operative Group Limited: Financial Overview (2019)

Figure 19 Royal FrieslandCampina N.V.: Financial Overview (2019)

Figure 20 Saputo Inc: Financial Overview (2019)

Figure 21 Sodilaal International: Financial Overview (2019)

Figure 22 Lactalis Group: Financial Overview (2019)

Figure 23 Glanbia plc: Financial Overview (2019)

Figure 24 Cargill, Incorporated: Financial Overview (2019)

Figure 25 Savencia SA: Financial Overview (2019)

Figure 26 Agropur Cooperative: Financial Overview (2019)